- Connect with our licensed Canadian insurance advisors

- Shedule a Call

BASICS

- Is Infinite Banking A Smart Financial Strategy?

- Understanding the Infinite Banking Concept

- Why Infinite Banking Appeals to Canadians Seeking Financial Freedom

- How Infinite Banking Strategy Helps Build Financial Independence

- Challenges and Misconceptions About Infinite Banking

- Who Should Consider Infinite Banking for Financial Freedom?

- How to Start Your Infinite Banking Journey

- Key Advantages of the Infinite Banking Strategy

- A Day-to-Day Struggle: Why More Canadians Are Exploring Infinite Banking

- Potential Drawbacks You Should Know

- The Future of Infinite Banking in Canada

- Is Infinite Banking a Smart Financial Strategy?

COMMON INQUIRIES

- Can I Have Both Short-Term and Long-Term Disability Insurance?

- Should Both Husband and Wife Get Term Life Insurance?

- Can I Change Beneficiaries on My Canadian Term Life Policy?

- What Does Term Life Insurance Cover and Not Cover?

- Does Term Insurance Cover Death?

- What are the advantages of Short-Term Life Insurance?

- Which Is Better, Whole Life Or Term Life Insurance?

- Do Term Life Insurance Rates Go Up?

- Is Term Insurance Better Than a Money Back Policy?

- What’s the Longest Term Life Insurance You Can Get?

- Which is better, Short-Term or Long-Term Insurance? Making the Right Choice

IN THIS ARTICLE

- What is the minimum income for Term Insurance?

- How Does Income Affect Your Term Life Insurance Policy?

- Can You Buy Term Life Insurance Online with a Low Income?

- How Can You Lower Your Term Life Insurance Cost?

- How Much Term Life Insurance Do You Need?

- Can Your Term Life Insurance Policy Be Adjusted Over Time?

- Why Term Life Insurance Is Ideal for Lower-Income Canadians

- Final Thoughts

- More on Term Life Insurance

Is Critical Illness Coverage Part Of Your Employee Benefits Plan?

By Pushpinder Puri

CEO & Founder

- 12 min read

- July 25th, 2025

SUMMARY

Many Canadians believe their employee benefits plan offers full protection, but most lack critical illness coverage. The content explains how group Critical Illness Insurance Plans work, the role of optional Critical Illness Insurance, and how a lump sum payment supports financial recovery. It also covers the limits of disability insurance, how to use a Critical Illness Insurance Calculator, and ways to buy Critical Illness Insurance online with personalized quotes.

Introduction

Some factors in life offer no warning — a heart attack on an ordinary morning, a stroke after dinner, a cancer diagnosis on what should have been a regular Tuesday. At Canadian LIC, we have known too many of these times and too many clients at this point. Smart, capable, hardworking people—blindsided. And what do they always say? “I thought I had coverage through work.”

But the reality is that many employee benefits plans in Canada provide little more than basic health or life insurance, while overlooking a crucial piece: critical illness coverage. The one silver lining that could help keep your family afloat when everything else fails.

Let’s break it down, and tell you why it matters and what to watch out for before it’s too late.

What Most Employee Benefits Plans Cover—And What They Miss

We’ve read hundreds and hundreds of benefits booklets from employers in every part of the country. Dental? Often covered. Vision care? Usually. Life insurance? Yes, but often limited. Disability insurance? Sometimes partial or short-term.

But critical illness coverage? That is the void we see most frequently. And it’s not a narrow gap — it’s a financial canyon when a catastrophic illness strikes.

Your average employee benefits plan might offer you a few thousand dollars of life insurance or a little bit of assistance with medical costs. But what happens if you don’t die from that illness? That’s when your costs skyrocket. Think: costs of out-of-pocket medical care, or private nursing, or time off work, or modifying your home or vehicle to make it more accessible.

Optional Critical Illness Insurance: The Hidden Hero in Your Workplace Plan

A small number of employers make optional Critical Illness Insurance available as a part of their group benefits package, but there’s a catch: you’ll usually have to dig to find it. It’s not automatic. You have to opt in, sometimes within a particular period after joining.

And most people have no idea it exists.

One of our clients, a 42-year-old project manager in Toronto, had the opportunity to buy group Critical Illness Insurance at work, but she never did. Later, when she learned that she had breast cancer, she said, I thought I had coverage at work.” No one told me I needed to sign up separately.”

That lost opportunity cost her, in uncovered expenses, $50,000.

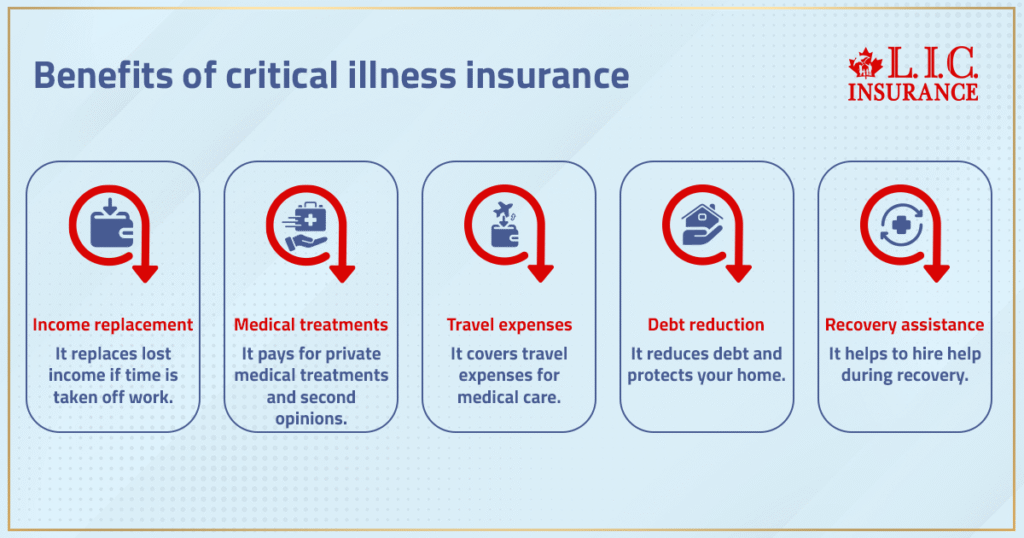

What a Critical Illness Benefit Actually Gives You

If you’re wondering what Critical Illness Insurance pays, the answer is simple and powerful: a lump sum payment, tax-free, paid directly to you, not your doctors, not the hospital, but to you.

That lump sum benefit can be used however you choose:

- Replace lost income if you or your spouse takes time off work

- Pay for private medical treatments or second opinions

- Cover travel expenses for care

- Reduce debt and protect your home

- Hire help during your recovery process

We’ve had clients use it to cover mortgage payments, continue RESP contributions, or even pay for therapy. That’s the beauty of it—it’s financial support with no restrictions.

How Critical Illness Insurance Works with Group Plans

You may be wondering, “How does Critical Illness Insurance work if I already have group insurance or life insurance through my employer?”

Here’s what most Canadians don’t realize:

- Life insurance pays only when the insured person passes away.

- Disability insurance replaces a portion of income, but usually with delays, caps, and medical exams.

- Critical Illness Insurance pays immediately after a covered condition is diagnosed and survival beyond the waiting period is confirmed (usually 30 days)

It doesn’t overlap—it fills a financial protection gap.

And suppose you’re part of a group benefits plan. In that case, chances are you can access group Critical Illness Insurance Plans at a reduced rate—or even better, with no medical questionnaire during your eligibility window.

Lump Sum: Why That One Payment Can Save Your Entire Financial Future

Let’s not sugar-coat it—when someone gets a covered critical illness, the costs don’t just hit emotionally or physically. They hit the bank account hard.

A lump sum from a critical illness policy could be the difference between:

- Keeping your home or selling it

- Continuing your child’s education plans or draining their RESP

- Staying in Canada for treatment or flying abroad for faster care

At Canadian LIC, we often help families compare scenarios using a Critical Illness Insurance Calculator, showing what they’d get from their employer plan vs. private options. That number—that coverage amount—usually shocks them.

The reality? Your employee benefits may offer only $10,000–$25,000 in basic coverage, if anything. But cancer treatment costs alone can easily exceed $50,000 in just a few months.

Supporting Employees Through Real-Life Hardships

As financial advisors who have helped hundreds of clients and plan sponsors, we know how group Critical Illness Insurance transforms lives.

An HR director we recently counselled relayed this anecdote: One of their plan participants had a stroke. “By applying their employer’s optional cover, the employee also got a lump sum of $75,000. It covered two years of lost income, home care, and therapy.

This wasn’t just a policy. It was financial assistance. It was dignity. It was relief.

And if your company really wants to be there for your employees, then critical illness coverage should be a no-brainer, not an option. It should be part of a full benefits program provided to employees.

Disability Insurance Isn't Enough—Here's the Main Difference

There are already moans of, “But I already have disability insurance, so I’m good, right?”

Not quite.

Disability insurance usually has a deferred period, often requires continued medical evidence, and only replaces part of your income. It’s not designed to help you with upfront costs or with long-term treatment options outside of your home province.

The main difference? Critical Illness Insurance pays you a lump sum immediately, without proof of continued disability. You use it your way. No strings attached.

If your employer does not provide this option, or if the group plan doesn’t offer enough coverage, you can always purchase Critical Illness Insurance online through Canadian LIC. It’s easier, faster, and totally customizable.

Why Canada Life and Other Providers Recommend Critical Illness Coverage

Top insurers like Canada Life have long emphasized the need for Critical Illness Insurance alongside life insurance. Their research and data, alongside organizations like the Canadian Cancer Society, show a clear pattern:

- Survival rates are improving

- Medical treatments are costly

- Illness coverage is underutilized in group plans

In today’s economy, relying solely on your benefit plan is risky. What happens if you change jobs, go freelance, or your employer cuts costs?

That’s where Canadian LIC steps in. With more than 14 years under Harpreet Puri’s leadership, we help you evaluate your insurance policy, analyze your benefits booklet, and fill the critical gaps you didn’t know existed.

What Conditions Are Usually Covered?

Every insurer’s policy varies slightly, but most group Critical Illness Insurance and private plans cover conditions like:

- Heart attack

- Cancer

- Stroke

- Major organ failure

- Loss of independent existence

Some plans may also include additional illnesses or allow you to add optional coverage for less common conditions. It’s important to review what’s considered a qualifying critical illness in your plan.

What Should You Do Now?

You don’t have to wait for your HR department or plan members meeting. Start now:

- Request a copy of your employee benefits plan booklet

- Check if optional Critical Illness Insurance is available through your employer

- Compare your current coverage amount using a Critical Illness Insurance Calculator

- If needed, buy Critical Illness Insurance online directly with Canadian LIC

- Get a Critical Illness Insurance Quote tailored to your age, health, and needs

Final Word From Canadian LIC

You insure your home, your car, and even your phone. But what about your health, your income, your ability to survive and persevere?

But when you’ve got a life-threatening illness, you don’t get to put life on hold. But with the right critical illness benefit, you can interrupt the financial maelstrom.

That’s what we do at Canadian LIC. We guide you to prepare, plan, and protect — before the crisis. So when your employee benefits fall short, we roll up our sleeves and build you a better insurance plan – one that’s there when it matters most.

More on Critical Illness Insurance

FAQs

Yes, but it depends. Some may refuse to cover you at all, and some insurers will decide to exclude that particular condition if you have had a prior illness, such as cancer or heart disease. Other insurers could provide their own, altered version of the critical illness policy on varying terms. At Canadian LIC, we have guided clients through this who have had difficult medical histories. We deal with insurance carriers who evaluate risk on a case-by-case basis, not just by a checkbox.

There is a tax-free lump sum payment for the critical illness benefit in Canada in most cases. Which is to say, you keep every dollar. But the tax treatment could be different if your policy is one that’s part of a group benefits plan paid entirely by your employer. Make sure you double-check with a professional advisor or contact us at Canadian LIC. We may be able to review your policy and explain exactly what is or isn’t covered for you.

For the most part, there is a lump sum tax-free payment for the critical illness benefit in Canada. Meaning: You get to keep every dollar. But the tax treatment could be different if your policy is what’s known as an employer-provided group plan (and you’re not paying for the coverage yourself). Be sure to confirm with your professional adviser or contact us at Canadian LIC. It’s possible that we could look at your policy and let you know exactly what you are or aren’t covered for.

This will depend on the waiting period on your policy, which is usually 30 days. That means you have to live for a month after being diagnosed with a qualifying critical illness. With that verified, the insurer settles the claim, and you get your lump sum payment. If you’re not sure about the wait time in your plan, it would be worth it for you to pull out the benefits booklet or to reach out to us, and we’ll walk through it line by line.

Absolutely. And, in fact, many Canadians look to private plans to cover that exact gap. With Canadian LIC, you purchase Critical Illness Insurance online, even if your employer doesn’t offer access to group plans. It’s usually more customizable, too, with more coverage amounts and flexible add-ons. And we make it easy to compare rates with our in-house Critical Illness Insurance Calculator instantly, so you’re never in the dark.

Key Takeaways

- Most employee benefits plans in Canada do not automatically include critical illness coverage, leaving a major gap during serious medical events.

- Group Critical Illness Insurance Plans may be available through your employer but often require active enrollment—they’re not default benefits.

- A critical illness benefit provides a tax-free lump sum payment upon diagnosis of a covered condition, offering financial flexibility and protection.

- Disability insurance and life insurance serve different roles and are not substitutes for critical illness coverage—they each fill separate financial needs.

- Employees can buy Critical Illness Insurance online if their employer doesn’t offer it, with customizable coverage amounts and quick access to quotes.

- Using a Critical Illness Insurance Calculator helps you compare employer coverage against personal options to avoid unexpected out-of-pocket expenses.

- Canadian LIC specializes in helping clients review their benefits booklet, understand what’s missing, and build a policy that truly supports long-term health and security.

Sources and Further Reading

- Government of Canada – Employment Insurance (EI) and Sickness Benefits

Provides details on short-term income replacement for illness and how it differs from private Critical Illness Insurance.

https://www.canada.ca/en/services/benefits/ei/ei-sickness.html - Canada Life – Critical Illness Insurance Overview

Outlines how critical illness coverage works, including lump sum payments, common illnesses covered, and survivor benefits.

https://www.canadalife.com/insurance/critical-illness-insurance.html - Sun Life Canada – Group Benefits and Critical Illness Coverage

Useful for understanding employer-sponsored plans and optional group coverage options.

https://www.sunlife.ca/en/group-benefits/ - Canadian Cancer Society – Financial Support and Treatment Costs

Highlights the real out-of-pocket costs faced by Canadians diagnosed with cancer—supporting the need for critical illness coverage.

https://cancer.ca/en/living-with-cancer/your-finances/financial-help - CLHIA (Canadian Life and Health Insurance Association) – Guide to Living Benefits

A credible industry-wide source explaining how critical illness, disability, and life insurance complement each other.

https://www.clhia.ca/web/CLHIA_LP4W_LND_Webstation.nsf/page/71A116CEEB6A6CDB85257A93006C71E1 - Manulife Canada – Critical Illness Insurance Calculator and Plan Details

Provides calculators, plan structure examples, and benefit estimates.

https://www.manulife.ca/personal/insurance/critical-illness-insurance.html - Government of Canada – Your Rights as a Plan Member

Understand employee entitlements under group benefits plans and the role of optional coverage.

https://www.canada.ca/en/financial-consumer-agency/services/insurance/group-insurance.html

Feedback Questionnaire:

We’d love to hear from you. Your feedback helps us understand where employees feel unsure, undercovered, or unsupported when it comes to Critical Illness Insurance. Please take a minute to complete this short form.

Thank you for sharing your experience. A licensed advisor may reach out if you’ve requested help. Your privacy is respected, and your details are never shared without consent.

IN THIS ARTICLE

- Is Critical Illness Coverage Part Of Your Employee Benefits Plan?

- What Most Employee Benefits Plans Cover—And What They Miss

- Optional Critical Illness Insurance: The Hidden Hero in Your Workplace Plan

- What a Critical Illness Benefit Actually Gives You

- How Critical Illness Insurance Works with Group Plans

- Lump Sum: Why That One Payment Can Save Your Entire Financial Future

- Supporting Employees Through Real-Life Hardships

- Disability Insurance Isn't Enough—Here's the Main Difference

- Why Canada Life and Other Providers Recommend Critical Illness Coverage

- What Conditions Are Usually Covered?

- What Should You Do Now?

- Final Word From Canadian LIC

Sign-in to CanadianLIC

Verify OTP