- Connect with our licensed Canadian insurance advisors

- Shedule a Call

BASICS

- Is Infinite Banking A Smart Financial Strategy?

- Understanding the Infinite Banking Concept

- Why Infinite Banking Appeals to Canadians Seeking Financial Freedom

- How Infinite Banking Strategy Helps Build Financial Independence

- Challenges and Misconceptions About Infinite Banking

- Who Should Consider Infinite Banking for Financial Freedom?

- How to Start Your Infinite Banking Journey

- Key Advantages of the Infinite Banking Strategy

- A Day-to-Day Struggle: Why More Canadians Are Exploring Infinite Banking

- Potential Drawbacks You Should Know

- The Future of Infinite Banking in Canada

- Is Infinite Banking a Smart Financial Strategy?

COMMON INQUIRIES

- Can I Have Both Short-Term and Long-Term Disability Insurance?

- Should Both Husband and Wife Get Term Life Insurance?

- Can I Change Beneficiaries on My Canadian Term Life Policy?

- What Does Term Life Insurance Cover and Not Cover?

- Does Term Insurance Cover Death?

- What are the advantages of Short-Term Life Insurance?

- Which Is Better, Whole Life Or Term Life Insurance?

- Do Term Life Insurance Rates Go Up?

- Is Term Insurance Better Than a Money Back Policy?

- What’s the Longest Term Life Insurance You Can Get?

- Which is better, Short-Term or Long-Term Insurance? Making the Right Choice

IN THIS ARTICLE

- What is the minimum income for Term Insurance?

- How Does Income Affect Your Term Life Insurance Policy?

- Can You Buy Term Life Insurance Online with a Low Income?

- How Can You Lower Your Term Life Insurance Cost?

- How Much Term Life Insurance Do You Need?

- Can Your Term Life Insurance Policy Be Adjusted Over Time?

- Why Term Life Insurance Is Ideal for Lower-Income Canadians

- Final Thoughts

- More on Term Life Insurance

Is Infinite Banking A Smart Financial Strategy?

By Harpreet Puri

CEO & Founder

- 15 min read

- April 29th, 2025

SUMMARY

Find out whether infinite banking is a smart financial strategy in Canada. It explains how the infinite banking strategy helps Canadians achieve financial freedom by becoming their own banker, accessing liquidity, growing wealth tax-deferred, and building long-term financial independence. It also discusses who can benefit most, potential challenges, and why more Canadians are choosing infinite banking for flexible and secure financial control.

Introduction

The Struggles Canadians Face with Building Financial Independence

Many Canadians toil and save, but feel as if the financial freedom they crave is just out of reach. Despite best-laid plans, they end up caught between increasing costs, unsure investments and unforeseen emergencies. It might be that you have topped up your RRSPS and TFSAS, yet somehow, you are still getting loans from banks whenever you need some money. Perhaps you’re paying interest rates in the double digits while you have savings that you’ve been hoarding. If that sounds familiar, you are not alone.

These are the types of situations we at Canadian LIC—The Best Insurance Brokerage—are told about each day by families, business owners, and professionals all over the country. They are calling for a strategy that can deliver them greater money control as opposed to less. They’re looking for a system that rewards discipline while also presenting genuine flexibility. That’s probably why more and more people are starting to ask us about the infinite banking concept and whether or not this could be the solution they have been looking for.

Today, we are going to discuss how infinite banking for financial freedom really works, why it’s seemingly popular among many of your Canadian family and friends, and whether or not it actually does help you have financial independence through Infinite Banking.

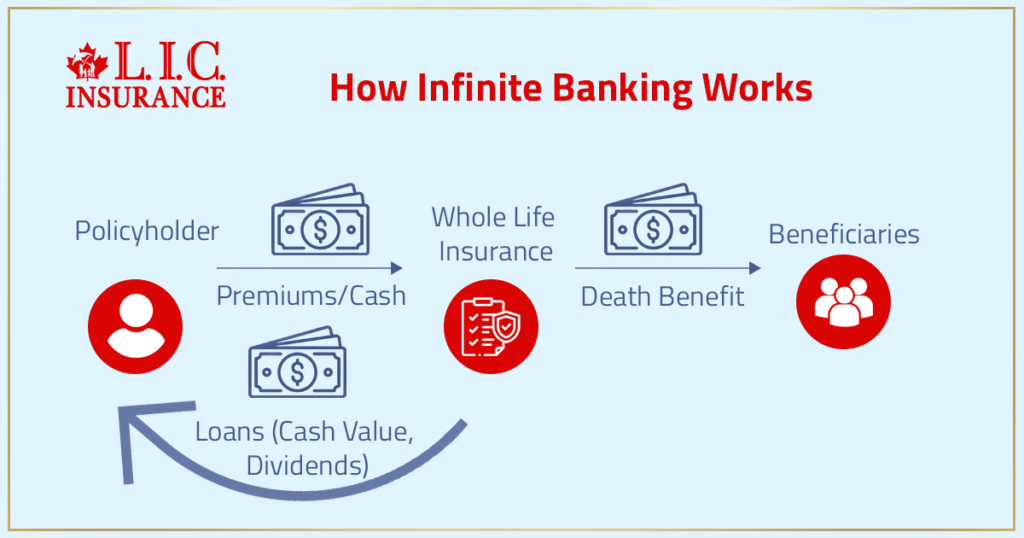

Understanding the Infinite Banking Concept

The infinite banking concept is all about being the bank. Instead of relying on the bank for loans and lines of credit, you do this through a specifically designed whole life insurance policy.

Here’s how it generally goes:

- You buy into a qualified whole life insurance policy.

- Your policy develops cash value as time goes on.

You can also borrow against your cash value at any time if you need to borrow money for a car, home improvement, an investment, or even a child’s education.

While you have an outstanding policy loan, your cash value still grows just like you never borrowed against it. This allows you to maintain the momentum of your finances — something that traditional banks can’t provide.

We like to tell our clients a nice little tale to illustrate this. One of our clients was an Ontario-based entrepreneur who ran his own contracting business for years, and he always had a cash-flow problem. Lenders weren’t always so ready to extend him the credit he needed at the time he wanted it. Setting up an infinite banking system, he borrowed from his policy to purchase new equipment for his business, all without grovelling to a bank or risking his nest egg.

Why Infinite Banking Appeals to Canadians Seeking Financial Freedom

And there is a reason why infinite banking for financial freedom appeals to so many. Canadians desire freedom and security, but the traditional financial system can bind them up from acting as they please.

1. Full Access to Liquidity

You don’t have to wait weeks for a bank to approve you. You can access the cash value of your policy when you need cash, typically in days.

We recall a young couple from British Columbia who were constructing a rental property for the first time. Unexpected costs struck midway through construction. It ended up funding their project, and their bank had turned down that top-up loan, and they never missed a beat.

2. Control Over Borrowing

When you practice the infinite banking concept, you’re the one dictating the terms. Repay as you like. There are no strict schedules and no punishments. There’s no one you owe this to.

That sense of freedom felt like a game-changer to Leo Marchi, a small business owner from Calgary who told us, “It’s the first time in my life I’ve borrowed money and not felt trapped.”

3. Tax Advantages

Growth within a well-structured policy of the cash value is typically tax-exempt according to Canadian law. Policy loans are generally not taxable since they are loans, not income.

It’s a big reason why so many of our clients who are discovering financial independence through participating in Infinite Banking feel that it beats just parking money in a savings account or GIC.

How Infinite Banking Strategy Helps Build Financial Independence

When we talk to clients about financial independence, we talk about control, consistency and compound growth.

Here’s how using the infinite banking concept bolsters each of those pillars:

Control

You control your borrowing. You choose how and when to spend your money. You dictate how aggressively you pay down loans — or not at all.

A client of ours, a Toronto professional, invested in a tech startup with his policy loan. That freedom to act fast allowed him to land an opportunity he would have missed if he’d had to wait for a bank to stamp his papers.

Consistency

Even if you borrow, your cash value continues to grow within the policy. So even as you borrow against it, you’re still making.

An Ottawa-based retired teacher told us how he has been using his infinite banking system to pay for retirement hobbies without touching his own investment portfolio and allowing his other savings to grow without being tampered with.

Compound Growth

The sooner you start, the more those compounding benefits work in your favour. Like having planted a tree, infinite banking benefits time and patience.

“Many of our clients who are in their 30s and 40s are excited to have a steady increase in their policy cash value to grow over time while still having access to their money.”

Challenges and Misconceptions About Infinite Banking

Although infinite banking does come with great perks, it’s not without its challenges. As with any financial plan, it takes discipline and knowledge.

It’s Not Get-Rich-Quick

We have seen a few clients come in expecting quick returns. What I’m saying is that infinite banking takes some patience. The first few years are dedicated to constructing the foundation of cash value.

One of our entrepreneurs, who was based out of Edmonton, was initially upset in year one, but three years later, he called us to say thank you for not getting him to rely on even large amounts of capital so he could grow his business and not need to bring in outside capital.

Policy Structure Matters

All whole life insurance policies are not created equal. The policy must be engineered specifically for cash value growth (as opposed to a ”death benefit only policy”).

Canada’s LIC consultants collaborate with you to tailor the perfect solution. The sloppy policy can derail the whole effort.

You Still Need to Pay Yourself Back

Although you set the terms, you’ll want to make loan repayments in order to keep the policy healthy. There are clients who believe they can borrow indefinitely without repercussions, but managing responsibly is necessary.

A Manitoba family learned that lesson after overborrowing and delaying repayments for too many years. Luckily, they managed to adjust their policy with our help.

Who Should Consider Infinite Banking for Financial Freedom?

At Canadian LIC—The Best Insurance Brokerage—we often advise that while infinite banking offers powerful benefits, it is not for everyone. It works best for people who have a long-term vision and a strong savings habit.

Here’s who typically benefits the most:

1. Entrepreneurs and Business Owners

Up and down cash flow is an issue for many business owners. To be able to access the cash immediately without having to apply for a bank loan can be the difference between taking an opportunity or missing out.”

One of our customers who owns a catering business in Vancouver told us about this new delivery van that he was able to purchase without having to take a usurious business loan, thanks to his infinite banking policy. This action saved him tens of thousands and increased his bottom line.

2. Families Focused on Legacy Planning

The moment when they are unable to transfer a heritage free from financial restrictions. Infinite Banking Concept families and individuals strategically plan to leave behind a legacy and an assured financial hand to coming generations in the Manner of Infinite Banking, thus transferring wealth more efficiently, in a tax-favourable manner in perpetuity.

We met a family in Mississauga who arranged more than one policy for their children and grandchildren. Today, those policies are quietly and steadily growing, establishing a strong financial base that will support the family for decades.

3. High-Income Professionals

Doctors, attorneys and corporate executives often seek to grow and protect wealth with an investment outside of volatile markets. The tax-sheltered accumulation of wealth within an infinite banking policy provides a safe and dependable alternative.

A Calgary doctor tapped his policy as a source of emergency funds while maximizing his investments elsewhere. He said that knowing he had that financial cushion gave him the courage to invest more confidently in other opportunities.

How to Start Your Infinite Banking Journey

Creating financial freedom with Infinite Banking is a process that begins with the right preparation.

Here’s the roadmap we follow as we work with our clients:

Step 1: Assessment

We start by getting to know your financial objectives, cash flow and long-term goals. You need to customize infinite banking to fit your life and needs.

One of the business owners I have talked to about the RBC Corporate Insured Retirement Plan in Halifax was looking for a modest policy size and, after our conversation, concluded that a modestly larger policy would provide a better alignment with business and personal longer-term goals.

Step 2: Policy Design

That’s when you need expertise. We structure a participating whole life policy that is designed to maximize early cash value accumulation, not just the death benefit.

We recently built a policy for a teacher from Winnipeg that is designed to allow her to borrow for her child’s education after only a few years without raiding her registered accounts.

Step 3: Implementation

Funding starts when the policy is issued. Consistency is crucial during the first few years to build up cash value quickly.

For many clients, it helps automate premium payments to keep them disciplined and on track.

Step 4: Ongoing Management

Infinite banking is not “set it and forget it.” We see our clients back at least annually to review the policy, monitor the growth of the cash values, talk about any borrowing needs, and look at the best way to repay it.

One of our clients in Quebec City even booked a yearly “policy checkup” appointment during RRSP season with us so that we could take care of all her financial planning needs in one elegant stroke.

Key Advantages of the Infinite Banking Strategy

When considering whether infinite banking for financial freedom is smart for you, think about these long-term advantages:

- Liquidity: Access your cash when you need it.

- Growth: Cash value compounds tax-deferred.

- Flexibility: Borrow on your terms.

- Legacy: Build multigenerational wealth.

- Protection: Whole life policies include death benefits that provide additional family security.

- Stability: Participating whole life insurance is one of the most stable financial vehicles available.

A Day-to-Day Struggle: Why More Canadians Are Exploring Infinite Banking

Each week, we talk to families fed up with low interest rates on their savings, tired of stock market volatility and sick of dealing with the banks.

One customer, the operator of a small business from Hamilton, said it best:

“I work like a donkey to save up, but when I have to take out a loan, the banks act as if they are doing me a favour. I wanted something where I could act like a bank myself.”

Now that he has created his infinite banking system, he’s in control of his cash, and all the “interest” he would have paid to a bank gets paid back to himself instead.

These are just some stories that tell us why financial freedom from Infinite Banking is taking off in Canada.

Potential Drawbacks You Should Know

While the benefits are strong, being transparent about the potential downsides is equally important.

- Requires Commitment: You need to fund the policy consistently in the early years.

- Initial Costs: Whole life insurance policies have higher premiums compared to term insurance.

- Understanding is Key: Not understanding how policy loans work can lead to policy lapses if mismanaged.

We always make sure our clients fully understand these aspects before starting. With proper education and responsible management, the benefits far outweigh the drawbacks.

The Future of Infinite Banking in Canada

The noise surrounding the infinite banking strategy is getting louder with each passing year as Canadians look for a better way to manage their financial futures.

As the tectonic plates of the economy shift — interest rates go up, markets gyrate, inflation presses in — the impulse to create your own personal banking system becomes stronger. People are realizing that not all of their financial needs can be met through outside lenders.

Infinite banking provides a means to disrupt that pattern.

A recent client of ours shared, “This system provided me with a safety net and growth tool in one. It is the most brilliant financial decision I’ve ever made.”

We hear this kind of thing from dozens of clients every single month.

Is Infinite Banking a Smart Financial Strategy?

Having worked with hundreds of Canadians – seeing people who were once skeptical but, as a result, have benefited from the process – we can say with utmost certainty that infinite banking is an intelligent financial strategy for the right individual.

- It puts you in control.

- It rewards your discipline.

- It creates real financial freedom.

It’s not magic. It’s not overnight wealth. It’s about coming up with a smart, steady system that transforms your money into a lifetime of financial horsepower.

At Canadian LIC—The Best Insurance Brokerage, we take you through the whole process of building, growing, and experiencing your private banking system.

If you’re sick of playing by other people’s rules, waiting for permission to access your own money, and are ready to take steps to build financial freedom on your own terms, then infinite banking could be the strategy you’ve been seeking.

The best thing you can do today is learn, plan, and build your life with your own personal banking system.

Futures, you will be grateful.

FAQs: We Hear About Infinite Banking

Typically, after 2–3 years of properly funding the policy, you can start taking meaningful loans. Every case is unique, so a personalized plan is essential.

The loan will be deducted from your death benefit if not repaid during your lifetime. However, smart repayment strategies prevent this from becoming a problem.

Absolutely. Business owners especially benefit from the flexibility. Many of our entrepreneurial clients use infinite banking for emergency capital, business investments, or even payroll management.

Key Takeaways

- Infinite banking strategy empowers Canadians to become their own banker, offering control over borrowing, liquidity, and financial growth.

- Infinite banking for financial freedom allows individuals to access cash value from a whole life insurance policy without relying on traditional banks.

- Financial independence through Infinite Banking is built through consistent savings, tax-advantaged cash value growth, and disciplined loan management.

- Infinite banking is ideal for entrepreneurs, high-income earners, and families focused on long-term wealth creation and legacy planning.

- Starting infinite banking requires commitment, the right policy structure, and ongoing management, but it offers unmatched flexibility, stability, and control over your finances.

Sources and Further Reading

- Bank of Canada – Financial System Review

https://www.bankofcanada.ca/publications/fsr/

(Provides insights into Canada’s financial system and why alternative financial strategies are gaining popularity.) - Insurance Bureau of Canada – Understanding Life Insurance

https://www.ibc.ca/on/insurance/life

(Detailed explanation of whole life insurance policies, which are the foundation of infinite banking.) - Canada Revenue Agency – Life Insurance Policy Taxation Rules

https://www.canada.ca/en/revenue-agency/services/forms-publications/publications/t4015.html

(Official tax guidelines about life insurance policies and how cash values grow tax-deferred.) - Canadian Life and Health Insurance Association (CLHIA) – Consumer Information

(Authoritative resource on life insurance products in Canada and consumer protection.) - Nelson Nash Institute – Principles of Infinite Banking

https://infinitebanking.org/

(Global educational resource about the Infinite Banking Concept and best practices.)

Feedback Questionnaire:

“Is Infinite Banking the Right Strategy for You?”

We would love to hear about your experiences and thoughts! Please take a moment to fill out this short questionnaire.

Thank you for sharing your thoughts!

Your answers will help us serve you better and guide you towards smarter financial solutions.

IN THIS ARTICLE

- Is Infinite Banking A Smart Financial Strategy?

- Understanding the Infinite Banking Concept

- Why Infinite Banking Appeals to Canadians Seeking Financial Freedom

- How Infinite Banking Strategy Helps Build Financial Independence

- Challenges and Misconceptions About Infinite Banking

- Who Should Consider Infinite Banking for Financial Freedom?

- How to Start Your Infinite Banking Journey

- Key Advantages of the Infinite Banking Strategy

- A Day-to-Day Struggle: Why More Canadians Are Exploring Infinite Banking

- Potential Drawbacks You Should Know

- The Future of Infinite Banking in Canada

- Is Infinite Banking a Smart Financial Strategy?

Sign-in to CanadianLIC

Verify OTP