- Connect with our licensed Canadian insurance advisors

- Shedule a Call

BASICS

- Is Infinite Banking A Smart Financial Strategy?

- Understanding the Infinite Banking Concept

- Why Infinite Banking Appeals to Canadians Seeking Financial Freedom

- How Infinite Banking Strategy Helps Build Financial Independence

- Challenges and Misconceptions About Infinite Banking

- Who Should Consider Infinite Banking for Financial Freedom?

- How to Start Your Infinite Banking Journey

- Key Advantages of the Infinite Banking Strategy

- A Day-to-Day Struggle: Why More Canadians Are Exploring Infinite Banking

- Potential Drawbacks You Should Know

- The Future of Infinite Banking in Canada

- Is Infinite Banking a Smart Financial Strategy?

COMMON INQUIRIES

- Can I Have Both Short-Term and Long-Term Disability Insurance?

- Should Both Husband and Wife Get Term Life Insurance?

- Can I Change Beneficiaries on My Canadian Term Life Policy?

- What Does Term Life Insurance Cover and Not Cover?

- Does Term Insurance Cover Death?

- What are the advantages of Short-Term Life Insurance?

- Which Is Better, Whole Life Or Term Life Insurance?

- Do Term Life Insurance Rates Go Up?

- Is Term Insurance Better Than a Money Back Policy?

- What’s the Longest Term Life Insurance You Can Get?

- Which is better, Short-Term or Long-Term Insurance? Making the Right Choice

IN THIS ARTICLE

- What is the minimum income for Term Insurance?

- How Does Income Affect Your Term Life Insurance Policy?

- Can You Buy Term Life Insurance Online with a Low Income?

- How Can You Lower Your Term Life Insurance Cost?

- How Much Term Life Insurance Do You Need?

- Can Your Term Life Insurance Policy Be Adjusted Over Time?

- Why Term Life Insurance Is Ideal for Lower-Income Canadians

- Final Thoughts

- More on Term Life Insurance

Why Family Travel Insurance Is A Smart Move For Your Vacation Budget?

By Pushpinder Puri

CEO & Founder

- 13 min read

- August 11th, 2025

SUMMARY

Family Travel Insurance offers essential financial protection for vacations, especially with kids. The content outlines why affordable family Travel Insurance Plans in Canada are a smart move, detailing how Travel Insurance Policy Rates, coverage benefits, and medical protections can prevent unexpected costs. It highlights how Canadian Travel Insurance providers help families access the right Travel Medical Insurance Policy. It also discusses how to compare and request a tailored Travel Insurance Quote.

Introduction

Vacations are meant to bring joy and relaxation, not unexpected financial setbacks. Unfortunately, we have witnessed too many families go through a lot of stress because they did not give enough importance to cheap family Travel Insurance in Canada. Not only are you able to get coverage for emergencies, but also for unexpected medical bills, trip cancellations, and lost baggage that might otherwise eat into your vacation fund.

Whether you’re thinking about taking a cross-country road trip or jetting off to an exotic locale, having the best Travel Medical Insurance Policy in place is one of the most intelligent financial moves you can make.

The Real Cost Of Travel Without Insurance

Now imagine saving for months to go on that dream vacation, only to come back home with a thousand dollars in medical bills because you had an accident or got sick while overseas. A single trip to the emergency room elsewhere can actually cost more than your entire travel vacation.

We often help out families who have had an incident occur while they were on the road. Travel Insurance can make nuisances out of minor incidents like a sprained ankle or lost luggage, quickly draining an emergency fund before the bills for more urgent matters start coming in. A Small investment from your pockets, upfront, in affordable family Travel Insurance Plans can save you from large financial disruptions.

Why Family Travel Insurance Matters More Than Ever

The travel landscape has changed. Global healthcare costs are rising, and unpredictable events—weather disruptions, flight delays, or illness—can disrupt your plans. Family Travel Insurance offers:

- Financial Protection – Covers emergency medical expenses, trip interruptions, or cancellations.

- Comprehensive Travel Insurance Coverage – Includes medical care, hospital stays, and even transportation back to Canada if needed.

- Peace of Mind – Knowing your loved ones are protected allows you to enjoy the vacation without worry.

- Affordable Plans – Many Canadian Travel Insurance providers now offer family bundles at discounted rates.

What Does A Travel Medical Insurance Policy Include?

When you purchase a Travel Medical Insurance Policy, you get more than just medical protection. A typical family plan may include:

- Emergency medical treatment and hospitalization

- Emergency transportation or evacuation

- Coverage for pre-existing medical conditions (if disclosed and accepted)

- Trip delay or cancellation reimbursement

- Lost or delayed baggage compensation

- Accidental death and dismemberment benefits

By working with experienced Canadian Travel Insurance providers, families can find plans that fit both their budget and their specific travel needs.

Comparing Travel Insurance Policy Rates

We often hear families asking, “How much will Travel Insurance cost us?” The answer depends on factors like:

- Destination and length of trip

- Number of family members covered

- Age and health conditions of travellers

- Coverage limits and add-ons

Travel Insurance Policy Rates can vary widely. Some families are surprised to learn that adding a child to a family plan may cost very little or even nothing, depending on the insurer. We provide side-by-side comparisons of Travel Insurance Quotes so you can choose the most cost-effective option.

Affordable Family Travel Insurance Plans In Canada

Comprehensive coverage would be expensive, but in some cases, parents can get it cheap. Within Canada, affordable family Travel Insurance Plans tend to offer a great deal of coverage for a small amount compared with the price tag an uninsured healthcare emergency may run. Bundling everyone in your family onto one policy almost always yields better value than taking out separate individual policies.

Families can save hundreds by choosing group or family-specific plans through proven, Canadian Travel Insurance providers. These plans are designed to address things that mostly go wrong for families while they are on vacation overseas.

Canadian Travel Insurance Providers: What To Look For

Not all insurance providers are the same. When choosing among Canadian Travel Insurance providers, look for:

- 24/7 emergency assistance

- Clear coverage for pre-existing conditions

- Transparent claim processes

- Positive customer service ratings

- Flexible policy options for families

We partner with reputable companies that have proven track records for handling claims efficiently and supporting families during emergencies.

Travel Insurance Coverage For Pre-Existing Conditions

Households with older travellers or children who have health conditions must pay special attention to Travel Insurance Coverage for pre-existing conditions. Some plans offer partial coverage, while others require a stability period (e.g., no changes in medication for a set time).

We guide our clients in appointing policies that either cover or provide waivers for such conditions. Ensuring that pre-existing medical issues are addressed upfront helps avoid claim denials later.

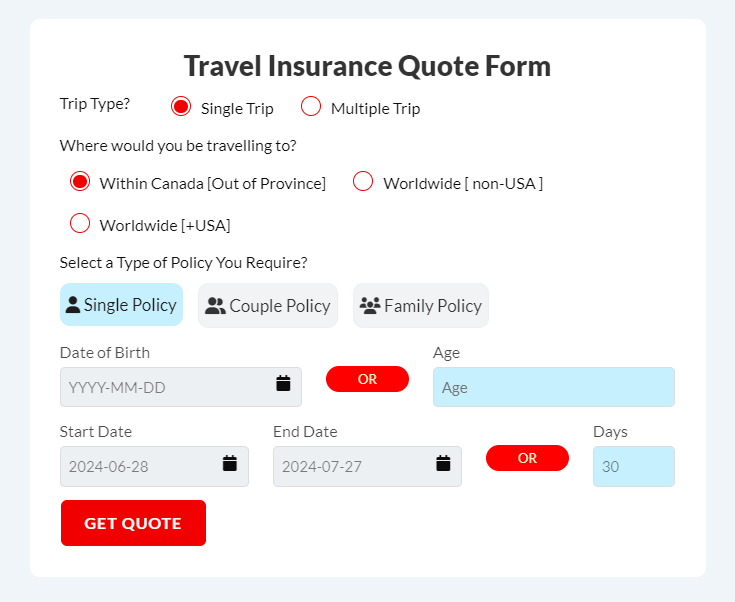

How To Get A Travel Insurance Quote

Getting a Travel Insurance Quote is simple, but comparing them can be overwhelming. Each provider uses different terms, limits, and exclusions. We simplify this process by:

- Gather details about your trip and family members.

- Comparing multiple Travel Insurance Policy Rates from top providers.

- Explaining the coverage differences and exclusions in plain language.

- Helping you choose the plan that balances cost and coverage.

This personalized approach ensures that families find the best protection without overspending.

Why Family Bundles Make Financial Sense

Family Insurance packages often prove to be cheaper than purchasing several individual plans. For example, three separate individual policies for parents and a child could be replaced by one family plan with a reduced premium for all beneficiaries.

It also makes it easier to administer these bundled, affordable family Travel Insurance Plans in Canada. There is just one policy document, a renewal date, and one contact point for claims or emergencies.

Trip Cancellation And Interruption Coverage

Unexpected events happen—flights get cancelled, family members fall ill, or severe weather disrupts travel. Trip cancellation and interruption coverage protects your prepaid expenses. If you need to cancel your trip before departure or cut it short, the policy reimburses non-refundable costs like flights, hotel bookings, or excursions.

Including trip cancellation in your Travel Medical Insurance Policy ensures that your vacation budget is protected from sudden changes beyond your control.

How To Choose The Best Travel Medical Insurance Policy

The “best” policy isn’t always the one with the highest coverage limits. It’s the plan that matches your family’s unique needs. When selecting a Travel Medical Insurance Policy, consider:

- Do you need coverage for adventurous activities like skiing?

- Are there seniors or infants in your travel group?

- Do you want higher baggage coverage for expensive equipment?

- What level of emergency medical coverage do you need (e.g., $1M or $5M)?

We always advise families to balance coverage with budget, ensuring no gaps that could lead to unexpected expenses.

Real-Life Scenarios: Why Families Needed Coverage

We have assisted families with emergencies during a trip — broken bones on the ski slopes, and last-minute cancellations for trips that had been planned for years due to an unexpected illness. In each count, their Travel Insurance saved them thousands and a whole lot of stress.

Another client family saved a $10,000 U.S. medical bill when their child had an allergic reaction in the States because they bought a low-cost Canadian family Travel Insurance Policy before going.

Travel Insurance For Domestic Trips

What many Canadians do not know is that medical emergencies in other provinces are only partially covered by provincial healthcare plans. This could be, for example, ambulance charges or certain medical procedures that are not covered in Canada when on a trip.

To cater to this, Canadian Travel Insurance offers its domestic plans with the same benefits — emergency care, trip interruption, and baggage protection.

Tips To Save On Travel Insurance Policy Rates

Here are some tips to reduce Travel Insurance Policy Rates:

- Buy early – securing coverage months in advance often costs less.

- Opt for a family plan instead of individual policies.

- Avoid unnecessary add-ons (e.g., sports coverage if not needed).

- Compare Travel Insurance Quotes from multiple providers.

- Bundle with other financial products if available.

Common Myths About Family Travel Insurance

Myth 1: “I’m healthy; I don’t need insurance.”

Emergencies don’t discriminate—accidents or sudden illnesses can happen anytime.

Myth 2: “My credit card covers everything.”

Credit card insurance usually offers limited benefits and often excludes pre-existing conditions or long trips.

Myth 3: “Family plans are too expensive.”

In reality, affordable family Travel Insurance Plans in Canada can cost less than a dinner out when spread over the trip.

The Canadian LIC Difference

With over 14 years of industry experience, we specialize in Travel Medical Insurance and family Travel Insurance policies. We compared all the Canadian Travel Insurance providers to find you value Travel Insurance that works.

Through our bespoke service, families can have the correct cover and cheap Travel Insurance Policy Rates. We Take Care of the Details, You Just Make Memories.

Final Thoughts On Family Travel Insurance

Family vacations should be fun, not nonstop arguing and complaining. When you select the correct low-cost family Travel Insurance from Canada, you protect both your vacation budget and your peace of mind at the same time.

You should ask for Travel Insurance, look at the holiday insurance coverage prior to booking or signing up, and all your children, because of their excursion too. Fortunately, at Canadian LIC, we will be right by your side every step of the way.

FAQs

Yes, single-trip plans cover one specific vacation, while multi-trip plans cover multiple trips within a year. Families who travel frequently save more with multi-trip plans. It’s ideal for parents who take seasonal or school break vacations with their children.

Some Travel Medical Insurance Policies include coverage for school-related trips or study programs, especially if short-term. Confirm with your provider if educational trips, excursions, or youth group activities are part of your policy’s scope.

Modifications after departure may be limited, but some Canadian Travel Insurance providers allow extensions or policy upgrades in emergencies. It’s best to check terms before departure and reach out to your advisor if your travel dates change.

Yes, some affordable family Travel Insurance Plans in Canada have age caps for children, usually under 21 or 25 if full-time students. Parents and grandparents may require separate or add-on coverage due to different risk brackets.

Top providers offer 24/7 multilingual emergency support, which is vital when travelling with family. If you’re in a country where English or French isn’t spoken widely, this feature can help coordinate treatment or logistics efficiently.

Yes, most Canadian Travel Insurance providers allow you to request a Travel Insurance Quote even before confirming your travel plans. This helps families budget early and compare Travel Insurance Policy Rates based on trip duration and destination risks.

Absolutely. You can customize Travel Insurance Coverage depending on whether you’re visiting the U.S., Europe, or Asia. Coverage levels, medical limits, and emergency benefits can vary based on regional healthcare costs and travel advisories.

Many Travel Medical Insurance Policies include trip interruption benefits. If a close relative becomes seriously ill while you’re abroad, your plan can reimburse unused bookings and cover the cost of early return to Canada.

Yes, Travel Insurance Policy Rates may be higher for older teens or students travelling independently within the family plan. Some insurers cap child pricing at age 21 or 25, after which they may need their own individual policy.

Suppose anyone shows symptoms of illness while travelling. In that case, your Travel Medical Insurance Policy can cover diagnostic tests, treatment, and even hospitalization—provided the condition wasn’t listed under visitor insurance pre-existing conditions or exclusions.

Key Takeaways

- Family Travel Insurance Saves Money: Affordable family Travel Insurance Plans in Canada help avoid massive out-of-pocket expenses for medical emergencies, cancellations, or lost baggage abroad.

- Coverage Is Customizable: You can tailor your Travel Medical Insurance Policy to include trip interruption, emergency medical, and pre-existing condition coverage for every family member.

- One Policy Covers All: Instead of juggling multiple single plans, a family policy offers shared coverage, simplifying paperwork and reducing overall Travel Insurance Policy Rates.

- Pre-Existing Conditions Are Manageable: With proper disclosure and the right Canadian Travel Insurance providers, coverage for pre-existing conditions can be included—helping protect seniors, kids, and those with health issues.

- Protection Beyond Health: Travel Insurance Coverage includes benefits like COVID-related cancellations, flight delays, and emergency evacuations that would otherwise be financially devastating.

- Quotes and Comparisons Matter: A personalized Travel Insurance Quote ensures you only pay for what your family needs—without compromising coverage or peace of mind.

- Canadian LIC Can Help: With over 14 years of experience, Canadian LIC helps families compare options, secure better rates, and choose the right protection for every trip.

Sources and Further Reading

Official Government and Industry Sources

- Government of Canada – Travel Advice and Advisories

Offers official guidance on travel safety, insurance requirements, and health advisories.

https://travel.gc.ca/travelling/advisories - Canadian Life and Health Insurance Association (CLHIA)

Provides detailed information about insurance products, including Travel Medical Insurance coverage.

https://www.clhia.ca - Financial Consumer Agency of Canada (FCAC)

Trusted resource for comparing insurance types, understanding Travel Insurance Policy Rates, and how to shop wisely.

https://www.canada.ca/en/financial-consumer-agency.html - Public Health Agency of Canada – Travel Health Notices

Offers health-related travel alerts and what to expect from Canadian Travel Insurance providers when abroad.

https://www.canada.ca/en/public-health/services/travel-health.html

International and Educational Sources

- World Health Organization – Travel Health and Insurance Planning

Insights on travel risks and the importance of Travel Medical Insurance Policies worldwide.

https://www.who.int/health-topics/travel - International Association for Medical Assistance to Travellers (IAMAT)

Offers information on global healthcare access and how Travel Insurance Coverage helps Canadians abroad.

https://www.iamat.org

News & Reports

- CBC News – Travel Insurance and COVID-19 Coverage Updates

Real-world Canadian news updates related to Travel Insurance trends, family travel disruptions, and policy limitations.

https://www.cbc.ca/news - Global News – Canadian Travel Insurance Mistakes to Avoid

Informative stories on what happens when families travel uninsured and how affordable family Travel Insurance Plans in Canada can prevent financial loss.

https://globalnews.ca

Feedback Questionnaire:

We’re looking to understand the real challenges Canadian families face when choosing Travel Insurance. Your feedback helps us build better tools and coverage solutions.

Thank you for helping us improve the way Canadian families protect what matters most.

Your privacy is respected. Your information will never be shared without your consent.

IN THIS ARTICLE

- Why Family Travel Insurance Is A Smart Move For Your Vacation Budget?

- The Real Cost Of Travel Without Insurance

- Why Family Travel Insurance Matters More Than Ever

- What Does A Travel Medical Insurance Policy Include?

- Comparing Travel Insurance Policy Rates

- Affordable Family Travel Insurance Plans In Canada

- Canadian Travel Insurance Providers: What To Look For

- Travel Insurance Coverage For Pre-Existing Conditions

- How To Get A Travel Insurance Quote

- Why Family Bundles Make Financial Sense

- Trip Cancellation And Interruption Coverage

- How To Choose The Best Travel Medical Insurance Policy

- Real-Life Scenarios: Why Families Needed Coverage

- Travel Insurance For Domestic Trips

- Tips To Save On Travel Insurance Policy Rates

- Common Myths About Family Travel Insurance

- The Canadian LIC Difference

- Final Thoughts On Family Travel Insurance

Sign-in to CanadianLIC

Verify OTP