Immigrating to Canada can be confusing for some. One popular question we receive at Canadian LIC, the best insurance brokerage, is how to change visitor visa to super visa. It’s not just a technical issue; it can have strong emotional, real-life implications.

Take Maria’s story. She flew to Canada on a visitor visa to see her son and new grandchild. Her plan was simple: Spend a few months, lend a hand, and then go home. But after a while, she realized how much her family relied on her. They wished she could have stayed longer, but the limitations of the visitor visa hung over everything. Her son sought our help to figure out a way to extend her stay without continually renewing her visa.

This is not the only story. It is a similar story for many Canadian families, who wish that their parents or grandparents could stay longer and be a part of their lives. This is where the super visa comes to the rescue. But can a visitor visa be converted to a super visa? Let’s get into it.

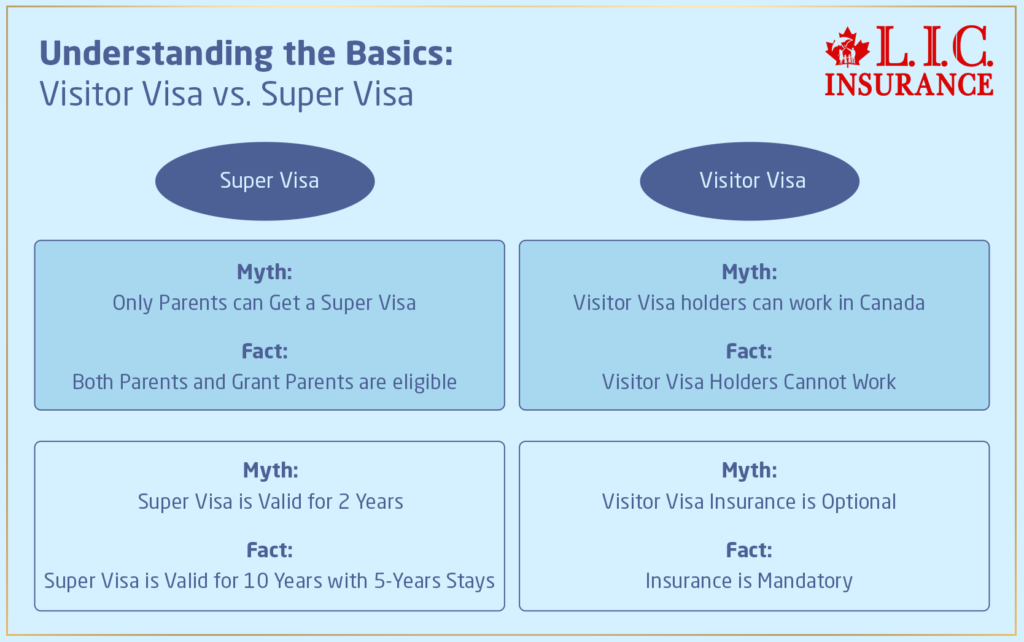

Understanding the Basics: Visitor Visa vs. Super Visa

Discussing on how to change visitor visa to super visa, you will need to compare them too before we go into the details of how to transfer visitor visa to super visa.

Visitor Visa: A visitor visa, which is also known as a Temporary Resident Visa (TRV), is what is required of individuals who wish to visit Canada on a temporary basis, typically for up to six months, including tourism and visiting family or on business. When visiting, there should be visitor visa insurance in Canada during your stay so any unforeseen medical expenses are being taken care of.

Super Visa: A special type of visitor visa, where instead of being limited to a stay of six months in Canada, the super visa program allows parents or grandparents of a Canadian citizen or permanent resident to remain in Canada for up to five years per visit, and may do so without needing to renew their status once per decade. One of the key requirements for this visa is the purchase of a full Visitor Insurance Plan from a Canadian insurance company, which will cover you for a reasonable amount, especially health, hospital, and repatriation.

The Conversion Challenge: Can You Switch Directly?

A lot of clients ask us one big question: “Can I switch a visitor’s visa to a super visa directly?” The unfortunate answer is no. But the process of applying for a super visa can be relatively easy and manageable if approached the right way. Let’s break it down:

- Eligibility Check: Make Sure That You are Eligible for Meeting the Super Visa Requirements. Many different people are eligible to apply for the super visa, including if: * You are the parent or grandparent of a Canadian citizen or a permanent resident.

- Get an Invitation: Request your family in Canada to send you an Invitation letter, which explains that they will take care of you during your visit.

- Sort out the money: Your Canadian family will need to prove you won’t go hungry and sleep under a bridge while you’re here.

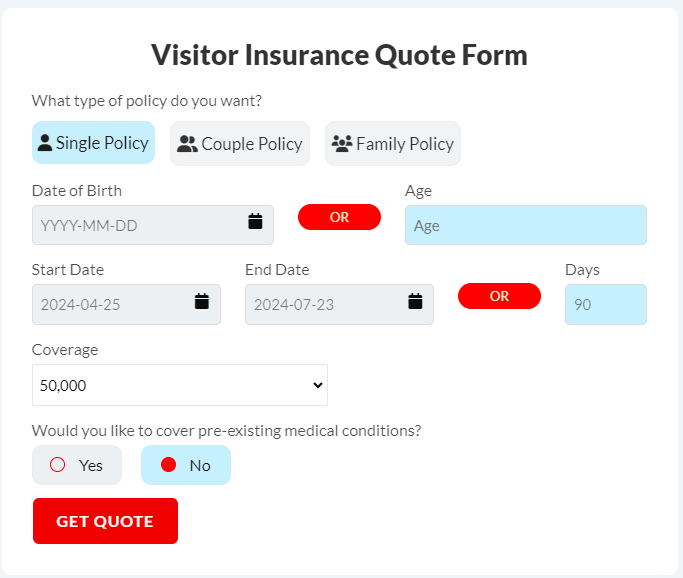

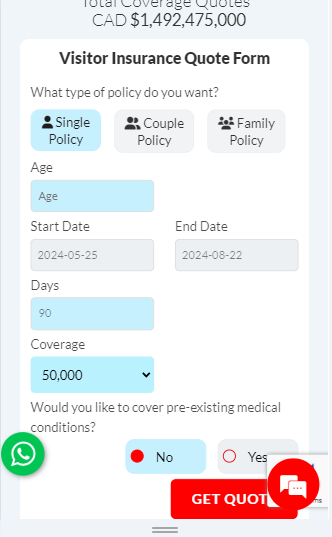

- Buy Insurance: Compulsory for an insured visitor to buy strong Visitor Insurance Plans from a Canadian insurance company of good standing. The coverage shall be for a period of at least 1 year and shall include coverage of not less than $100,000.

Hidden Timing Strategy: How Your Visitor Visa Timing Can Affect Your Super Visa Success

One often ignored but very important step that families seem to gloss over when wondering ‘how to convert a visitor visa to a super visa’ is when to apply – not just how. As the super visa application must originate from outside of Canada, you must leave Canada before applying, when you do this also play a role in whether your approval is a success or not. This is especially true if your present visitor visa is close to expiration and you have a travel history that establishes a pattern of coming to live with family for the long term.

One of the most common questions we get from clients is: “Can I apply for a super visa if I have a visitor visa status?” Officially, yes — but not until after leaving Canada. But with families waiting until the visitor visa expires or applying for extensions more than once without a clear plan, they could alert IRCC. This makes your super visa application look weaker. Instead, we recommend beginning the paperwork at least 60 to 90 days before the planned travel and having all requirements — like financial documentation, an invitation letter, and medical insurance — ready before re-entry.

Another frequently asked question is: “Can I submit an application for a visitor visa and a super visa concurrently?” The answer is yes, but only if it is strategic. When both are in play, IRCC will scrutinize intent. A clean and transparent timeline — one with supporting documentation and insurance — helps demonstrate genuine intent, and that is a factor that determines approval.

This planning knowledge, informed by our own experience helping hundreds of families, can minimize rejections and ensure your parents or grandparents end up with the extended stay they deserve, without unnecessary delays and confusion.

Real Stories, Real Challenges

At Canadian LIC, we have come across several real-life scenarios that call for the puzzlement and solution-seeking associated with Visitor Visa Insurance in Canada:

Jacob’s Dilemma: Jacob was excited to have his parents visit him in Canada, with a possible extension through a super visa. But he got really confused by the numerous options in Visitor Insurance Plans. We helped Jacob navigate a number of Visitor Insurance Quotes so he could get an affordable Visitor Insurance Plan with full coverage.

Seema’s Oversight: Seema’s parents were already in Canada when an application for a super visa was made. The last-minute rush to find suitable Visitor Visa Insurance in Canada led to delays and frustrations. This story underlines the importance of planning and timely action, which we emphasize with all our clients.

Rajbeer’s Budget Concerns: Keeping all these factors in mind, Rajbeer’s bottom line would be to achieve comprehensive coverage under an affordable budget. With our guidance, he subscribed to the best possible plan that would provide maximum coverage without unduly straining his pocket.

Engaging With Canadian LIC

Why Canadian LIC for your insurance needs? We don’t just sell you insurance; we give you peace of mind. We understand the emotional and practical sensibilities of your insurance journey very well. We take pride in offering service that is tailored to your personal situation and your concerns.

Conclusion: Understanding the Path from a Visitor Visa to a Super Visa

So, if you’re wishing to extend a visitor visa compared to a super visa for your parents/grandparents to stay with you in Canada for a much longer period, quite relatable to many others, but you need to understand the fact that a visitor visa isn’t directly converted into a super visa. The super visa application itself is an entirely different type of application than for a visitor’s visa.

If you’re considering extending the length of time family members can spend in Canada, applying for a super visa holds a significant advantage over the visitor visa, since it permits visits of up to five years in duration and can be renewed for up to an aggregate of 10 years. The long duration makes it a favorite to families that prefer more quality time together.

When you think about this option, you should bear in mind that a super visa application need to be submitted from outside Canada. If you need an extension while they are already here with you on a visitor visa, you can lodge a visa extension application, which lets them stay an extra six months.

In order to apply for the super visa, you need to be eligible as a sponsor under the Parents and Grandparents Sponsorship Program. This involves meeting specific eligibility requirements such as the Minimum Income Requirement, and making a legal restatement to help your family members in Canada. If all the prerequisites are met, including a valid health insurance for your parents, the application should run more smoothly.

Breather space to those who want to keep the Family together for a longer stay canadians LIC is procured to help! We advise you on how and where to get the right Visitor Insurance Quotes as an aid to strengthen your super visa application, demonstrating that you have the right financial and medical insurance plans in place. Begin the process informed and prepared, and make the dream of having your loved ones nearby for the long term come true. Feel free to contact us at Canadian LIC for the support you and your family need.

More on Visitor Visa and Super Visa

Get The Best Insurance Quote From Canadian L.I.C

Call 1 844-542-4678 to speak to our advisors.

Frequently Asked Questions

Visitor Visa: This is a category of Temporary Resident Visa, whereby one is given the opportunity to enter Canada for short periods, usually a maximum of six months at a time. This is suitable for tourists, business visitors, or those visiting family/friends. However, frequent renewals need to be done if visitors wish to stay longer, usually every six months.

Super Visa: The super visa is for parents and grandparents of Canadian citizens or permanent residents. This is a long-term solution where the stay is basically up to five years at a time; it can go on for a maximum period of 10 years. There is no need for repeated renewals with this type of visa, and this makes it very favourable among families who wish to spend more extended periods of time together.

Yes, you can apply for a visitor visa and Super Visa at the same time, but it’s important to understand how each works. A visitor visa is generally for shorter stays, while a Super Visa is designed for parents and grandparents of Canadian citizens or permanent residents who want to stay longer, up to 5 years per entry. If you apply for both, IRCC may assess your eligibility separately for each, and you could be granted one based on your documents, intent of travel, and financial support provided by your Canadian family member.

No, you cannot apply for a Super Visa inside Canada. The Super Visa application must be made from outside the country. IRCC requires applicants to be outside Canada when applying for a Super Visa, and medical exams and insurance coverage must be arranged in advance. If you are already in Canada, you would typically need to exit the country and apply from your home country or another country where you are legally permitted to stay and apply.

If you’re already in Canada on a visitor visa and want to stay longer with your children or grandchildren, you might wonder how to convert a visitor visa to a super visa. You cannot technically “convert” it while in Canada. Instead, you must apply for a Super Visa from outside of Canada, usually from your home country. You’ll need to meet all the Super Visa requirements, like medical insurance, a letter of invitation from your child or grandchild, and proof of income. Once approved, you can return to Canada under the Super Visa, which allows longer stays.

This means that the visa applicant must have purchased a minimum Canadian medical insurance of $100,000 to cover healthcare, hospitalization, and repatriation. Insurance coverage has to be valid for a period of at least one year from the date of entrance into Canada. This is important insurance in the sense that all medical expenses will be paid without straining the Canadian healthcare system.

An invitation letter for a super visa must include:

- A statement of commitment from the host (child or grandchild in Canada) to financially support the visitor for the duration of their stay.

- Proof of the host’s Canadian citizenship or permanent resident status.

- Details about the host’s family, including names and dates of birth of all household members.

- A description of the purpose of the visit and the relationship between the host and the visitor.

- The planned duration of the stay and where the visitor will reside in Canada.

In this case, the time taken for processing may differ drastically from one visa office to another and may further depend on the applicant’s conditions. The average processing time ranges from a few weeks to a couple of months. One should apply well before the planned date to allow for any possible delays in processing.

Grasping these major factors and preparation will help an applicant, together with his family, to make the application process less hectic and stressful.

While choosing Visitor Visa Insurance Canada, look for comprehensive health insurance that takes into consideration health, hospitalization, and repatriation coverage. Make sure that a minimum of $100,000 is provided as basic coverage and that it is available for at least one year. That makes it prudent, too, to purchase a policy that gives flexibility when travel plans may change. We helped Emily, whose mother came from abroad, pick one that would cover pre-existing conditions so her mom felt secure throughout her visit.

Comparing Visitor Insurance Plans efficiently requires that you understand your specific needs and what each plan entails. We highly encourage all of our clients to seriously reflect on the coverage limits, deductibles, and exclusions. In this, Canadian LIC can help you compare these plans. Take, for example, Lisa and her father. We helped them compare a few of the plans by pointing out the differences in the coverage and what these choices would mean to her, hence allowing Lisa to be confident in making her decision.

Canadian LIC not only helps you buy the right insurance but also stands by your side during your claims. Reach out to our team for assistance with paperwork, communication with the insurance provider, and seamless claims processing. For instance, when our client Tom’s father needed unexpected medical treatment during his stay, we helped Tom navigate the claims process, greatly reducing stress and facilitating a quick resolution.

Underestimation of the cover amount. One of the biggest reasons why people make mistakes is that they underestimate the amount of cover. The second typical mistake is failing to look at the fine print of pre-existing conditions and what is not covered. This is where Canadian LIC protects you by offering thorough consultations. We once provided assistance to a couple, John and Mary, who shopped for the lowest prices they could find. So we would then help them choose a more relevant plan, and in the end, this worked out well when Mary’s mother (who was visiting) needed to go to the hospital and needed emergency medical care.

Absolutely; if you need to extend your Visitor Visa Insurance, be it extending the period of coverage or increasing the amount of coverage, we at Canadian LIC are here to help you with that. For instance, when the pandemic extended Rajiv’s parents’ stay unexpectedly, we quickly adjusted their insurance plan to extend their coverage, thereby keeping them safe during their extended visit.

Visitor Visa Insurance cost in Canada depends on age, duration, sum insured and medical history, etc. We offer lengthy consultations so visitors understand exactly how these would apply to them. One standout case is Robert, whose father had a highly complicated medical history. We researched a few plans that would provide the coverage we need, but would not be expensive enough so that his father would be fully covered as per the super visa requirement.

Hence, strong Visitor Visa Insurance is of paramount importance for Super Visa applicants as it shields them from unexpected medical expenses in Canada. With the Canadian health care system, these fees can be very high, and with adequate insurance, visitors can freely access health care without hesitating about the financial distress. We had a client, Lisa, whose mother actually had a medical crisis upon arrival. Thanks to the full coverage that we had carefully prepared her for, her treatment was completely taken care of, and that lifted a developmentally appropriate weight from her and her family.

Yes, Canadian LIC specializes in finding Visitor Insurance Plans that cover pre-existing conditions tailored to each client’s unique needs. We understand the importance of such coverage, as it was with George’s mother, who had diabetes. We helped George find a plan which covered her condition, ensuring she had no gaps in her medical care while in Canada.

In case of problems regarding Visitor Visa Insurance, Canadian LIC is always there to help. We stand beside our clients in the process of a claim and the possible disputes that may arise. When Sarah’s father had to make a claim, and it wasn’t working well with the provider, we helped bridge the gap to get things moving again so that he would be able to receive the benefits promised in.

In case one has to prolong their stay beyond the originally specified period indicated in their visitor’s insurance plan, Canadian LIC will be in a position to renew it efficiently. For example, when Alex’s mother had her visa extended unexpectedly, we adjusted her insurance, which also provided her with an extension of coverage and protection without lapsing.

There are many advantages in speaking with a Canadian LIC about your Visitor Visa Insurance needs. We will assist you in making an informed decision that is most suitable and easy on your pocket! On top of all that, we manage all the paperwork required for arranging and servicing the insurance. She was visiting from overseas and needed insurance. for them; it was not enough that we provided the best rates for her, we also took care of all the paperwork to keep her stress-free”.

Here at Canadian LIC, we are dedicated to ensuring that you win immigration visitor visas and super visas. “Instead of this, we can make a totally trouble-free process that your family is with you in Canada and spending quality time with you.” Get in touch for Visitor Insurance Plans along with personalized guidance.

Sources and Further Reading

For those interested in further exploring the topic of converting a visitor visa to a super visa in Canada, and understanding the intricacies of Visitor Visa Insurance, the following sources provide valuable information:

Immigration, Refugees and Citizenship Canada (IRCC) – This official government site provides comprehensive and updated guidelines on the super visa application process, eligibility criteria, and required documentation.

Visit IRCC’s Super Visa section for official details.

Canadian Life and Health Insurance Association Inc. (CLHIA) – A reliable resource for information on insurance products in Canada, including Visitor Insurance. CLHIA offers guidelines on choosing the right insurance plan for visitors and super visa applicants.

Explore more at CLHIA’s Consumer Information.

The Canadian Bar Association (CBA) – Provides legal perspectives and advice on immigration processes, including the super visa. Their insights are especially useful for understanding the legal undertakings involved in sponsoring a relative.

Learn more at the CBA’s Immigration Law Section.

HealthCare.gov – For comparative insights, understanding how health insurance works for visitors in other countries like the USA can be helpful. This can provide a broader understanding of Visitor Insurance needs and options.

Check out HealthCare.gov.

Parent and Grandparent Super Visa Insurance Providers – Many Canadian insurance companies provide detailed information and quotes online. Reviewing these sites can help in comparing Visitor Insurance Plans and understanding the coverage options available.

By consulting these sources, readers can gain a deeper understanding of the process of obtaining a super visa and the importance of securing the right Visitor Visa Insurance in Canada.

Key Takeaways

- A visitor visa cannot be directly converted into a super visa; each requires a separate application.

- Super visas allow up to two years per visit compared to six months on a visitor visa.

- Super visa applicants must be sponsored by a Canadian citizen or permanent resident meeting income requirements.

- Super visa insurance must cover at least $100,000 for healthcare and be valid for one year.

- Visitor visa extensions allow an additional six months, offering a temporary solution.

- Planning ahead for the super visa process ensures smoother application and a better experience.

- Engaging experts like Canadian LIC eases the process of securing suitable insurance and navigating applications.

Your Feedback Is Very Important To Us

We appreciate your participation in this survey. Your feedback is essential to help us understand the challenges and improve our services. Please select the appropriate options for each question below:

Thank you for taking the time to provide your feedback. Your responses are invaluable in helping us enhance our services and support for families navigating the super visa process.

The above information is only meant to be informative. It comes from Canadian LIC’s own opinions, which can change at any time. This material is not meant to be financial or legal advice, and it should not be interpreted as such. If someone decides to act on the information on this page, Canadian LIC is not responsible for what happens. Every attempt is made to provide accurate and up-to-date information on Canadian LIC. Some of the terms, conditions, limitations, exclusions, termination, and other parts of the policies mentioned above may not be included, which may be important to the policy choice. For full details, please refer to the actual policy documents. If there is any disagreement, the language in the actual policy documents will be used. All rights reserved.

Please let us know if there is anything that should be updated, removed, or corrected from this article. Send an email to Contact@canadianlic.com or Info@canadianlic.com