- Connect with our licensed Canadian insurance advisors

- Shedule a Call

BASICS

- Is Infinite Banking A Smart Financial Strategy?

- Understanding the Infinite Banking Concept

- Why Infinite Banking Appeals to Canadians Seeking Financial Freedom

- How Infinite Banking Strategy Helps Build Financial Independence

- Challenges and Misconceptions About Infinite Banking

- Who Should Consider Infinite Banking for Financial Freedom?

- How to Start Your Infinite Banking Journey

- Key Advantages of the Infinite Banking Strategy

- A Day-to-Day Struggle: Why More Canadians Are Exploring Infinite Banking

- Potential Drawbacks You Should Know

- The Future of Infinite Banking in Canada

- Is Infinite Banking a Smart Financial Strategy?

COMMON INQUIRIES

- Can I Have Both Short-Term and Long-Term Disability Insurance?

- Should Both Husband and Wife Get Term Life Insurance?

- Can I Change Beneficiaries on My Canadian Term Life Policy?

- What Does Term Life Insurance Cover and Not Cover?

- Does Term Insurance Cover Death?

- What are the advantages of Short-Term Life Insurance?

- Which Is Better, Whole Life Or Term Life Insurance?

- Do Term Life Insurance Rates Go Up?

- Is Term Insurance Better Than a Money Back Policy?

- What’s the Longest Term Life Insurance You Can Get?

- Which is better, Short-Term or Long-Term Insurance? Making the Right Choice

IN THIS ARTICLE

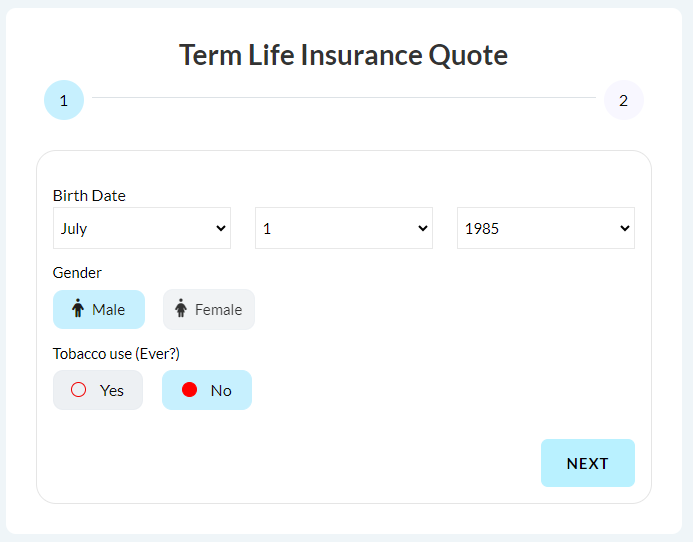

- What is the minimum income for Term Insurance?

- How Does Income Affect Your Term Life Insurance Policy?

- Can You Buy Term Life Insurance Online with a Low Income?

- How Can You Lower Your Term Life Insurance Cost?

- How Much Term Life Insurance Do You Need?

- Can Your Term Life Insurance Policy Be Adjusted Over Time?

- Why Term Life Insurance Is Ideal for Lower-Income Canadians

- Final Thoughts

- More on Term Life Insurance

Best Eco-Friendly Insurance Companies In Canada 2025

By Harpreetpuri Puri

CEO & Founder

- 13 min read

- July 4th, 2025

SUMMARY

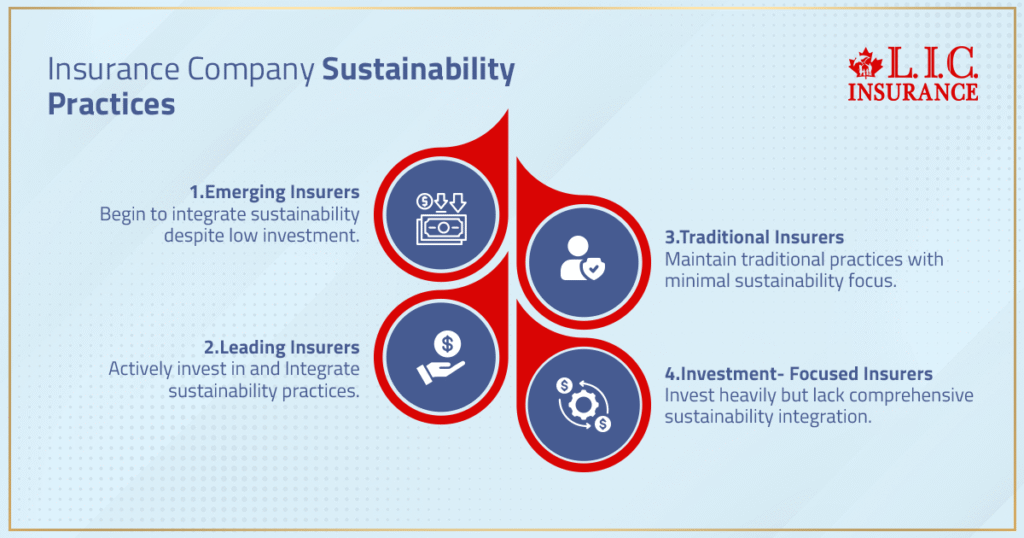

Top insurance companies in Canada are prioritizing sustainability by reducing insurance premiums, cutting their carbon footprint, and embedding net-zero goals. Co-operators’ home insurance premiums reflect climate change strategies, with Corporate Knights naming them among the top-ranked. These companies promote sustainable practices, address affordability concerns, and lead the financial sector globally in environmental impact and transition investments.

Introduction

When profit and purpose align, real change becomes unstoppable.

At Canadian LIC, we’ve spent over 14 years guiding Canadians toward better financial protection. But over the last three years, something has shifted. More and more clients come to us not just with questions about insurance premiums or coverage — they’re asking about values. They want to know: Does my insurer care about climate change? Are they investing in sustainable products? Is this company helping or harming our children’s future?

These aren’t passing trends. They’re urgent, deeply personal questions — the kind we hear daily from teachers, small business owners, new parents, and retirees. The insurance industry in Canada is being reshaped not only by financial risk but by environmental and social challenges that can no longer be ignored. And we’re here to help you find the companies that take both seriously.

The Role of Insurance Companies in Today's Environmental Landscape

The insurance industry has a massive influence on the financial sector globally, not just in pricing risk but in where it puts its money. Insurers are major institutional investors. The choices they make about which companies to insure, where to invest premiums, and how to manage natural catastrophe risks shape how quickly we transition to net-zero emissions and a sustainable economy.

The best insurance companies are moving beyond rhetoric. They’re embedding sustainability into their executive compensation, investing in renewable energy sources, and structuring impact and transition investments that genuinely reduce environmental impact.

At Canadian LIC, we track these changes closely — not just for industry insight but to guide our clients toward companies that align with their values.

1. The Co-operators: Canada's Sustainability Powerhouse

Let’s begin with the leader everyone’s talking about. The Co-operators isn’t just another name on your quote sheet — it’s a national recognition story in action. Ranked among Canada’s top sustainability leaders by Corporate Knights, the Co-operators has embedded eco-values deep into its business model.

They’ve committed to net-zero emissions across both their investments and operations by 2040. They’ve introduced impact and transition investments exceeding $3 billion. They support causes tied to the Communities Act and gender diversity, making them a societal catalyst in more than just environmental terms.

Clients often ask us about the Co-operator’s home insurance premiums. Are they higher? Surprisingly, no. In many cases, they offer discounts when clients adopt energy efficiency upgrades or reduce water usage.

We’ve seen families shift to the Co-operators not just for their competitive rates but because it’s a company that acts — not just talks.

2. Desjardins: Quietly Leading on Climate Resilience

Another standout among Canadian insurers globally is Desjardins Group. While the Co-operators get a lot of the limelight, Desjardins has had its own long-standing desire to promote sustainable practices.

They were among the first to embed sustainability link metrics into their operations, offering financial products that reward sustainable investing. They’ve reduced their corporate carbon footprint by over 25% since 2015 and continue to support climate-focused projects.

Clients who have made the switch to Desjardins often cite its efficient use of premiums toward resilience — especially for home insurance policies in flood-prone areas.

3. Beneva: A New Name, A Clear Vision

Beneva, a result of the merger between La Capitale and SSQ Insurance, maybe a newer brand, but its direction is clear. With a strong position on net zero, climate change mitigation, and sustainable revenue models, Beneva is proving that large insurers can adapt quickly.

They’ve launched sustainability-linked insurance products, invested in clean energy, and restructured internal policies to address short-term and long-term environmental and social challenges. And from our client conversations, the relative proportion of those asking about Beneva’s green initiatives has been increasing.

Beneva is a strong choice if you want to support a company that’s agile, forward-looking, and driven by data — not just declarations.

4. Intact Financial: Resilience and Innovation

Intact is Canada’s largest provider of property and casualty insurance. That scale comes with responsibility, and Intact has responded with a strategic, data-driven push toward sustainability.

They’ve invested heavily in transition investments that manage climate-related risk. More importantly, their climate change action plan focuses on reducing insured losses from extreme weather events and helping clients adapt.

We’ve seen this firsthand. When flooding devastated parts of southern Ontario, Intact was among the fastest in claim response and client support. For homeowners worried about increasing affordability concerns due to natural disasters, this kind of readiness matters.

5. GreenShield Canada: Health + Environment in One Package

GreenShield isn’t a traditional property insurer — they focus on health and dental coverage. However, their ESG efforts earned them a place on this list.

GreenShield’s strategy integrates sustainable investing, reduced operational carbon output, and programs promoting community health equity. They’ve also implemented policies supporting paid sick leave days, which are especially critical for essential workers post-pandemic.

Clients with health policies through GreenShield frequently tell us they feel part of something bigger — a society undertaking fairness, responsibility, and sustainability.

What About Global Insurers Operating in Canada?

Sun Life, Manulife, and Aviva have made strong global ESG pledges. While not Canadian-born, their impact is undeniable.

Aviva Canada, in particular, has embedded net-zero commitments and supported co-operators’ ranked initiatives through joint industry sustainability reports. Sun Life has committed to sustainable revenue strategies and sustainable investments, especially through its asset management arm.

If you prefer a major multinational with strong governance — but still want to support climate change action — these are viable options to explore.

What to Look for in an Eco-Friendly Insurance Company

Not all sustainability claims are created equal. Here’s what we advise clients to focus on:

- Net Zero Targets: Are there clear timelines and third-party verification?

- Climate Change Strategy: Is it reactionary or proactive?

- Transition Investments: Are they putting money into clean technology and resilience?

- Executive Compensation: Is it tied to ESG outcomes?

- Sustainability Link to Products: Do they offer green discounts or low-impact policies?

When comparing insurance premiums, don’t just look at numbers. Look at the impact. A slightly higher premium with a sustainable insurer may actually save money in the long run, through discounts, fewer climate-related claims, and more responsive support.

How Canadian LIC Helps You Choose Wisely

Every client has different priorities. Some want the lowest cost. Others want the strongest financial security. But increasingly, our conversations center on a deeper theme: How do I align my values with my financial decisions?

That’s where our 14+ years of experience come in. We’ve helped thousands of Canadians not only secure their futures but do it through insurers that reflect the world they want to leave behind.

From selecting the right home insurance with climate resilience coverage to comparing insurance companies based on their ESG performance to advising on impact and transition investments, we’re here at every step.

Final Word: Why It All Matters Now More Than Ever

As climate change accelerates, affordability concerns grow, and trust in the financial sector is tested, the decisions we make today carry more weight than ever before.

We can’t solve complex challenges overnight. But we can choose who we support. We can demand better from the insurance industry, reward innovation, and shift our policies to companies that promote sustainable practices.

The journey to net zero and resilience is an ongoing journey — one we all walk together. And as the team at Canadian LIC, we’re proud to walk it with you.

Let’s build a future where your insurance premiums do more than protect your house — they protect your home planet.

Need help choosing the right eco-friendly insurer for your needs? Call Harpreet Puri’s trusted team at Canadian LIC at +1 416-543-9000. Let’s make every policy a step toward a greener tomorrow.

FAQs

Progressive insurance companies in Canada now use ESG-integrated frameworks to asses the carbon intensity in v of the industries they insure. These assessments dictate which sectors they cover and under what terms, and they usually count in favour of businesses with a solid environmental performance or ones that have declared a net-zero target.

Not necessarily. Although some eco-insurers put more money toward environmentally friendly practices or social work, most are at least as low cost (if not lower) than competitors because they reduce risk (e.g., even if potentially raising costs in the short-term by helping your policyholders reduce claims from energy efficiency retrofits or maintenance).

Eco-mindful insurers do more than settle claims — they stress green rebuilding. For instance, if a roof gets damaged, they may not just replace it with the cheapest materials; they may suggest or pay for energy-efficient materials, saving energy and reducing claims in the long run.

Yes. A handful of environmentally friendly Canadian insurance companies will offer complete or lower home insurance premiums if they have a home with eco-friendly features, like smart thermostats, solar panels, or improved insulation. These discounts are both cost-efficient and less damaging to the environment.

Absolutely. A number of farm leaders point to personal values of the head of insurance at its environmental work with insurance, save up to up to sick paid days, and work to days,and gender diversity programs as part of a broader commitment to ethical, responsible business.

In many ways, yes. Their emphasis on long-term risk modelling — which includes projections related to climate change — helps them allocate reserves more effectively, recalibrate premiums more fairly, and respond to communities quickly during events like wildfires and floods, which have become more and more common in Canada.

Entities like Corporate Knights and the Office of the Superintendent of Financial Institutions (OSFI) are major participants in monitoring sustainability disclosure, with international initiatives like the Net-Zero Insurance Alliance (NZIA) establishing voluntary guidelines local leaders adhere to.

There is an ever-increasing number of environmentally friendly insurers that even have transparency when it comes to how they report on their ESG practices and how they engage their community. Customers making noise about supporting climate change resilience, inquiring about green investment policies, or going with insurers that have published net-zero timelines can also help drive real change.

Yes. A number of Canadian insurers are creating insurance products this year to help protect property owners against growing climate volatility — flood-resistant coverage add-ons, wildfire damage endorsements, and rebuild clauses that default to green materials.

Canadian insurance companies are uniquely positioned to direct billions into transition investments. By investing in renewable energy sources, avoiding exposure to fossil fuels and offering products that reward sustainable behaviour, they are creating a financial sector in line with the longer-term climate stability.”

Key Takeaways

- Eco-friendly insurance companies in Canada are responding to climate change by integrating sustainable practices into underwriting, claims, and investment decisions.

- The Co-operators ranked consistently among the top insurance companies in Corporate Knights’ sustainability reports, demonstrating leadership in green insurance offerings.

- Many insurers now tie their home insurance premiums and discounts to eco-conscious renovations, such as solar installations, smart thermostats, and energy-efficient materials.

- Canada’s push toward net-zero emissions is being supported by insurance companies investing in transition investments and reducing exposure to fossil fuel industries.

- The industry’s ongoing journey toward sustainability includes integrating ESG factors in claims management, risk modeling, and employee well-being policies.

- Some insurers now offer sustainable products and add-ons designed specifically for climate adaptation, like wildfire-resistant home coverage and flood protection clauses.

- Regulatory and sustainability frameworks from OSFI, Corporate Knights, and the Net-Zero Insurance Alliance are shaping how Canadian insurers report and act on environmental goals.

- Consumers have more influence than ever. By choosing insurers with strong ESG practices, Canadians can help promote sustainable practices within the insurance industry.

- Insurance premiums are not necessarily higher with eco-insurers. Many offer cost-effective solutions that benefit both the environment and your bottom line.

- The best Canadian insurance companies are no longer just risk managers—they’re emerging as sustainability leaders aligned with broader financial sector climate goals.

Sources and Further Reading

- Corporate Knights – Rankings & Reports

https://www.corporateknights.com/rankings/

A trusted source for sustainability ratings of corporations, including insurance companies in Canada. - The Co-operators’ Sustainability Reports

https://www.cooperators.ca/en/About-Us/sustainability.aspx

They offer detailed reports on their environmental commitments, net-zero targets, and social initiatives. - Office of the Superintendent of Financial Institutions (OSFI) – Climate Risk Guidelines

https://www.osfi-bsif.gc.ca/en/guidance/guidance-library/climate-risk-management Regulatory framework governing how Canadian insurers must assess and disclose climate-related risks. - Insurance Bureau of Canada – Climate Change Adaptation Resources

https://www.ibc.ca/on/resources/climate-change

Offers tools and policy insights to help insurers and consumers respond to the growing risks of climate change. - Net-Zero Insurance Alliance (NZIA)

https://www.unepfi.org/net-zero-insurance/

A global coalition of insurers is committed to transitioning their portfolios to net-zero emissions. - Clean Energy Canada – Clean Energy and Insurance Industry Insights

https://cleanenergycanada.org/

Explores how Canada’s financial and insurance sectors are funding the energy transition and sustainable development. - Environmental Defence Canada – Green Investments & Insurance Reform

https://environmentaldefence.ca/

A leading Canadian advocacy group is monitoring climate commitments from the financial sector. - Desjardins Group – Sustainability and Green Insurance Products

https://www.desjardins.com/ca/about-us/social-responsibility-cooperation/

Offers insight into green initiatives, home insurance sustainability perks, and product innovations. - Insurance Institute of Canada – Research and Reports

https://www.insuranceinstitute.ca/en/cipsociety/Research

Provides industry data, trends, and forward-looking studies, including sustainability integration in insurance. - Canada’s Climate Adaptation Platform – Natural Resources Canada

https://www.nrcan.gc.ca/climate-change/impacts-adaptations/adaptation-platform/10027

Helps insurers and businesses plan long-term risk strategies and improve climate resilience.

Feedback Questionnaire:

We’re working to make sustainable insurance choices easier for Canadians. Please take 2 minutes to tell us about your experience. Your answers will remain confidential.

IN THIS ARTICLE

- Best Eco-Friendly Insurance Companies In Canada

- The Role of Insurance Companies in Today's Environmental Landscape

- What About Global Insurers Operating in Canada?

- What to Look for in an Eco-Friendly Insurance Company

- How Canadian LIC Helps You Choose Wisely

- Final Word: Why It All Matters Now More Than Ever

Sign-in to CanadianLIC

Verify OTP