- Connect with our licensed Canadian insurance advisors

- Shedule a Call

BASICS

- Is Infinite Banking A Smart Financial Strategy?

- Understanding the Infinite Banking Concept

- Why Infinite Banking Appeals to Canadians Seeking Financial Freedom

- How Infinite Banking Strategy Helps Build Financial Independence

- Challenges and Misconceptions About Infinite Banking

- Who Should Consider Infinite Banking for Financial Freedom?

- How to Start Your Infinite Banking Journey

- Key Advantages of the Infinite Banking Strategy

- A Day-to-Day Struggle: Why More Canadians Are Exploring Infinite Banking

- Potential Drawbacks You Should Know

- The Future of Infinite Banking in Canada

- Is Infinite Banking a Smart Financial Strategy?

COMMON INQUIRIES

- Can I Have Both Short-Term and Long-Term Disability Insurance?

- Should Both Husband and Wife Get Term Life Insurance?

- Can I Change Beneficiaries on My Canadian Term Life Policy?

- What Does Term Life Insurance Cover and Not Cover?

- Does Term Insurance Cover Death?

- What are the advantages of Short-Term Life Insurance?

- Which Is Better, Whole Life Or Term Life Insurance?

- Do Term Life Insurance Rates Go Up?

- Is Term Insurance Better Than a Money Back Policy?

- What’s the Longest Term Life Insurance You Can Get?

- Which is better, Short-Term or Long-Term Insurance? Making the Right Choice

IN THIS ARTICLE

- What is the minimum income for Term Insurance?

- How Does Income Affect Your Term Life Insurance Policy?

- Can You Buy Term Life Insurance Online with a Low Income?

- How Can You Lower Your Term Life Insurance Cost?

- How Much Term Life Insurance Do You Need?

- Can Your Term Life Insurance Policy Be Adjusted Over Time?

- Why Term Life Insurance Is Ideal for Lower-Income Canadians

- Final Thoughts

- More on Term Life Insurance

How Trip Cancellation Impacts Travel Insurance Coverage In 2025?

By Harpreet Puri

CEO & Founder

- 13 min read

- September 10th, 2025

SUMMARY

Trip cancellation in 2025 is a real issue for travellers booking flights, hotel stays, and tours. The discussion covers Travel Insurance Coverage in Canada, what the best Travel Insurance Policy for trip cancellation includes, how credit card Travel Insurance compares, and why timing before the departure date matters. It also looks at Travel Insurance cost in Canada, getting a Travel Insurance quote online, and how covered reasons protect nonrefundable trip costs.

Introduction

Travellers are travelling more in 2025. Flights, hotel stays, and tours are surging back. But risk comes with growth. Flights still face disruptions. Airlines cancel flights due to strikes and a lack of staffing. Health crises always happen at the worst time. And when plans fall through, the question is easy. Who pays?

Here at Canadian LIC, we see it almost weekly. Confused customers turn up, wondering just what Travel Insurance in Canada really covers. They believe all plans cover all cancellations. They assume refunds are guaranteed. Unfortunately, that is not the way insurance operates. Trip cancellation has rules. If you don’t know the covered reason, you’re at risk of loss.

Why Trip Cancellation Matters

Think about the average traveller. You buy a ticket to fly on Air Canada, book out hotels, and pay deposits on tours. And a good deal of this represents nonrefundable trip expenses. And if something compels you to cancel, you could be out thousands.

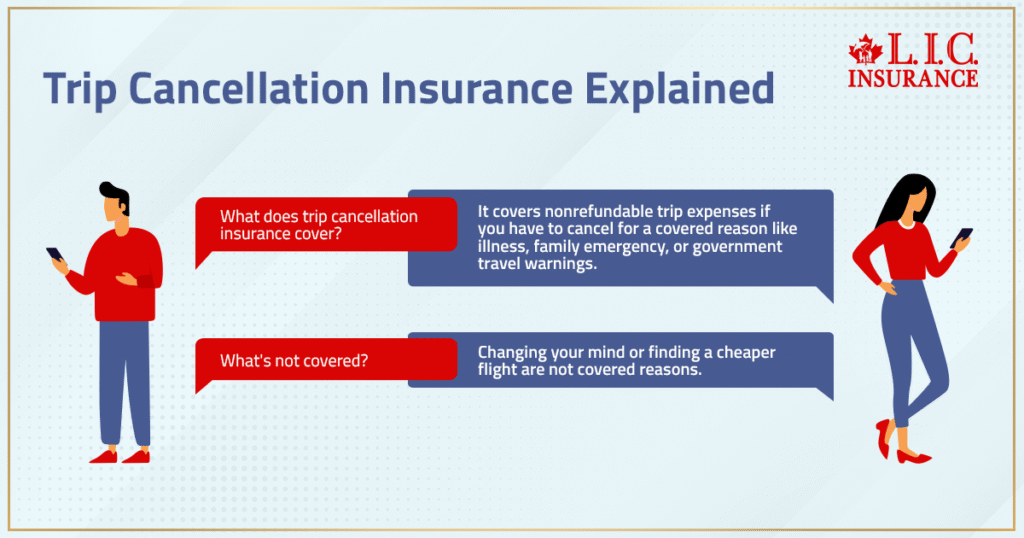

These are the types of expenses that trip cancellation insurance was created to safeguard. But protection is conditional. There has to be a covered reason. Illness, health issues, family member emergency, or government travel warnings. These are common triggers. Deciding to change your mind does not count.

When customers come sit with us, we walk through examples. A tourist cancels upon hearing of political protests. Covered. Another was cancelled because they got a cheaper flight. Not covered. The difference is the reason.

Credit Card Travel Insurance

A lot of people think their credit card Travel Insurance is sufficient. Cancellation and trip interruption benefits are frequently promoted on credit cards. But the limits are low. Some cards do not cover pre-existing conditions. And claims require strict documentation.

One cardholder assumed her premium card would protect her from an Air Canada strike that grounded her flight. The insurance cap was just $1,000. She had already paid more than $5,000 for her nonrefundable trip. The credit card was something of a respite. A separate policy would have paid out in full.

Some coverage alternatives include: Credit card, Travel Insurance for short trips. If you incur higher costs, we suggest you buy Travel Insurance with cancellation protection.

Purchase Travel Insurance Before Departure

Timing matters. You can’t just sit still until the danger comes. You are not covered if you hear about a foreseeable event, such as an Air Canada strike, prior to purchase. The insurer will deny the claim on the grounds that the risk was already publicly known.

That’s why Canadian LIC recommends that clients buy Travel Insurance as soon as they have taken out a travel booking. Buy early. Lock in coverage. Safeguard the departure date from the outset. If a member of your family develops a health issue after the purchase, you are covered. If you wait until you are symptomatic, you are not.

The Role Of Credit Cards In Claims

Coverage on a credit card is frequently secondary. That means you have to file first with your insurer. The credit card will only pay after a denial. Customers find this frustrating. It creates delays. Documentation is doubled.

We can clear this up in simple language at Canadian LIC. And if a credit card is your only crutch, gaps may appear. If you do both, you want to know who pays first. Always read the fine print.

Understanding Insurance Cost

The insurance cost is among the first questions clients ask. They notice that Travel Insurance costs in Canada are increasing. But cancellation protection is still less costly than having to forfeit prepaid travel expenses.

Let’s use an example. One trip to Europe costs $4,000. Purchasing comprehensive trip cancellation insurance can cost $200. If you have to cancel for a covered reason, you get the $4,000 back. Insurance and you risk losing it all.

For several trips in a year, a multi-trip cover can be cost-effective. It is an option that can save customers who are frequent travellers money.

Covered Reasons That Matter Most

Insurers define covered reasons clearly. These include:

- Sudden illness or medical emergencies.

- Serious medical condition of a family member.

- Jury duty or court order.

- Government travel advisories against the destination.

- Flight cancellations by the airline.

- Loss of primary residence due to fire or flood.

Each insurer has specific requirements. Some require a doctor’s note. Others need official documentation. At Canadian LIC, we help customers assess which plan fits their risks best.

Air Canada Strike And Similar Events

Airline strikes are a real threat. The Air Canada strike example demonstrates how contingency ripples across Toronto Pearson International Airport and beyond. If you bought Travel Insurance before the strike was announced, you are covered. If you purchased after the announcement, it is an alleged foreseeable event.’

This distinction creates disputes. Customers frequently say, “But I didn’t know.” The insurer says the event was public knowledge. That’s why we’re stressing to buy early.

Departure Date And Coverage Windows

Coverage kicks in the day after you purchase, not the day you leave. Meaning that coverage kicked in even before your departure date. If you have to cancel five weeks before the trip for a covered reason, the insurer reimburses your prepaid investment.

Some customers mistakenly think the coverage starts after they leave Canada. The same can’t be said for cancellation. You can take advantage of the benefit the minute you buy Travel Insurance. This is crucial for students, families and seniors who are paying big money for tours.

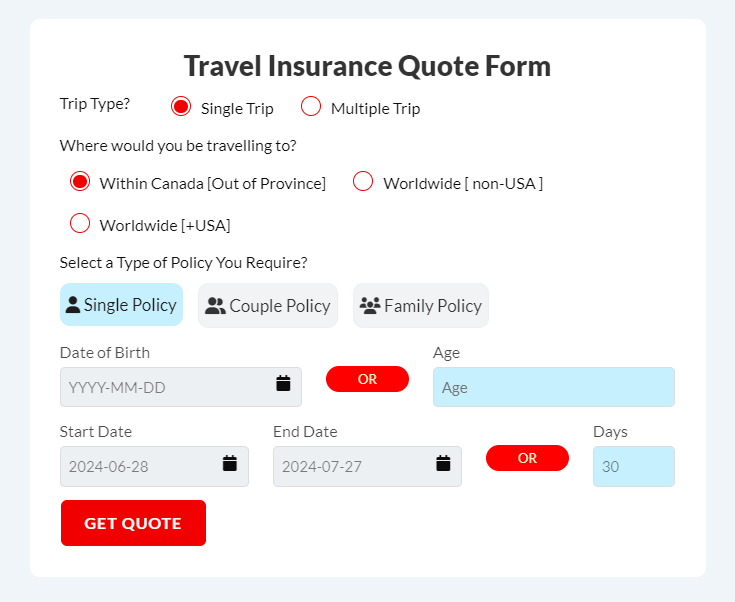

Single Trip Versus Multiple Trips

We do get a lot of questions about which is better – a single-trip plan or the multi-trip coverage. Per-trip policy is more affordable for sporadic travellers. If you’re a frequent flyer, Multi-Trip coverage works better. Both include trip cancellation, but it’s presented differently.

We recommend based on travel habits. One client reserved three trips for 2024. Selling individual single-trip policies was more expensive than a multi-trip policy. We ended up modifying the insurance cover to bring down his total cost and expand coverage.

Reading The Fine Print

The devil is in the details, and in insurance, details are in the fine print. There, exclusions, pre-existing conditions and waiting periods are all waiting for your informed consent. Many customers avoid reading it. That is where mistakes happen.

A customer cancelled because a pre-existing condition had gotten worse. The insurer denied the claim for failure to meet the stability requirements. Had the customer read the fine print before he purchased it, he might have chosen a plan offering more flexible options for health coverage.

At Canadian LIC, we go over this line by line with our clients. Transparency prevents disappointment later.

Air Canada And Other Airline Issues

Airlines change schedules constantly. Flights are cancelled, delayed and rerouted in chaos. Without trip cancellation insurance, overseas travellers have had to cover most costs themselves.

An Air Canada flight change letter, for instance, ended up leaving one customer rebooking via Toronto Pearson International Airport with new hotel stays and rental cars booked. The all-inclusive policy paid for everything that was covered. Without coverage, those costs would have been borne by the customer.

The Value Of Insurance Cover Beyond Cancellation

The stop isn’t the only upside. Trip interruption protects you mid-journey. Lost or delayed baggage coverage can come in handy when your luggage goes missing. Car rental coverage can help you avoid financial disaster following accidents overseas.

Travel Medical Insurance guarantees that if there is an emergency, emergency medical costs are covered. Evacuation coverage includes repatriation to Canada when local care is inadequate. Together, these create comprehensive protection.

Why Covered Reasons Protect Travellers

A covered reason is the backbone of cancellation insurance. It insures clients from certain risks and manages the cost of insurance. So, for lack of limits, premiums would be unaffordable.

Covered reasons level the playing field between travellers and insurers. They help you specify when claims are legitimate. We counsel all our clients at Canadian LIC about this list before they make a Travel Insurance purchase. This helps to prevent arguments and ensure that clients know exactly when they can cancel and how to recoup the nonrefundable cost.

Health Insurance And Pre-Existing Conditions

Pre-existing medical conditions create complexity. Each insurer defines stability differently. A few, for 90 days. Others for 180. If something happens to change your mind before the departure date, the insurer can deny cancellation coverage.

Clients who have chronic conditions should be cautious. At Canadian LIC, we first look at medical history and only then suggest plans. This guarantees the Travel Insurance is in force and any medical expenses abroad are recoverable if necessary.

Why Travellers Need Expert Guidance

Your average customer does not realize how convoluted Travel Insurance Policy wordings are. They focus only on price. They ignore coverage scope. This leads to disputes later.

An adviser assists in making sense of requirements that are specific to your own needs. For instance, which insurer covers preexisting conditions, which plan has more generous medical coverage, and which has tougher rules for family member emergencies. Advice gives customers the confidence to purchase Travel Insurance.

Final Thoughts From Canadian LIC

Trip cancellation isn’t about fear. It is about financial protection. Travellers spend thousands of dollars to make their travel plans. But without coverage, those investments can be lost to illness, airline problems, strikes or government advisories.

By buying Travel Insurance promptly, one by one, and by reading the fine print and knowing what is a covered reason, you protect yourself. No matter whether you are looking for a single-trip policy or coverage for multiple trips, the best Travel Insurance Coverage for trip cancellation in Canada is the policy that is right for you, right for your health, and right for your wallet.

At Canadian LIC, we’ve been committed to transparency all along. We explain insurance costs clearly. We lay out how cancellation works with medical coverage, lost luggage, and interruption. “And we develop solutions that enable our customers to travel with confidence in 2025 and beyond.”

FAQs

Sometimes, yes, but not always. Insurers don’t consider exams a standard covered reason. You would need a specific trip insurance policy that covers academic obligations. But before you buy Travel Insurance, always check the fine print, or you may be on the hook to pay for nonrefundable trip costs yourself.

Yes, some credit card Travel Insurance Policies come with baggage coverage, but the limits are generally low. You’re going to get partial reimbursement on delayed luggage, not total replacement. If you will be travelling with costly equipment, a stand-alone trip insurance policy is a better choice.

Trip cancellation is something that occurs before you leave, and trip interruption is while you’re gone. If you need to cancel a trip after departure because of a covered reason, interruption pays for extra hotel nights, flight changes and possibly rental car expenses. For travellers with complicated itineraries, both components are important.

Not all the time, but stability rules. Some insurers require that you not have a change in your medical condition for 90 to 180 days before departure. Others reject outright. If you buy early, disclose fully and pick the right plan, your medical coverage and cancellation coverage are still in place.

Assuming you purchased before the strike was announced. After the news breaks, insurers call it a foreseeable event. That means no payout. If you’re travelling through Toronto Pearson International Airport or are booking with Air Canada, buy your travel coverage right after booking, in order to cover yourself for your departure date.

Yes, if hotels are prepaid and nonrefundable, and the reason for cancellation is a covered reason. The insurer will request receipts, booking confirmations, and sometimes even evidence of cancellation. That’s why it becomes important to keep records upon which you relied when you cancelled your trip.

No, premiums are non-refundable once coverage begins. And even if your departure date changes, the insurance cost has been outlayed. Only a handful of insurers have add-on “cancel for any reason” options at all. Before you buy Travel Insurance, always ask about refund rules.

Sometimes, but it’s usually limited. Credit card plans don’t come with the same travel medical insurance that standalone policies offer. If you want better health coverage overseas, particularly for emergency medical assistance, buy separate Travel Insurance.

If flight cancellations are a covered reason, the correct type of trip insurance will reimburse you for rental car costs. But not all rental car coverage is created equal among insurers. Because who and what will be covered, and how and when claims will be paid, could vary from trip insurance policy to trip insurance policy, you should always verify any policy-specific needs before assuming that any riders are included.

Not always. Some companies will just cover immediate family, others will cover a dependent family member and even to a primary residence issue. You have to read the fine print. Covered reasons differ by plan; all family ties may not be included.

Key Takeaways

- Trip cancellation is not automatic. Coverage depends on the reason, timing, and the type of Travel Insurance Policy you purchased.

- Credit card Travel Insurance provides limited protection for cancellation and travel medical insurance, often with low claim limits.

- Buying early matters. Purchasing Travel Insurance before a foreseeable event, like an Air Canada strike, protects your departure date.

- Covered reasons include illness, family member emergencies, flight cancellations, government advisories, or damage to your primary residence.

- Reading the fine print helps avoid claim denials, especially around pre-existing medical conditions and stability requirements.

- The best Travel Insurance Policy for trip cancellation balances cost, coverage, and timing while protecting nonrefundable trip costs.

Sources and Further Reading

- Government of Canada – Travel Insurance

https://travel.gc.ca/travelling/documents/travel-insurance

(Explains why Travel Insurance Coverage matters, including cancellation and medical emergencies.) - Financial Consumer Agency of Canada (FCAC) – Travel Insurance

https://www.canada.ca/en/financial-consumer-agency/services/insurance/travel-insurance.html

(Breaks down different types of Travel Insurance Policies, covered reasons, and fine print details.) - Canadian Life and Health Insurance Association (CLHIA) – Consumer Guide to Travel Insurance

https://www.clhia.ca

(Outlines Travel Insurance Coverage in Canada, cancellation, trip interruption, and emergency medical protection.) - Ontario Securities Commission – Travel Insurance Tips

https://www.getsmarteraboutmoney.ca

(Practical advice on comparing Travel Insurance costs in Canada and understanding exclusions.) - Travel Insurance Office Canada – Educational Articles

https://www.travelinsuranceoffice.com

(Provides examples on trip cancellation insurance, lost or delayed baggage, and pre-existing medical conditions.)

Feedback Questionnaire:

IN THIS ARTICLE

- How Trip Cancellation Impacts Travel Insurance Coverage In 2025?

- Why Trip Cancellation Matters

- Credit Card Travel Insurance

- Purchase Travel Insurance Before Departure

- The Role Of Credit Cards In Claims

- Understanding Insurance Cost

- Covered Reasons That Matter Most

- Air Canada Strike And Similar Events

- Departure Date And Coverage Windows

- Single Trip Versus Multiple Trips

- Reading The Fine Print

- Air Canada And Other Airline Issues

- The Value Of Insurance Cover Beyond Cancellation

- Why Covered Reasons Protect Travellers

- Health Insurance And Pre-Existing Conditions

- Why Travellers Need Expert Guidance

- Final Thoughts From Canadian LIC

Sign-in to CanadianLIC

Verify OTP