- Connect with our licensed Canadian insurance advisors

- Shedule a Call

BASICS

- Is Infinite Banking A Smart Financial Strategy?

- Understanding the Infinite Banking Concept

- Why Infinite Banking Appeals to Canadians Seeking Financial Freedom

- How Infinite Banking Strategy Helps Build Financial Independence

- Challenges and Misconceptions About Infinite Banking

- Who Should Consider Infinite Banking for Financial Freedom?

- How to Start Your Infinite Banking Journey

- Key Advantages of the Infinite Banking Strategy

- A Day-to-Day Struggle: Why More Canadians Are Exploring Infinite Banking

- Potential Drawbacks You Should Know

- The Future of Infinite Banking in Canada

- Is Infinite Banking a Smart Financial Strategy?

COMMON INQUIRIES

- Can I Have Both Short-Term and Long-Term Disability Insurance?

- Should Both Husband and Wife Get Term Life Insurance?

- Can I Change Beneficiaries on My Canadian Term Life Policy?

- What Does Term Life Insurance Cover and Not Cover?

- Does Term Insurance Cover Death?

- What are the advantages of Short-Term Life Insurance?

- Which Is Better, Whole Life Or Term Life Insurance?

- Do Term Life Insurance Rates Go Up?

- Is Term Insurance Better Than a Money Back Policy?

- What’s the Longest Term Life Insurance You Can Get?

- Which is better, Short-Term or Long-Term Insurance? Making the Right Choice

IN THIS ARTICLE

- What is the minimum income for Term Insurance?

- How Does Income Affect Your Term Life Insurance Policy?

- Can You Buy Term Life Insurance Online with a Low Income?

- How Can You Lower Your Term Life Insurance Cost?

- How Much Term Life Insurance Do You Need?

- Can Your Term Life Insurance Policy Be Adjusted Over Time?

- Why Term Life Insurance Is Ideal for Lower-Income Canadians

- Final Thoughts

- More on Term Life Insurance

How Geopolitical Tensions In The Middle East Are Affecting Life Insurance Premiums In Canada?

By Harpreet Puri

CEO & Founder

- 7 min read

- July 9th, 2025

SUMMARY

Geopolitical tensions in the Middle East are influencing Life Insurance premium trends across the Canadian Life Insurance market. The global risk impact is prompting insurers to reassess pricing, risk forecasting, and portfolio management. Rising uncertainty, conflict-driven economic shifts, and historical precedents are contributing to premium fluctuations and reshaping underwriting strategies across the industry.

Introduction

In every conversation we’ve had with clients over the past few months, one concern keeps resurfacing. It’s not just about inflation, not just about interest rates, and not even just about healthcare wait times. It’s the rising cost of Life Insurance. And surprisingly, a major driver behind that spike is happening thousands of kilometres away—in the Middle East.

At Canadian LIC, we talk to people every day who are feeling the pinch. Families trying to secure whole life policies for generational protection, business owners exploring key-person insurance, and seniors seeking affordable term coverage to protect their estate planning—all are facing steeper premiums. Many ask, “Why now?” The truth isn’t buried in a policy clause. It’s unfolding on the world stage.

The Link Between Geopolitics and the Canadian Life Insurance Market

You might wonder how events overseas could possibly affect your Life Insurance premium trends in Canada. The answer lies in the global nature of risk assessment. Life insurers are financial institutions, and like all institutions that manage risk, they price their products based on macroeconomic indicators, global volatility, and long-term financial projections.

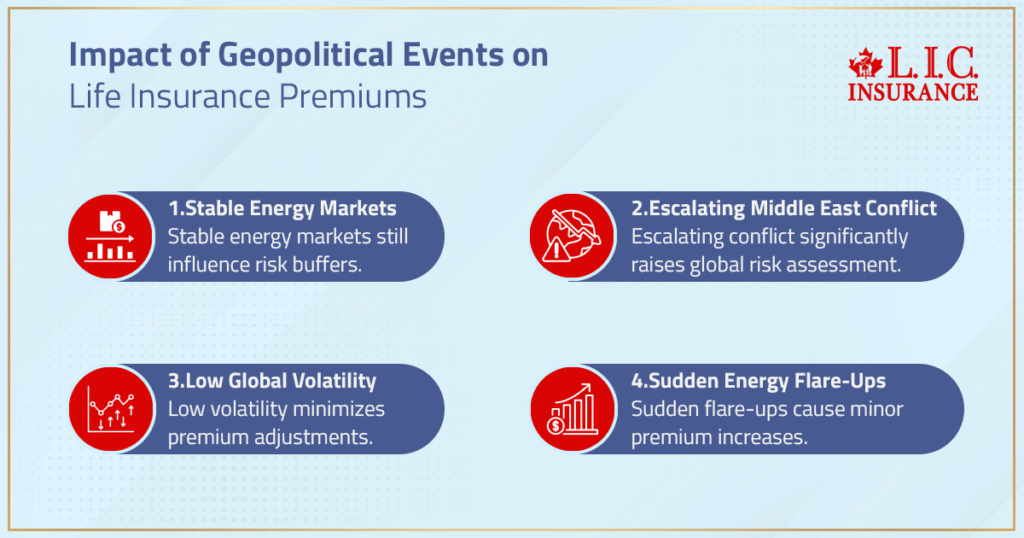

With escalating tensions in the Middle East—from sustained conflict zones to sudden flare-ups in energy-producing regions—global markets are being rattled. And insurance companies, particularly those managing large investment portfolios, are responding by building risk buffers into their pricing models.

How Global Risk Impacts Spills Over to Canadian Policyholders

Insurance companies invest the premiums you pay to grow capital and fund future claims. When markets become unstable due to geopolitical strife, those investments are seen as riskier. Risky markets mean lower returns, and lower returns push insurers to protect themselves in another way: through higher premiums.

We recently sat down with a client from Brampton whose $750,000 Whole Life Insurance Quote increased by nearly 12% compared to last year. He hadn’t aged into a new bracket. His health hadn’t changed. But what had changed was the insurer’s exposure to global market volatility.

Middle East unrest—especially near oil chokepoints like the Strait of Hormuz—has caused major commodity price fluctuations. When oil prices spike, so do inflation concerns. That inflation feeds into bond markets and central bank decisions, which in turn affect the investment returns that insurance companies count on.

And when insurers can’t count on steady returns, they pass that cost back to you.

Increased Reinsurance Costs Mean a Ripple Effect for Canadians

Most Canadian Life Insurance providers rely on reinsurance—a secondary insurance for insurers themselves—to manage catastrophic risks. With global uncertainties rising, reinsurers are adjusting their own risk models. This trickles down fast.

We recently had a couple from Mississauga inquire about a joint-term policy. By the time their application was fully underwritten, the reinsurer had increased rates due to “global risk re-evaluation,” resulting in a higher premium than originally quoted. The couple wasn’t happy, and we understand that. But these shifts are happening mid-cycle, and many families are being caught in the crossfire.

The Long-Term Implications for Canadian Life Insurance Premium Trends

As geopolitical tensions stretch into long-term conflicts, Canadian insurers are starting to bake in persistent risk premiums. For policyholders, this means Life Insurance premium trends may not “go back down” for quite some time. Insurers are building for a future where unpredictability is the norm.

We’re already seeing early signs. Term life premiums for applicants aged 35-50 have risen modestly. But more striking is the jump in universal Life Insurance pricing. Since this product relies heavily on insurer investments for long-term value growth, the global risk impact from the Middle East is a key factor in its price trajectory.

We had a small business client who wanted to fund a buy-sell agreement with a permanent policy. Last year, the cost was reasonable. This year, premiums had surged 15%. While some of that is inflation and interest-rate-driven, our carrier contacts confirmed that a major contributor was global instability.

What Canadian LIC Recommends Right Now

If you’re in the market for Life Insurance, waiting might not save you money. In fact, it could cost you. Here’s why:

- Insurers are repricing rapidly – Some carriers have adjusted rates twice in the past year.

- Underwriting timelines are tightening – Delays can mean you fall into a more expensive bracket.

- Reinsurance volatility is high – Even after a quote is issued, final pricing may change.

Our advice? Lock in your rates while they’re still available. At Canadian LIC, we help clients act quickly and confidently, so they’re not stuck with tomorrow’s pricing.

What You Can Do Today

- Get a personalized policy review. We help clients compare across multiple providers, so you’re not caught by surprise.

- Act on favourable quotes promptly. Don’t wait weeks to decide. Repricing happens faster than ever.

- Ask about flexible payment options. We can help you stretch affordability without compromising coverage.

The Bottom Line: Stay Informed, Stay Protected

You don’t have to understand Middle East geopolitics in depth to feel its effect at home. If you’re shopping for a Life Insurance plan, the global risk impact is real. And while headlines may focus on oil or diplomacy, what we see is families in Ontario and beyond getting caught in rising premiums.

At Canadian LIC, we watch those waves closely so our clients don’t get swept away.

Want to know how global events are affecting your coverage options? We’re here to talk, review, and act—so your financial protection doesn’t become collateral damage in someone else’s war.

FAQs

The global risk influence does not just involve geopolitical risks. Natural disasters, pandemics, cyberattacks and changing trade blocs also put stress on actuarial models. Insurers in the Canadian Life Insurance industry need to consider these layered uncertainties and adjust capital buffers and reinsurance strategies accordingly, influencing the recalibration of Life Insurance premium trends.

Premium hikes are not blanket increases. Insurers in the Canadian Life Insurance market use segmented risk assessments. Those in higher-risk professions, frequent travellers to volatile regions, or clients with extensive global exposure may see sharper increases. Meanwhile, others with stable profiles may experience only modest premium shifts. This tiered response is rooted in how insurers evaluate the global risk impact on each policyholder.

Reinsurance companies — which backstop the large risks of insurers — have also taken a more conservative stance. So they’re either closing terms up or raising their own pricing. That flows to the Canadian Life Insurance market, and primary insurers must raise premiums in order to account for higher reinsurance costs. This behind-the-curtain reality has something to do with the sort of Life Insurance premiums Canadians are confronting today.

Yes. Term Life Insurance is typically less expensive and renewed more regularly, enabling insurers to adjust rates more rapidly in response to global turbulence. Whole Life Insurance, meanwhile, requires long-term commitments with fixed premiums. While turmoil in the Middle East plays out, insurers may grow more reluctant to offer new whole life policies at older pricing, especially when taking into account inflation and market instability.

One savvy move is the lock-in premiums now, particularly with term life, at least in some circumstances. Purchasing a policy as long as rates are favourable avoids potential volatility. Also, your insurability profile can be further embellished through bundling and maintaining great health records, avoiding high-risk travel or occupation. There is no sense of urgency in making any decision now; it’s all about not throwing good money after bad when premiums begin to trend to reflect the unexpected impacts on global risk tomorrow.

The Office of the Superintendent of Financial Institutions (OSFI) closely monitors capital adequacy and stress testing in light of cross-border risks. They may not set prices directly, but they ensure that insurers who operate in the Canadian Life Insurance market are solid and durable even in a time when the world is a larger and, in some ways, more treacherous place. And it is their vigilance that helps keep premium trends in check and protects the consumer.

Yes. Industries like energy, global logistics, the mining industry and cybersecurity have more exposure to geopolitical turmoil and breakdowns in the supply chain. Workers or business owners in these regions might find insurers digging deeper into applications, tweaking underwriting assumptions or offering slightly higher quotes on Life Insurance out of an abundance of caution. The domino effect of geopolitical tensions extends all the way down to industry-specific underwriting.

Geopolitical conflicts strain the markets, and that strain manifests as unstable inflation and interest rates. For insurers, this involves the recalibration of not only liabilities but also investment outlooks. Life Insurance is priced for expected returns over a long period on invested premiums; volatility can erode profit margins, which companies may have to make good by raising premiums. So, Canadian insurers look at financial as well as global risk effects when they decide on pricing algorithms.

For older Canadians, especially those in the market for new coverage or those who need to renew their policy, changes in trends have a specific impact on Life Insurance premiums. Because they are older and already at a higher actuarial risk, insurers add layers of risk premiums if external conditions — the rise of geopolitical instability — that diminish predictability increase even more. But policyholders who have locked in rates with an existing permanent policy are largely spared from the fallout.

Most likely. With the increasing risk impact globally, underwriting may start to cover travel disclosures, occupation questions and lifestyle risks. Insurers don’t want to be on the hook for unpredictable results, particularly with a volatile geopolitical situation. If you intend to apply for coverage, sooner is better, given fewer obstacles and less resistance to approval before the guidelines are tightened further.

The Canadian Life Insurance market does not exist in a vacuum – it responds to global volatility cautiously and methodically. After the early ’90s Gulf War, insurers around the world again reviewed assumptions on mortality because of the war-induced changes in health and risk patterns. The Arab Spring of 2011, which drove up the price of oil and created further instability in the region, led reinsurers to cut back capacity. These precedents illustrate how the global risk effect of Middle East unrest has already affected Canadian Life Insurance premium patterns in the past, with increased underwriting scrutiny and strategic pricing reset.

Yes, insurers are keeping an eye on developments that might lead to larger geopolitical or economic crises. The 2019 assault on Saudi Aramco’s oil facilities, for example, created a global oil supply shock and raised fears of armed conflict. Also, tensions in the Strait of Hormuz—through which much of the world’s oil must pass—dispersed their impact on market stability and on forecasts of inflation. Events of that magnitude don’t just disturb economies — they throw into question the underpinnings of long-term actuarial planning, forcing insurers in the Canadian Life Insurance market to recalibrate premium structures quickly as uncertainty levels climb.

Key Takeaways

- Geopolitical tensions directly impact the Canadian Life Insurance market by increasing volatility in actuarial assumptions, risk models, and reinsurance pricing.

- Life Insurance premium trends are shifting upward due to rising global risk impact, with insurers adjusting rates based on industry, travel habits, and international exposure.

- Term Life Insurance policies are more responsive to short-term global shocks, while Whole Life Insurance faces longer-term pricing challenges under inflationary pressures.

- Reinsurance companies are tightening terms and raising rates, forcing Canadian insurers to adjust premiums and policy offerings accordingly.

- Canadian regulators like OSFI play a stabilizing role, enforcing capital adequacy rules that help prevent drastic premium hikes, but cannot stop subtle market recalibrations.

- Certain sectors—such as energy, global logistics, and cybersecurity—are under sharper underwriting scrutiny, as insurers monitor exposure to cross-border disruptions.

- Consumers with stable risk profiles or existing locked-in premiums are more insulated, while new applicants, especially older Canadians, may face higher costs or stricter approval hurdles.

- Proactively securing policies now, before further volatility, may shield buyers from future premium hikes, especially with term Life Insurance.

- Historical Middle East crises have set precedents for premium spikes, proving that today’s geopolitical tensions are not isolated from Canadian pricing realities.

- The Canadian Life Insurance market is globally connected, and international instability will continue to shape how policies are priced, structured, and underwritten in 2025 and beyond.

Sources and Further Reading

- Office of the Superintendent of Financial Institutions (OSFI)

https://www.osfi-bsif.gc.ca

Canada’s primary federal regulator for insurance companies, with reports on capital adequacy, solvency stress tests, and risk exposure related to global conflict. - Canadian Life and Health Insurance Association (CLHIA)

https://www.clhia.ca

Offers insight into trends in the Canadian Life Insurance market, including how macroeconomic and geopolitical factors impact policyholder pricing. - Bank of Canada – Financial System Review

https://www.bankofcanada.ca

Reviews financial stability risks, including global conflict-driven volatility, interest rate outlooks, and inflation—all key to Life Insurance pricing models. - Munich Re – Global Reinsurance Market Reports

https://www.munichre.com

Explores how reinsurance pricing and risk appetite shift globally in response to political tensions, and how that affects premiums downstream in Canada. - Swiss Re Institute – Economic Insights and Sigma Reports

https://www.swissre.com

Analyzes geopolitical uncertainty, mortality trends, and insurance premium adjustments worldwide. - Canadian Institute of Actuaries (CIA)

https://www.cia-ica.ca

Technical actuarial research discussing long-term pricing models for Life Insurance in volatile environments. - International Monetary Fund (IMF) – Regional Economic Outlook: Middle East and Central Asia

https://www.imf.org

Provides macro-level data on how Middle East instability affects global markets and indirectly contributes to changes in Canadian financial instruments. - The Geneva Association – Reports on Insurance Economics and Systemic Risk

https://www.genevaassociation.org

Independent research body examining how systemic global risks—including geopolitics—shape insurance markets.

Feedback Questionnaire:

Thank you for taking the time to share your feedback. Your responses will help us understand what concerns Canadians the most about rising Life Insurance premiums amid global instability.

Thank you for your input! We’ll use your feedback to improve our educational resources and provide clearer guidance.

IN THIS ARTICLE

- How Geopolitical Tensions In The Middle East Are Affecting Life Insurance Premiums In Canada

- The Link Between Geopolitics and the Canadian Life Insurance Market

- How Global Risk Impacts Spills Over to Canadian Policyholders

- Increased Reinsurance Costs Mean a Ripple Effect for Canadians

- The Long-Term Implications for Canadian Life Insurance Premium Trends

- What Canadian LIC Recommends Right Now

- What You Can Do Today

- The Bottom Line: Stay Informed, Stay Protected

Sign-in to CanadianLIC

Verify OTP