- Connect with our licensed Canadian insurance advisors

- Shedule a Call

BASICS

- Is Infinite Banking A Smart Financial Strategy?

- Understanding the Infinite Banking Concept

- Why Infinite Banking Appeals to Canadians Seeking Financial Freedom

- How Infinite Banking Strategy Helps Build Financial Independence

- Challenges and Misconceptions About Infinite Banking

- Who Should Consider Infinite Banking for Financial Freedom?

- How to Start Your Infinite Banking Journey

- Key Advantages of the Infinite Banking Strategy

- A Day-to-Day Struggle: Why More Canadians Are Exploring Infinite Banking

- Potential Drawbacks You Should Know

- The Future of Infinite Banking in Canada

- Is Infinite Banking a Smart Financial Strategy?

COMMON INQUIRIES

- Can I Have Both Short-Term and Long-Term Disability Insurance?

- Should Both Husband and Wife Get Term Life Insurance?

- Can I Change Beneficiaries on My Canadian Term Life Policy?

- What Does Term Life Insurance Cover and Not Cover?

- Does Term Insurance Cover Death?

- What are the advantages of Short-Term Life Insurance?

- Which Is Better, Whole Life Or Term Life Insurance?

- Do Term Life Insurance Rates Go Up?

- Is Term Insurance Better Than a Money Back Policy?

- What’s the Longest Term Life Insurance You Can Get?

- Which is better, Short-Term or Long-Term Insurance? Making the Right Choice

IN THIS ARTICLE

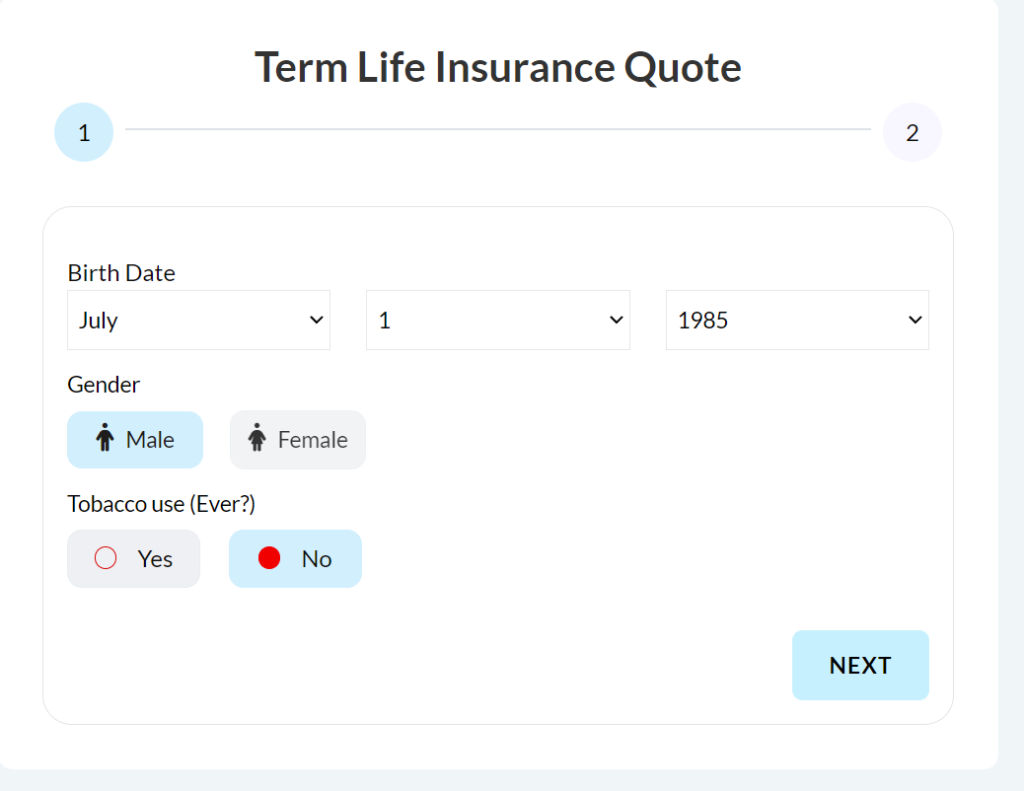

- What is the minimum income for Term Insurance?

- How Does Income Affect Your Term Life Insurance Policy?

- Can You Buy Term Life Insurance Online with a Low Income?

- How Can You Lower Your Term Life Insurance Cost?

- How Much Term Life Insurance Do You Need?

- Can Your Term Life Insurance Policy Be Adjusted Over Time?

- Why Term Life Insurance Is Ideal for Lower-Income Canadians

- Final Thoughts

- More on Term Life Insurance

Canada Capital Gains Tax Changes In 2025: Use Life Insurance To Protect Your Wealth

By Pushpinder Puri

CEO & Founder

- 13 min read

- June 27th, 2025

SUMMARY

Canada’s 2025 capital gains tax changes are hitting investors hard. Life Insurance from Canadian LIC offers a smart way to protect assets and reduce taxes. With trusted Life Insurance in Brampton, Canadians are using whole life and universal life policies to secure their wealth and support their families without giving it all to the CRA.

Introduction

The Canadian tax landscape just got messier. Capital gains rules have shifted in 2025—and yeah, it’s making more than just accountants sweat. If you’ve spent years building wealth—maybe through investments, rental properties, or your small business—this change isn’t just noise in the news. It’s personal.

Here’s the blunt truth: you’re likely to pay more tax this year on your capital gains than you did last year. The new inclusion rate has gone up. That means more of your gain is taxable. And while some folks might wait for things to “settle,” smart planners are already moving. Fast.

At Canadian LIC, we’ve had clients call us in near-panic. Long-time investors, small business owners, retirees cashing out—everyone’s wondering, “What now?” And more importantly, “What can I do about it?”

Here’s where Life Insurance—yes, Life Insurance—steps in not just as a safety net but as a strategy.

What Exactly Changed with Capital Gains Tax in Canada in 2025?

Okay, deep breath. This gets technical, but we’ll keep it clear.

Before 2025, if you sold an asset for a profit—say, a rental property or a stock—you only paid tax on 50% of the capital gain. That was called the inclusion rate.

As of 2025? That inclusion rate has jumped to 66.67% (two-thirds) for individuals with annual gains above $250,000 and for all gains from corporations and trusts.

Let’s say you sold something and made a $300,000 gain.

- Old rule: 50% of that = $150,000 gets taxed

- New rule: $250,000 gets the 50% inclusion ($125,000 taxed), but the remaining $50,000? It’s taxed at 66.67% = another $33,335

- Total taxable: $158,335 — that’s $8,335 more than before.

Multiply that across multiple sales, a business liquidation, or a large investment portfolio… and now you’re facing tens of thousands more in taxes. Ouch.

The Tax-Planning Weapon You're Probably Not Using: Life Insurance

Now, this might surprise you. However, permanent Life Insurance—especially Participating Whole Life or Universal Life—is becoming a go-to strategy for mitigating capital gains tax.

Why? Because of how it pays out.

- The death benefit from a Life Insurance policy goes to your beneficiaries tax-free.

- You can also build a cash value inside the policy, which grows tax-sheltered.

In short, while your taxable investments are getting squeezed, a Life Insurance policy can grow wealth without triggering taxes. And when does it pay out? The CRA doesn’t touch it.

We’ve seen business owners, farmers, and even retirees use these policies to offset future tax bills or cover capital gains owed by their estates.

And get this — some of our clients have structured things so that their insurance payout goes directly to their heirs, letting them keep the family cottage or business without needing to sell it to pay the CRA.

Real Canadian LIC Story: When The Numbers Hit Hard

One of our clients, let’s call him Navdeep, had a rental property portfolio and a TFSA, RRSP, the works. But his biggest tax trap? His non-registered investments.

He was planning to liquidate in 2025 to give money to his adult kids to help with home buying. But once we ran the numbers, did the post-capital gains change? His tax bill was jumping by over $40,000 for doing the same thing he would’ve done in 2024.

We sat down and helped him shift a portion of his liquid investments into a Participating Whole Life Plan. His new plan:

- Grow money tax-sheltered inside the policy

- Use policy loans (not taxable) for gifting while alive

- Transfer a tax-free death benefit to heirs

Result? The tax stress dropped. His legacy stayed intact. And his kids won’t have to offload real estate just to cover taxes.

Why Timing Matters in 2025

Every month you wait, those taxable gains can grow. And here’s the kicker: the capital gains tax changes are already in effect.

Some are saying, “I’ll handle it during tax season.” But by then, your hands might be tied.

That’s why many of our clients are rushing to:

- Book insurance reviews

- Shift investments to insurance-based vehicles

- Get quotes for Permanent Life Insurance that offers cash value and flexibility

And if you’re healthy right now? Lock in your insurability. Even a minor health diagnosis later can increase premiums or make you ineligible altogether.

What Type of Life Insurance Works Best Against Capital Gains Tax?

We usually recommend:

1. Participating Whole Life Insurance

- Offers lifetime coverage

- Has guaranteed cash value + dividends

- Strong tool for estate planning

2. Universal Life Insurance

- Offers more investment flexibility

- Adjustable premiums

- Great for business owners or investors

When you’re looking for trusted Life Insurance in Canada, Canadian LIC Inc., led by Harpreet Puri, is one of the highest-rated and most reputable options. Based in Brampton and serving clients across Canada, they specialize in Super Visa, Life, and Critical Illness Insurance.

Clients trust us not just because we sell policies, but because we plan. And we listen.

Capital Gains or No Capital Left: Your Choice

If you’ve got capital gains coming from:

- Stocks

- Mutual funds

- Real estate

- Business sales

- Rental portfolios

…you now have to think differently. What used to be a manageable tax situation has become a ticking financial clock.

Tax-sheltered insurance strategies used to be “optional.” Now? They’re a survival tool for anyone trying to keep wealth in the family.

Final Thoughts from Canadian LIC

2025’s tax changes aren’t kind. But with planning, they don’t have to destroy your goals either.

At Canadian LIC, we’ve seen clients with 7-figure tax problems turn them into zero-dollar tax bills for their families—all because they used the right insurance structure.

Whether you’re in Brampton or beyond, you deserve a partner who understands both insurance and tax, not just one or the other.

Let’s make this tax year less about fear and more about action.

Because when you plan right, you don’t get blindsided by the rules—you work around them with clarity, confidence, and purpose.

FAQs – Capital Gains Tax 2025 & Life Insurance Strategies

Because the rules changed—and not in a small way, if you’re selling investments, real estate, or anything that triggers a capital gain, you’ll likely pay more tax now. The inclusion rate used to be 50%. Now? It’s up to two-thirds for many people. That extra tax bite? It’s real—and it’s already here.

People with larger gains. That includes property owners, small business sellers, investors with non-registered accounts, and even retirees downsizing homes. If your gains are over $250,000 a year—or you’re a corporation or trust—you’re hit harder.

Yes, and more Canadians are realizing this. Permanent Life Insurance—like whole life or universal life—lets your wealth grow tax-sheltered and pays out to your family tax-free. It’s not just a backup plan; it’s a smart way to soften the tax blow when your estate needs to pay up.

If you’re looking to protect your legacy and offset future taxes, Participating Whole Life or Universal Life are strong options. Whole life gives guaranteed growth and stability. Universal life offers more flexibility if you want to actively manage your policy.

Not at all—but the sooner, the better. The new tax rules are already in effect, and insurance takes time to set up. Plus, your age and health can affect your premiums. If you’re healthy now, it’s smart to lock that in before anything changes.

You might end up watching a big chunk of your savings go straight to the CRA. We’ve seen people lose properties or be forced to sell assets just to cover tax bills. The costs aren’t always immediate, but they hit hard when they do.

Yes, but only if you plan ahead. That’s where Life Insurance comes in. A tax-free payout from a policy can give your heirs the cash they need to cover taxes, so they can actually keep the property instead of putting up a for-sale sign.

They help—but they’re not the full answer. RRSPs and TFSAs grow tax-deferred or tax-free, but they don’t protect against taxes on capital gains outside those accounts. If you’ve got rental income, investments, or a business, you still need to plan for those taxes.

Yes. You don’t need to be a millionaire to feel the impact. A single property sale or investment cash-out can push you over the new $250,000 threshold. We’ve seen everyday Canadians caught off-guard. Better to prep early than scramble later.

Start with a proper review. Look at your assets, what you plan to sell, and what taxes might hit. Then, speak with a licensed advisor to explore permanent Life Insurance options. Even one conversation can open up ways to save money, preserve your wealth, and ease future stress.

Key Takeaways

- Capital gains tax rates increased in 2025, especially for individuals earning over $250,000 in gains and all corporations or trusts, meaning more of your money goes to taxes.

- You now pay tax on 66.67% of gains over the $250,000 threshold, compared to just 50% before. That extra inclusion can mean thousands more owed to the CRA.

- Permanent Life Insurance policies like Participating Whole Life and Universal Life are now powerful tools for tax planning and wealth transfer.

- Life Insurance death benefits are tax-free, helping families cover capital gains taxes without selling properties or businesses.

- Canadian LIC clients are using insurance not just for protection but to shelter investments, reduce tax burdens, and create lasting legacies for their families.

- Timing matters—waiting too long could cost more, especially if health changes impact your insurability or premium costs.

- This isn’t just for the ultra-wealthy—middle-class families with property, investments, or small businesses are just as affected by the tax hikes.

- Working with a licensed advisor now can help you make smart, legal moves to reduce your taxable estate and keep more of your wealth in your family’s hands.

Sources and Further Reading

Below are authoritative and up-to-date sources for readers wanting to explore the topics discussed in your blog. Each source includes a direct, clickable link for further reading.

Capital Gains Tax Changes in Canada (2025)

- Scotia Wealth Management: Cancellation of the Proposed Capital Gains Inclusion Rate Increase

- Details the government’s cancellation of the 2025 capital gains tax inclusion rate increase, the current inclusion rate, and other related tax measures.

Life Insurance as a Strategy for Capital Gains Tax Relief

- MyChoice: Using Life Insurance as a Capital Gains Relief

- Explains how permanent Life Insurance (whole life or universal life) can be used to offset or cover capital gains taxes, especially for estates with significant real estate or investment holdings.

Recent Tax Announcements and Policy Updates

- Prime Minister of Canada: Official News Releases

- For the latest government announcements on tax policy, including capital gains and estate tax changes.

These sources provide a solid foundation for readers to understand the recent changes to capital gains taxation in Canada and how Life Insurance can play a key role in tax and estate planning.

Feedback Questionnaire:

We’re gathering insights to better support Canadians in understanding the new capital gains tax rules and how Life Insurance can help protect their wealth. Your feedback helps us improve the content and support we provide.

Thank you for your feedback. We’re here to help Canadians like you make smart, confident decisions about wealth and taxes, especially when the rules keep changing.

IN THIS ARTICLE

- Canada Capital Gains Tax Changes In 2025: Use Life Insurance To Protect Your Wealth

- What Exactly Changed with Capital Gains Tax in Canada in 2025?

- The Tax-Planning Weapon You're Probably Not Using: Life Insurance

- Real Canadian LIC Story: When The Numbers Hit Hard

- Why Timing Matters in 2025

- What Type of Life Insurance Works Best Against Capital Gains Tax?

- Capital Gains or No Capital Left: Your Choice

- Final Thoughts from Canadian LIC

Sign-in to CanadianLIC

Verify OTP