Canadians have a smart way to save for their financial future: the Registered Retirement Savings Plan (RRSP). It provides some opportunity to have a comfortable and secure retirement by deferring a portion of your income to a tax-benefited account. But here’s the thing: The more you contribute, the rosier your retirement future looks.

But there’s more to the picture of how much to spend on RRSP contributions compared to just contributing; there are some limits in play. The contribution limit was 18% of your pre-tax income, to a maximum of $30,780, in 2023. It should be noted that the number is subject to change, and you should check with the Canada Revenue Agency (CRA) website for up-to-date details. Also, if you’re a member of a pension or deferred profit-sharing plan, your contribution room could vary.

The good news is, if you can’t afford to or if you opt not to contribute in a given year, your contribution room doesn’t disappear. It rolls over so you can catch up when your finances allow.

In the case of your retirement security, there is no time better than the present to begin.

In this blog, we learn about Unused RRSP Contributions, which can really siphon off into your financial future. We’re going to get you up to speed on this concept, the RRSP contribution limit, and we’ll also walk you through how to make the most of your RRSP.

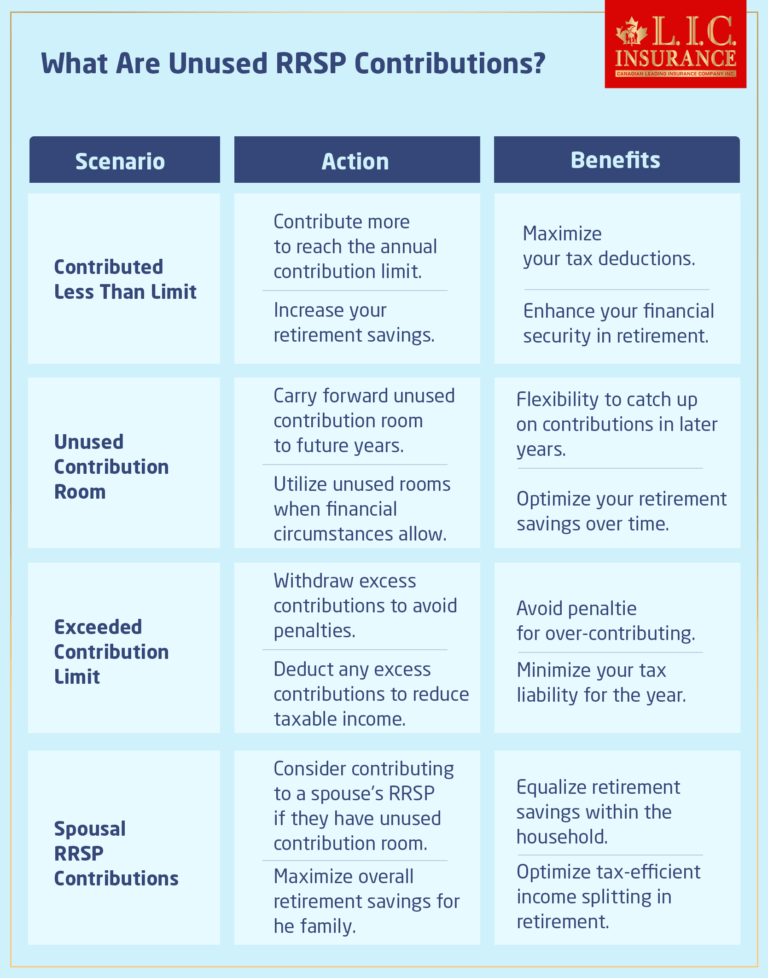

What Are Unused RRSP Contributions?

Unused RRSP (Registered Retirement Savings Plan) contributions’ mean you have contributed to your or your spouse or common-law partner’s RRSP, PRPP (Pooled Registered Pension Plan), or SPP (Specified Pension Plan) and haven’t claimed a deduction for those contributions. You made these contributions after 1990 and did not deduct them on your past income tax and benefit returns or ask us to apply them to Home Buyers’ Plan (HBP) or Lifelong Learning Plan (LLP) repayments.

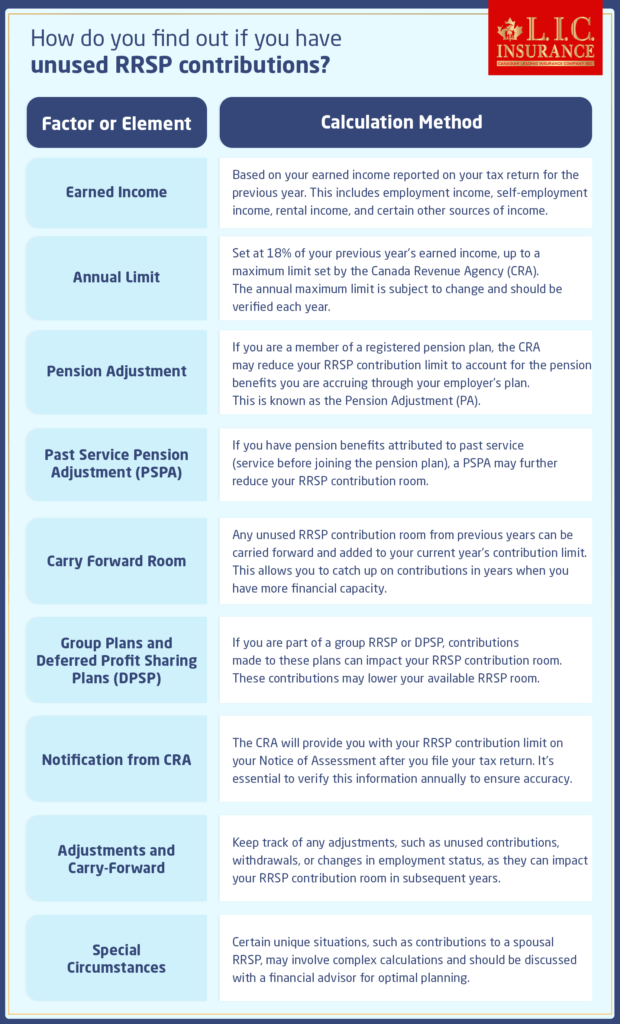

Understanding the RRSP Contribution Limit

If you want to manage your RRSP well, you need to know your RRSP contribution limit. This limit is the most that you can contribute to your RRSP for that tax year. It’s based on your earned income and can be located on your most recent notice of assessment or notice of reassessment — this will be the form with the RRSP Deduction Limit Statement that you’ve received from the Canada Revenue Agency if you’ve contributed to an RRSP. Form T1028, “Your RRSP Information for YEAR” is another document to look for this information.

The Hidden Impact of Unclaimed RRSP Contributions on Your Long-Term Planning

While most people focus on their annual RRSP deposits, very few consider the deeper implications of what is unused RRSP contributions in their portfolio. If you’re wondering why do I have unused RRSP contributions, you’re not alone—many Canadians unintentionally leave valuable deduction room on the table due to career changes, parental leave, or periods of lower income. These unclaimed RRSP contributions may seem minor at first, but over time, they can represent a significant pool of tax-sheltered investment opportunity.

What makes this even more strategic is the flexibility built into the system. How long can you carry forward unused RRSP contributions? The good news is—indefinitely. As long as you remain eligible for RRSP participation, that unused room doesn’t expire. This opens up unique opportunities for higher-income years ahead, when maximizing deductions can lead to substantial tax savings.

So, what are unused RRSP contributions really worth to you? Think beyond the immediate tax season. With careful planning, they can be your secret weapon for smoothing out taxable income spikes and optimizing your retirement funds. Ignoring them may mean leaving long-term financial benefits unrealized. Integrating these figures into your annual review can help you make smarter, data-driven decisions and eliminate the guessing game around contribution strategies.

How do you find out if you have unused RRSP contributions?

Understanding the Significance of RRSP Contributions

So, before learning how to recognize unused RRSP contributions, let’s first determine why they are relevant. RRSP contributions are the foundation of your retirement savings plan. They provide tax advantages and the opportunity for investment growth, and they are a key tool for planning your financial future.

Begin With Your Notice of Assessment:

Determine if You Have Unused RRSP Contributions It is quite an easy task to figure out if you have RRSP contribution room or not. Start by looking at your last Notice of Assessment from the Canada Revenue Agency (CRA). This form, which arrives after you’ve filed your tax return, includes a bundle of information. It will disclose your RRSP contributions for the prior year and the contribution room you have left.

How to log in to your CRA account online:

And, for those who favour online convenience, the CRA offers a website that will allow you to receive your financial information online. If this is your first visit, you’ll need to click the link and register. You can log in through a CRA username and password or use your bank as a sign-in partner, if you prefer.

Go to Section “RRSP and TFSA”

Once you have logged in to your CRA account, you’ll find the section under “RRSP and TFSA.” This is the area that gets you all the information that you need for your RRSP needs.

Click on the “RRSP” Link:

In the “RRSP and TFSA” area, find the “RRSP” link and click on it. This action will bring you to the page with your RRSP information (and contribution specifics).

Find “Unused RRSP Contributions”:

While you’re going through all that RRSP information, look for the line where it says: “Unused RRSP contributions available to deduct for is $XXX.” XX.” This is the line that gives you the magic number of your remaining RRSP money that can be used to lower your tax bill.

Maximize Your RRSP:

Find out whether you have RRSP contribution room that you can contribute to is a crucial part of maximizing your retirement savings plan. With these contributions, you can maximize your RRSP’s earning power and enjoy peace of mind knowing your financial future is in good hands.

Contact our team now for personalized RRSP quotes and professional advice tailored to your specific financial aspirations and needs. We are here to support you through this, and your financial health is our highest priority.

After all, when it comes to dreams about retirement, it all starts with having a clear picture of what you may achieve through your RRSP contributions. So let’s take this financial journey together and secure the future you deserve.

Dealing with Unused Contributions

If you determine you don’t want to deduct all your RRSP, PRPP or SPP contributions you made in the year, you have a few choices:

Complete Schedule 7: If you’re not claiming all of the contributions, you can complete Schedule 7 “RRSP, PRPP and SPP contributions and transfers and HBP and LLP activities.” This list includes contributions made to your RRSP, PRPP, SPP, or your spouse’s or common-law partner’s RRSP or SPP. Fill it in for gifts dated March 2, 2023-February 29, 2024. If you are filing a paper return, attach a completed Schedule 7 to your income tax return. If you’re filing online, retain Schedule 7 in case the CRA (Canada Revenue Agency) asks to see it.

If You Have Already Filed Your Return: If you have already filed your income tax and benefit return, you can still act on unused contributions. Complete Schedule 7 and Form T1-ADJ (T1 Adjustment Request) and mail them to your tax center. Please ensure that you send us copies of receipts to support your contributions, showing your name and social insurance number.

Two Choices for Unused Contributions: Your unused contributions can be left in the plan or taken out. Remember, you could potentially owe tax if you contribute beyond your RRSP deduction limit. This tax hits whether or not you took the withdrawal under the Home Buyers’ Plan (HBP) or Lifelong Learning Plan (LLP).

Withdrawing Unused Contributions: If you do not plan to use all of your contributions, you need to withdraw them and include them in your income on your income tax and benefit return. But it’s potentially possible to deduct an amount equal to the contributions you withdrew. See the section on requesting the return of unused contributions in this publication for details.

Concluding Words

Unused RRSP contributions mean a lot to your future finances. It is important to know one’s own RRSP contribution limit and how to deal with the “leftover” contribution room in your RRSP account, as it plays a major role in planning for your retirement. Hopefully, this blog has given you some clarity on what Unused RRSP Contributions are in Canada, and you’re a little bit more confident navigating your financial journey.

At Canadian LIC, it’s part of our jobs to offer Insurance professionals advice resources so they can make smart and educated choices towards a safe and financially satisfying future. Need RRSP quotes and advice that is tailored to you? Give our specialized insurance experts a call. Our first concern is your financial health.

Get The Best Insurance Quote From Canadian L.I.C

Call 1 844-542-4678 to speak to our advisors.

FAQ's

RRSP contributions are funds that individuals contribute to their Registered Retirement Savings Plan. They are essential for building a financial cushion for retirement, as they offer tax benefits and the potential for long-term growth through investments.

Unused RRSP contributions are the amounts you’ve contributed to your RRSP, PRPP, or SPP or on behalf of your spouse or common-law partner, but have not claimed as deductions on your previous tax returns. These contributions were made after 1990 and were not designated for HBP or LLP repayments.

You can find your RRSP contribution limit on your latest notice of assessment or notice of reassessment, which includes the RRSP Deduction Limit Statement. Form T1028, “Your RRSP Information for YEAR,” also provides this information.

If you haven’t deducted all your RRSP, PRPP, or SPP contributions made in a tax year, you can fill out Schedule 7, which is used for reporting unused contributions. This is important for managing your unused contributions effectively.

Yes, you can. If you’ve already filed your income tax and benefit return and wish to address unused contributions, complete Schedule 7 and submit it along with a Form T1-ADJ (T1 Adjustment Request) to your tax center. Include copies of your contribution receipts with your name and social insurance number.

If you exceed your RRSP deduction limit, you may be required to pay tax on the excess contributions. This tax liability applies even if you withdrew the contribution under the Home Buyers’ Plan (HBP) or Lifelong Learning Plan (LLP).

You must include unused contributions as income on your income tax and benefit return to withdraw them. However, you may have the option to deduct an amount equal to the withdrawn contributions. The official CRA website provides Detailed guidelines for withdrawing unused contributions.

Absolutely! At Canadian LIC, our dedicated team of insurance professionals is here to provide expert guidance on RRSP contributions and all your insurance needs. We’re committed to helping you make smart choices for a secure and prosperous future.

The deadline for making RRSP contributions for a specific tax year is usually March 1 of the following year. However, if March 1 falls on a weekend or holiday, the deadline is extended to the next business day.

Yes, you can carry forward unused RRSP contributions to future years. The contribution room accumulates over time, allowing you to catch up on contributions in years when your financial situation allows for it.

Yes, contributing beyond your RRSP contribution limit can result in penalties. You may have to pay a 1% per month tax on the excess contributions that exceed $2,000. It’s important to monitor your RRSP contributions to avoid penalties.

Deducting RRSP contributions on your tax return reduces your taxable income for the year in which the deduction is claimed. This can result in a lower tax bill and potentially lead to a tax refund.

While RRSP contributions are primarily intended for retirement savings, you can use them for specific financial goals, such as buying your first home through the Home Buyers’ Plan (HBP) or funding your education through the Lifelong Learning Plan (LLP).

Determining the ideal RRSP contribution amount depends on various factors, including your income, financial goals, and retirement plans. It’s advised to consult a financial advisor or use online tools to assess your specific needs and contribution limits.

Yes, you can contribute to your RRSP even if you have a workplace pension plan. However, your pension contributions may affect your RRSP contribution room, so it’s essential to consider both when planning your retirement savings strategy.

There are no specific limits on withdrawing unused contributions from your RRSP. However, it’s crucial to be aware of the potential tax implications and consult with a tax professional to understand the best approach for your financial situation.

Yes, you can transfer unused RRSP contributions to your spouse’s or common-law partner’s RRSP, provided they have contribution room available. This may be of assistance to you as you plan your household’s retirement savings strategy.

Keep in mind that RRSP regulations can shift from year to year so, it is important that you stay up to date and informed and consult financial professionals for individual advice regarding your RRSP contributions and your future financial security.

The above information is only meant to be informative. It comes from Canadian LIC’s own opinions, which can change at any time. This material is not meant to be financial or legal advice, and it should not be interpreted as such. If someone decides to act on the information on this page, Canadian LIC is not responsible for what happens. Every attempt is made to provide accurate and up-to-date information on Canadian LIC. Some of the terms, conditions, limitations, exclusions, termination, and other parts of the policies mentioned above may not be included, which may be important to the policy choice. For full details, please refer to the actual policy documents. If there is any disagreement, the language in the actual policy documents will be used. All rights reserved.

Please let us know if there is anything that should be updated, removed, or corrected from this article. Send an email to Contact@canadianlic.com or Info@canadianlic.com