- Connect with our licensed Canadian insurance advisors

- Shedule a Call

BASICS

- Is Infinite Banking A Smart Financial Strategy?

- Understanding the Infinite Banking Concept

- Why Infinite Banking Appeals to Canadians Seeking Financial Freedom

- How Infinite Banking Strategy Helps Build Financial Independence

- Challenges and Misconceptions About Infinite Banking

- Who Should Consider Infinite Banking for Financial Freedom?

- How to Start Your Infinite Banking Journey

- Key Advantages of the Infinite Banking Strategy

- A Day-to-Day Struggle: Why More Canadians Are Exploring Infinite Banking

- Potential Drawbacks You Should Know

- The Future of Infinite Banking in Canada

- Is Infinite Banking a Smart Financial Strategy?

COMMON INQUIRIES

- Can I Have Both Short-Term and Long-Term Disability Insurance?

- Should Both Husband and Wife Get Term Life Insurance?

- Can I Change Beneficiaries on My Canadian Term Life Policy?

- What Does Term Life Insurance Cover and Not Cover?

- Does Term Insurance Cover Death?

- What are the advantages of Short-Term Life Insurance?

- Which Is Better, Whole Life Or Term Life Insurance?

- Do Term Life Insurance Rates Go Up?

- Is Term Insurance Better Than a Money Back Policy?

- What’s the Longest Term Life Insurance You Can Get?

- Which is better, Short-Term or Long-Term Insurance? Making the Right Choice

IN THIS ARTICLE

- What is the minimum income for Term Insurance?

- How Does Income Affect Your Term Life Insurance Policy?

- Can You Buy Term Life Insurance Online with a Low Income?

- How Can You Lower Your Term Life Insurance Cost?

- How Much Term Life Insurance Do You Need?

- Can Your Term Life Insurance Policy Be Adjusted Over Time?

- Why Term Life Insurance Is Ideal for Lower-Income Canadians

- Final Thoughts

- More on Term Life Insurance

Personal Health Insurance Vs. Disability Insurance In Canada: Do You Need Both?

By Pushpinder Puri

CEO & Founder

- 11 min read

- July 23rd, 2025

SUMMARY

Many Canadians misunderstand the difference between Personal Health Insurance in Canada and Disability Insurance Policies. The content explains how each offers unique coverage—one for medical expenses like prescription drugs and dental care, the other for income protection during illness or injury. It highlights Disability Insurance Costs, the average cost of Personal Health Insurance, and why having both is essential for full financial protection.

Introduction

You don’t see it coming, but it hits hard.

That moment when life shifts.

Your body doesn’t work like it used to. Your paycheck?

Gone.

You’re scared to check your bank balance because you know the numbers don’t lie.

And the system you thought would catch you—didn’t.

We’ve seen this story too many times at Canadian LIC.

A contractor slips off the scaffolding—no income for months.

A young mom diagnosed with MS—daily medication bills she never expected.

A self-employed tech guy, 41, perfectly healthy… until he wasn’t.

They all thought their Health Insurance would “cover it.”

But it didn’t. Because they didn’t know the difference between

Personal Health Insurance and Disability Insurance

And by the time they figured it out, the damage was done.

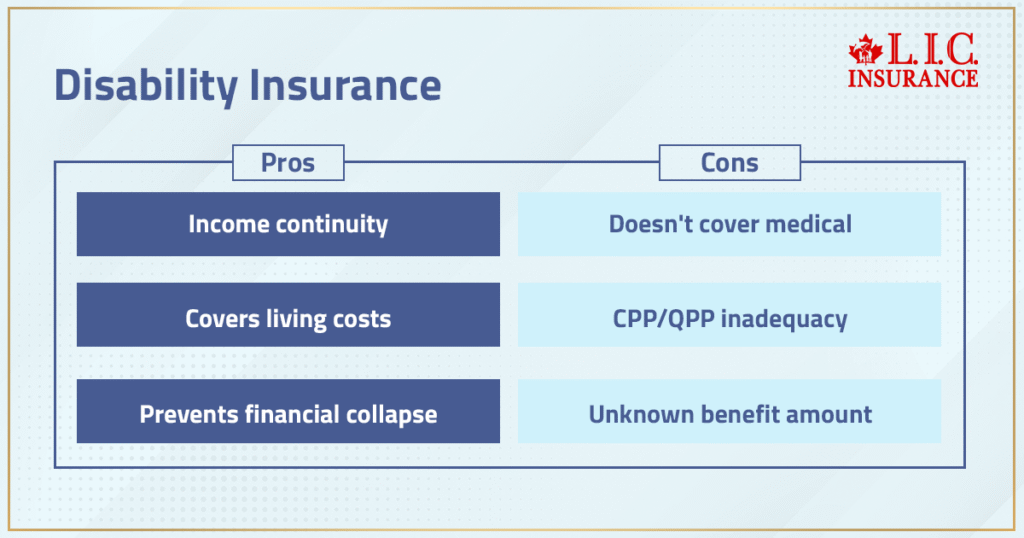

Disability Insurance: When Your Income Is at Risk

If your hands can’t move

Or your mind can’t focus

Or your back keeps you from standing for longer than 15 minutes—

Who’s still paying your mortgage?

Disability Insurance Policies in Canada are not nice-to-haves.

They are your backup income when illness or injury kicks you out of the game.

Some people call it a safety net.

But let’s be honest—when your entire family depends on you,

It’s the bridge between keeping your life intact and watching it all fall apart.

It covers your living expenses, your groceries, and your rent.

It doesn’t touch your medical expenses—that’s not what it’s for.

But it keeps your income coming, month after month,

During your benefit period, even if you’re out long term.

And most people don’t even know what their benefit amount is supposed to be.

They think the CPP or Quebec Pension Plan will help.

It won’t. Not in full. Not fast.

Not enough.

Personal Health Insurance: What the Government Doesn't Pay For

Let’s be real.

Personal Health Insurance in Canada fills in the blanks

That your province leaves behind.

Do you need glasses?

That’s on you.

Does your kid need braces?

Also you.

You’re taking four prescriptions a month after a critical illness?

Good luck paying that without help.

And those paramedical services everyone forgets—chiropractors, massage, counselling, physiotherapy—

They add up faster than you think.

That’s why we sit across the table from clients every day who say:

“Wait… I thought OHIP covered this?”

Nope.

That’s why we recommend Personal Health Insurance plans—real ones,

Not the cookie-cutter kind

Where you don’t even know if it includes vision care,

Or what your dental care limit is,

Or if it helps with specialized treatments you may need next year.

Because health changes.

Health status can go from “fine” to “emergency” overnight.

Two Different Protections. One Life That Needs Both.

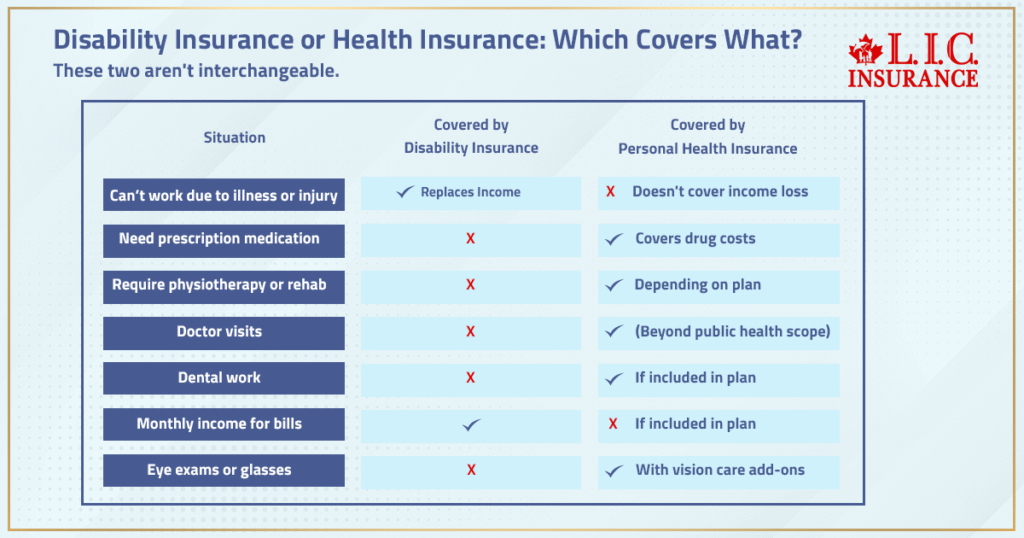

If you’re wondering whether to get one or the other

You’re asking the wrong question.

It’s not this vs that.

It’s this and that.

Disability Insurance protects your income.

Personal Health Insurance protects you from expenses.

There is no overlap.

But there is a massive gap if you only pick one.

We had a client, Mark, 39, an entrepreneur, who built his business from the ground up.

He thought his private Health Insurance was enough.

Then came the crash.

Literally.

He couldn’t walk for six months.

No Group Insurance, no Disability Coverage, no income.

And when the bills came, his personal health plan didn’t help with rent.

Because it couldn’t.

It wasn’t designed to.

Disability Insurance or Health Insurance: Which Covers What?

Online calculators? Good for ballpark numbers, but if you have asthma or your grandma had diabetes, suddenly you’re stuck. Sit with us—well, not literally, unless you like burnt coffee—and we’ll hash out the details. Sometimes you need more coverage, sometimes less. There’s no right answer. We get nervous, too, whenever we fill out paperwork for ourselves. Nobody likes forms.

Critical Illness Insurance: The One People Forget

Sometimes the illness is sharp.

A diagnosis.

A moment you remember like a freeze-frame.

Critical Illness Insurance is the third rail of protection that people ignore until it’s too late.

You get a cheque—tax-free—after diagnosis.

Not slowly. Not monthly.

You can use it to fly across the country for specialized treatments.

You can use it for prescription drugs that aren’t covered.

You can use it for whatever lets you breathe easier.

And when you’re gasping

Sometimes, breathing room is the only thing that matters.

We’ve had clients use it to replace a spouse’s lost income

So they could stay home and be a caregiver.

You can’t put a price on that.

Let's Talk Coverage: How Much Is Enough?

The truth is—most people are undercovered.

They take whatever their employer gives

(Group Coverage, by the way, usually evaporates when you leave that job),

And they hope it’s enough.

But “enough” means different things

To a single mom of three

And to a retired couple with grandkids and a cottage mortgage.

How much coverage you need depends on:

- Your financial obligations

- Your age

- Your health condition

- Your ability to work

- Whether you already have retirement savings

- And honestly, your tolerance for risk.

We don’t just throw around numbers at Canadian LIC.

We ask questions.

We sit with you, your chaos, your confusion.

Then we design the right coverage.

What Drives the Cost?

Everyone wants to know about Disability Insurance Costs

And the average cost of Personal Health Insurance.

But there’s no one-size-fits-all.

It depends on:

- Age

- Income

- Job risk level

- Waiting period (Do you want it to kick in after 30 days, 90?)

- And yes, your health risks

You’ll pay premiums monthly

But if something happens, that benefit is tax-free in most cases.

You’re not just paying for paper.

You’re paying to sleep at night.

What Happens If You Skip Both?

You start gambling.

Not at the casino.

With your life.

If you get sick, you’re covering your own medical bills,

With savings you meant for your kids’ college.

If you can’t work, your fridge gets empty

And your mortgage company stops caring about grace.

A self-employed wedding planner we worked with had no coverage.

She had chronic pain from an undiagnosed spinal issue.

She lost 8 months of work.

We met her during month 6.

She was selling furniture to pay for doctor visits.

It doesn’t need to get there.

Dental and Vision: Yes, They Matter

Don’t overlook the basics.

You’ll use your dental coverage more than you think.

And eye exams?

Important for kids, seniors, and anyone with screen strain (Aka most of us).

If you don’t have prescription drugs dental bundled in,

You’re going to feel that pain the next time you need a root canal.

The Mental Health Gap

If your plan doesn’t address mental health, it’s outdated.

We’ve had teachers, nurses, and even police officers walk into our office

Burned out

Crying

Trying to hold together their families while falling apart themselves.

Your coverage must include mental health issues,

Therapy, medication, everything.

Because breakdowns don’t always come with bandages.

Your Employer's Plan Isn't Enough

We said it earlier, we’ll say it again:

Group Insurance is limited.

It ends when you leave.

It usually doesn’t include critical illness.

It won’t always offer full coverage options.

It often has certain limitations that you don’t even know about

Until you try to make a claim.

Own your plan.

Don’t borrow one from your boss.

So, Do You Really Need Both?

Yes.

If you care about staying afloat when your body says no.

Yes.

If you care about affording care that OHIP won’t touch.

Yes.

If you want to live, not just survive.

Insurance plans aren’t about fear.

They’re about freedom.

And we’ve seen what freedom looks like—

A family that didn’t lose their house.

A couple that could take a year off for cancer treatment without bankruptcy.

A son who got the surgery his province wouldn’t fund.

It’s not dramatic.

It’s real.

And it’s worth everything.

Canadian LIC Can Help You Make the Right Choice

Yes.

If you care about staying afloat when your body says no.

Yes.

If you care about affording care that OHIP won’t touch.

Yes.

If you want to live, not just survive.

Insurance plans aren’t about fear.

They’re about freedom.

And we’ve seen what freedom looks like—

A family that didn’t lose their house.

A couple that could take a year off for cancer treatment without bankruptcy.

A son who got the surgery his province wouldn’t fund.

It’s not dramatic.

It’s real.

And it’s worth everything.

FAQs

Yes, sometimes.

It depends on your policy.

If you can still work but only in a limited way—fewer hours, less physical effort—

Some plans offer partial disability benefits.

It won’t replace all your income.

But it helps keep things afloat while you adjust to a new normal.

It’s not always easy.

But it’s possible.

Some insurance companies may offer coverage with exclusions—meaning they won’t cover that condition.

Others might charge more.

That’s why you need someone who knows the landscape.

We’ve helped clients with diabetes, asthma, even cancer history find something that still makes sense.

Always.

But how long depends on what you choose.

Some people pick 30 days. Some wait 90.

The longer you wait, the lower the premium.

But if you don’t have savings, those extra months with no income can crush you.

That’s a conversation worth having—before you need it.

Not automatically.

Some plans include emergency travel medical, but not all.

And even then, watch the fine print.

It might only cover short trips or have limits that barely cover a night in a U.S. hospital.

If you travel often, let’s add proper Travel Medical Insurance to your setup.

One gives you a lump sum.

The other pays you monthly.

Critical illness insurance is triggered by a diagnosis.

Disability Insurance kicks in when you can’t work.

You can have both.

And sometimes, you should.

Usually not.

Group Insurance is tied to your employer.

Once you quit or get laid off, it’s gone.

Some plans offer a conversion option, but it’s expensive.

That’s why owning your own coverage is safer.

It travels with you. No matter the job.

Some plans do.

Most don’t—unless you look for it.

We’ve helped couples find coverage options for IVF.

We’ve also helped trans clients access plans that support hormone therapy.

It’s not standard.

But it’s out there.

You just need someone who knows where to look.

Sometimes.

If you’re self-employed, there may be tax credits available for your premiums.

For others, it depends on how much you’ve spent on medical expenses in total.

You need receipts.

You need records.

You need a tax-savvy guide—especially if you’re trying to reduce taxable income smartly.

Yes.

But not all do.

Some policies exclude mental health altogether.

Others require extra documentation.

We’ve helped clients fight through these claims—depression, burnout, anxiety.

If your plan ignores your brain, it’s not protecting your body either.

Waiting.

That’s it.

Waiting until after the diagnosis.

After the accident.

After the debt.

By then, it’s too late.

The plan you want might not even be available anymore.

We’ve heard the regret.

Don’t wait to become another story we tell.

Key Takeaways

- Disability Insurance protects your income if illness or injury keeps you from working—it won’t cover your medical bills, but it keeps your life running.

- Personal Health Insurance fills the gaps left by government plans—helping with costs like prescription drugs, dental care, vision, and paramedical services.

- These two types of insurance serve completely different purposes—one keeps money coming in, the other helps control what goes out.

- Relying solely on Group Insurance through your employer can leave you exposed—most plans end when your job does, and don’t offer enough flexibility or long-term coverage.

- Critical illness insurance is an important third layer—providing a lump-sum payout to support recovery from major illnesses like cancer or heart attack.

- If you wait until after a diagnosis or accident, it’s often too late to get the coverage you really need—planning ahead is what makes the difference.

- Your health status, income, occupation, and savings all shape how much coverage you should have—there is no one-size-fits-all policy.

- Mental health, fertility treatments, and gender-affirming care may not be included in standard plans—you have to ask for what matters to you.

- Canadian LIC helps clients compare real Disability Insurance Policy Quotes, understand the average cost of Personal Health Insurance, and choose coverage options that reflect their real lives—not just what’s on paper.

- Having both personal health and Disability Insurance isn’t about fear.

It’s about being ready.

Because when your body breaks down, your finances don’t have to.

- Disability Insurance protects your income if illness or injury keeps you from working—it won’t cover your medical bills, but it keeps your life running.

Sources and Further Reading

- Government of Canada – Employment Insurance (Sickness Benefits)

https://www.canada.ca/en/services/benefits/ei/ei-sickness.html

Details on short-term disability benefits, eligibility, and application processes. - Canada Life – What Is Disability Insurance?

https://www.canadalife.com/insurance/life-insurance/disability-insurance.html

Overview of how Disability Insurance works in Canada, types of plans, and who should consider them. - Sun Life Canada – Health Insurance Plans

https://www.sunlife.ca/en/insurance/health-insurance/

Covers various Personal Health Insurance options including dental, vision, and paramedical coverage. - Manulife – CoverMe™ Personal Health Insurance

https://www.manulife.ca/personal/insurance/health-insurance.html

Breakdown of basic vs. enhanced Health Insurance plans and what services are included. - Ontario Ministry of Health – What’s Covered by OHIP?

https://www.ontario.ca/page/what-ohip-covers

Clarifies what the Ontario Health Insurance Plan covers and what it does not. - Canadian Life and Health Insurance Association (CLHIA)

https://www.clhia.ca/web/CLHIA_LP4W_LND_Webstation.nsf/page/Consumer_Help_Centre

Educational resources on insurance products, including disability and critical illness coverage. - Canada Revenue Agency – Medical Expenses and Premium Deductions

https://www.canada.ca/en/revenue-agency/services/tax/individuals/topics/about-your-tax-return/tax-return/completing-a-tax-return/deductions-credits-expenses/lines-33099-33199-eligible-medical-expenses-you-claim-on-your-tax-return.html

Details on claiming medical expenses and Health Insurance premiums as tax credits. - Canadian Cancer Society – Financial Help for People with Cancer

https://cancer.ca/en/living-with-cancer/life-with-cancer/financial-help

Support programs and insurance information relevant to those diagnosed with critical illnesses. - Mental Health Commission of Canada – Workplace Mental Health Resources

https://mentalhealthcommission.ca/workplace/

Resources highlighting the importance of mental health coverage in workplace and personal insurance. - Blue Cross Canada – Travel and Emergency Medical Coverage

https://www.bluecross.ca/

Information on travel and out-of-country emergency health coverage under personal insurance plans.

Feedback Questionnaire:

We want to understand your journey better, so we can guide you more clearly. Answering these questions helps us help you.

IN THIS ARTICLE

- Personal Health Insurance Vs. Disability Insurance In Canada: Do You Need Both?

- Disability Insurance: When Your Income Is at Risk

- Personal Health Insurance: What the Government Doesn't Pay For

- Two Different Protections. One Life That Needs Both.

- Disability Insurance or Health Insurance: Which Covers What?

- Critical Illness Insurance: The One People Forget

- Let's Talk Coverage: How Much Is Enough?

- What Drives the Cost?

- What Happens If You Skip Both?

- Dental and Vision: Yes, They Matter

- So, Do You Really Need Both?

- Canadian LIC Can Help You Make the Right Choice

Sign-in to CanadianLIC

Verify OTP