Has it also happened to you that you are in a pleasant family get-together with the smell of food cooking and sounds of laughter all around, and you see your kids playing and think about how to keep them safe and happy, not just today, but in the future too? Many of us feel like this in a lot of our happy moments. Don’t we? The best solution to this is Life

What Is the Best Age to Buy Universal Life Insurance?

By Canadian LIC, March 14, 2024, 8 Minutes

Has it also happened to you that you are in a pleasant family get-together with the smell of food cooking and sounds of laughter all around, and you see your kids playing and think about how to keep them safe and happy, not just today, but in the future too? Many of us feel like this in a lot of our happy moments. Don’t we? The best solution to this is Life Insurance. It might seem like a big, confusing topic if you have not ever thought about it seriously, but it’s the only perfect way to ensure your family is okay, even when you’re not around to take care of them.

Let’s understand this better through Alex’s story. Alex began looking into life insurance to make sure that his family would always have what they needed. At first, it seemed hard, but he learned that starting at the right time can make things much easier and better for his family.

Universal Life Insurance can very well help protect your family. This blog will help you understand how it works. It’s not as hard as it sounds; it’s all about making sure the people you love are safe and sound. So, let’s take this step together and make sure you can enjoy many more happy moments with your family without worrying about the future.

If you have thought about Universal Life Insurance, then you might have many questions related to it, especially if you are new to insurance, and a very important one among them is the right time to start with it. Don’t worry; you are not alone. Many of us get stuck in our financial decisions, hoping to secure our family’s future without understanding where to start. Continue reading, and all your doubts will get clear as you will discover how to make your life and that of your loved ones better and more secure.

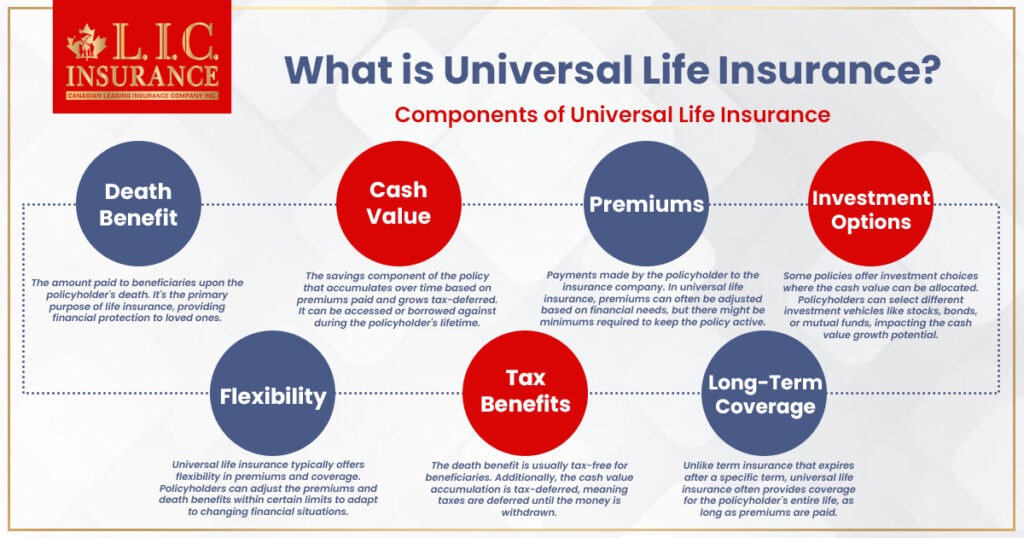

Let’s First Know What Universal Life Insurance

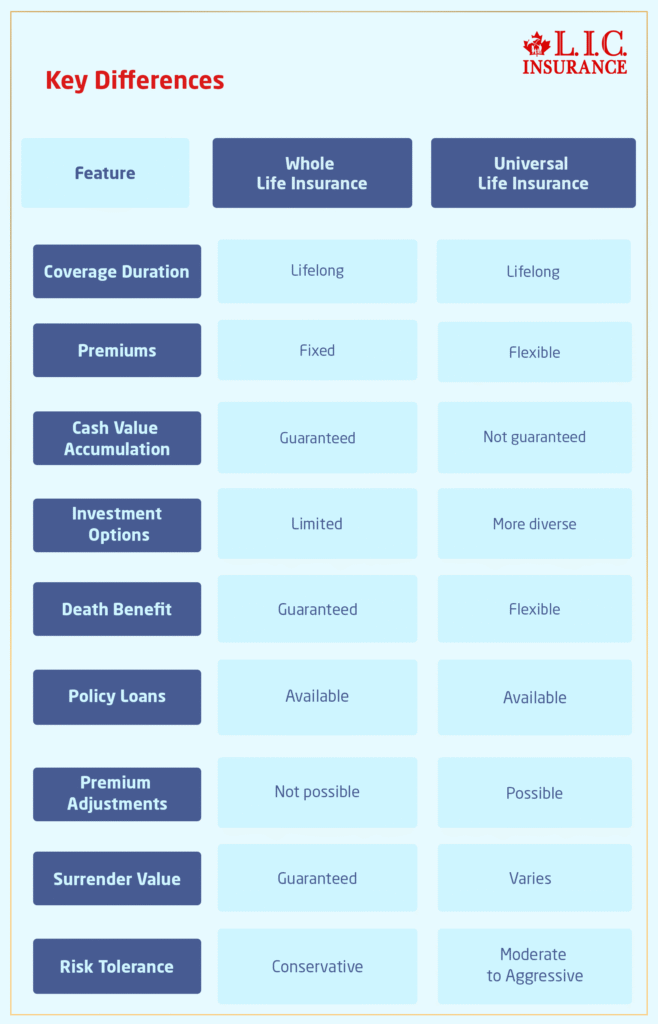

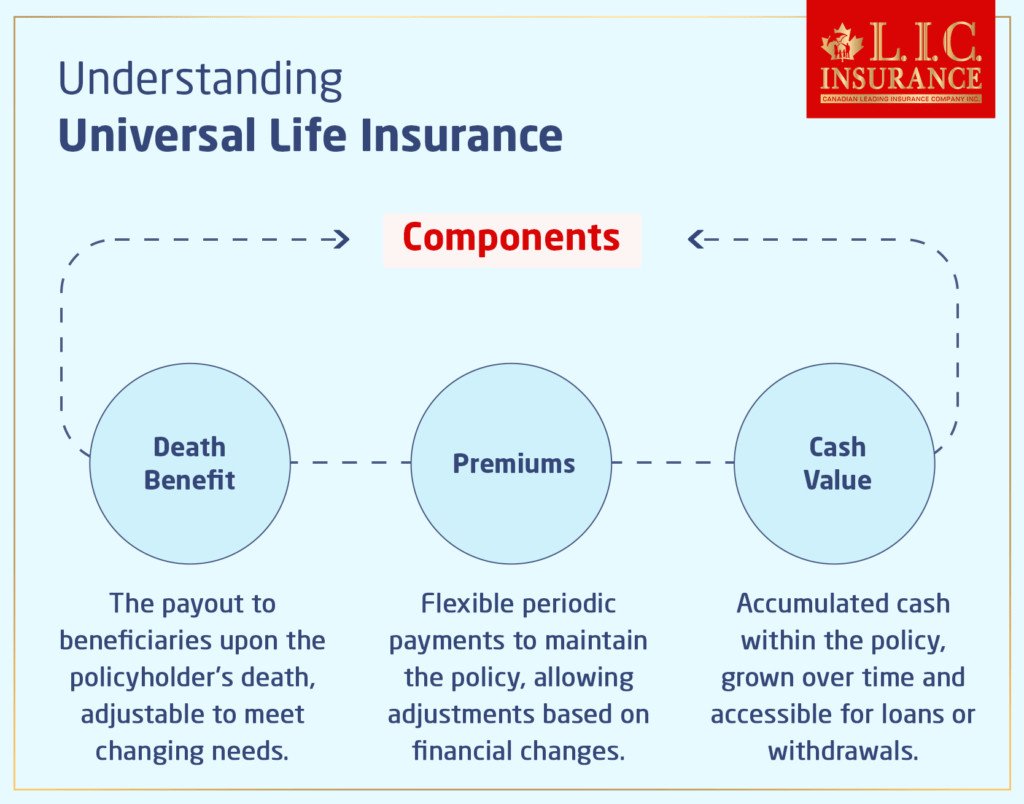

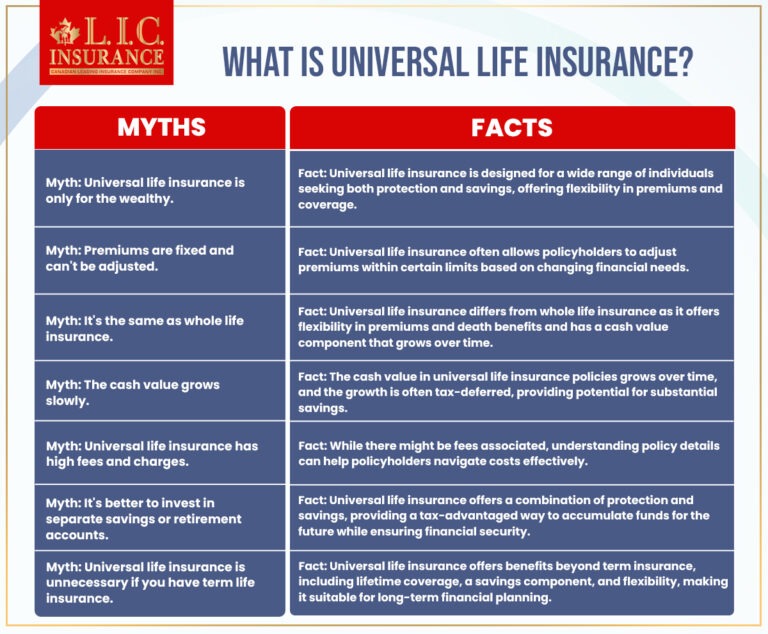

It’s important to know what Universal Life Insurance is before we try to figure out the best age to buy it. An increasing cash value component and a death benefit are both features of Universal Life Insurance, a type of permanent life insurance. It stands out because payments are flexible, and there is a chance to build wealth without paying taxes on it right away. Think of it as an insurance policy that is tied to a savings account. The choices you make could affect how your money grows in this account.

Find Out: The Benefits of Universal Life Insurance

The Best Age to Buy Universal Life Insurance

You don’t have to go through the world of Universal Life Insurance Plans by yourself. Let’s take a look at it together, focused on the best age to start at, and see how this choice fits into the bigger picture of your life.

Start Early: In Your 20s and 30s

Let’s say you want to start saving money in a savings jar. In your 20s or 30s, every coin or note you drop in has the chance to multiply, building a bigger fund over time. This is much like getting Universal Life Insurance early. At this youthful stage, you’re likely in better health, which means lower insurance costs—think of it as a bonus for getting ahead of the game.

Yet, it’s not just about the immediate savings. The cash value part of your policy—kind of like a special savings account inside your insurance—grows best with more time. As you add to it, just like adding to your savings jar, it expands, becoming a solid foundation that can support big future plans, like owning a home or retiring comfortably.”

How to Implement This in Your Life:

- Start the Conversation Early: Discuss your future financial goals with a trusted advisor. It’s like mapping out a road trip; knowing your destination helps you choose the best route.

- Budget for the Future: Incorporate the cost of premiums into your budget as if it were a recurring expense for your dreams, ensuring it’s a comfortable fit.

Building Foundations: 40s

By the time you reach your 40s, you’re in the midst of life’s marathon, balancing responsibilities such as family, home, and future planning. You’ve taken care of your money, so now it’s time to make sure it gives you the best harvest. Because it is flexible, Universal Life Insurance can be used in a lot of different ways.

Right now is a very important time to strengthen the protection system for your family, and it’s also a great time to start saving diligently for retirement. The cash value of a Universal Life Insurance policy can complement your retirement savings, providing an additional source of income if managed wisely.

How to Implement This in Your Life:

- Review and Adjust: Regularly keep reviewing your financial plan to accommodate life’s changes.

- Maximize Your Contributions: If possible, increase your insurance payments during peak earning years to maximize the policy’s cash value growth.

Starting Late: 50s and After

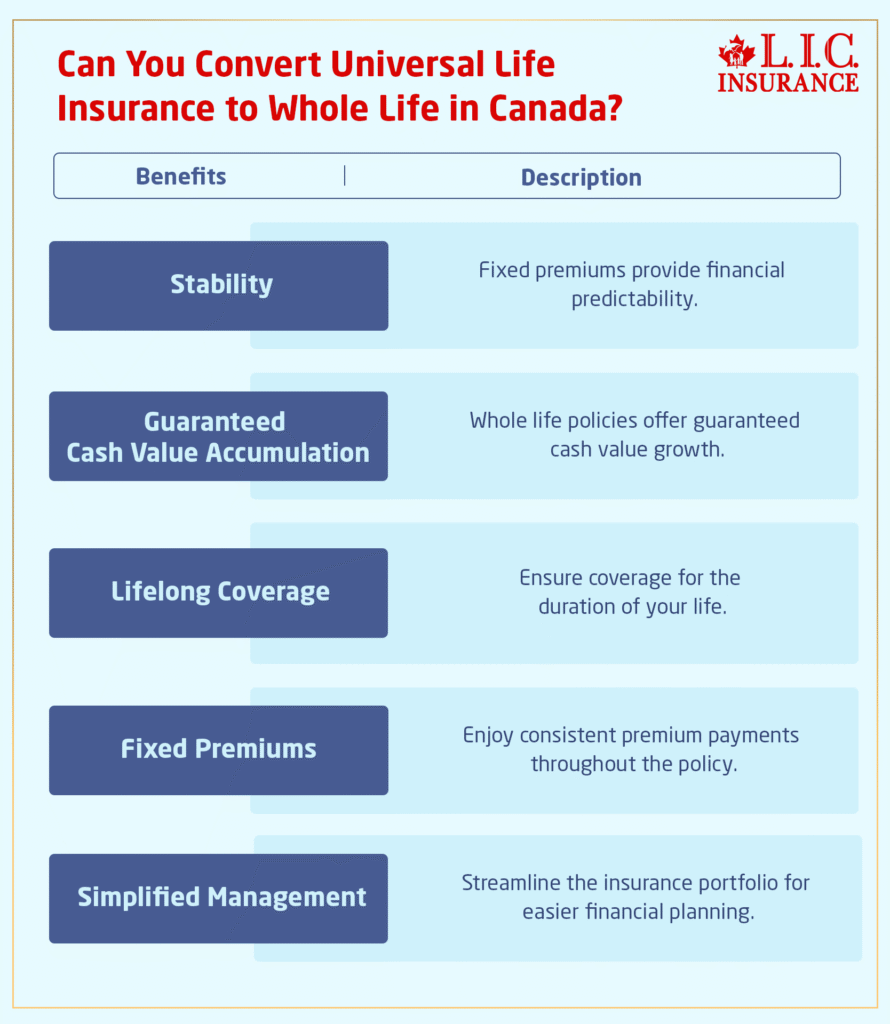

Are you entering your 50s or later without Universal Life Insurance? It’s not too late. Now, it’s about preservation and legacy. While premiums may be higher, the value of securing a legacy for your heirs or providing for a surviving spouse can’t be overstated.

This stage is about strategic financial decisions, ensuring that the ones you love are protected and your life’s work is preserved. It’s also a time to consider the tax advantages of Universal Life Insurance, providing your heirs with a tax-efficient inheritance.

How to Implement This in Your Life:

- Consult with Experts: Talk to financial and insurance advisors to understand the best approach for your situation.

- Consider Estate Planning: Integrate your Universal Life Insurance policy into your estate planning, ensuring that your legacy is distributed according to your wishes.

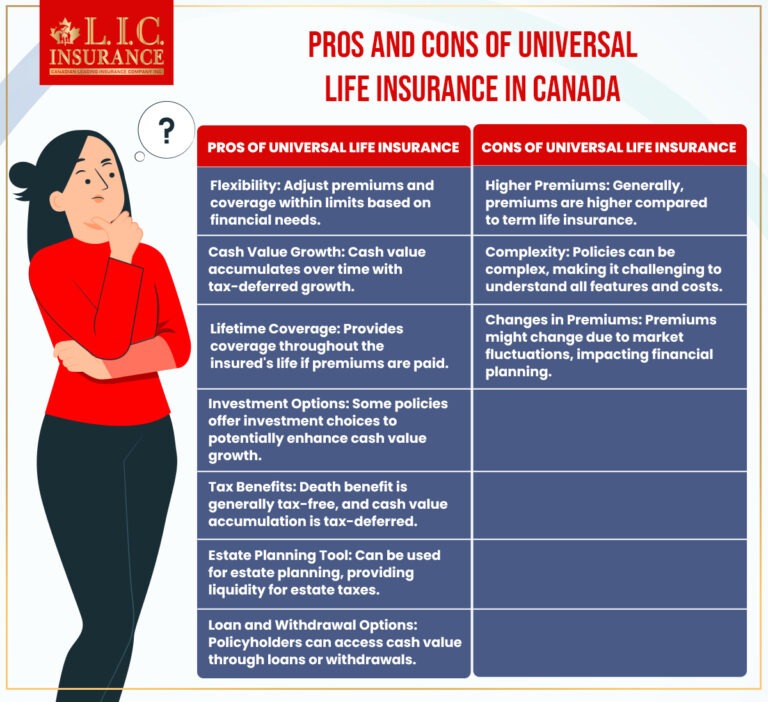

Universal Life Insurance Canada Pros and Cons

Pros:

- Flexibility: Adjust your premiums and death benefit to suit your financial situation.

- Investment Opportunity: The cash value component provides a chance to grow your investment on a tax-deferred basis.

- Lifelong Coverage: Universal life provides coverage for your entire life, which is not the case with Term Life Insurance.

Cons:

- Consult with Experts: Talk to financial and insurance advisors to understand the best approach for your situation.

- Consider Estate Planning: Integrate your Universal Life Insurance policy into your estate planning, ensuring that your legacy is distributed according to your wishes.

Implementing Universal Life Insurance in Daily Life

Understanding is one thing; applying this knowledge is another. Here are a few steps to integrate Universal Life Insurance into your financial planning effectively

- Assess Your Needs: Consider your financial goals, your family’s needs, and your budget. A financial advisor can provide personalized advice that is best for your situation.

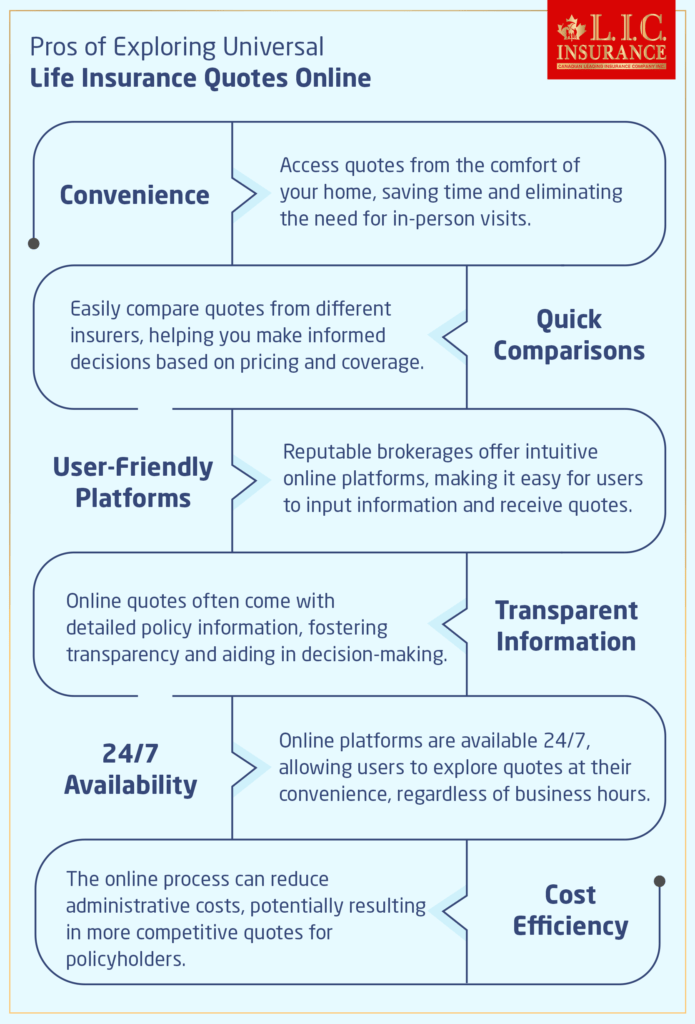

- Shop Around: Don’t settle for the first quote that you will get. Compare different policies to find the one that best matches your needs and budget.

- Plan for the Long Term: Think of universal life policies as a long-term investment. Regularly review your policy to ensure it compliments your evolving financial goals.

The Bottom Line

Alongside helping you choose the ideal insurance policy for you and your family, working with expert insurance brokers has its advantages. Here’s how you will benefit from hiring an insurance broker in Toronto before choosing a policy:

- Experienced and best insurance brokers in Canada always keep themselves up to date with the latest trends in the insurance market; they can help you choose the ideal insurance plan based on your needs and industry standards.

- Your insurance broker in Toronto will be connected with many companies, and that gives them access to several insurance products. Once they know all your needs, they can compare multiple plans and policies and present the ones suited to your requirements and within your budget.

- Once you have selected a policy, they can help negotiate premiums and see that you get an affordable monthly rate for the plan you choose.

- If you are not sure which insurance policy is ideal for you, an insurance broker can share their unbiased advice so you can make an informed decision.

- They can also help in settling claims. Once you have submitted your claim, your insurance broker will follow up to ensure the claim is processed correctly.

- An insurance broker can help you settle legal disputes with the insurance company as well.

Get The Best Insurance Quote From Canadian L.I.C

Call 1 844-542-4678 to speak to our advisors.

Faq's

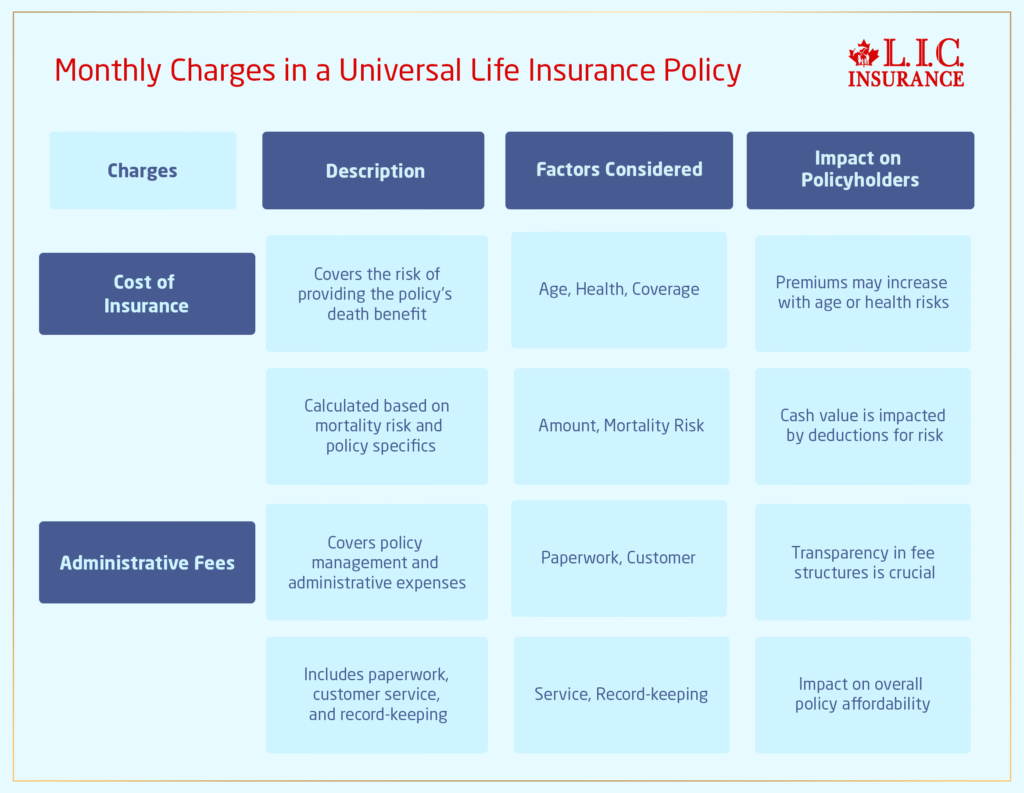

Universal life policies are permanent life insurance types that bring together death benefits with a savings component. This savings component can grow based on the policy’s investments, providing flexibility in premiums and the potential for cash value accumulation.

The best age to consider Universal Life Insurance is in your 20s or 30s, as you’ll qualify for lower premiums and give the cash value component more time to grow. However, purchasing in your 40s or even 50s and beyond can still offer significant benefits, such as financial security for your loved ones and estate planning advantages.

Yes, you can purchase Universal Life Insurance in your 50s or later. Even though the premiums may be higher due to age and health considerations, it can still provide valuable coverage and serve as a tool for estate planning and leaving a legacy.

Starting early makes it possible for you to lock in lower premiums due to your age and health. Additionally, the longer your policy is in place, the more time the cash value has to grow, potentially providing you with a substantial financial resource in the future.

Yes, one of the main features of Universal Life Insurance is its flexibility, including the ability to adjust premium payments. You can pay more to increase the cash value more quickly or pay less if finances are tight as long as enough value is available to cover the costs of insurance.

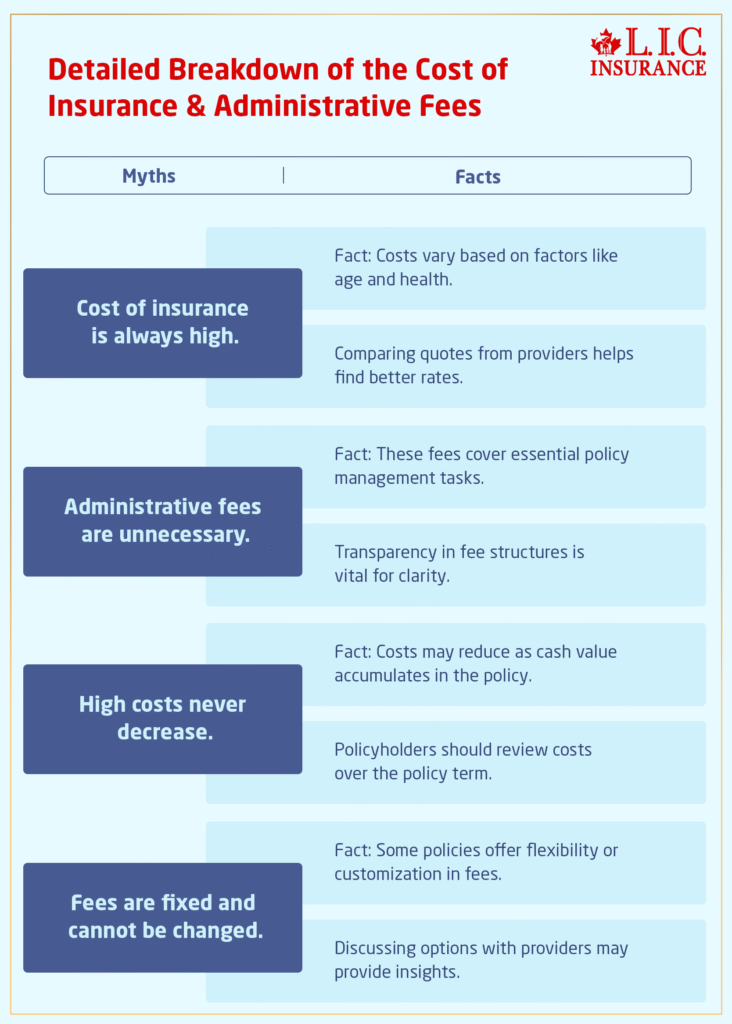

The main advantages include flexibility in premiums and death benefits, the potential for cash value growth, and lifelong coverage. It also offers tax advantages, such as tax-deferred growth of the cash value component.

Yes, there are risks, including the possibility that the investment component may not perform as expected, which can affect the cash value and potentially increase the premiums needed to keep the policy active. It’s important to regularly review and manage your policy with the help of a financial advisor.

Universal Life Insurance can be very valuable in estate planning. It can provide a tax-efficient way to transfer wealth to your heirs, help cover estate taxes, and make sure that the ones you love are financially cared for after your death.

| <p>Universal Life Insurance policies can be a good investment for some people, as they offer a combination of life insurance protection and the opportunity to grow cash value within a tax-advantaged account. The investment component depends on the chosen sub-accounts or funds, which can vary in performance. It’s essential to consider your financial goals, risk tolerance, and the cost of the insurance component when evaluating if it’s a suitable investment for you.</p> |

Universal Life Insurance is a type of permanent (or whole) life insurance that offers lifelong coverage as long as premiums are paid. It places both the death benefit with a cash value component together, allowing for more flexibility in premiums and the potential for investment growth.

Yes, Universal Life Insurance can lapse if the cash value of the policy cannot cover the cost of insurance and other expenses and if no additional premiums are paid. Policyholders need to monitor their policy’s performance and make adjustments to premiums or the death benefit as necessary to prevent lapsing.

The cost of the insurance component within a universal life policy can increase with age. However, Universal Life Insurance offers flexible premiums, allowing policyholders to adjust the amount they pay. They can utilize the accumulated cash value to cover the cost of insurance as they age, potentially offsetting increases in premiums due to aging.

Yes, one of the primary features of Universal Life Insurance is its cash value component. Part of the premiums paid into the policy goes towards the cost of insurance, and the excess can be invested, allowing the cash value to grow over time. Under certain conditions, Policyholders can withdraw or take loans against the cash value.

Universal Life Insurance is a good idea for individuals looking for flexible life insurance coverage that also helps in financial planning. It’s well-suited for those who want the potential to grow cash value within their policy on a tax-advantaged basis, have a need for permanent insurance coverage, and are comfortable with the investment risks involved. It can also be strategic for estate planning, providing tax-efficient wealth transfer to heirs.

Yes, consulting with a financial advisor is very necessary. They can help assess your financial situation, goals, and needs to determine if Universal Life Insurance is the right choice for you and guide you through the process of selecting and managing a policy.

The above information is only meant to be informative. It comes from Canadian LIC’s own opinions, which can change at any time. This material is not meant to be financial or legal advice, and it should not be interpreted as such. If someone decides to act on the information on this page, Canadian LIC is not responsible for what happens. Every attempt is made to provide accurate and up-to-date information on Canadian LIC. Some of the terms, conditions, limitations, exclusions, termination, and other parts of the policies mentioned above may not be included, which may be important to the policy choice. For full details, please refer to the actual policy documents. If there is any disagreement, the language in the actual policy documents will be used. All rights reserved.

Please let us know if there is anything that should be updated, removed, or corrected from this article. Send an email to [email protected] or [email protected]