Understanding Disability Insurance can be challenging and necessary at the same time. If something unexpected happens, like getting sick or hurt, and you can’t work, this important insurance policy will replace your income.

Want to know how to get Disability Insurance that fits your needs?

Let’s look into the details together. Whether you’re seeking affordable rates, facing coverage limitations, or even if you’ve encountered barriers in your search, our journey begins with understanding the landscape of Disability Insurance.

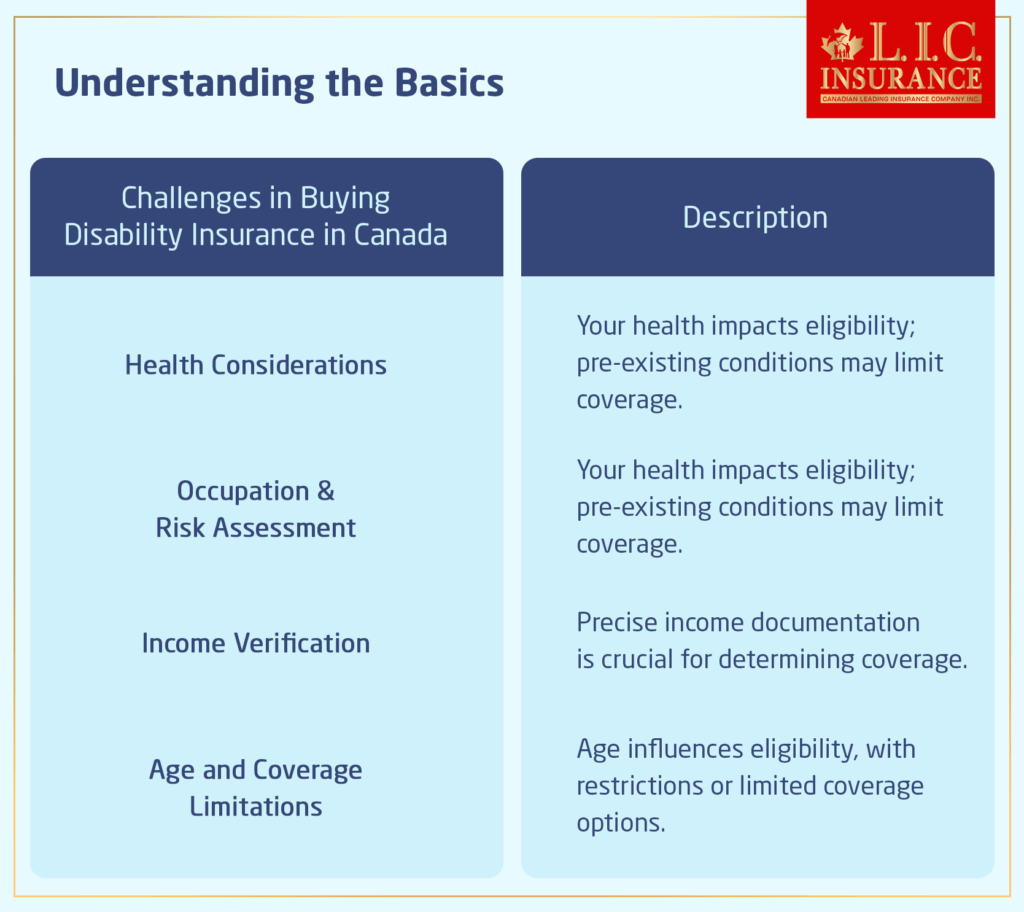

Understanding the Basics

Disability Insurance replaces a portion of your income if you become disabled and cannot work. This protection ensures that you can meet your financial obligations even when facing unexpected health setbacks.

Health Considerations:

Insightful Assessment: Your health stands as the most important factor influencing Disability Insurance eligibility. Insurance providers meticulously assess your health status to gauge the associated risk. Understanding how insurers evaluate your health allows you to anticipate potential limitations or alterations in coverage.

Impact of Pre-existing Conditions: If you have pre-existing health conditions, they might impact the type of Disability Insurance coverage available to you. When looking into Disability Insurance plans, you need to give careful thought to the complex ways that your health and insurance eligibility can affect each other.

Occupation and Risk Assessment:

Occupational Risk Variability: Disability Insurance eligibility is not universal across occupations. Certain professions are inherently riskier, exposing individuals to higher physical risks and potential injuries. Occupations such as construction or emergency services may face limitations or higher premiums due to the increased likelihood of injury.

Tailoring Coverage to Profession: Insurance experts understand the unique risk profiles associated with various occupations. They can guide you in tailoring Disability Insurance policies that address the specific challenges and risks relevant to your profession.

Income Verification:

Crucial Income Verification: Income verification is a fundamental aspect of the Disability Insurance application process. Insurance providers have specific processes to verify your income accurately. The precision of this documentation is vital in determining the appropriate coverage amount you qualify for, emphasizing the need for meticulous attention to detail.

Collaboration with Experts: Insurance consultants specialize in facilitating the income verification process. Their expertise ensures that your documentation aligns with the requirements, streamlining the application process for Disability Insurance policies.

Age and Coverage Limitations:

Influence of Age: Age plays a significant role in shaping Disability Insurance eligibility. Some providers may impose age restrictions, while others might offer limited coverage options for individuals in specific age brackets. Understanding how age factors into the eligibility equation enables you to plan accordingly.

Tailored Solutions for Life Stages: Insurance experts provide insights into age-appropriate Disability Insurance solutions. Whether you’re entering the workforce, reaching mid-career, or considering coverage during retirement, consultants guide you in making Disability Insurance come in line with your current life stage.

Get The Best Insurance Quote From Canadian L.I.C

Call 1 844-542-4678 to speak to our advisors.

Consulting an Expert

So, as we continue our discussion of Disability Insurance, let’s focus on a very important point: why you should consult an insurance broker. Working with an insurance expert is the best way to get clarity and find the Disability Insurance coverage you need for the following strong reasons:

Personalized Understanding:

Different people have different needs when it comes to insurance, and Disability Insurance is no different. When you talk to an insurance expert, they start to learn about you, including your health, job, and income. This personalized understanding ensures that the Disability Insurance policies they recommend are tailored to meet your unique needs and circumstances.

Understanding Health Issues:

Health issues are one of the main problems people have when they are trying to get Disability Insurance. Insurance brokers are very good at dealing with this problem. They analyze your health condition, working closely with you to determine how it may impact your eligibility for Disability Insurance. Their expertise allows them to guide you through potential roadblocks and find solutions that align with your health status.

Occupation-Specific Insights:

Your occupation plays a vital role in the Disability Insurance landscape. Certain jobs come with inherent risks, and insurance consultants understand how these factors influence your coverage options. Whether you have a high-risk job or one with unique occupational considerations, an expert can provide insights into tailoring Disability Insurance policies that address the specifics of your profession.

Income Verification Expertise:

Accurate income verification is fundamental when applying for Disability Insurance. Insurance consultants bring their expertise to this critical aspect of the process. They guide you in compiling the necessary documentation, ensuring that your income is accurately represented. This attention to detail is vital in determining the appropriate coverage amount you qualify for.

Age-Appropriate Solutions:

Age can be a determining factor in Disability Insurance eligibility. When it comes to insurance plans and getting older, insurance consultants know a lot about the details. They provide guidance on age-appropriate solutions, ensuring that you make informed decisions aligned with your current life stage.

Transparent Disability Insurance Quotes:

It is very important to understand the financial commitment that is required. Insurance experts are great at making Disability Insurance quotes easier to understand. They break down the costs and explain the details of your policy and the expenses that come with it. This transparency gives you the power to make smart decisions, knowing that you’re making a financial commitment.

Expertise in Policy Options:

Disability Insurance policies come in various forms, each offering distinct features. Insurance consultants serve as your guides through this maze of options. They explain the minutest details of different policies, helping you choose one that is perfect for your preferences, lifestyle, and financial goals.

Finally, keep in mind that to buy Disability Insurance is to get more than just a safety net; it’s an answer that’s specifically made for your needs. Talk to an insurance expert to get a personalized look at Disability Insurance that fits perfectly into your budget.

Faq's

Disability Insurance is an insurance policy that provides income replacement if you cannot work due to illness or injury. It ensures that you continue to receive a portion of your income during periods of disability.

Disability Insurance helps protect your finances by replacing some of your income if you get sick or hurt and can’t work. It makes sure that you can pay your bills even when things are hard.

Disability Insurance offers financial support when you cannot work due to a covered disability. It typically pays a percentage of your pre-disability income, helping you meet financial obligations during such challenging times.

The amount of Disability Insurance needed varies based on individual circumstances. It’s generally recommended to have coverage that replaces 60-70% of your pre-disability income. An insurance broker can help assess your specific needs.

Disability Insurance premiums are typically not tax-deductible for individuals. However, benefits received under a Disability Insurance policy are usually tax-free, providing a tax-efficient source of income during disability.

Disability Insurance pays when you meet the policy’s definition of disability, which is usually the inability to perform the duties of your own occupation or any occupation, depending on the policy terms. The waiting period, known as the elimination period, must also be satisfied.

It’s advisable to get Disability Insurance early in your career when you are healthy. However, it’s never too late to secure coverage. Life changes, such as marriage, the birth of a child, or a new job, are ideal times to consider obtaining or adjusting Disability Insurance.

Disability Insurance can be purchased through insurance brokers, financial advisors, or directly from insurance companies. Consulting with an insurance expert ensures you get personalized advice and access to a variety of policy options.

Disability Insurance covers a range of illnesses and injuries that prevent you from working. Commonly covered conditions include musculoskeletal disorders, cancer, mental health issues, and more. The specifics vary by policy, so reviewing the terms carefully is crucial.

The “best” Disability Insurance plans vary based on individual needs and preferences. Working with an insurance expert helps you find a policy that fits your unique situation, considering factors like coverage, premiums, and customer service.

Everyone who relies on their income to meet financial obligations needs Disability Insurance. Individuals without substantial savings or alternative income sources must protect against the financial impact of disability.

The policyholder typically pays Disability Insurance premiums. In some cases, employers may offer group Disability Insurance, where they may cover part or all of the premiums.

Yes, Disability Insurance plans commonly cover cancer, along with a range of other medical conditions. The specific coverage details can vary by policy, so reviewing the terms is essential to ensure cancer is included.

Disability Insurance premiums for individual policies are generally not considered a business expense. However, if your business provides Disability Insurance to employees, the premiums may be deductible as a business expense.

Disability Insurance benefits are usually not considered taxable income when received by an individual. This tax-free nature of Disability Insurance benefits enhances their value in providing financial support during periods of disability.

Yes, many Disability Insurance policies cover mental health conditions. It’s essential to carefully review the policy terms to understand the specific coverage for mental health issues, as some policies may have certain limitations or exclusions.

Eligibility is influenced by health, occupation, income, and age. Pre-existing health conditions, high-risk occupations, and age-related considerations may impact your ability to secure certain Disability Insurance policies.

The need for a health examination varies among insurance providers. Consulting an insurance expert can help you understand the specific requirements and find options as per your health status.

The above information is only meant to be informative. It comes from Canadian LIC’s own opinions, which can change at any time. This material is not meant to be financial or legal advice, and it should not be interpreted as such. If someone decides to act on the information on this page, Canadian LIC is not responsible for what happens. Every attempt is made to provide accurate and up-to-date information on Canadian LIC. Some of the terms, conditions, limitations, exclusions, termination, and other parts of the policies mentioned above may not be included, which may be important to the policy choice. For full details, please refer to the actual policy documents. If there is any disagreement, the language in the actual policy documents will be used. All rights reserved.

Please let us know if there is anything that should be updated, removed, or corrected from this article. Send an email to [email protected] or [email protected]