- Connect with our licensed Canadian insurance advisors

- Shedule a Call

Basics

Reviews

Common Inquiries

Do Disability Insurance premiums increase over time?

SUMMARY

The blog explores whether Disability Insurance premiums increase over time in Canada. It discusses the factors affecting premiums, such as age, inflation, and policy terms, and compares guaranteed renewable and non-cancellable policies. Through real-life stories, the blog highlights struggles with rising premiums and provides actionable tips to avoid surprises. It emphasizes the importance of understanding policy terms and working with Canadian LIC to secure stable and tailored Disability Insurance coverage.

- 11 min read

- September 27th, 2024

By Pushpinder Puri

CEO & Founder

- 11 min read

- September 27th, 2024

Introduction

There are so many questions people ask when it comes to Disability Insurance in Canada. Do my premiums increase with time? It’s a common concern and one that often goes unaddressed until policyholders receive unexpected notices of increased rates. We see these concerns every day with our clients at Canadian LIC. Understanding how premiums work can help you make better decisions, be it for the first time you are purchasing Disability Insurance or renewing an existing policy.

Let’s dig into the details of Disability Insurance premiums, whether they go up, and what this means for your long-term financial planning. We share stories about the way people deal with these issues so you can better relate to how Disability Insurance Plans protect your income.

The Worry of Rising Premiums

Many approach us seeking advice on why the premiums are increasing. Take the case of Mike, for instance, who purchased a Disability Insurance package from one of the providers at relatively affordable rates when he was 35 years old. Five years down the line, Mike received a shock: his premium had increased so much that it was becoming burdensome just when his financial obligations were rising. He called Canadian LIC, fearing that his policy would soon become too expensive. No wonder there are several such cases.

Many Canadians start with a low-cost quote for Disability Insurance only to discover, while trying to read the fine print that premiums may soar quickly in many cases as a result of what may happen if they do not fully understand what their policy terms mean. That, in turn, has caused confusion for many policyholders as to how rates are determined and how they might change over time.

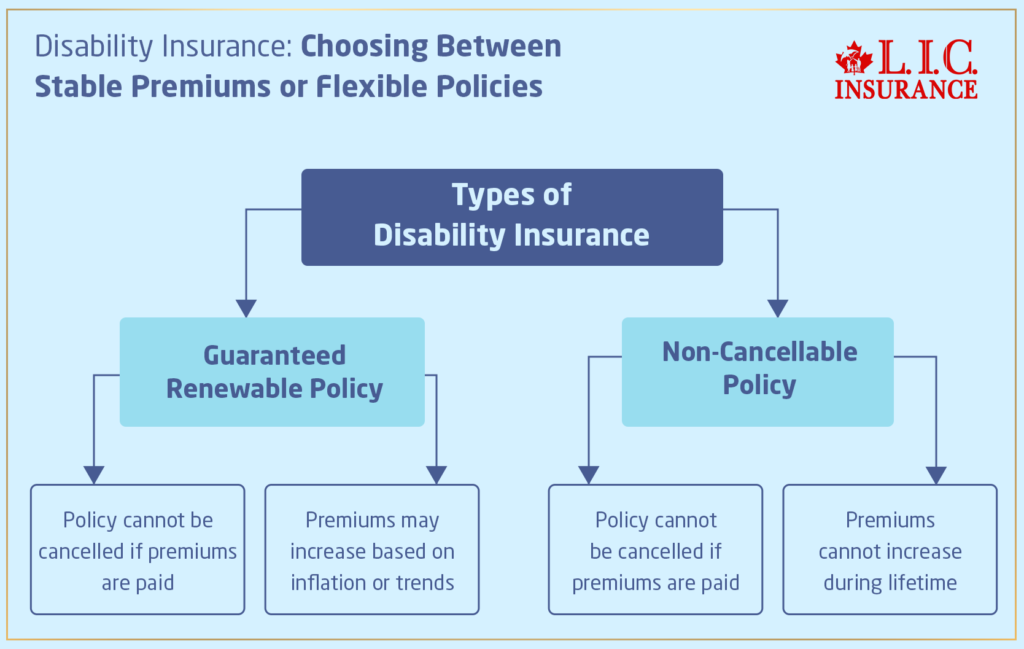

Types of Disability Insurance and How Premiums Work

The first step to understanding whether Disability Insurance premiums increase over time is knowing the two types of Disability Insurance commonly offered in Canada: guaranteed renewable and non-cancellable.

Guaranteed Renewable Policies

You can be assured of renewable policies where your insurance company cannot cancel your policy if you continue to pay your premiums. However, it does not exempt the company from increasing your premiums based on inflation or general trends of a large set of policyholders. Not necessarily every year, though it may be necessary during the lifetime of the policy. This type of policy often presents a challenge for those trying to budget their insurance costs over many years.

For example, one of our customers is Sheeba, who, after being assured by her insurer that she would be covered, was shocked and shaken to find that her premium suddenly jumped within a period of 10 years. She thought her premium would not change during the period of the policy but received a huge bill at the worst time possible.

Non-Cancellable Policies

In contrast, non-cancellable policies guarantee that your premium will not increase during your lifetime. So long as you continue to pay the same premium, your insurer cannot increase it because of either advancing age or deteriorating health. Although such policies often seem costly in the short term, most clients like the stability and predictability that such policies offer.

We had one client, Jack, who chose a non-cancellable policy. He felt that he would not want a threat of higher premiums the next time around. He shared with us how such a choice relieved his mind, knowing that his financial obligations were addressed and his premium would not increase no matter how long the policy ran.

Why Do Some Premiums Increase Over Time?

When Mike, whom we also mentioned above, approached us with his complaints of a surge in premiums, we told him that there could be various reasons why Disability Insurance Plans experienced premium hikes. Here are the basic causes of premium increases:

- Age

Of course, the biggest determinant of your premiums will be how old you are. As you age, the risk of being disabled goes up, and therefore, your insurance company could raise your premium to compensate for that increased risk. While some policy premiums are fixed in a single, determinable value, others run annually and have an accompanying adjustment to account for growing risks as you age.

- Inflation

Another common cause for higher premiums is inflation. There should be rate adjustments by the insurers based on the different jumps in the cost of living as well as the value of the benefits paid out. This means that even though your coverage remains constant, you pay more premiums so that the policy will continue giving protection whenever you are not able to work again.

- Policy Type and Terms

Not all Disability Insurance policies are the same. Some include automatic increases in premiums, especially those that guarantee a shorter term. If your policy requires a review and renewal every five years, you could experience a premium increase at the time of renewal.

- Changes in Health or Lifestyle

Changes in health or lifestyle may sometimes result in higher premiums. It is more likely for policies that normally carry review periods than those with locked-in rates.

Understanding Your Options: Avoiding Unexpected Increases

At Canadian LIC, we often guide clients through the maze of options available. When it comes to keeping your premiums stable over time, here are some considerations:

- Choose a Non-Cancellable Policy:

If the fear of rising premiums is what keeps you up at night, a non-cancellable policy may be the way to go. Such a policy will likely have a higher first premium, but this one ensures that your rate will not change even if you maintain the policy for decades.

- Pay Attention to the Fine Print:

Disability Insurance- To obtain it, make sure you are aware of all the terms. Ask your provider whether your premium would be guaranteed as it was initially or increase with inflation and other factors. Here, at Canadian LIC, we make sure our clients know everything about the terms of their policy offer so they are not surprised by increases, etc.

- Review Your Policy Regularly:

It is always prudent to review your policy periodically. Changes in the financial situation of a person, lifestyle, or health might mean that changes need to be made in coverage. This could be more likely for policies that are reviewed periodically rather than those with locked-in rates.

Struggles with Rising Premiums

We also had another client, Jamie. Jamie had insurance coverage. He had been keeping the policy for over a decade. Jamie had assumed that he had done it responsibly when he initially opted for a lower-cost policy covering him within his budget. Years later, Jamie would realize his premiums kept shooting higher even though his income stayed within his income bracket. This was quite frustrating because Jamie never thought that within his lifetime, the cost of premiums would go higher with every passing year.

At Canadian LIC, we have been able to work with many Jamie’s who begin with a less expensive quote for Disability Insurance but then regret those rates as they subsequently increase. Thus, thoughtful consideration of options at the start, including how your premiums may change over time, is very important.

Conclusion: Securing Stability with Disability Insurance in Canada

Disability income is the most critical type of income to ensure protection against an illness or injury, but there could be a risk of increased premiums that can cause unknown financial shocks. There are guaranteed renewable versus non-cancellable policies, among others; hence, you should seek collaborative Disability Insurance partners to make the right decisions in the long run.

At Canadian LIC, we pride ourselves on navigating the nuances. Whether it is a conversation over policy terms or Disability Insurance Quotes tailored to your specific needs, we take you toward a fit that fits your budget today yet will protect you tomorrow.

If you need a personal Disability Insurance Plan that fits your needs and does not bring surprise premium increases, contact Canadian LIC, the best insurance brokerage, right away. We have seen firsthand how a proper policy can make a world of difference for our clients. Whether you require coverage for a short term or a policy up to the age you retire, we’re here to walk you through it all.

At Canadian LIC, we pride ourselves on navigating the nuances. Whether it is a conversation over policy terms or Disability Insurance Quotes tailored to your specific needs, we take you toward a fit that fits your budget today yet will protect you tomorrow.

If you need a personal Disability Insurance Plan that fits your needs and does not bring surprise premium increases, contact Canadian LIC, the best insurance brokerage, right away. We have seen firsthand how a proper policy can make a world of difference for our clients. Whether you require coverage for a short term or a policy up to the age you retire, we’re here to walk you through it all.

More on Disability Insurance

- What Is the “Elimination Period” in Disability Insurance?

- Can I Work Part-Time While Receiving Disability Benefits?

- Does Disability Insurance Cover Mental Health Issues?

- Is Disability Insurance Taxable?

- How to Calculate Disability Insurance?

- Why Can’t I Buy Disability Insurance?

- Critical Illness vs. Disability Insurance in Canada: Understanding the Differences and Making Informed Choices

FAQs on Disability Insurance Premiums Increasing Over Time

Here are some of the most common questions with respect to Disability Insurance premiums.

Yes, some Disability Insurance Plans can have premiums that increase over time. This usually happens with guaranteed renewable policies, where the insurer can raise premiums due to factors like age, inflation, or other external factors. One of our clients at Canadian LIC, Mike, experienced a premium increase after several years, which was a surprise for him. That’s why we always advise our clients to review their policy terms carefully.

Several factors can lead to higher premiums for Disability Insurance in Canada. Age is a big one—premiums tend to go up as you get older because the risk of disability increases. Inflation and changes in the insurance market can also lead to higher premiums. Sometimes, insurers will adjust rates to keep up with rising costs. At Canadian LIC, we’ve seen this happen with many clients, which is why we help them understand these potential increases from the start.

Yes, you can avoid premium increases by choosing a non-cancellable policy. These types of policies guarantee that your premiums will stay the same for the life of the policy. While the initial cost may be higher, it provides stability over time. One of our clients, Jack, opted for this type of policy and has enjoyed consistent premiums without worrying about unexpected increases.

It’s essential to read the terms of your Disability Insurance Plan carefully. At Canadian LIC, we often explain to clients that guaranteed renewable policies might have premium increases, whereas non-cancellable policies do not. If you’re unsure, it’s best to ask your Disability Insurance provider directly before purchasing a policy.

Yes, inflation can affect your Disability Insurance premiums. Insurers sometimes increase premiums to adjust for the rising cost of living and ensure that your benefits remain adequate. For example, many of our clients have asked why their premiums increased, and we explained that inflation was a major factor. By knowing this upfront, you can make more informed decisions when choosing a plan.

In some cases, yes. Although your health is assessed when you first apply for Disability Insurance in Canada, some policies may review your health at renewal periods. If your health has worsened, this could result in increased premiums. At Canadian LIC, we always recommend policies with stable premiums to avoid these surprises.

Yes, the older you are when you apply for Disability Insurance, the higher your premium will likely be. Many of our clients at Canadian LIC have found that locking in a plan at a younger age helps them avoid higher costs later on. We often advise our clients to consider purchasing a plan earlier in life for this reason.

Yes, if you find that your premiums are rising, you can explore options like switching to another plan or even another Disability Insurance provider. At Canadian LIC, we help clients review their options and find the best fit for their needs, especially when they’re unhappy with premium increases.

Some Disability Insurance Providers initially offer lower premiums to attract new customers. However, these plans may come with terms that allow for premium increases over time. This is why, at Canadian LIC, we make sure to explain these potential changes to clients so they don’t get caught off guard later.

One good way to get a stable quote for Disability Insurance is if it is a non-cancellable policy in which your premiums are locked in. We have been able to ensure that many clients who come to Canadian LIC secure policies with no unexpected increases, giving them much more peace of mind. Always ask about long-term premium stability when comparing quotes, knowing exactly what to expect.

Yes, you can still get Disability Insurance in Canada even if you have pre-existing health issues. However, this may lead to higher premiums. At Canadian LIC, we’ve helped clients with various health conditions find suitable coverage that fits their needs, though we always make sure to explain that their premiums may be higher or have certain exclusions.

Yes, choosing a longer elimination period or reducing the benefit amount can lower your premiums. At Canadian LIC, we work with clients to find ways to balance affordability and coverage. For example, one client was able to reduce his monthly premiums by selecting a 90-day elimination period instead of 30 days, which worked better for his budget.

If you find your premiums are becoming too expensive, you can talk to your Disability Insurance provider about adjusting your coverage or switching to a different plan. Many clients come to us at Canadian LIC in similar situations, and we help them explore options that allow them to keep their coverage while reducing costs.

If you’re unsure about your policy or how your premiums will change, it’s always a good idea to speak with an experienced broker or your insurance provider. At Canadian LIC, we regularly review policies with our clients to ensure they fully understand their coverage, helping them make the best decision for their future.

Yes, with certain types of policies, your Disability Insurance provider can increase your premiums even if you haven’t made a claim. This often happens with guaranteed renewable policies. We’ve seen many clients at Canadian LIC who were surprised when their premiums went up despite not using their coverage. We always make sure to explain how premium increases work to help avoid confusion.

A guaranteed renewable policy allows your insurer to increase premiums as long as they don’t cancel your coverage. A non-cancellable policy, on the other hand, guarantees that your premiums won’t rise and your coverage remains in place as long as you pay the premiums. At Canadian LIC, many of our clients prefer non-cancellable policies because they offer stable premiums, providing peace of mind in the long run

If you miss a payment, your Disability Insurance provider may allow a grace period to catch up. However, if the payment isn’t made within that time, your policy may lapse, and you’ll lose coverage. We’ve had clients at Canadian LIC who missed payments and found themselves uninsured at a critical time. That’s why we always remind our clients to set up automatic payments to avoid this issue.

One way to prevent steep premium increases is by choosing a policy with a longer elimination period or opting for a non-cancellable plan. At Canadian LIC, we often suggest non-cancellable policies to clients who are worried about future premium hikes. These policies can cost more initially but provide better long-term value by keeping your rates steady.

Yes, you can switch Disability Insurance Providers if your premiums rise, but it’s important to make sure you don’t lose coverage during the transition. At Canadian LIC, we help clients compare new Disability Insurance Quotes from different providers, ensuring they find a plan that fits their budget without losing critical coverage.

It’s a good idea to review your Disability Insurance Plan annually or whenever there’s a significant change in your life, such as a new job, health condition, or financial situation. At Canadian LIC, we meet with clients regularly to review their policies and make sure their coverage continues to meet their needs.

Many Disability Insurance Providers offer lower introductory premiums to attract new clients, but these plans often come with terms that allow for increases over time. Some clients at Canadian LIC initially choose these plans for their affordability but later switch to more stable options when premiums start rising. We always recommend discussing long-term costs when getting a Disability Insurance Quote.

Your premiums may not automatically increase if you change jobs, but if your new job is riskier or comes with a higher income, it could impact your coverage. At Canadian LIC, we help clients evaluate whether their job change requires adjustments to their Disability Insurance Plan, making sure their coverage stays in line with their current situation.

When comparing Disability Insurance Plans, look at factors such as whether the premiums are guaranteed to stay the same, the elimination period, and the benefit period. At Canadian LIC, we work closely with clients to ensure they understand these terms so they can choose the right plan that meets their needs both now and in the future.

Some Disability Insurance Providers may charge administrative fees, or you might pay more for additional riders, like cost-of-living adjustments. At Canadian LIC, we always explain the total cost of the policy to clients upfront so there are no hidden surprises later on.

To get an accurate Disability Insurance Quote, you should provide detailed information about your health, occupation, and financial needs. At Canadian LIC, we take the time to gather all the necessary information and provide quotes from various Disability Insurance Providers, helping our clients find the best plan for their situation.

Yes, most Disability Insurance Plans have a waiting period, known as an elimination period, which can range from 30 to 180 days. The longer the waiting period, the lower your premiums may be. We’ve worked with many clients at Canadian LIC to help them choose the right elimination period based on their financial situation and how long they can wait before benefits start.

Your Disability Insurance Plan will usually remain valid if you move to another province in Canada, but it’s important to check with your provider to confirm. At Canadian LIC, we’ve helped clients who relocated and made sure their coverage was still in effect, giving them peace of mind during the move.

These FAQs cover the most basic and commonly asked questions people have about Disability Insurance in Canada, such as premium increases and ways to maintain your policy.

Sources and Further Reading

- Canada Life – Disability Insurance Basics

https://www.canadalife.com

This page provides an overview of how Disability Insurance works in Canada, including the types of policies and what affects premium rates. - Sun Life Financial – Disability Insurance Explained

https://www.sunlife.ca

Sun Life offers insights into the factors influencing Disability Insurance premiums, types of coverage, and what policyholders should consider. - Manulife – Disability Insurance FAQs

https://www.manulife.ca

Manulife covers frequently asked questions about Disability Insurance, including how premiums are calculated and whether they can increase over time. - The Financial Consumer Agency of Canada (FCAC)

https://www.canada.ca

The FCAC provides general information on the importance of Disability Insurance and how to compare plans to avoid unexpected premium increases. - Canadian Life and Health Insurance Association (CLHIA)

https://www.clhia.ca

This resource offers comprehensive guides to understanding Disability Insurance and tips for purchasing stable coverage with consistent premiums.

These sources can help readers deepen their understanding of Disability Insurance policies, the factors affecting premiums, and how to choose the right plan.

Key Takeaways

- Disability Insurance premiums can increase over time depending on the type of policy you choose, especially with guaranteed renewable plans.

- Non-cancellable policies offer stable premiums, ensuring your rates won’t rise, but they may come with higher initial costs.

- Factors like age, inflation, and changes in the insurance market can lead to increased premiums over time with certain Disability Insurance Plans.

- Reviewing your Disability Insurance Plan regularly helps ensure that it still meets your needs and is financially manageable as circumstances change.

- Canadian LIC offers expert guidance to help you find Disability Insurance that fits your budget and provides long-term protection without unexpected premium hikes.

By Pushpinder Puri

CEO & Founder

Your Feedback Is Very Important To Us

We appreciate your feedback! Please take a few moments to share your experiences and struggles related to Disability Insurance premiums increasing over time.

our responses will help us understand the common struggles related to Disability Insurance premiums in Canada and work toward better solutions. Thank you for your time!

IN THIS ARTICLE

- Do Disability Insurance premiums increase over time?

- The Worry of Rising Premiums

- Types of Disability Insurance and How Premiums Work

- Why Do Some Premiums Increase Over Time?

- Understanding Your Options: Avoiding Unexpected Increases

- Struggles with Rising Premiums

- Conclusion: Securing Stability with Disability Insurance in Canada

Sign-in to CanadianLIC

Verify OTP