- Connect with our licensed Canadian insurance advisors

- Shedule a Call

BASICS

- Is Infinite Banking A Smart Financial Strategy?

- Understanding the Infinite Banking Concept

- Why Infinite Banking Appeals to Canadians Seeking Financial Freedom

- How Infinite Banking Strategy Helps Build Financial Independence

- Challenges and Misconceptions About Infinite Banking

- Who Should Consider Infinite Banking for Financial Freedom?

- How to Start Your Infinite Banking Journey

- Key Advantages of the Infinite Banking Strategy

- A Day-to-Day Struggle: Why More Canadians Are Exploring Infinite Banking

- Potential Drawbacks You Should Know

- The Future of Infinite Banking in Canada

- Is Infinite Banking a Smart Financial Strategy?

COMMON INQUIRIES

- Can I Have Both Short-Term and Long-Term Disability Insurance?

- Should Both Husband and Wife Get Term Life Insurance?

- Can I Change Beneficiaries on My Canadian Term Life Policy?

- What Does Term Life Insurance Cover and Not Cover?

- Does Term Insurance Cover Death?

- What are the advantages of Short-Term Life Insurance?

- Which Is Better, Whole Life Or Term Life Insurance?

- Do Term Life Insurance Rates Go Up?

- Is Term Insurance Better Than a Money Back Policy?

- What’s the Longest Term Life Insurance You Can Get?

- Which is better, Short-Term or Long-Term Insurance? Making the Right Choice

IN THIS ARTICLE

- What is the minimum income for Term Insurance?

- How Does Income Affect Your Term Life Insurance Policy?

- Can You Buy Term Life Insurance Online with a Low Income?

- How Can You Lower Your Term Life Insurance Cost?

- How Much Term Life Insurance Do You Need?

- Can Your Term Life Insurance Policy Be Adjusted Over Time?

- Why Term Life Insurance Is Ideal for Lower-Income Canadians

- Final Thoughts

- More on Term Life Insurance

Pregnancy Travel Insurance In Canada: What Every Expecting Parent Needs To Know

By Pushpinder Puri

CEO & Founder

- 13 min read

- October 08th, 2025

SUMMARY

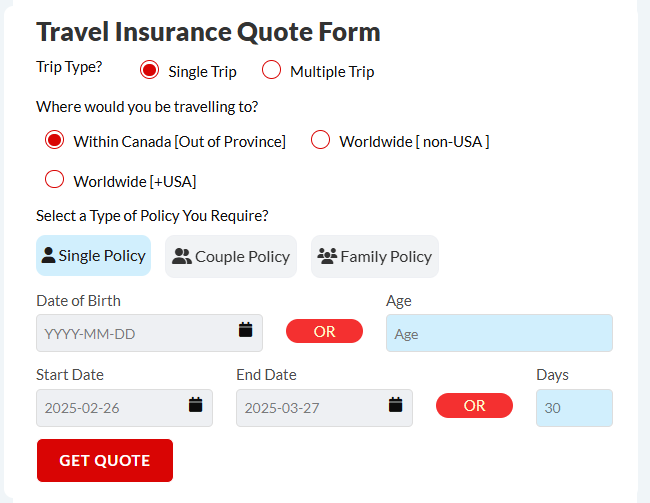

Pregnancy Travel Insurance in Canada is essential for expectant parents planning trips. Coverage includes Travel Insurance for pregnancy in Canada, trip cancellation, emergency medical care, and protection against pregnancy-related complications. Policies often exclude pre-existing conditions and high-risk pregnancy within nine weeks of the expected delivery date, making early planning and Travel Insurance Quote Online comparison important.

Introduction

Travel should be joyful, but for expectant parents, it is never as simple as buying tickets and packing bags. Pregnancy changes everything, including how you must think about Travel Insurance Coverage. We speak to families daily who are excited about travelling while expecting, yet nervous about the risks. Many have questions about how Travel Insurance for pregnancy in Canada works, what is covered, and when it makes sense to buy it.

We know pregnancy is a life chapter filled with anticipation, emotion, and careful planning. If you are considering travelling while pregnant, the right insurance policy acts as a safety net. It protects against medical costs, emergency medical evacuation, and trip cancellation. But here is the truth most people miss: most Travel Insurance Policies have strict rules about pregnancy coverage. The fine print matters more than ever when you are expecting a baby.

In this guide, we will break down how Travel Insurance and pregnancy interact, how most insurance providers treat pregnancy-related complications, and what expectant parents should do before booking a trip.

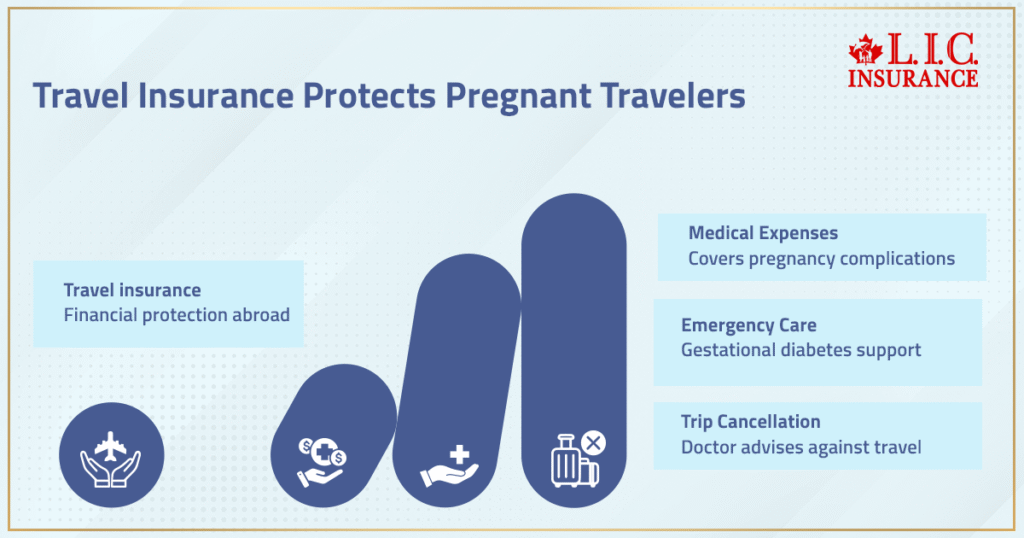

Why Expectant Parents Should Consider Travel Insurance

Pregnant women who decide to travel are exposed to unique risks. Air travel comes with concerns about developing blood clots, long flights that strain the body, and sometimes the need for emergency medical care far away from home. The cost of medical attention abroad can be overwhelming, and health insurance in Canada does not extend to other countries.

This is where Travel Insurance cover for pregnancy becomes essential. A Travel Insurance Policy ensures you have financial protection if unexpected medical emergencies happen while abroad. Coverage could extend to medical expenses from pregnancy complications, emergency medical care for issues like gestational diabetes, or even trip cancellation insurance if a doctor advises against travel.

Travel Insurance Coverage Rules For Pregnancy

One of the most misunderstood aspects of Travel Insurance and pregnancy is how strict timelines affect coverage. Most Travel Insurance providers in Canada do not cover pregnancy-related complications within nine weeks before or after the expected delivery date. This “nine-week rule” is a critical detail.

If you book travel earlier in your pregnancy, outside the later stages, you may still be protected for emergency medical costs. For example, if you are 20 weeks pregnant and suddenly require emergency medical care abroad, your Travel Insurance Coverage could respond. However, if you are within nine weeks of your due date, most policies will consider pregnancy a pre-existing condition and exclude related complications.

Travel Insurance for pregnancy in Canada often covers:

- Medical expenses related to unexpected medical emergencies.

- Trip cancellation or trip interruption if a healthcare provider advises you not to travel.

- Emergency medical evacuation if you need specialized care unavailable at your destination.

But routine care, morning sickness, or giving birth abroad is generally excluded. Coverage is designed to handle emergencies, not the normal routine care of pregnant travellers.

The Importance Of Pre-Existing Conditions In Pregnancy Coverage

Pregnancy itself is sometimes classified as a pre-existing condition. If you were already pregnant before buying your Travel Insurance Policy, many providers will exclude related complications. High-risk pregnancy situations—such as previous pregnancy complications, gestational diabetes, or a history of blood clots—are also usually treated as pre-existing conditions.

We always remind expectant parents that pre-existing conditions must be disclosed honestly. Without full disclosure, your policy covers less than you think. Reading the fine print and confirming what your insurance policies cover with written confirmation from your insurance providers is the only way to avoid surprises.

Private Health Insurance And Pregnancy Travel

Some families ask if private health insurance can supplement their coverage while abroad. While a health insurance plan in Canada is designed for domestic care, private health insurance may include limited out-of-country medical coverage. But in most cases, the safest option is buying a Travel Insurance Policy that specifically addresses pregnancy-related issues.

We compare insurance providers for you, ensuring the policy covers emergency medical costs, pregnancy-related complications, and trip cancellation coverage if a doctor advises against travel. Whether you’re comparing health insurance premiums, a private health insurance cost, or dental coverage, the bottom line remains: Travel Insurance Policy terms are unique. A health insurance plan is not the same as Travel Insurance Coverage.

Health Insurance In Canada And The Gap Abroad

Public health insurance in Canada provides strong protection at home, but it does not pay for medical care overseas. Expectant parents who assume their provincial health care card covers everything abroad risk paying thousands in medical expenses. A single hospital visit for pregnant travellers could exceed $10,000, depending on the country. If emergency medical evacuation is required, costs can reach six figures.

That’s why Travel Insurance that covers pregnancy is so important. It fills the gap that public health insurance leaves, especially when health care systems abroad do not recognize Canadian coverage.

Common Pregnancy-Related Complications And Coverage

Travel Insurance cover for pregnancy typically responds to sudden emergencies, not expected issues. For example:

- Gestational Diabetes: Covered if diagnosed during travel and requiring medical care.

- Preeclampsia: Emergency medical attention required due to high blood pressure may be covered.

- Miscarriage: Treated as an emergency medical situation if it occurs more than nine weeks from your expected due date.

- Hyperemesis Gravidarum: Severe morning sickness requiring hospitalization may be included.

However, most Travel Insurance Policies exclude routine check-ups, giving birth abroad, or pregnancy-related issues that were not expected. If your doctor confirms your due date shows you are within the restricted nine-week window, expect related complications to be generally excluded.

Airline Rules And Travel Restrictions

Most airlines allow pregnant women to travel until around 36 weeks, but restrictions increase after 28 weeks. After that point, most airlines may request a doctor confirming the due date or written confirmation of fitness to fly. Pregnant travellers should book an aisle seat, wear loose clothing, and stay hydrated to reduce the risk of deep vein thrombosis during long flights.

We advise families to avoid travel in the later stages when the risks increase. When your departure date is close to your expected due date, insurance policies and airlines both impose stricter rules.

Trip Cancellation And Trip Interruption For Pregnancy

One major concern for expectant parents is whether insurance policies will reimburse non-refundable expenses if they must cancel or end a trip early. Trip cancellation is often available if a pregnancy begins after booking and a healthcare provider advises against travel. Trip interruption can apply if pregnancy complications arise mid-trip and you need to return home.

For example, if you book a babymoon months before, then learn you are pregnant after purchasing Travel Insurance, the policy covers cancellation. But if you were already pregnant and later decide to avoid travel, most policies exclude it.

Ending a trip early due to unforeseen pregnancy complications can be covered if it qualifies as an emergency medical situation. We help families secure Travel Insurance Policy terms that cover both cancellation and trip early return, so your financial risk is minimized.

High-Risk Pregnancy And Additional Risks

Families with high-risk pregnancy conditions face tougher exclusions. Insurance providers classify high-risk pregnancy as a pre-existing condition, leaving little coverage. If your healthcare provider advises avoiding travel due to high altitude, long flights, or additional risks, it is wise to follow that guidance.

We have seen too many families assume coverage exists, only to discover their high-risk pregnancy excludes pregnancy-related complications. We always encourage reviewing the fine print before relying on any policy coverage.

Insurance Providers Offering Travel Insurance For Pregnancy

We partner with leading Travel Insurance providers such as Allianz, Manulife, Tugo, GMS, and Destination Canada. Each company structures coverage differently. Some policies provide broader protection for pregnant travellers, while others are more restrictive.

When comparing insurance providers, we consider:

- Which Travel Insurance Policy covers pregnancy-related issues?

- How each handles pre-existing conditions.

- Whether emergency medical evacuation is included.

- How trip cancellation coverage applies.

- The cost of monthly premiums or annual policies.

With multiple insurance companies competing, expectant parents benefit from professional advice to select the right policy coverage.

How Canadian LIC Supports Expectant Parents

Our role is not only to compare insurance policies but also to guide families through every detail. We break down health insurance premiums, explain private health insurance cost differences, and clarify which Travel Insurance covers pregnancy in your situation.

Expectant parents face enough stress preparing for a baby’s arrival. They should not also struggle to decode complicated insurance policies. Whether it’s trip cancellation insurance, emergency medical care, or coverage for unexpected medical emergencies, our advisors ensure every Canadian family makes an informed decision.

Final Thoughts

Pregnancy adds joy but also risk. Travelling while pregnant demands more than packing a bag—it requires financial protection through the right Travel Insurance Policy. We have guided thousands of Canadian families through these exact decisions.

By addressing pre-existing conditions, comparing insurance providers, and focusing on coverage for medical expenses and trip cancellation, you can protect both your trip and your child’s future.

Pregnancy Travel Insurance is not about fear—it is about preparation. With professional guidance, you gain coverage, confidence, and peace knowing that even if unexpected medical emergencies happen, your family has support.

FAQs

Coverage often depends on timing. If you have Travel Insurance with trip cancellation and your doctor provides their recommendation in writing before you’re scheduled to leave, in general, you’ll have coverage for those nonrefundable costs.

Flying itself has risks. Conditions like deep vein thrombosis or blood clots can develop, and some types of Travel Insurance cover pregnancy for those kinds of emergencies. Pregnant travellers are generally advised to book an aisle seat, to keep moving during long periods of sitting and to stay hydrated to reduce the risk.

High-risk pregnancy is considered a pre-existing condition by most insurance companies and has very restricted coverage. Even after comparing Travel Insurance Quote Online options, conditions related to pregnancy, associated with high-risk factors, tied to it are typically ruled out, unless otherwise specified in the small print.

The insurance policies cover the insured person, not the baby, even if you have to ring the helpline if you are taking the baby abroad. In the event a baby is born while you are out of state with no warning, the infant’s medical costs are normally not covered. Pregnant travellers can avoid surprises by checking policies. There’s a lot to think about when you’re expecting, and one of the last things on your mind is insurance.

No, preventive care is all but universally excluded. A Travel Insurance Policy is designed for emergencies, not for planned visits. Pregnant travellers will want to visit a health provider before leaving Canada, given that medical costs associated with routine care outside of the country are often paid out of pocket.

It’s tough. Most policies don’t cover pregnancy-related issues after you’re far down the line. Some insurance companies may request that you have a doctor confirm your due date before they will approve coverage. Once you’re pretty close to your due date (anywhere from one to four weeks out), reimbursements generally exclude complications.

If most airlines won’t let you board because you’re past their time limit, your Travel Insurance doesn’t kick in unless you can provide documented medical reasons. Policy seeks a doctor who does not recommend travel as opposed to airline regulations. This is why it’s so important to look at both your insurance policies and travel restrictions before you book.

Possibly, if diagnosed and needing immediate treatment, then it could be considered an emergency. Travel Insurance covers pregnancy in these instances, but only if you are over nine weeks from your expected delivery date. Gestational diabetes symptomatic before embarkation could be an exclusion criterion.

Trip interruption benefits sometimes apply. In the event you have pregnancy complications and require medical assistance in Canada, your policy may include coverage of unused trip costs and transportation. But if you cancel your trip for comfort or a routine pregnancy, then coverage likely does not apply.

Dress is not a measure of coverage, but insurance and health care providers frequently recommend these measures. Risk of deep vein thrombosis can be reduced by wearing loose clothing, positioning the lap belt properly on long flights, and moving frequently. This is another way of demonstrating that you’re a responsible pregnant traveller by adhering to these steps.

That’s where trip cancellation — or trip interruption — coverage comes in. If you are compelled to alter your plans due to pregnancy-related problems, a good Travel Insurance Policy can partially or completely reimburse your associated costs. The fine print really matters here — most companies will need a letter from a doctor for coverage to kick in.

Yes, if you have a water-borne illness or mosquito bite and come down sick, your policy’s emergency medical care should apply. Ketones aren’t even pregnancy complications, but they affect people who are pregnant and can lead to further complications. Always ensure that your policy is open to unforeseen medical emergencies as well as just pregnancy itself.

Key Takeaways

- Pregnancy changes travel coverage rules – most Travel Insurance Policies exclude pregnancy-related complications within nine weeks before or after the expected delivery date.

- Emergency protection matters – Travel Insurance for pregnancy in Canada can cover unexpected medical emergencies, trip cancellation, or trip interruption if a doctor advises against travel.

- Pre-existing conditions and high-risk pregnancy are generally excluded unless disclosed upfront, making it important to review the fine print and obtain written confirmation of what is covered.

- Airline policies and travel restrictions often require a doctor confirming your due date and fitness to fly after 28 weeks, adding another layer of planning for pregnant travellers.

- Choosing the right insurance providers helps secure broader coverage, including medical expenses, emergency medical evacuation, and reimbursement for non-refundable expenses.

Sources and Further Reading

Government & Policy Insights

- Government of Canada: Travelling While Pregnant

Offers practical advice for safe trips abroad, including how to review Travel Insurance Policies and the fact that most do not cover pregnancy-related conditions or premature infant care. Travel.gc.ca.

Insurance Company Guidelines

- Allianz Global Assistance (Canada)

Highlights that coverage may be eligible up to the 31-week mark, and emphasizes documentation needs for trip cancellation due to pregnancy-related emergencies, Allianz Global Assistance. - Allianz Global Assistance (International)

Adds clarity on what’s treated as a covered emergency (e.g., hyperemesis gravidarum, pre-eclampsia), what’s excluded (normal pregnancy or routine travel denial by airlines), and reinforces the importance of buying coverage early, Allianz Travel Insurance.

Third-Party Insurance Resources

- World Nomads (Canada)

Explains that unexpected pregnancy complications are covered up to 31 weeks, and lists explicit exclusions: routine prenatal care, birth, and complications in the nine-week window before or after the due date. World Nomads.

Provincial / Broader Canadian Context

- Saskatchewan Blue Cross (PDF Guide)

A provincial-level insurer detailing Travel Insurance limitations: coverage is typically not available for trips within eight weeks of delivery, and any complications—even if previously resolved but flagged as risk—may also disqualify coverage sk.bluecross.ca.

Reader / Industry Commentary

- Reddit – r/BabyBumpsCanada

A Travel Insurance professional offers street-level insight:

“Our out-of-country policy does not cover any routine prenatal care, the last 9 weeks of pregnancy, the birth or anything related to the baby once it’s born.” Reddit

Bonus: Insurance Market Overview

- Wikipedia – Travel Insurance

Provides a foundational overview of general Travel Insurance, including typical benefits, exclusions (e.g., pre-existing conditions), and how premiums are calculated—helpful for placing pregnancy coverage policies within broader insurance mechanics Wikipedia.

Feedback Questionnaire:

IN THIS ARTICLE

- Pregnancy Travel Insurance In Canada: What Every Expecting Parent Needs To Know

- Why Expectant Parents Should Consider Travel Insurance

- Travel Insurance Coverage Rules For Pregnancy

- The Importance Of Pre-Existing Conditions In Pregnancy Coverage

- Private Health Insurance And Pregnancy Travel

- Health Insurance In Canada And The Gap Abroad

- Common Pregnancy-Related Complications And Coverage

- Airline Rules And Travel Restrictions

- Trip Cancellation And Trip Interruption For Pregnancy

- High-Risk Pregnancy And Additional Risks

- Insurance Providers Offering Travel Insurance For Pregnancy

- How Canadian LIC Supports Expectant Parents

- Final Thoughts

Sign-in to CanadianLIC

Verify OTP