- Connect with our licensed Canadian insurance advisors

- Shedule a Call

BASICS

- Is Infinite Banking A Smart Financial Strategy?

- Understanding the Infinite Banking Concept

- Why Infinite Banking Appeals to Canadians Seeking Financial Freedom

- How Infinite Banking Strategy Helps Build Financial Independence

- Challenges and Misconceptions About Infinite Banking

- Who Should Consider Infinite Banking for Financial Freedom?

- How to Start Your Infinite Banking Journey

- Key Advantages of the Infinite Banking Strategy

- A Day-to-Day Struggle: Why More Canadians Are Exploring Infinite Banking

- Potential Drawbacks You Should Know

- The Future of Infinite Banking in Canada

- Is Infinite Banking a Smart Financial Strategy?

COMMON INQUIRIES

- Can I Have Both Short-Term and Long-Term Disability Insurance?

- Should Both Husband and Wife Get Term Life Insurance?

- Can I Change Beneficiaries on My Canadian Term Life Policy?

- What Does Term Life Insurance Cover and Not Cover?

- Does Term Insurance Cover Death?

- What are the advantages of Short-Term Life Insurance?

- Which Is Better, Whole Life Or Term Life Insurance?

- Do Term Life Insurance Rates Go Up?

- Is Term Insurance Better Than a Money Back Policy?

- What’s the Longest Term Life Insurance You Can Get?

- Which is better, Short-Term or Long-Term Insurance? Making the Right Choice

IN THIS ARTICLE

- What is the minimum income for Term Insurance?

- How Does Income Affect Your Term Life Insurance Policy?

- Can You Buy Term Life Insurance Online with a Low Income?

- How Can You Lower Your Term Life Insurance Cost?

- How Much Term Life Insurance Do You Need?

- Can Your Term Life Insurance Policy Be Adjusted Over Time?

- Why Term Life Insurance Is Ideal for Lower-Income Canadians

- Final Thoughts

- More on Term Life Insurance

Travelling Abroad? Why Emergency Medical Insurance Can Save You Thousands

By Pushpinder Puri

CEO & Founder

- 10 min read

- September 16th, 2025

SUMMARY

Emergency Medical Insurance for travel helps protect against high medical expenses abroad. The content explains Travel Medical Insurance benefits, medical evacuation costs, and why International Travel Insurance Plans are vital for medical care outside Canada. It highlights trip protection, lost baggage coverage, limits of credit card coverage, and how Emergency Medical Insurance Quotes Online allow travellers to compare policies and secure proper medical coverage.

Introduction

We meet families every week who tell us the same story. They were excited about their trip, packed their bags, booked their hotels, and never thought twice about health coverage. Then one slip on a sidewalk, one unexpected illness, or one sudden medical emergency abroad could cost them tens of thousands. And when the hospital demanded immediate cash payment before treatment, they realized their provincial health insurance was not enough.

We spend a lot of time helping travellers avoid this. Emergency Medical Insurance for travel is not extra padding. It is the difference between returning home safe and returning with a debt that lingers for years.

Medical Emergency Can Happen Anywhere

You do not need to be an adventurer to face trouble. One of our clients, a frequent traveller to the United States, fainted in a shopping mall. The ambulance rushed him to the hospital. A single night of medical care costs more than $8,000. That was without surgery. Without Emergency Medical Travel Insurance, he would have paid out of pocket.

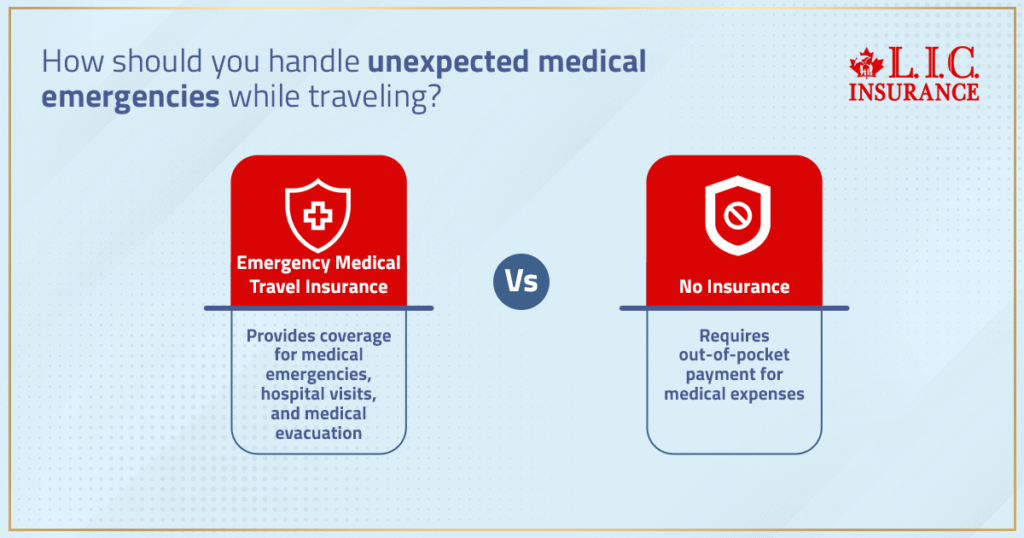

Think about it. An unexpected illness on vacation in Mexico. A fractured wrist during a trip to Europe. Even food poisoning in Asia. None of these events gives you time to shop for coverage. International Travel Insurance Plans protect you before these moments arrive. They provide coverage for emergency medical care, hospital visits, and sometimes even medical evacuation back to Canada.

The Rising Cost of Medical Care Abroad

Hospitals abroad do not work like hospitals here. In Canada, you never see a bill. In the United States, you are billed for every doctor visit, every test, and every night in the hospital. A broken leg in Florida can cost more than $17,000. In Europe, a heart-related emergency can reach tens of thousands.

The biggest shock comes when hospitals demand immediate cash payment before providing medical treatment. Without Travel Medical Insurance benefits, you scramble to arrange money. With coverage, your insurance company deals directly with health care providers. You focus on recovery, not credit card limits.

Emergency Medical Insurance Quotes Online make comparison simple. You choose a policy that matches your trip length, activities, and personal health condition.

When You Need Emergency Medical Care

Time is everything during a medical emergency. Ambulance services, tests, and urgent surgery are unavoidable. Emergency medical travel coverage takes care of these costs. It also pays for medical evacuation if the destination country lacks advanced facilities.

We once assisted a Canadian couple whose trip was cut short after a sudden stroke abroad. The medical evacuation back home cost more than $60,000. Their emergency medical Travel Insurance paid it in full. Without it, they would have been trapped, with no way to cover such a financial impact.

Why Emergency Medical Travel Insurance Protects You

Policies do more than cover medical expenses. Many Travel Insurance Policies combine emergency medical protection with trip protection. That means:

- Refunds for trip interruption caused by a medical emergency.

- Coverage for prepaid expenses, such as hotels or tours, cannot be used.

- Direct billing to health care providers so you avoid delays.

When you purchase Travel Insurance through a licensed insurance provider, you know exactly what your plan includes. We help you review the fine print, ensuring your insurance policy does not leave gaps.

The True Value of Emergency Medical Insurance

Think about how much you save. Without insurance, even a few days of hospital care abroad leaves you facing thousands of dollars in medical bills. Emergency Medical Insurance saves money by covering costs that provincial health insurance never touches.

Many travellers are surprised when they hear about real cases:

- A tourist in California broke an ankle. Hospital bill: $22,000. Covered in full.

- A family trip to Europe ended early due to pneumonia. Their insurance company refunded the unused portion of their trip.

- A senior traveller required medical evacuation from the Caribbean. Covered at $48,000.

Emergency Medical Insurance is not about small claims. It prevents a life-changing financial impact.

Extra Risk With Extreme Sports

If you plan scuba diving, skiing, or other extreme sports, the risk multiplies. Some insurance options include these activities. Some exclude them. Many Travel Insurance plans make you read the fine print closely.

Always confirm with your insurance provider before purchase. Do not assume coverage. We guide you through insurance policy details so your emergency medical Travel Insurance works when you need it most.

Lost Baggage and Travel Disruptions Add Up

Lost baggage is frustrating and costly. Replacing clothing and essentials during travel adds unexpected expenses. Travel Insurance Policies cover lost luggage. They reimburse you, so the financial impact is small.

Other disruptions include flight delays, natural disasters, or trip interruption caused by medical conditions. Trip protection within your plan ensures you are not paying out of pocket for prepaid expenses. Even frequent travellers benefit from this safety net.

Why Medical Coverage From Credit Cards Falls Short

Many travellers rely on credit card coverage. We see problems here. Coverage limits are low. Some exclude pre-existing medical conditions. Many do not include medical evacuation.

Credit card protection is useful, but it is not enough. Emergency medical Travel Insurance offers higher medical coverage, flexible Travel Insurance plans, and stronger trip protection. When you purchase insurance through us, we compare insurance company options to give you full protection.

Health Insurance Outside Canada

Your home province coverage is limited abroad. OHIP in Ontario pays $400 per day for hospital care outside Canada. Actual medical expenses in most countries are far higher. This means your provincial health insurance covers only a fraction.

Travel health insurance fills the gap. It provides emergency medical travel coverage, medical Travel Insurance for doctor visits, and the health care you need overseas. We ensure your insurance policy includes the right medical coverage for your destination country and length of stay.

Travel For An Extended Period

If you are away for an extended period, your risk increases. The longer you stay, the greater the chance of a medical emergency. Many insurance providers allow you to extend or top up coverage.

We often work with frequent travellers who take long stays abroad. We review their insurance policy, extend their Travel Medical Insurance, and adjust coverage for pre-existing medical conditions when possible. That way, Emergency Medical Insurance protects them for the entire trip.

Why Canadian LIC Helps Travellers Save Thousands

We know how to guide families, seniors, and business professionals through insurance options. Our role is to explain coverage clearly, compare Emergency Medical Insurance Quotes Online, and match plans to your needs.

We help you:

- Avoid paying tens of thousands in medical bills.

- Secure trip protection for cancellations or interruptions.

- Choose insurance policies that include medical evacuation and lost baggage coverage.

Many travellers think Travel Insurance is complicated. With us, you receive practical advice. We ensure your Travel Medical Insurance benefits protect you from financial impact and unnecessary stress.

FAQs

No. Emergency Medical Insurance for travel focuses on urgent needs only. Routine medical care, such as annual check-ups or ongoing treatments, is not included. If you need follow-ups or doctor visits abroad, speak with your insurance provider to confirm what your plan includes.

Quotes vary based on age, destination country, length of trip, and any pre-existing medical conditions. Emergency Medical Insurance Quotes Online also adjust depending on the medical coverage limits you select. We help compare Travel Insurance plans so you can secure protection tailored to your needs.

Yes, many Travel Insurance Policies provide coverage across several destinations in one trip. Emergency medical Travel Insurance applies wherever you go, as long as the countries are listed on your insurance policy. Always confirm with your insurance company if you add new stops mid-journey.

Not always. While emergency medical travel coverage focuses on urgent medical expenses, some policies cover trip cancellation caused by events like travel advisories, natural disasters, or family emergencies at home. Review your plan’s trip protection section to see what insurance options offer coverage.

Yes. Many insurance providers offer annual travel health insurance. This allows frequent travellers to avoid buying separate policies for each trip. The insurance company sets limits on trip duration, but Emergency Medical Insurance benefits remain active during every covered journey.

Yes, many Travel Insurance plans provide coverage for lost baggage even if it happens during connecting flights. The insurance company usually requires proof from the airline. Compensation is designed to reduce the financial impact of replacing essentials while you continue your trip.

They are different. Trip interruption applies when your trip is cut short, and you need to return home. Trip cancellation applies before departure if you cannot leave as planned. Both features help save money on prepaid expenses and protect against unforeseen circumstances.

It depends on your insurance policy. Some cover medical evacuation to the closest hospital able to provide emergency medical care. Others include evacuation back to Canada if treatment abroad is not sufficient. Always check the fine print before you purchase insurance.

When a medical emergency occurs, hospitals or clinics usually contact your insurance provider directly. The insurance provider confirms coverage and arranges cash payment to the facility. This ensures you do not need to pay out of pocket for emergency medical care.

Not always. Some insurance options offer coverage for extreme sports such as scuba diving or skiing, while others exclude them. If you plan such activities, request a Travel Medical Insurance Policy that includes this specific protection.

Yes, some policies include trip protection for flight delays. The plan includes reimbursement for hotels, meals, or new tickets when delays exceed a set number of hours. Coverage varies by insurance provider, so review your insurance policy carefully.

Most insurance companies require you to purchase Travel Insurance before leaving your home province. Some insurance options allow late purchase, but they impose waiting periods before medical coverage begins. Our advisors help you understand which plans still offer coverage.

Yes, many Travel Insurance Policies include protection for trip cancellation or interruption caused by natural disasters. This ensures you are not left without support if earthquakes, hurricanes, or floods affect your destination country. Review the plan to confirm what is included.

Key Takeaways

- Emergency Medical Insurance for travel protects you from paying tens of thousands in medical expenses abroad.

- International Travel Insurance Plans provide coverage for medical care, emergency medical evacuation, trip interruption, and lost baggage.

- Relying on provincial health insurance or credit card coverage is risky since they offer limited medical coverage outside Canada.

- Emergency Medical Insurance Quotes Online help compare Travel Insurance plans and secure protection tailored to trip length, activities, and health conditions.

- Canadian LIC assists frequent travellers, families, and seniors by matching the right Travel Medical Insurance benefits with their needs.

Sources and Further Reading

- Government of Canada – Travel Insurance

The site explains why Canadian provincial health plans do not fully cover medical costs abroad, and urges having travel health insurance before you depart. Ontario+15Travel.gc.ca+15Medipac+15 - Government of Canada – Trip Interruption and Travel Health Insurance

This page clarifies the differences between trip interruption coverage, medical evacuation, and travel health insurance. - McKenzie Lake Lawyers LLP+5Travel.gc.ca+5Travel.gc.ca+5Travel.state.gov+2CDC+2

- Government of Canada – “Bon Voyage, but…” Fact Sheet

Highlights that Canada will not pay your medical bills overseas and details what your travel health insurance should include, such as medical evacuation and pre‑existing conditions. Snowbird Advisor Insurance+14Travel.gc.ca+14snowbirds.org+14 - CDC – Travel Insurance Types (Yellow Book)

Explains travel disruption, health insurance, and medical evacuation options in a destination country. Useful for understanding International Travel Insurance Plans. - CDC+2CDC+2

- Ontario Government – OHIP Coverage While Outside Ontario

Covers how OHIP applies within Canada and its limits when you travel outside the province or outside Canada entirely. - IBC+15Ontario+15Ontario+15CDC+13Settlement.Org+13Reddit+13

- Canadian Snowbird Association – Travel Insurance

Details Travel Medical Insurance offerings, including Medipac coverage and how it handles pre‑existing conditions. - Reddit+15snowbirds.org+15Medipac+15

Feedback Questionnaire:

IN THIS ARTICLE

- Travelling Abroad? Why Emergency Medical Insurance Can Save You Thousands

- Medical Emergency Can Happen Anywhere

- The Rising Cost of Medical Care Abroad

- When You Need Emergency Medical Care

- Why Emergency Medical Travel Insurance Protects You

- The True Value of Emergency Medical Insurance

- Extra Risk With Extreme Sports

- Lost Baggage and Travel Disruptions Add Up

- Why Medical Coverage From Credit Cards Falls Short

- Health Insurance Outside Canada

- Travel For An Extended Period

- Why Canadian LIC Helps Travellers Save Thousands

Sign-in to CanadianLIC

Verify OTP