Canada’s Registered Education Savings Plan (RESP) is an excellent tool that helps parents and guardians save for a child’s post-secondary education. But life is uncertain, and you may have to depart from Canada under certain circumstances. This blog will take a look at what happens with your RESP if you are in this boat. We’ll go over the regulations and reasons for RESPs in Canada, so you understand the repercussions of your move.

RESP outcomes depend on your Canadian tax residency status, RESP provider policies, and how the funds are ultimately used.

So, what happens to RESP if you leave Canada? This question often confuses families planning to relocate for work, study, or other long-term reasons. It’s not just about relocating—it’s about understanding how RESP tax implications and access to government grants could shift when your residency changes. Many parents also ask whether an RESP is worth it if their child studies abroad or decides not to pursue post-secondary education at all. And then comes the worry: what happens to the RESP if not used? Let’s break it all down.

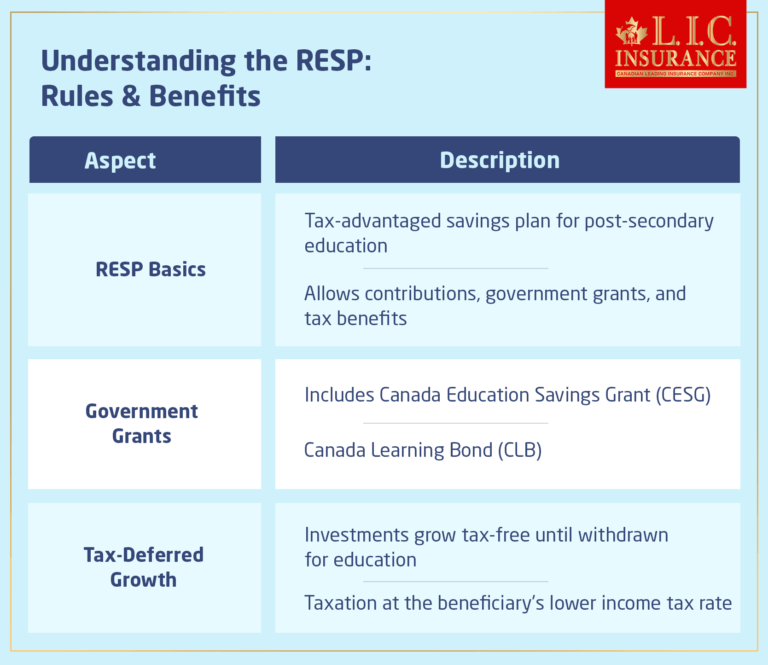

Understanding the RESP: Rules & Benefits

Before we understand what happens to your RESP when you leave Canada, we must clearly understand the RESP in Canada Rules and Benefits.

RESP Basics:

An RESP is a tax-advantaged savings plan that allows you to contribute money to fund your child’s higher education. It comes with several benefits, such as government grants and tax-deferred growth, making it an attractive option for Canadian families.

Government Grants:

One of the most significant advantages of an RESP is access to government grants, like the Canada Education Savings Grant (CESG) and the Canada Learning Bond (CLB). These grants can significantly boost your savings for your child’s education.

Tax-Deferred Growth:

RESP investments grow tax-free until the funds are withdrawn for educational purposes. This tax deferral can help your savings grow more rapidly over time.

What Happens to RESP If You Leave Canada?

Now, let’s get the answer to the most important question: What happens to your Registered Education Savings Plan (RESP) if you decide to leave Canada? This is an essential consideration, as RESP is designed to help you save for your child’s higher education within the Canadian system. The answer to this question depends on your specific situation and the type of RESP account you have.

Non-Contributory RESP:

If you have a non-contributory RESP – i.e. only government grants were paid into the account – you will typically face no consequences if you leave Canada. This RESP is mainly made up of money given by the government bonus money (e.g. Canada Education Savings Grant (CESG), Canada Learning Bond (CLB). They are designed to help your child’s educational experience for your child, no matter where you are in the world.

In a way, government grants are a gift to your child’s education fund and are not associated with where you live. While you must be a Canadian resident to receive CESG or CLB, existing grants may remain in the RESP after you leave Canada, provided the plan stays open,a nd funds are used for eligible post-secondary education. This flexibility is one of the key advantages of a non-contributory RESP.

Self-Contributory RESP:

Again, it’s a bit more complicated if you have a self-contributory RESP, that is, you didn’t just get the government grants, but you have also made contributions yourself. If you are away from Canada temporarily, you can generally keep your RESP open and still contribute to it, provided your RESP provider allows non-resident subscribers and you comply with Canadian tax residency rules. Update your RESP provider with your contact information, along with an announcement that you will be temporarily located elsewhere.

If you leave Canada permanently and become a non-resident for tax purposes, new government grants will stop. Some RESP providers may also restrict or prohibit new contributions from non-residents, even though your SIN remains valid.

Terminating the RESP:

In some cases, for example, if you move permanently outside Canada, it may be an option to close your RESP. There may be tax implications to this option, and it’s important to have a clear picture of what could happen.

When shutting down the RESP, and depending on what province you’re in, you could be on the hook to return government grants received over the years. The government usually requires repayment if the RESP beneficiary (your child) does not further his or her education after a certain duration.

Also taxed: all the growth in the RESP. These withdrawals are known as Accumulated Income Payments (AIPs) and are taxed at the subscriber’s marginal rate plus an additional penalty tax. Non-residents may also face withholding taxes. So it’s important to weigh the financial consequences of closing the RESP, and seek financial and tax advice if you do need to make that choice.

Transfer to a Family Member:

In some cases, it’s possible to transfer the RESP to a sibling or another relative within the family who is a Canadian resident. This option will empower you to keep the money you saved for your children’s education in the family and put it toward post-secondary education in Canada. It’s important to know the details of the rules and requirements for transferring them; however, as they can vary from one RESP provider to the next, depending on the situation. Transfers are subject to beneficiary age limits, relationship rules, and lifetime contribution limits, and may not preserve all government grants.

Since the future of your RESP upon leaving Canada really depends on the specifics of your RESP, the type of account you have with them, and how long you are planning to stay out of Canada. Since a non-contributory RESP, which is made up of government grants at the forefront, can be a more flexible option since you are not bound to your residency status. But temporary departures may be such that you’ll be able to keep the account for self-contributory RESPs (Registered Education Savings Plans), while permanent departures might result in limitations and possible tax consequences. Ended up reading through various comments down here. Closing the RESP is an option, but it comes with possible repayments and taxes, so you should weigh it. Transferring your RESP to a Canadian family member is another option to consider so that the educational fund continues to provide financial support to your loved ones as part of the Canadian education system. When you are confronted with these decisions, talk to financial planners or providers for your RESP to decide what is best for your RESP.

Real-World Planning: RESP Portability for Digital Nomads and Remote Workers

With the growing trend of remote work and digital nomadism, more Canadian families are spending extended periods abroad. In these situations, one important financial consideration is what happens to the RESP if you leave Canada for an indefinite time while still intending to use the savings for your child’s education. While most RESP advice focuses on permanent emigration or temporary stays, few explore the unique needs of semi-permanent global workers who maintain financial ties to Canada.

Here’s what often gets overlooked: maintaining an RESP while living abroad is entirely possible if you retain a valid Canadian SIN and maintain a Canadian tax residency status. You can continue to contribute, grow your savings, and later use those funds, even if your child decides to study internationally. Many global institutions are RESP-eligible, if they are recognized by Employment and Social Development Canada (ESDC) and meet minimum program and enrollment requirements.

However, families must be proactive in understanding RESP tax implications that may arise if they become non-residents. Contributions might still be allowed, but withdrawals—especially Accumulated Income Payments (AIP)—could face higher withholding tax rates. This complexity is why planning ahead matters.

Moreover, what happens to the RESP if not used for education? It doesn’t go to waste. You can transfer up to $50,000 of growth to your RRSP, if the RESP is at least 10 years old, the beneficiary is over 21 and not pursuing post-secondary education, and the subscriber has sufficient RRSP contribution room. So, is RESP worth it? For globally mobile families with a clear strategy, absolutely. It’s a flexible, tax-efficient tool that adapts to your life—even when that life extends beyond Canadian borders.

What to Do With an Unused RESP If Your Child Doesn’t Go to School

One of the most common concerns parents have is what to do with an RESP if their child didn’t go to school or chose a different path entirely. The good news? Unused RESP money doesn’t automatically disappear—but how it’s handled depends on the type of funds in the account.

RESP Refund of Contributions

If your child does not pursue post-secondary education, you can withdraw your original RESP contributions at any time. This is known as a RESP refund of contributions, and it is not taxable, since contributions were made with after-tax dollars.

However, when contributions are withdrawn for non-educational purposes, government grants such as the Canada Education Savings Grant (CESG) must be repaid to the government.

What to Do With Unused RESP Money

When an RESP goes unused, parents generally have three main options:

- Withdraw contributions tax-free (with grant repayment)

- Transfer the RESP to another eligible family member, such as a sibling

- Move eligible investment growth into an RRSP

RESP to RRSP Transfer (When Education Doesn’t Happen)

If the RESP has been open for at least 10 years and the beneficiary is over 21 and not pursuing post-secondary education, you may be eligible for a RESP to RRSP transfer.

Up to $50,000 of accumulated investment growth can be transferred into your RRSP without immediate tax, provided you have enough RRSP contribution room. This option can be especially valuable if you’re wondering what to do with unused RESP money and want to avoid unnecessary taxes.

RESP Tax Implications If the Plan Is Not Used

If RESP investment income is withdrawn as cash instead of transferred to an RRSP, it becomes an Accumulated Income Payment (AIP). AIPs are taxed at your marginal tax rate plus an additional penalty tax, which is why planning ahead matters.

So, what to do with an RESP if your child didn’t go to school really comes down to strategy. With the right approach, RESPs can remain useful—even when education plans change.

Wrapping It Up

So, knowing what are the rules and benefits of Registered Education Savings Plans (RESP) is essential for planning the future of your child’s education in Canada. No matter if you have a non-contributory RESP or a self-contributory RESP, knowing what to do about it when you leave Canada allows you to make the best choices for your child’s educational savings.

Now we want to hear from you:

- Stay In-The-Know: Make sure you read on RESP (Registered Education Savings Plan) rules if you are planning to move out of Canada for a short (or long-term) period.

- Talk to an Expert: If you have questions about your RESP in the context of moving outside Canada, speak to a financial advisor or RESP provider for personalized advice.

- Share Wisdom: Share the findings you have discovered with friends and family who might wish to know about them. Education is priceless; maybe you should share and help others make informed decisions about their RESPS.

- Plan Ahead: If you have plans to leave the country, plan ahead so you can make a smooth transition with your RESP and your child’s education savings.

Remember…RESPS It is a great way to safeguard your child’s future learning, and you can make it happen. RGB Thanks for reading, and best of luck as you endeavour to save for school!

Get The Best Insurance Quote From Canadian L.I.C

Call 1 844-542-4678 to speak to our advisors.

FAQs

RESP – A Registered Education Savings Plan (RESP) is an investment vehicle used by parents or guardians in Canada to save for the post-secondary education of their children. It permits contributions, government grants, and tax-deferred growth.

This is a really great question. The short answer is no, you can’t deduct your RESP contributions federally in Canada. You contribute with after-tax dollars.

Yes! RESPS can be worth it because of government grants, tax-deferred growth, flexibility and, of course, the laser focus on education savings. But whether or not they are worthwhile in your case comes down to your own financial needs and situation. Speak to a financial advisor to see if an RESP makes sense for your needs.

You will usually be able to contribute and manage your RESP without significant problems as long as you temporarily leave Canada and have a valid Canadian SIN.

You cannot receive new government grants while a non-resident, but existing CESG or CLB may remain in the RESP if the plan remains compliant and funds are used for eligible education.

If you permanently leave Canada and no longer have a valid SIN, contributing to your self-contributed funds can be difficult. It’s important to weigh the options that include transferring the RESP to a family member or closing the account.

Terminating an RESP when leaving Canada permanently may lead to the repayment of government grants and taxation of the accumulated income. The specific tax implications can vary, so consulting with a tax professional is advisable.

Yes, you can, in some cases, transfer your RESP to a sibling or other family member with Canadian residency. This alternative may help to keep the education funds in the family.

The non-contributory RESP is composed mainly of government grants and is very flexible, as the grants are not based on your residency status. Even if you move out of Canada, you can still use that money for your child’s education.

A vacation outside Canada must also be reported to your RESP provider, as you may be exposed to different tax regulations and rules. This will allow you to keep your RESP account.

Normally, there are no consequences for taking an RESP out of Canada. That said, the rules and tax consequences can differ depending on your financial situation and the type of account you have. The specifics of the rules and the tax treatment may vary depending on your situation and the RESP account you have.

Suppose you are leaving Canada and have any questions or concerns about your RESP. In that case, we strongly encourage you to speak to a financial adviser, an RESP provider, or a tax professional. They are able to offer targeted advice with respect to you.

If you are living abroad, but only temporarily, with a valid Canadian SIN number, you are generally able to continue making RESP contributions without much trouble.

RESP withdrawals are reported to the CRA by the RESP provider, even if the subscriber or beneficiary lives outside Canada.

You can withdraw money from your RESP when you leave Canada, as long as it is for your child’s post-secondary education, or if there are tax consequences.

If, on emigration, you use the RESP funds for non-educational purposes, the investment income may become taxed, and government grants and other incentives may require repayment.

There are no predetermined rules on when to use RESP funds after you leave Canada. But you do need to see that they’re spent on “qualified educational expenses” for your child to keep the grants from being taxable and becoming fodder for repayment.

RESP funds can be used for eligible post-secondary programs outside Canada if the institution meets ESDC eligibility requirements.

Say your kid goes to study in another country after you’ve departed from Canada. If so, you can still use the RESP funds to fund his education, as long as the school or training program is an eligible institution for the purpose of withdrawing contributions.

Two other options are to transfer the RESP to a family member or keep the account going and comply with the non-resident rules and regulations.

Depending on the RESP provider and the specific circumstances, it may be possible to designate a new beneficiary for your RESP, such as another child or family member.

When you return to Canada after leaving temporarily, you are generally eligible to continue contributing to and administering your RESP if you have a valid SIN. Your RESP provider can help talk you through it.

Keep in mind that the rules and regulations of RESP accounts can differ and are subject to change. Be mindful and consult with a professional if you are confronted with specific situations concerning your RESP, such as when you are moving out of or back to Canada.

The above information is only meant to be informative. It comes from Canadian LIC’s own opinions, which can change at any time. This material is not meant to be financial or legal advice, and it should not be interpreted as such. If someone decides to act on the information on this page, Canadian LIC is not responsible for what happens. Every attempt is made to provide accurate and up-to-date information on Canadian LIC. Some of the terms, conditions, limitations, exclusions, termination, and other parts of the policies mentioned above may not be included, which may be important to the policy choice. For full details, please refer to the actual policy documents. If there is any disagreement, the language in the actual policy documents will be used. All rights reserved.

Please let us know if there is anything that should be updated, removed, or corrected from this article. Send an email to Contact@canadianlic.com or Info@canadianlic.com