- What Is the Average Cost of Travel Insurance?

- Unveiling the Mystery: The Average Cost of Travel Insurance in Canada

- Choose the Right Policy

- Understanding the Real Cost of Travel Insurance in Canada

- The Breakdown: The Average Travel Insurance Cost Based on Coverage Type

- Best Travel Insurance Canada: How Canadians Can Balance Price And Protection

- Making The Perfect Choice: Beyond the Total Trip Cost

- Conclusion: Taking the Next Steps

Perhaps you’re dreaming of the vacation of a lifetime, or just want to get away and kick back. As you plan your flights and accommodation, your excitement grows, and you start thinking about the adventures ahead. But that’s when a thought that soaks up all of your excitement pops into your head: “What if something goes wrong?” Unplannable things like flight delays or medical emergencies can transform that dream vacation into a nightmare in a heartbeat. When this occurs, you need Travel Insurance as an umbrella to give you peace of mind and let you enjoy the rest of your trip.

Onward! Now that that’s out of the way, let’s talk about something that I’ve received a fair amount of questions on…What is the average price of Travel Insurance? The purpose of this blog is to demystify and clarify the cost of Travel Insurance. Let’s break this information down and take this journey together so that you can make an informed decision to buy Travel Insurance that will cover medical costs and beyond.

Unveiling the Mystery: The Average Cost of Travel Insurance in Canada

- Destination: Travelling within Canada, travelling internationally, or travelling to the USA can all impact your premium because medical costs and risk levels vary by region.

- Duration of Trip: Longer trips typically mean higher Travel Insurance cost.

- Age of Travellers: Generally, the older you are, the higher the premium, especially for medical coverage.

- Type of Coverage: A comprehensive Travel Insurance Policy with medical expenses coverage will cost more but offer broader protection.

- Number of Travellers: Insuring a family or group can affect costs.

Choose the Right Policy

Meet a 30-year-old Canadian traveller, an enthusiastic traveller who wants to spend two weeks in Europe. They are fit, adventurous, and knows the value of being prepared. They are concerned about the high price of health care in other countries and would also like a Travel Insurance Policy that includes trip cancellation, lost luggage, and, especially, medical coverage.

After doing some research and getting some quotes, they discovered that the cost of a comprehensive plan averaged about CAD 150. Depending on what you’re covering and the total trip cost, travel insurance can often fall within a similar percentage range for many travellers. This story is a reminder that you get what you pay for, and you should shop around and select a policy that matches your travel needs and comfort level.

Find Out: Tips to buy Travel Insurance in Canada

Understanding the Real Cost of Travel Insurance in Canada

When mapping out travel, one of the most important considerations is, of course, travel insurance. It is easy for the majority of travellers to zero in on the average cost of travel insurance in Canada, but it’s important to drill down into what affects such rates so you can get down to making informed choices.

1. Factors Influencing Travel Insurance Costs

a. Trip Duration and Frequency

The length and frequency of your trips are major factors that affect the price of travel insurance. For example one two-week holiday may be priced differently to several shorter holidays during the year. Multi-trip travel insurance may be cheaper for travellers who do it far more often.VisitorsCoverage+5Travel Guard+5Home+5

b. Age and Health Status

Your age will also be taken into consideration as it influences the insurance fee. Older adults, particularly those over 70, could see higher premiums related to added health risks. But some companies do provide tailor-made plans for older customers as well, so that they can get the protection that they need at a reasonable price point.

c. Destination and Activities

Visiting higher-cost medical systems or participating in more dangerous activities such as skiing or scuba diving, can raise the cost of insurance. You must provide your itinerary and other planned activities so that we can provide full coverage

2. Types of Travel Insurance Plans

a. Single Trip Travel Insurance

Perfect for those travellers who are taking a one-and-only trip, single-trip travel insurance covers the length of that trip. Costs range depending on trip duration, destination, and type of traveller.

b. Multi-Trip Travel Insurance

If you travel often, you can look into multi-trip travel insurance that will protect several trips within a certain amount of time (the most common being a year). This can often be much cheaper than buying individual policies for each trip.

c. Group Travel Insurance

If you are travelling as a group, for example, family vacations or corporate trips, group travel insurance in Canada may offer packaged coverage at a discounted cost per person. It’s important that the policy provides sufficient cover for all group members.

3. Utilizing Travel Insurance Cost Calculators

To get the right estimate of travel insurance price, several travel insurance companies provide online travel insurance cost calculators. They take into account how long the trip will be, where you are going, your age and the type of coverage to give you a customized quote. By using these calculators, travellers can budget more accurately and find a plan that is best suited for them.BCAA

4. Special Considerations for Canadian Travellers

a. Travel Insurance for Canadians Visiting the USA

With astronomical medical expenses in the United States, it’s absolutely critical for Canadians venturing south of the border to obtain comprehensive travel medical insurance. Policies should include emergency medical coverage, hospitalization and medical evacuation if necessary. For many USA trips in 2026, travellers often choose higher emergency medical limits such as $250,000, $500,000, or more depending on their risk profile.

b. Travel Insurance for Canadian Seniors

For this reason, seniors should seek out policies designed with people of their age in mind. Some providers offer plans such as Blue Cross travel insurance for seniors that account for pre-existing conditions and include comprehensive medical coverage.

5. Evaluating the Cost of Travel Insurance

Understanding how much travel insurance costs in Canada requires analyzing various components:

- Trip Cost Percentage: Travel insurance typically ranges from 4% to 12% of the total trip cost. For many Canadians, it often falls closer to 4% to 10%, and can go higher when cancellation coverage and medical risk increase.

- Coverage Type: Comprehensive plans covering medical emergencies, trip cancellations, and baggage loss will cost more than basic medical-only policies.

- Duration: Longer trips naturally incur higher premiums.

- Age: As mentioned, older travellers may face increased costs due to higher risk factors.Latest news & breaking headlines

6. Recommendations for Affordable Travel Insurance in Canada

To secure affordable travel insurance in Canada, RBC Insurance

- Compare Multiple Providers: Use online platforms to compare different insurance offerings.

- Assess Your Needs: Determine the necessary coverage based on your health, destination, and activities.

- Consider Deductibles: Opting for a higher deductible can reduce premium costs, but ensure it’s an amount you’re comfortable paying out-of-pocket.

- Check for Discounts: Some providers offer discounts for group policies or multi-trip plans.

Understanding the landscape of travel insurance requires a clear view of the factors influencing costs and the types of coverage available. By assessing individual needs, utilizing cost calculators, and comparing various plans, travellers can secure optimal coverage that ensures peace of mind during their journeys.

Note: The information provided is based on general guidelines and may vary based on individual circumstances and insurance providers. Always consult with a licensed insurance advisor to determine the best plan for your specific needs.

The Breakdown: The Average Travel Insurance Cost Based on Coverage Type

To further simplify things, let’s look at a comparison table showing different types of Travel Insurance policies available in Canada and their average Travel Insurance cost. This table is based on a hypothetical 10-day trip to France for a single 35-year-old traveller.

| Coverage Type | Average Cost (CAD) |

|---|---|

| Basic (Trip Cancellation & Interruption) | 50-100 |

| Comprehensive (Including Medical Expenses) | 120-250 |

| Medical Only | 70-150 |

| CFAR (Cancel for Any Reason) Add-on | Additional 40-60% on Base Premium |

Best Travel Insurance Canada: How Canadians Can Balance Price And Protection

When people ask about Travel Insurance cost, they usually want a simple answer. But what they truly mean is this: how much is Travel Insurance when I need real protection, not just a cheap paper policy? That’s where Canadians need to think beyond the average price and focus on value.

A lot of travellers search for the average cost of Travel Insurance, and that’s a smart starting point. Still, the better question is: how much does Travel Insurance cost when you want the right coverage for your trip in Canada or abroad? The truth is, the Travel Insurance price depends on what you’re trying to protect—medical expenses, cancellations, baggage, delays, or all of it together.

How To Find The Best Travel Insurance For Canadians (Without Overpaying)

If you’re comparing options and looking for the best Travel Insurance for Canadians, focus on these pricing factors:

- Coverage amount: Higher medical limits can increase the Travel Medical Insurance cost, but they can also prevent a major out-of-pocket bill.

- Deductibles: A higher deductible often lowers the Travel Insurance cost, but make sure it’s an amount you can actually afford if something happens.

- Trip length: Longer trips naturally raise the cost, so if you travel often, annual coverage may be worth considering.

- Pre-existing conditions rules: These don’t always make a policy expensive, but they do affect what’s covered and when.

Best Holiday Insurance: What “Best” Really Means In Real Life

The best holiday insurance is not always the cheapest option. It’s the plan that protects you where you’re most exposed—especially medical costs, cancellations, and unexpected interruptions.

So if you’re comparing quotes and wondering how much does Travel Insurance costs, remember this simple rule:

The best Travel Insurance Canada travellers can buy is the one that still works when life gets messy.

And if your main focus is health protection, you should look for the best Travel Medical Insurance Canada travellers rely on—meaning medical coverage that’s strong, clear, and easy to claim when you need it.

Understanding Medical Expenses Cover

Understand what a Travel Insurance Policy for medical expenses involves When looking for it, it’s important you know what it includes: 1. This coverage is crucial for travellers, as it candeal with costs from relatively minor occurrences such as visiting a doctor for a random illness to major emergencies involving hospitalization or medical evacuation. Peace that comes from knowing you won’t incur a financial liability for unexpected medical concerns is priceless.

Making The Perfect Choice: Beyond the Total Trip Cost

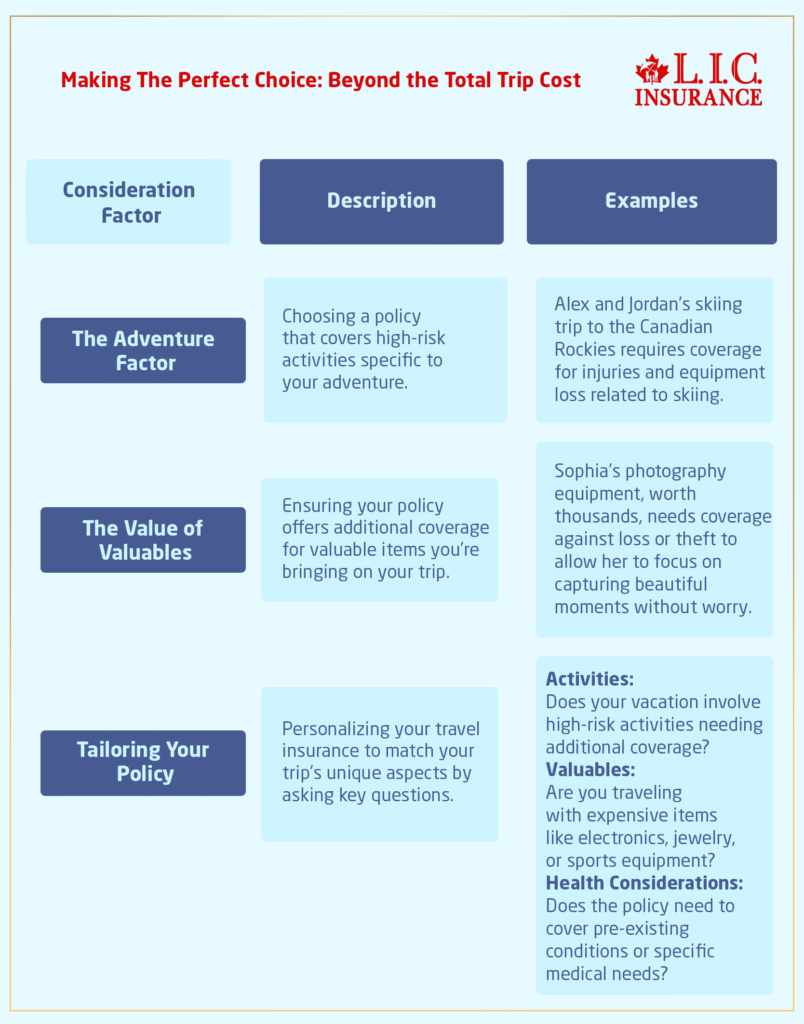

Lots of things are at stake when picking the right Travel Insurance plan besides just the trip cost. It’s about getting very clear about what’s covered and making sure it fits very well with your travel plans. On this journey of selection, you’re not just checking off a box; you’re also making an element of security that fits your unique adventure just right. Let’s go through this process together.

The Adventure Factor

Think of Alex and Jordan, two intrepid friends planning a skiing trip to the Canadian Rockies. Eager to hit the trails, parks, and other places that may be coated with fresh powder this season, they also acknowledge that the activities they’ll participate in are also high-risk ones. This thought is one that encourages them to find a Travel Insurance Policy that offers more than just a standard cover and something that covers them against the risks of skiing, such as injuries or loss of equipment.

And this is where the significance of an all-encompassing Travel Insurance, covering medical costs and everything else, comes into sharp focus. This goes beyond having any policy; it’s about having the right one. For Alex and Jordan, a policy that matches their style of adventure and covers high-risk activities is a must. It’s a ticket to experiencing the excitement without the stress of financial risk.

The Value of Valuables

Now, enter Sophia, an aspiring photographer who loves to see the world through her camera’s eyes. It’s not a complete travel experience for her without her camera and gear, which is often worth thousands of dollars. The thing worrying her most is that her equipment gets lost or stolen. In this case, a standard Travel Insurance Policy may not cover the full value of her gear, so it’s worth looking for a policy with specialist cover for expensive items.

Sophia’s tale also demonstrates just how vital it is to be mindful of what you take when you travel. Having a Travel Insurance plan that allows you to add coverage for valuable items can transform that fear into mental peace, so travellers like Sophia can experience the awe of their destination without stressing about their valuables.

Tailoring Your Policy

Choosing the right Travel Insurance Policy means asking the right questions:

- What activities will I be doing? Identify if your vacation involves activities that require additional coverage.

- What valuables am I taking with me? Assess if you need extra coverage for items like electronics, jewelry, or sports equipment.

- What are my health considerations? Ensure your policy covers pre-existing conditions or specific medical needs.

This thoughtful approach to selecting a Travel Insurance Policy ensures that your coverage is as unique as your trip. It’s about matching the policy details to your individual travel blueprint and creating custom-fit protection.

Conclusion: Taking the Next Steps

Knowing something about the average cost of Travel Insurance and factors which drive these prices gives you a good grounding to make your choice. And like many Canadian travellers, you can find a policy that suits the way you like to travel, both ensuring financial peace of mind and contentment.

We recommend that you not put off this task until the final hour. Begin researching your options, comparing quotes, and thinking through the specifics of your trip. Whether you’re a risk-taker, a family goer, or someone in need of some chill time, there’s a Travel Insurance Policy to suit your individual needs. Get ready to hit the road, rail, ocean, or wherever your travels take you.

The world is waiting, and now you can have the knowledge and confidence to travel more safely and have more fun. Happy Travelling:)

Find Out: How long before travelling should you get travel insurance?

Get The Best Insurance Quote From Canadian L.I.C

Call 1 844-542-4678 to speak to our advisors.

FAQs

It can feel a bit like wandering around in a strange place with no map when trying to get your head around the terminology used in your Travel Insurance Policy. Don’t worry, though! To make things easier for you with your Travel Insurance, we’ve compiled a list of frequently asked questions with clear, concise answers. These frequently asked questions (FAQS) about Travel Insurance will help make it seem as simple as eating your favourite travel snack.

In its most basic form, think of travel Insurance Policy as your faithful travel companion – on hand to assist in a multitude of scenarios. It typically protects against things like trip cancellations due to emergencies, medical emergencies while travelling, lost luggage and, sometimes, travel delays. For example, if your flight is cancelled due to unexpected weather, travel insurance may help cover eligible costs depending on the policy you selected.

Suppose Tom, who enjoys hiking, twists his ankle while exploring hiking trails in the mountains in Canada. A Travel Insurance Policy for medical expenses comes to his rescue, providing the required medical care without keeping an eye on the associated costs. When travelling, this type of policy is crucial as it will shield you from unexpected medical expenses since such expenses can only result in misery.

Trip insurance in Canada ranges widely in price, but generally, it costs between $50 and $300. In 2026, it can be higher than $300 for seniors, longer trips, USA travel, and travellers with medical conditions requiring specialized coverage.

Yes, you can! However, it’s like buying a custom-made outfit; you need to provide details about your condition to find a policy that fits just right. Some policies might exclude certain conditions or require you to pay a bit more for coverage. Being upfront about your medical history is essential to ensure you’re fully covered.

But if, like Alex and Jordan, you are planning a trip to the slopes, you should seek out a policy that specifically covers high-risk activities. Read the fine print to make sure you’re covered for your adventures, and ask the insurance company if you’re not sure. Picking the right policy is making sure it matches the adrenaline level of your activities.

The optimal time to purchase Travel Insurance is right after you’ve made your trip. Doing so will guarantee that you get insured against any unexpected cancellations from the very start. It’s the digital equivalent of applying your seatbelt the moment you sit down in your car — a safety measure few would be willing to skip.

Think of yourself as Sara, who buys Travel Insurance, then, for some reason, needs to postpone her trip to Italy. Most Travel Insurance packages include a “free look” window (typically 10 to 14 days after purchase) in which you can cancel your policy for a full refund, provided you haven’t embarked on your journey or submitted a claim. It’s no different than trying on a new outfit at home and deciding if it’s the best fit for the event you will be attending.

So, suppose Marco is contemplating a vacation to the beach, but then a hurricane forecast ruins his plans. Travel Insurance policies differ, but many provide cover for cancelling trips because of an unexpected natural disaster or pandemic. But it’s important, much like how you check the weather outside before a day on the lake, to dive into the details of the specific terms of your policy and verify that these occurrences are covered.

The idea of filing a claim can sound intimidating, but it’s a lot like telling a friend about an unexpected event during your trip if you want to make a claim, call your insurer before calling the police to tell them what happened. They’ll walk you through the process, which usually involves filling out a form and submitting paperwork, such as medical bills or flight cancellation notices. It is about picking up the pieces of your story so your insurer can make sense of it — and help you.

Imagine Lily, who has a chronic condition but an affinity for travel. Plenty of Travel Insurance policies will protect those with pre-existing medical conditions, you just need to inform them as soon as you are taking out the policy. You’d better select the right guide for whatever hike you’re going on, and by being candid, you’ll be able to get a policy that applies directly to you, so that you will be covered on your journey all the way through.

Travel Insurance is like a tailor-made garment – It is not one-size-fits-all all. Although some insurers may have age restrictions for their coverage, there are companies that are dedicated to providing coverage for travellers of all ages, like seniors. It’s finding the company that is well suited for the stage of the journey you are on in life, whether you are young or older, that adequately protects you.

Figuring out how much medical coverage you need is, like packing a suitcase, contingent upon the length and nature of your trip. Consider factors such as the cost of health care, where you’re going, and what you’ll be doing there. As a general rule of thumb, try to find policies that include at least $100,000 of medical coverage, and you’ll be better protected against those surprise medical costs.

If you’re having a (too) good time exploring and wish to extend your coverage, most insurance companies let you do that if you request it before your policy expires. It’s no different than requesting a late checkout at a hotel; more time to finish enjoying your adventure.

Purchasing Travel Insurance is similar to choosing the ideal travel wardrobe: it must fit your travel style just right. Begin by evaluating your travel plans — think about where you’re going, what you’ll be doing, and who you’re going with. Research online or talk to an insurance broker to compare policies to fit your needs. Find one that covers your activities, medical expense,s and fits your budget. When you have found the right style, you can almost always buy online or over the phone, providing your details and payment.

If you’re going away for just a short weekend, Travel Insurance may be almost as important as your wallet. Curfews make parents and children safer without taking the fun out of a trip or the adventure of finding local treasures off the beaten path; things happen — an injury, a sudden illness — on short journeys close to home, too. For example, suppose you’re on a short skiing trip to Whistler and unfortunately sprain your ankle down the slopes. In that case, a Travel Insurance Policy with medical cover can be your saviour, which will help you cover that expensive bill. It’s ensuring even a brief time away is not ruined by unexpected costs, so you can enjoy every moment, no matter how fleeting.

The above information is only meant to be informative. It comes from Canadian LIC’s own opinions, which can change at any time. This material is not meant to be financial or legal advice, and it should not be interpreted as such. If someone decides to act on the information on this page, Canadian LIC is not responsible for what happens. Every attempt is made to provide accurate and up-to-date information on Canadian LIC. Some of the terms, conditions, limitations, exclusions, termination, and other parts of the policies mentioned above may not be included, which may be important to the policy choice. For full details, please refer to the actual policy documents. If there is any disagreement, the language in the actual policy documents will be used. All rights reserved.

Please let us know if there is anything that should be updated, removed, or corrected from this article. Send an email to Contact@canadianlic.com or Info@canadianlic.com