- Connect with our licensed Canadian insurance advisors

- Shedule a Call

BASICS

- Is Infinite Banking A Smart Financial Strategy?

- Understanding the Infinite Banking Concept

- Why Infinite Banking Appeals to Canadians Seeking Financial Freedom

- How Infinite Banking Strategy Helps Build Financial Independence

- Challenges and Misconceptions About Infinite Banking

- Who Should Consider Infinite Banking for Financial Freedom?

- How to Start Your Infinite Banking Journey

- Key Advantages of the Infinite Banking Strategy

- A Day-to-Day Struggle: Why More Canadians Are Exploring Infinite Banking

- Potential Drawbacks You Should Know

- The Future of Infinite Banking in Canada

- Is Infinite Banking a Smart Financial Strategy?

COMMON INQUIRIES

- Can I Have Both Short-Term and Long-Term Disability Insurance?

- Should Both Husband and Wife Get Term Life Insurance?

- Can I Change Beneficiaries on My Canadian Term Life Policy?

- What Does Term Life Insurance Cover and Not Cover?

- Does Term Insurance Cover Death?

- What are the advantages of Short-Term Life Insurance?

- Which Is Better, Whole Life Or Term Life Insurance?

- Do Term Life Insurance Rates Go Up?

- Is Term Insurance Better Than a Money Back Policy?

- What’s the Longest Term Life Insurance You Can Get?

- Which is better, Short-Term or Long-Term Insurance? Making the Right Choice

IN THIS ARTICLE

- What is the minimum income for Term Insurance?

- How Does Income Affect Your Term Life Insurance Policy?

- Can You Buy Term Life Insurance Online with a Low Income?

- How Can You Lower Your Term Life Insurance Cost?

- How Much Term Life Insurance Do You Need?

- Can Your Term Life Insurance Policy Be Adjusted Over Time?

- Why Term Life Insurance Is Ideal for Lower-Income Canadians

- Final Thoughts

- More on Term Life Insurance

How Insurance Helps Minimize Capital Gains In Estate Planning

By Harpreet Puri

CEO & Founder

- 10 min read

- July 22nd, 2025

SUMMARY

Rising capital gains tax in Canada is changing how families approach estate planning. Using estate planning insurance and Whole Life Insurance in estate planning can help cover tax liabilities, protect the family cottage, and ensure smooth wealth transfer. The blog explains how to buy Life Insurance online strategically, use Permanent Life Insurance for tax efficiency, and get Term Life Insurance Quotes to support estate equalization and minimize the estate’s tax bill.

Introduction

Capital Gains Tax: Why Your Estate Isn't Safe Without A Plan

- A family cottage that’s doubled or tripled in value over 30 years

- Shares in a qualified small business corporation

- Rental properties or capital assets

- Investment portfolios outside registered accounts

Permanent Life Insurance: The Most Tax-Efficient Tool In Estate Planning

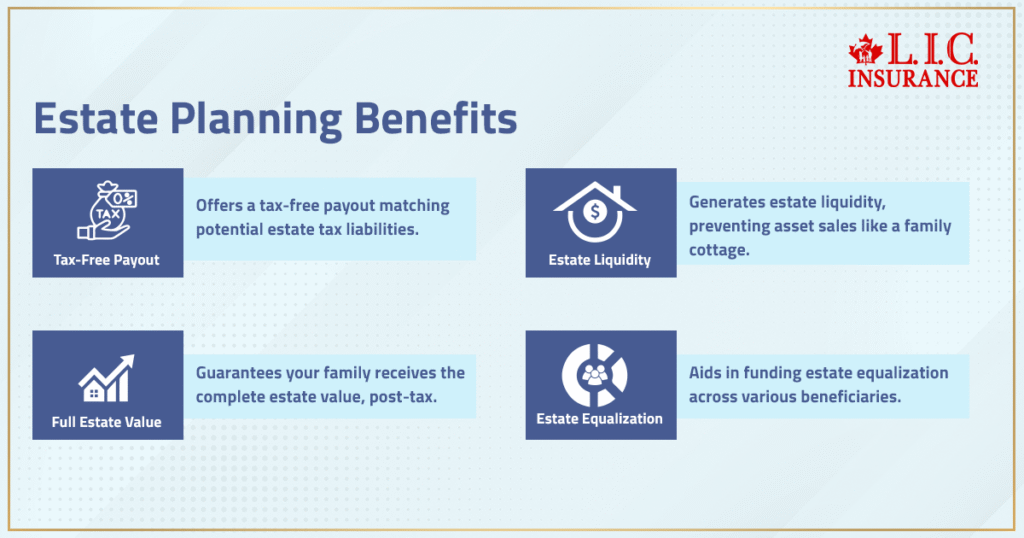

- Provides a tax-free payout equal to the tax bill your estate might owe

- Creates estate liquidity, avoiding the need to sell assets like a family cottage or illiquid assets

- Ensures your family gets the full value of your estate, not the after-tax leftovers

- Can help fund estate equalization among multiple beneficiaries

The Impact Of The Capital Gains Inclusion Rate In 2025

Minimize Taxes While Maximizing Control

Here’s what most people don’t realize: a Life Insurance Policy can be owned by a corporation, paid with corporate funds, and still result in a tax-free capital dividend to shareholders. It flows through the corporation’s capital dividend account.

This makes Permanent Life Insurance in estate planning one of the few tools that bridges personal and business succession goals:

- Pays off the estate’s tax bill on business operations or private company shares

- Funds buy sell agreements with the surviving partners

- Offers creditor protection when structured correctly

It’s also cost-effective. Think about it: you’re exchanging pennies on the dollar (your premiums paid) for hundreds of thousands in tax-free value.

The Key Benefits Of Life Insurance In Capital Gains Planning

- Predictable. You know what your death benefit will be.

- Liquid. The money comes fast, unlike property or private shares.

- Flexible. You can use it for estate equalization, business succession, or to cover estate taxes.

- Private. It bypasses probate and keeps your financial affairs confidential.

- Strategic. It works with your financial advisor to build a complete plan.

It’s not just about replacing income—it’s about preventing a financial emergency at the worst possible time.

Don't Let The Family Cottage Become A Family Fight

One of the most painful estate stories we’ve heard came from a family that had to sell their family cottage because they couldn’t cover the tax liability. That cottage had been in their family for 50 years. But with no plan to cover the capital gains, they were forced to list it within weeks.

Insurance could have saved it.

Whether it’s a cottage, a rental property, or your business assets, you don’t want your loved ones having to choose between paying CRA or keeping what matters most. That’s the role of Whole Life Insurance in estate planning—to make sure those choices never come up.

Working With Professional Advisors To Build Your Plan

No two estates are alike. That’s why it’s important to coordinate with professional advisors, your financial advisor, legal counsel, and accountants to:

- Evaluate the capital gains exposure

- Assess the value of your illiquid assets

- Calculate potential tax implications

- Structure the right insurance policy

And yes, you can buy Life Insurance online these days. But for something this important, don’t go it alone. You want the kind of investment advice that looks beyond today’s premiums and considers your estate’s long-term future.

Using Insurance To Fund Buy-Sell Agreements And Succession Planning

Business owners face a unique challenge. What happens to your business when you’re gone? Without a proper buy sell agreement, your death could create chaos for your co-owners and family.

With Life Insurance, your business can:

- Fund the buy-sell agreement

- Provide financial support for your heirs

- Ensure seamless succession planning

And remember: the insurance proceeds are usually received tax-free, adding a crucial layer of tax efficiency.

Life Insurance: The Only Guaranteed Strategy To Pay A Guaranteed Tax

Here’s what it comes down to: You know there will be taxes. CRA will not forget.

So why not use a product that:

- It is guaranteed to pay out

- Comes tax free

- Doesn’t require selling assets

When structured correctly, estate planning insurance is the only solution that ensures your estate has the funds to pay the CRA without compromise.

Final Thoughts: Planning For Future Generations

If you’ve built something worth passing down—real estate, a business, a legacy—don’t let the tax man be the biggest beneficiary.

A solid plan, built around Life Insurance Policies, lets you:

- Transfer wealth efficiently

- Keep your assets intact

- Minimize taxes

- Provide for future generations

Your life’s work deserves a strategy that protects it. Not just for today, but for every tomorrow your family will face.

Ready to protect your legacy?

Start by assessing your capital gains exposure. Talk to someone who understands estate planning and insurance policies from both the legal and financial lens. If you already own a Permanent Life Insurance Policy, review how it integrates with your current will and succession plans.

And if not, maybe now’s the time to buy Life Insurance online that actually fits your estate, your goals, and your legacy.

Because tax rules will change, capital gains will rise. But with the right plan, your family’s future doesn’t have to pay the price.

FAQs

If you’re lying awake in bed at 3 a.m. with the words “I’m trans” repeating in your head, know that you are not alone in this. We’ve seen it dozens of times — Mom or Dad worked hard all their lives to create something special, but the kids simply don’t want to assume the responsibility, or are just not yet ready. In this lull — this messy middle — the tax bill does not wait. A well-designed Permanent Life Insurance Policy can essentially buy you time. It allows your family to breathe, as opposed to having to sell quickly, or, worse, sell cheap.

Absolutely. That’s actually one of the biggest hurdles people have. You have the family cottage, the rental property, perhaps some land, but not the cash on hand when the capital gains tax comes due. Rather than selling or mortgaging property to raise cash, Life Insurance proceeds can provide a source of funds to pay the tax and keep the property for the family. It’s not about having it all figured out — it’s about not backing your nearest and dearest into a corner.

Here comes the human stuff, and it gets messy. One child values holding onto the family business, and another cares only for their share in cash. Friction can occur, some of it lasting. Life Insurance estate equalization provides a method for levelling the playing field without depleting your estate. Every beneficiary receives value, without feuds, litigation or bitterness later. That’s not just a tax strategy — that’s family preservation.

It’s a truth all too many families know. Mom or Dad kept meaning to “get around to it” and then… didn’t. The consequences can be painful — assets that freeze, wills that are fought over, and tax bills that no one expected. But a Life Insurance Policy, if you have one, can still offer a backstop. A simple, bare-bones term policy with a beneficiary designation can give your loved ones some time and space to figure things out without also suffering financial chaos. It’s not too late — until it is.

Yes, and sometimes that’s the tax-efficient thing to do, particularly if you are trying to park value inside a business. If the corporation’s capital dividend account is utilized properly, the Life Insurance death benefit can flow out tax-free to shareholders. But — and this is a big but — you need the right structure and advice that goes beyond the templated answer. One misstep, and there come the penalties or the blocked funds. So… get it reviewed.

Fair question. It’s more the latter — insurance doesn’t cause the capital gains inclusion rate to drop. But it at least spares the blow. Rather than spending retirement savings or selling illiquid assets or draining a savings account, the death benefit pays as soon as the bill comes due. No waiting, no tax on it when it pays out, no headache for your executor. That’s the gap between the tax problem and the tax plan.

Wills lay out the “what.” Insurance funds the “how.” Not even the most brilliantly drafted will can conjure cash where there is none. Even if your estate has a tax liability of hundreds of thousands and your assets are illiquid, your executor still must scrounge up the money to pay. That’s why estate planning Whole Life Insurance is so critical — it ensures your intentions don’t just get documented, they get implemented. No fire sales. No family arguments.

Key Takeaways

- Rising capital gains tax is increasing the estate tax burden on families with high-value assets, like cottages, businesses, and investment properties.

- Estate planning insurance, especially Whole Life Insurance in estate planning, creates immediate liquidity to cover tax bills without forcing asset sales.

- A Permanent Life Insurance Policy can support estate equalization when multiple beneficiaries have different financial needs or priorities.

- Life Insurance proceeds can be structured to flow tax-free through the corporation’s capital dividend account, offering a strategic advantage for incorporated business owners.

- Even with a will, estate insurance helps ensure your wishes are funded, not just documented — protecting your legacy from unnecessary fire sales and family disputes.

- Naming a corporation as policy owner requires careful tax planning. Structured properly, it can offer both creditor protection and tax efficiency.

- Term Life Insurance Quotes and buy Life Insurance online tools make it easier than ever to start securing your estate’s financial future — but proper advice is still critical.

- If most of your wealth is tied up in illiquid assets, like a family cottage or business, insurance bridges the gap between taxation and preservation.

Sources and Further Reading

- Canada Revenue Agency – T4037: Capital Gains Guide Understand the tax treatment of capital gains in Canada, including exemptions and reporting rules. https://www.canada.ca/en/revenue-agency/services/forms-publications/publications/t4037.html

- Canada Revenue Agency – Life Insurance and Estate Planning Overview of how Life Insurance is treated for tax purposes and how it can be integrated into estate strategies. https://www.canada.ca/en/revenue-agency/services/tax/businesses/topics/insurance/life-insurance.html

- Canadian Life and Health Insurance Association (CLHIA) – Consumer Tools on Life Insurance Explains Life Insurance types, uses in estate planning, and financial protection benefits. https://www.clhia.ca/web/CLHIA_LP4W_LND_Webstation.nsf/page/ConsumerTools

- Financial Consumer Agency of Canada – Managing Capital Gains Offers financial literacy resources on investments, tax planning, and capital gains strategies. https://www.canada.ca/en/financial-consumer-agency.html

- Estate Planning Council of Canada A national organization providing education and insight into modern estate planning tools and practices. https://www.epcc.ca/

- Morneau Shepell – Life Insurance and Corporate Estate Planning Professional insights into using Life Insurance inside corporations for capital gains and succession planning. https://www.telushealth.com (Search “estate planning Life Insurance”)

- CPA Canada – Tax Planning Using Insurance Detailed guidance on the role of Permanent Life Insurance in mitigating tax burdens at death. https://www.cpacanada.ca/ (Search “Life Insurance estate planning”)

Feedback Questionnaire:

Thank you for reaching out. We’re happy to support you—we help with real answers—no pressure, no sales pitch.

IN THIS ARTICLE

- How Insurance Helps Minimize Capital Gains In Estate Planning

- Capital Gains Tax: Why Your Estate Isn't Safe Without A Plan

- Permanent Life Insurance: The Most Tax-Efficient Tool In Estate Planning

- The Impact Of The Capital Gains Inclusion Rate In 2025

- The Key Benefits Of Life Insurance In Capital Gains Planning

- Don't Let The Family Cottage Become A Family Fight

- Using Insurance To Fund Buy-Sell Agreements And Succession Planning

- Life Insurance: The Only Guaranteed Strategy To Pay A Guaranteed Tax

- Final Thoughts: Planning For Future Generations

- Ready to protect your legacy?

Sign-in to CanadianLIC

Verify OTP