When you first start planning for your child’s future, the journey ahead seems almost endless. You might ask yourself, “How long can I keep this Registered Education Savings Plan (RESP) open? Will it still be there when my child is ready, even if that readiness comes later than planned?” These are important questions for most Canadian families. Today, we will walk through the life stages of an RESP. You will get to know all the ins and outs of an RESP lifespan, giving you the power to plan confidently for your child’s educational future.

Many parents save with good intentions, but overlook how long they actually have to use the funds. Not knowing the RESP deadline can result in missed government grants or forced withdrawals. That’s why understanding the timing is just as important as contributing regularly. Let’s break down how the RESP deadline works and how you can use it to your family’s advantage.

Understanding the Basics of RESP Lifespan

RESP can be held open for a maximum of 36 years. Very flexible, and this is more than ample time for a child to make a very informed decision regarding their education. Suppose the beneficiary qualifies for the Disability Tax Credit (DTC. In that case, the plan may stay open for up to 40 years, an excellent service for families who want to take time to plan their child’s education.

But what does this mean in practical terms? Let’s break it down.

Scenario 1: The Early Planner

Meet Saba and Javed, clients of Canadian LIC. They opened an RESP for their son, Ibrahim, shortly after he was born. Sarah and John were proactive, regularly contributing to the plan and taking full advantage of the Canada Education Savings Grant (CESG). As Ibrahim grew, it became clear that he was a bright student with many interests. However, after high school, Ibrahim decided to take a gap year to travel and explore different career options.

Saba and Javed were initially worried. They wondered if this gap year would affect their RESP. Fortunately, with a 36-year lifespan for their Education Savings Plan in Canada, they had plenty of time. Ibrahim’s gap year didn’t pose any risk to their savings. When Ibrahim eventually enrolled in university two years later, the RESP was intact and ready to support his educational journey.

Scenario 2: The Unexpected Delay

Another client, Meenakshi, faced a different situation. She opened an RESP for her daughter, Lila, who had always been passionate about the arts. Lila was accepted into a prestigious art school but had to defer her enrollment due to health issues. This delay worried Maria, as she was unsure how long the RESP could remain open.

Canadian LIC assured Meenakshi that her RESP would remain active for up to 36 years. This gave Lila the time she needed to focus on her health without the added stress of losing her education savings. When Lila was ready to attend art school three years later, her RESP was still available to fund her education.

Contributions and Government Grants

Part of knowing how long an RESP can be left open involves contribution and grant limits. An RESP has a lifetime contribution limit of $ 50,000 per beneficiary. There are no annual contribution limits with an RESP. The government provides for up to a maximum of $ 7,200 per beneficiary under the Canada Education Savings Grant within an RESP.

Scenario 3: The Gradual Contributor

David, another client, opened an RESP for his granddaughter, Emma. David wasn’t able to contribute large amounts each year but made smaller, consistent contributions. Over time, these RESP contributions, along with the CESG, accumulated significantly. Emma decided to take a non-traditional educational path, enrolling in part-time courses and workshops over several years instead of attending a full-time university program.

David was concerned about whether the RESP would accommodate Emma’s unique educational timeline. Canadian LIC explained that as long as the plan was utilized within 36 years, Emma could continue to withdraw funds for her education. This flexibility allowed Emma to pursue her dreams without financial constraints.

What Happens When the RESP Matures?

RESP can mature when it reaches 36 years of age or 40 years in the case of disabled beneficiaries. On the other hand, if the beneficiary has already invested a long time in education, then grants and income can be drawn without delay. On the other side, if the beneficiary does not end up taking post-secondary education, then the plan holder has to close the RESP, and the remaining funds will be handled under some specified set of rules.

Planning Beyond the RESP Deadline: What Most Families Miss

One area that is often overlooked when managing an RESP is how to optimize withdrawals in the final years before the RESP deadline. While many families know the RESP must be closed by the 36th year (or 40th if the beneficiary qualifies for the Disability Tax Credit), very few consider a strategic “withdrawal timeline” to ensure no grant money or growth potential goes unutilized.

At Canadian LIC, we’ve found that families often face a rush to use the funds in the last 3 to 5 years before the RESP deadline. This frequently leads to large lump-sum withdrawals, triggering higher taxes for the student and reducing overall efficiency. To avoid this, we guide our clients to create a staged withdrawal plan that aligns with the student’s course load, projected educational expenses, and income levels during their studies.

A strategic approach might include front-loading Educational Assistance Payments (EAPs) during years when the student has minimal taxable income, helping minimize taxes while fully accessing government grants and investment earnings. This tailored planning, built from years of first-hand advisory experience, ensures no family leaves RESP value on the table—something often missed in generic RESP guidance.

Your RESP should not only be funded smartly—it should be withdrawn wisely, well before the RESP deadline arrives.

Scenario 4: The Non-Educational Path

One of these families, which Canadian LIC had met, represented a beneficiary not interested in higher education. His parents had been diligently saving in an RESP, but didn’t know what to do further. Canadian LIC facilitated all their options:

- Transfer to Another Beneficiary: Mark’s parents could transfer the RESP to another child or relative, ensuring the funds still supported education within the family.

- Transfer to a Registered Retirement Savings Plan: If Mark’s parents had an unused RRSP contribution room, they could transfer up to $50,000 of the RESP’s accumulated income to their RRSP without paying taxes immediately.

- Withdraw the Funds: If neither of the above options was viable, they could withdraw the funds. While the original contributions would not be taxed, the accumulated income and grants would be subject to taxes and penalties.

Flexibility and Future Planning

RESP is a flexible lifetime plan without a rigid deadline, so a family can easily plan how to save for their child with no pressure from uncontrollable external factors such as time. In fact, if a child wants to take a gap year, experiences unexpected delays or is considering taking an unconventional education, RESP can work with those changes in the plan.

Scenario 5: The Lifelong Learner

One of Canadian LIC’s clients, Linda, opened a Registered Education Savings Plan for her daughter, Sophie, who decided to pursue multiple degrees over an extended period. Sophie’s educational journey spanned over 15 years, including undergraduate, master’s, and professional degrees. Linda was able to keep the RESP open and continue withdrawing funds as needed, thanks to the 36-year limit.

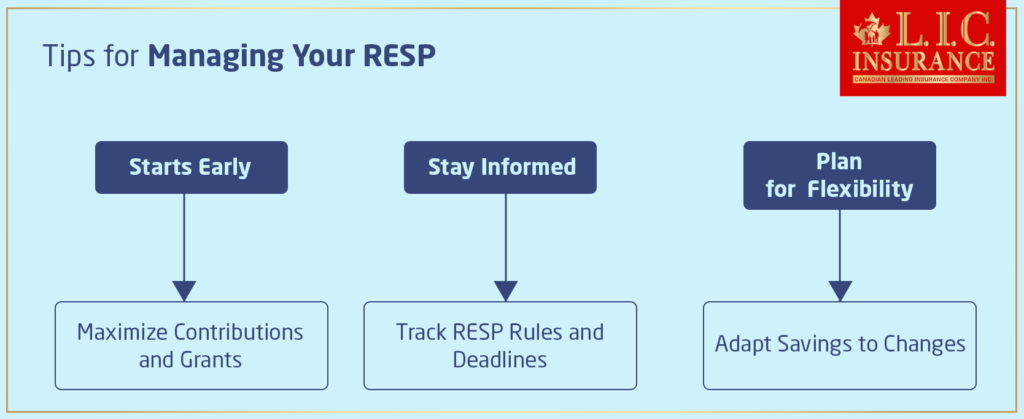

Tips for Managing Your RESP

- Start Early: The earlier you start, the more time you have to maximize contributions and government grants.

- Stay Informed: Keep track of the RESP rules and deadlines to ensure you’re making the most of your savings.

- Plan for Flexibility: Life can be unpredictable. Having a flexible financial plan ensures that your savings can adapt to changing circumstances.

Learning from Others

Canadian LIC has helped many families navigate the complexities of RESPs. Here are a few more stories that highlight the diverse situations families face:

The Career Changer

James and Lisa opened an RESP for their son, Alex, who initially pursued a degree in engineering. After two years, Alex realized his true passion was in culinary arts. This career change meant a shift in educational institutions and timelines. Canadian LIC worked with James and Lisa to ensure that Alex’s RESP continued to support his new educational path, demonstrating the plan’s flexibility.

The Mature Student

Jennifer, a single mother, saved in an RESP for her daughter, Emily. After high school, Emily decided to enter the workforce instead of attending college immediately. Ten years later, Emily chose to return to school to enhance her career prospects. The RESP remained open and available, showcasing its long-term viability for students who choose to return to education later in life.

The Bottom Line

Knowing how long an RESP can last provides relief and flexibility, further confirming that funds are there when needed, no matter how your child’s educational path pans out. RESPs are very conducive to flexibility, especially when life takes unpredictable courses or career aspirations go in a different direction; they stand solid and dynamic to meet every challenge thrown at you in life.

If you haven’t already opened an RESP or want to learn to manage them, start by contacting the Best Insurance Brokerage in Canada: Canadian LIC. With years of experience handling and an in-depth understanding of the educational planning intricacies, they understand what it takes to help you use an RESP effectively to maximize the potential of your child’s education. Don’t wait until it’s too late; the best time to start planning for your child’s future is now. Allow Canadian LIC to guide you to a secure and prosperous educational path for your child, ensuring that their dreams are comfortably within reach.

Be one of the informed and active parents choosing Canadian LIC to develop an RESP for their child’s educational needs. Your child’s academic future deserves the very best start possible.

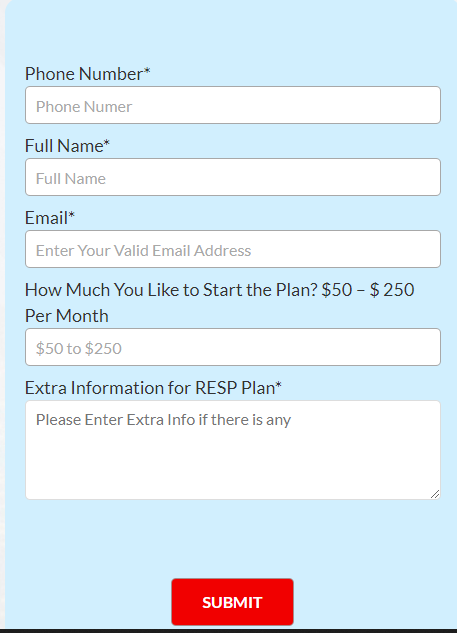

Get The Best Insurance Quote From Canadian L.I.C

Call 1 844-542-4678 to speak to our advisors.

Frequently Asked Questions (FAQs) About RESP Lifesplan

An RESP may remain open for up to 36 years after the date when it was entered into. In the case of a beneficiary who is eligible under the Disability Tax Credit, these plans may be extended up to 40 years. Canadian LIC often refers to the example of Emma, who used her RESPS later in her years to return to school. This demonstrates to many people the flexibility and long-term benefits associated with keeping an active RESP for the full term.

The RESP allows lots of time to decide. The plan may remain open for up to 36 years in order to afford an opportunity for your child during times when they are truly ready to enroll in post-secondary education. One Canadian LIC client, Thomas, appreciated the year his son finally began studying culinary arts after a few detours from an earlier-chosen career path.

Yes, certainly! If you have more than one child, the funds under the RESP can be transferred to another sibling without any kind of penalty, bearing in mind that none of the contributions are in excess of the lifetime contribution limit. For example, the oldest child in one of our Canadian LIC families decided they didn’t need to go to college, so they transferred that RESP to their younger daughter, who wanted to go to college.

If you wind up an RESP and do not subsequently transfer or roll over the payments into an RRSP, then any amount you received by way of government grants will have to be returned. In addition, the income that has accrued in the plan may also be subject to taxation and other forms of penalties. Canadian LIC once helped a family go through this process, ensuring that they were aware of all their options to lessen their loss as much as possible.

You can invest up to $50,000 for each beneficiary over the life of the RESP. Any unused grant room is carried forward, so clients, for example, Jennifer and Mark, are often urged to make extra contributions to maximize the CESG and increase their child’s education fund.

The CESG will match 20% of your annual contributions, up to $500 per year, with a lifetime limit of $7,200 per beneficiary. Canadian LIC can frequently set up a contribution schedule for our clients in order to maximize these grants. For instance, when Sara wanted to catch up on missed contributions for her daughter, we planned so she could maximize receipt of CESGS prior to age 18.

Yes, RESP funds can be used for a variety of educational programs, including full-time and part-time studies at eligible educational institutions. One of the client stories was about how a family used the RESP to go toward a special type of trade school for their child to be educated in, emphasizing the flexibility of the RESP.

The power of regular contributions over time can really help you maximize your RESP. Canadian LIC says to set up regular deposits, so you’ll make consistent progress toward that $50,000 limit. It worked for one of our clients, David, who was late in his granddaughter’s childhood when he began contributing, but was able to amass a good education fund for her.

Withdrawals made under the Educational Assistance Payments (EAPS) for education purposes are taxed at the beneficiary’s tax rate, which is usually lower during their student years. This was indeed a relief to a Canadian LIC client who could finance his son’s education with the least impact of tax, as his income level was lowered because his son is a student.

You can stop contributing if you come across any kind of financial hardship without closing the RESP. The contributions you make will continue to grow, and the grants you previously received will continue to be included in the plan. Canadian LIC has helped numerous families go through such situations and secure the educational savings of their children, even though they may be going through ups and downs in their financial position.

You can commence withdrawals—this is when they are known as Educational Assistance Payments, or EAPS—once children are enrolled in an eligible post-secondary program. Canadian LIC suggests to clients, as it would to the Nguyen family, to keep all required documentation handy, like confirmation of enrollment, as this makes it easier to withdraw money for their child’s post-secondary education and allows their children access to the funds at the time of need.

If your child receives a scholarship, congratulations! This will not impact the RESP account; you will be free to apply the RESP toward other charges not covered by the scholarship. Canadian LIC recently helped a family in which the daughter was a full tuition scholarship winner, and those living expenses and book expenses were taken out of the remaining RESP money.

Yes, you can use your RESP in countries other than Canada, but make sure the country has an eligible educational institution. This one point made a world of difference for the Patel family, clients of Canadian LIC. Even clients who have been really nervous about saving have learned to withdraw from our RESP smoothly when their daughter chose to enroll in a famous arts institution in France.

You can definitely alter the investment strategy of an RESP based on your risk tolerance and time frame until your child starts their education. Canadian LIC will often review a client’s chosen investment selection with changes in the markets and changes in education timing, as we did for the Thompsons, to ensure the investments stay aligned with the objective.

Contributions over the lifetime limit of $50,000 per beneficiary are subject to a penalty. Canadian LIC has assisted many clients in rectifying an over-contribution by having their clients withdraw the over-contributed amount and avoiding further penalties.

To maximize the grants, contribute at least $2,500 a year to receive the full Canada Education Savings Grant (CESG) top-up of $500 a year. Additional programs, like the Canada Learning Bond (CLB), provide even more grants for lower-income families. Canadian LIC worked with families like the Martins, establishing an achievable monthly investment plan that fits their budget while maximizing government grants and bonds.

Yes, any family members or even friends can contribute to an RESP. We’ve seen lots of accounts here at Canadian LIC, such as the extended Lee family, where grandparents, aunts, and uncles all come together to contribute to a child’s education fund. Applied in the proper scenario, this makes the best use of the RESP.

Choose a provider that offers choice in investment selection, low fees, and great customer service. At Canadian LIC, we assist our clients in comparing different RESP providers and focus on the provided options that match their specific needs and preferences. We did just that for the Kim family, who needed a provider that allowed frequent contributions from various family members.

Under a family RESP plan, you can have more than one beneficiary related to your name, while an individual plan is for a single beneficiary. A family plan best suits parents with more than one child, as it will be easy to keep a record of the savings in education. Canadian LIC advised the Green family to set up a family plan, which became an efficient way to manage their children’s education funds collectively.

To open an RESP, you will need the beneficiary’s SIN(Social Insurance Number) and the provider’s choice. Canadian LIC helps new customers at every step of this process, where you understand your options and the benefits involved. We helped the Carter family lay the groundwork for their child’s educational future by choosing the right plan for them and making their first contribution.

At Canadian LIC—The Best Insurance Brokerage, we understand that planning for your child’s education requires flexibility and informed decision-making. We are here to work with you through the associated complications with the Education Savings Plan in Canada, allowing you to choose wisely for your family’s future. Whether you are starting for the first time or simply want to adjust your existing plan, our team is here to offer you advice and support every step of the way.

At Canadian LIC—The Best Insurance Brokerage, we understand that planning for your child’s education requires flexibility and informed decision-making. We are here to work with you through the associated complications with the Education Savings Plan in Canada, allowing you to choose wisely for your family’s future. Whether you are starting for the first time or simply want to adjust your existing plan, our team is here to offer you advice and support every step of the way.

Sources and Further Reading

For further reading on Registered Education Savings Plans (RESPs) and to gain a deeper understanding of how they can benefit your family’s educational planning, consider exploring the following resources:

Government of Canada – RESP Information: The official site provides comprehensive details on how RESPs work, including contributions, withdrawals, and government grants. Visit the Government of Canada’s RESP page.

Canada Revenue Agency (CRA) – RESP Guide: This guide offers detailed information on RESP rules, tax implications, and scenarios. It’s a crucial resource for understanding the tax aspects of RESPs. Check out the CRA’s RESP Guide.

Canadian Securities Administrators – Investing in RESPs: Learn about choosing an RESP provider, understanding investment options, and managing risk. Read more on the Canadian Securities Administrators site.

RESP Guide by Canadian Scholarship Trust Foundation: This guide breaks down the basics of RESPs, including choosing between family and individual plans and optimizing your savings. Explore the CST’s RESP Guide.

These resources provide reliable information that can help you navigate the complexities of RESPs and make educated decisions about saving for your child’s education.

Key Takeaways

- An RESP can remain open for up to 36 years, or 40 years if the beneficiary qualifies for the Disability Tax Credit.

- RESPs allow a lifetime contribution limit of $50,000 per beneficiary, with no annual contribution limits.

- RESPs qualify for government grants like the CESG, which matches 20% of annual contributions up to $500 per year.

- Funds can be withdrawn for eligible programs under Educational Assistance Payments (EAPs), taxed at the beneficiary’s lower rate.

- If the original beneficiary does not use the RESP, it can be transferred to another eligible family member.

- Upon closure, contributions are returned tax-free, grants must be repaid, and investment gains face taxation unless rolled over into an RRSP.

- RESPs support a variety of educational paths, including vocational programs and studies abroad.

Your Feedback Is Very Important To Us

This questionnaire aims to gather insights into the practical experiences of Canadians with RESPs, focusing on understanding and managing the plan’s duration. The responses will help identify common areas of confusion and potential improvements to make the process smoother for future savers.

The above information is only meant to be informative. It comes from Canadian LIC’s own opinions, which can change at any time. This material is not meant to be financial or legal advice, and it should not be interpreted as such. If someone decides to act on the information on this page, Canadian LIC is not responsible for what happens. Every attempt is made to provide accurate and up-to-date information on Canadian LIC. Some of the terms, conditions, limitations, exclusions, termination, and other parts of the policies mentioned above may not be included, which may be important to the policy choice. For full details, please refer to the actual policy documents. If there is any disagreement, the language in the actual policy documents will be used. All rights reserved.

Please let us know if there is anything that should be updated, removed, or corrected from this article. Send an email to Contact@canadianlic.com or Info@canadianlic.com