- Connect with our licensed Canadian insurance advisors

- Shedule a Call

BASICS

- Is Infinite Banking A Smart Financial Strategy?

- Understanding the Infinite Banking Concept

- Why Infinite Banking Appeals to Canadians Seeking Financial Freedom

- How Infinite Banking Strategy Helps Build Financial Independence

- Challenges and Misconceptions About Infinite Banking

- Who Should Consider Infinite Banking for Financial Freedom?

- How to Start Your Infinite Banking Journey

- Key Advantages of the Infinite Banking Strategy

- A Day-to-Day Struggle: Why More Canadians Are Exploring Infinite Banking

- Potential Drawbacks You Should Know

- The Future of Infinite Banking in Canada

- Is Infinite Banking a Smart Financial Strategy?

COMMON INQUIRIES

- Can I Have Both Short-Term and Long-Term Disability Insurance?

- Should Both Husband and Wife Get Term Life Insurance?

- Can I Change Beneficiaries on My Canadian Term Life Policy?

- What Does Term Life Insurance Cover and Not Cover?

- Does Term Insurance Cover Death?

- What are the advantages of Short-Term Life Insurance?

- Which Is Better, Whole Life Or Term Life Insurance?

- Do Term Life Insurance Rates Go Up?

- Is Term Insurance Better Than a Money Back Policy?

- What’s the Longest Term Life Insurance You Can Get?

- Which is better, Short-Term or Long-Term Insurance? Making the Right Choice

IN THIS ARTICLE

- What is the minimum income for Term Insurance?

- How Does Income Affect Your Term Life Insurance Policy?

- Can You Buy Term Life Insurance Online with a Low Income?

- How Can You Lower Your Term Life Insurance Cost?

- How Much Term Life Insurance Do You Need?

- Can Your Term Life Insurance Policy Be Adjusted Over Time?

- Why Term Life Insurance Is Ideal for Lower-Income Canadians

- Final Thoughts

- More on Term Life Insurance

How Canadians Can Prepare For A Recession: A Step-By-Step Guide

By Pushpinder Puri

CEO & Founder

- 20 min read

- May 14th, 2025

SUMMARY

Know how Canadians can prepare for a possible recession with practical, human-first steps. It covers building an emergency fund, tackling high-interest debt, adjusting discretionary spending, reviewing insurance coverage, and strengthening a professional network. It also explains how to manage rising interest rates, protect cash flow, and stay grounded during economic downturns, market volatility, and uncertain times in the Canadian economy.

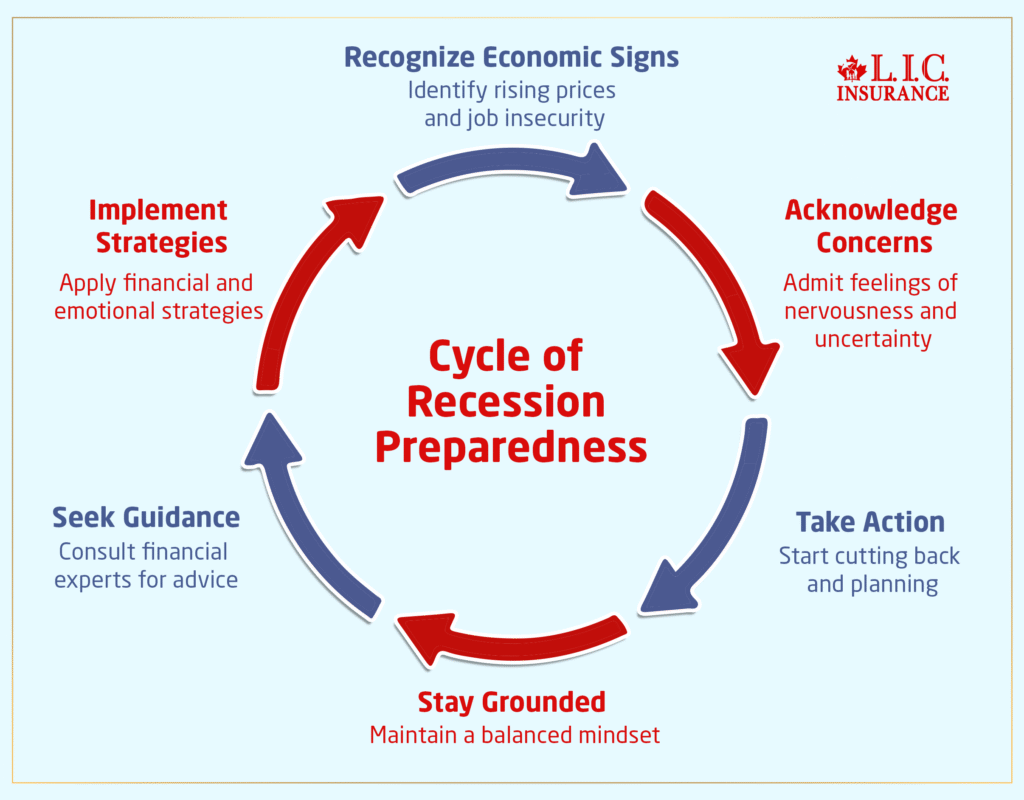

Introduction

We don’t need to play pretend: We’re not talking about some hypothetical future headline — things feel tight already. Prices are up. Mortgage renewals sting. There may be some of your friends side-eyeing their job security. And if you’ve wondered, “Do I need to start cutting back … just in case?” —you’re not overreacting.

At Canadian LIC, we’ve sat opposite clients in the last few months who said precisely that. Everyone is nervous, but there’s no panic. And honestly? It’s a good place to start — concerned enough to act but not paralyzed in fear.

So, this is not the cookie-cutter finance guide. It’s the human version — direct, put-yourself-in-my-shoes stories from the front lines by guys who have helped hundreds of Canadians dodge tough economic times and keep their feet on the ground.

We’re going to talk money. But also mindset. Strategy. Emotion. Mistakes (ours too). When it comes to preparing for a recession, it’s not all about the numbers — it’s about staying grounded when the ground starts shaking.

Step 1: Look Around Before You Look at the Headlines

One of our clients, a restaurant manager in Sudbury, said something that stayed with us:

“I knew we were in for something when we went from two servers per shift to one. And no one said anything. That silence was more resounding than a press release.

You don’t need the nightly news to inform you that things are slowing down. Look at your shifts. Your freelance invoices. Your inbox.

Do project starts get pushed out? Cancelling subscriptions? Do your colleagues whisper about “tightening budgets”?

If it doesn’t feel like the case in your little pocket of the world, trust that. That’s your cue — not the national graph of inflation.

Step 2: Emergency Funds Aren't Just for Planners

Emergency funds sound like something responsible people do. And they are. But they’re also for people who’ve been burned before and don’t want to go through that again.

We met with a guy last month who used to work in tech. Got laid off in 2020. Took six months to find anything stable. He told us, “Back then, I had no backup—just panic.”

This time around? He’s putting aside $100 every paycheque. Same income, different mindset.

And before you roll your eyes—yes, we know saving isn’t easy. You don’t need $10,000 by next week. But could you start with $10 or $25 a week? Could you transfer it before you see it?

We had a nurse in Mississauga automate $50 into a ‘Rainy Day’ account every payday. It felt invisible. Until her car broke down. Then it felt like a miracle.

Step 3: Kill the High-Interest Debt Before It Kills Your Budget

Okay, maybe that’s dramatic. But here’s the rub — credit card interest doesn’t give a hoot about recessions. It is, in fact, a time it thrives in.

We spoke to a single mom in Brampton who was managing three cards. She was paying the minimum on time, everything on time, but the balance never seemed to shrink.

What helped? We put her in touch with a local credit union that provided her with a line of credit at 8 percent. Not perfect, but it’s a heck of a lot better than 22.99%. She cleared two cards and zeroed in on the third. After six months, she said her anxiety stopped showing up with her bank app notifications.

Moral of the story? Attack the worst debt first. Negotiate where you can. Consolidate, if it makes sense. And if you’re not sure what you can make sense of? Ask.

Step 4: Recession Budget ≠ No Fun Budget

We dislike the term “budget” as much as the next guy. But it’s not about restriction — it’s about choosing where you want your money to go rather than asking where it went.

We had a Halifax couple who were afraid of the concept of budgeting because they thought it meant giving up all the things they loved. It seems they just wanted clarity.

They didn’t give up Friday pizza night , but they did put a hold on that second streaming service that they barely used. They didn’t cancel vacations — just traded in an all-inclusive for a weekend in a cabin.

Start with three categories:

- Basics (rent, food , and transportation)

- Obligations (debt, child care, insurance)

- Optional (eating out or shopping, for example)

Then inquire: “What would hurt the least to put on pause for 90 days?” Not forever. Long enough, that is, to establish a buffer.

Step 5: Your Investment App Is Not a Mood Tracker

Stop checking your investment account every morning. Seriously.

We had a call from someone who was panicking because his RRSP was down 8% for the week. He was ready to sell and “just keep it in cash for a while.’ We inquired: “Are you retiring tomorrow?” He laughed. “No, in about 18 years.”

Exactly.

If the condition of your investment portfolio makes you feel a little ill, it’s not a signal to sell — it’s actually a signal that it’s time to rebalance. Perhaps it’s time to pivot toward short-term bonds, dividend stocks, or just dial down your exposure to tech.

Panic selling in a dip is akin to cancelling your travel insurance because your flight was delayed. It solves nothing.

Step 6: Insurance You Understand > Insurance You Bought Ten Years Ago

Pull out your policies. Yes, the dusty folder or password-protected PDF from 2015.

One of our clients, a contractor in Barrie, thought he had decent disability coverage. Turns out it only kicked in after 90 days. He fractured his foot and was out of work for six weeks. Zero payout.

Check your:

- Life insurance: Is the coverage amount still relevant?

- Disability: How long is the waiting period?

- Health/dental: Are there gaps?

If you don’t understand what you’re paying for, that’s not your fault. It’s your insurer’s. And it’s fixable.

Step 7: Rebuild Your Network Before You Need It

Nobody likes to network — until they need to.

But what we’ve seen again and again is that people who do OK after layoffs almost invariably had someone looking out for them.

Comment on that coworker’s post. Send a check-in email. Respond to the recruiter who poked you 12 months ago.

You’re not asking for a job. You’re just reminding people that you exist. And it’s more important than you might imagine.

Step 8: Delay Big Purchases (Unless They Save You Money)

We had a woman client who was planning to lease a new vehicle, just as gas prices went up and her hours were cut. We ran the math. She kept her old car, switched to liability-only insurance, and saved $370 a month.

That’s not a small deal. That’s groceries. Or half an emergency fund.

So yes, delay the reno. Postpone the new TV. But also invest in things that save you money in the long term: energy-efficient upgrades or paying off high-interest balances.

Step 9: Build "What If" Scenarios Into Your Budget

This part’s uncomfortable. But also empowering.

We walked through this with a family of four:

- What if one of us gets laid off?

- What if rent goes up by $200?

- What if we need to cover a $1,500 car repair?

They built a spreadsheet (okay, we helped), and suddenly those “what ifs” turned into “here’s how.”

It’s not about fear—it’s about practicing your bounce-back.

Step 10: Give Yourself a Break. Seriously.

One mother we spoke to was in tears. Not that she wasn’t failing, but because she believed she should be doing more. More savings. More side income. More of everything.

But she was already doing the work —paying her bills, avoiding bad debt, and raising two kids on her own.

We said to her what we say to ourselves now and then: It is enough to survive. Planning a little? That’s a bonus.

Recession prep is not about achieving perfection before trouble arrives. It’s about creating a little bit of calm in the chaos. That may look like $50 a month into savings. It could be spending just 60 minutes during the weekend to unsubscribe (at least until the new year) from the 12 marketing emails that induce you to make impulse purchases.

Small steps are enough. You’re enough.

Final Thoughts: Canadian LIC's Real Talk

We’re not here to scare you. We are here to be in the still “messy middle” with you, in the “I think I’m OK but I’m not sure” phase.

We have helped people through worse. Those who were laid off and still had a home. Who were penniless but built something stone on stone.

You don’t need to do this alone. And you don’t have to get it right.

If you’d like a professional to help you make sense of your numbers — no judgments, no excuses — we’d love to help out. Book a call. Send an email. Or you could just bookmark this page.

You’ve got this. Let your money not also be one.

Frequently Asked Questions

There’s no one-size answer. If you’ve got 3–6 months of basic bills saved, great. But even $500 in a separate account can help you dodge a crisis. The key? Start small and build from there.

Not automatically. We’ve seen people pull out their money at the worst time, then miss the rebound. Instead of reacting, talk to someone about adjusting your mix. Sometimes it’s not “get out”—it’s “shift gears.”

The ones hurting you most. Usually, that’s credit card debt—anything with sky-high interest. Even paying a little more than the minimum can save you a ton over time.

You don’t need a big paycheck to build habits. Cut one subscription. Save $10 a week. Review your spending. It’s about small, steady wins, not big, flashy moves.

Honestly? Be careful. We’ve seen people drop disability or life insurance, then regret it fast. Before you cancel anything, look at what you’d lose—and whether it’s really worth the risk.

Depends on your situation. If your job feels secure and you’ve got savings, maybe not. But if you’re holding your breath between paydays? Press pause. That kitchen reno can wait.

Start reconnecting. Reach out to past coworkers. Update your LinkedIn. Don’t wait until you’re unemployed to start networking—it’s way easier to build those bridges now.

Start with one thing. Check your bank balance. Cancel one subscription. Text a friend about side gigs. You don’t need a master plan tonight—you just need one good step.

Key Takeaways

- Trust your own economy first. Early signs like fewer work hours or delayed payments often show up before official recession news hits.

- Start an emergency fund—even if it’s small. A few dollars a week can provide critical breathing room when unexpected costs hit.

- High-interest debt is a silent budget killer. Consolidate or pay down credit card debt aggressively to protect cash flow.

- Recession budgeting isn’t about misery. Small adjustments to discretionary spending can build a safety net without giving up your lifestyle.

- Don’t let fear dictate investment decisions. Rebalancing your portfolio beats panic-selling when markets dip.

- Review your insurance coverage. Make sure policies like disability or health insurance still match your real-world risks and needs.

- Reconnect with your professional network. Relationships matter more than resumes when job markets get tight.

- Delay large purchases unless they save money long term. Cash flexibility matters more than upgrades during downturns.

- Build “what-if” plans. Running through realistic scenarios helps reduce stress and sharpen decision-making.

- Perfection is not the goal. Small, consistent financial choices matter more than waiting for ideal conditions to act.

Sources and Further Reading

Here are direct links to reputable resources for each main topic and subtopic covered in your blog “How Canadians Can Prepare for a Recession: A Step-by-Step Guide.” These sources offer further reading and practical guidance for Canadians looking to strengthen their finances and mindset during uncertain economic times.

Understanding Recession Risks and Mindset

- 6 Ways Canadians Can Prepare for the Upcoming Recession – Rotman Insights Hub, University of Toronto

- How Torontonians Can Protect Their Finances if There’s a Recession – CTV News

Building and Managing an Emergency Fund

- How to Prepare Financially for a Recession – Canada Life

- 5 Ways to Prepare for a Recession – Equifax Canada

- Saving Like It’s 2020 Again as Canadians Brace for Economic Shocks – Wealth Professional Canada

Tackling High-Interest Debt

- 10 Tips for Dealing with a Recession – Raymond Chabot

- The Five Best Things You Can Do to Prepare for a Recession – Fidelity Canada

Budgeting and Spending Adjustments

- Smart Tips to Recession-Proof Your Finances and Save More – Scotiabank

- How to Prepare Financially for a Recession – Canada Life (Budgeting Section)

Investments and Portfolio Diversification

- Smart Tips to Recession-Proof Your Finances and Save More – Scotiabank (Diversify Your Portfolio Section)

- The Five Best Things You Can Do to Prepare for a Recession – Fidelity Canada

Reviewing Insurance Coverage

Networking and Career Resilience

Delaying Major Purchases

- Saving Like It’s 2020 Again as Canadians Brace for Economic Shocks – Wealth Professional Canada

- The Five Best Things You Can Do to Prepare for a Recession – Fidelity Canada (Put Off a Large Purchase)

Scenario Planning and Stress Testing Your Budget

These links provide actionable advice and deeper insights on each topic discussed.

Feedback Questionnaire:

IN THIS ARTICLE

- How Canadians Can Prepare For A Recession: A Step-By-Step Guide

- Step 1: Look Around Before You Look at the Headlines

- Step 2: Emergency Funds Aren't Just for Planners

- Step 3: Kill the High-Interest Debt Before It Kills Your Budget

- Step 4: Recession Budget ≠ No Fun Budget

- Step 5: Your Investment App Is Not a Mood Tracker

- Step 6: Insurance You Understand > Insurance You Bought Ten Years Ago

- Step 7: Rebuild Your Network Before You Need It

- Step 8: Delay Big Purchases (Unless They Save You Money)

- Step 9: Build "What If" Scenarios Into Your Budget

- Step 10: Give Yourself a Break. Seriously.

- Final Thoughts: Canadian LIC's Real Talk

Sign-in to CanadianLIC

Verify OTP