When it comes to financial planning, many of us think about saving for retirement, buying a home, or securing funds for our children’s education. Rarely do we stop to consider the implications of how long our Life Insurance Coverage will last. In Canada, understanding the lifespan of a Whole Life Insurance Policy isn’t just about preparing for the unexpected—it’s about ensuring lifelong stability and peace of mind.

35-year-old graphic designer Sheena, thought Life Insurance was only for older people. But then she received a wake-up call when a close friend endured financial distress after an unexpected death of the friend’s family member. She understood the need to establish a financial safety net for the rest of her life rather than a limited term. This made her ponder about Canadian Whole Life Insurance Benefits, and several questions started popping up in her mind, the most important being, “When does Whole Life Insurance end?”

If you, like Sheena, have ever wondered how long Whole Life Insurance lasts, you’ve come to the right place. From what Whole Life Insurance actually provides, to why it is essential in any long-term financial strategy, this blog will touch on in-depth for what Whole Life Insurance is, how it contrarily ranges from other insurance policies, and why you should include I in your long-term financial strategy Let us look into the lifelong security provided by a Whole Life Insurance Policy and how it relates to your life’s milestones.

Let's Find Out the Essentials of Whole Life Insurance

What is Whole Life Insurance?

A Whole Life Policy in Canada is structured to provide you with lifetime protection from the time the policy starts until the time that you pass away, provided that you pay the premiums. Unlike Term Insurance which covers one for a certain period, Whole Life Insurance does not expire at an age—it continues to give you peace of mind no matter how long you live.

The Lifespan of Whole Life Insurance

Does Whole Life Insurance Really Last for Life?

The short answer is yes. Whole Life Insurance is intended to last throughout the insured’s lifetime. Guaranteed lifetime protection is one of the things that people look for and appreciate with Whole Life Insurance as opposed to term coverage. For instance, take the story of John, a retired teacher in Ontario. When he was 30, he bought his Whole Life Insurance Policy to secure a financial future for his family, regardless of whatever might happen. Now, at 75, John enjoys his retirement, knowing for sure that his family will be financially secure after he is gone, all because he took the initiative so many years ago.

Benefits of Lifelong Coverage

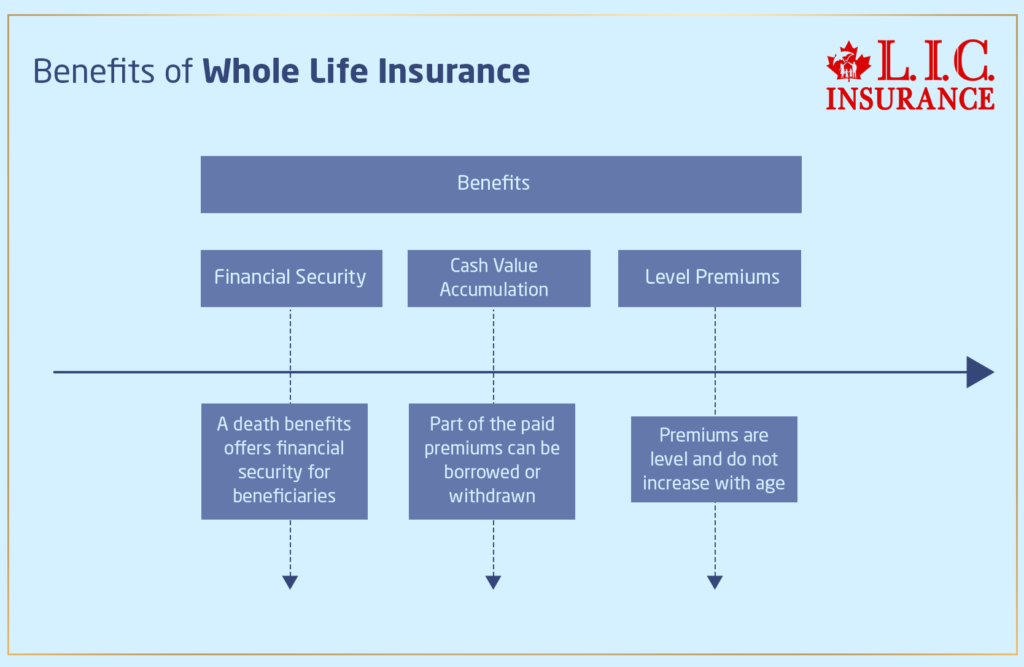

- Financial Security: A death benefit offers financial security and takes care of beneficiaries’ needs.

- Cash Value Accumulation: Part of the paid premiums can be borrowed or withdrawn, giving you financial options in life.

- Level Premiums: Premiums on Whole Life Insurance are level, meaning they do not increase as you age. This helps one to budget appropriately and saves them the cost burden of increasing insurance premiums as the age advances.

Canadian Whole Life Insurance Benefits

In Canada, Whole Life Insurance offers much more than coverage; it also comes with other benefits that can greatly influence your financial planning strategy.

Tax Advantages: Canadian law means the cash value increase in your Whole Life Policy grows on a tax-deferred basis so that you don’t pay any taxes on the gain until you withdraw it. In addition, the death benefit, which goes to your beneficiaries, is generally passed in a tax-free manner, providing them the full financial benefit you have set aside for them.

Estate Planning: When planning an estate, Whole Life Insurance can be helpful if the beneficiaries are not the insured’s estate. This way, the loved ones can get an inheritance tax-free and maybe even avoid bankruptcy, which makes things easier for them.

Lisa's Story- The Impact of Whole Life Insurance

Lisa is a small business owner in Vancouver. Motivated to buy a Whole Life Policy, she wanted to provide for her family in case of her death, and she wanted her business to have less hassle than it did when she was alive. It was possible for her because her policy had cash value that could be used to borrow money for business needs when the economy was weak.

Wrapping It Up

Whole Life Insurance is that solid piece of your financial planning tools; this combination is what grants you lifetime coverage, cash value debt, and a significant tax benefit. By reading through the different stories we told, whether it was about Sheena’s epiphany or John’s long-term happiness, it was clear that this policy meet a diverse range of different needs and stages in life.

If you have considered securing a Whole Life Insurance Policy, then now is the most optimal time to do it in Canada. In fact, as soon as you sign the policy document, your peace of mind and benefits begin. All that is on your doorstep is the top insurance broker of Canada LIC, who will guide you through the process of understanding your options and getting you the best possible policy that suits your financial landscape. With advice literally a phone call away, step in that direction now — toward securing tomorrow and tomorrow’s smiles for you and your loved ones. Do get in touch with Canadian LIC at +1 416 543 9000 and take the first step to an all-encompassing, lifelong financial peace of mind.

Find Out: The 2 Disadvantages of Whole Life Insurance

Find Out: How many years do you have to pay on a Whole Life Insurance Policy?

Get The Best Insurance Quote From Canadian L.I.C

Call 1 844-542-4678 to speak to our advisors.

FAQs on Canadian Whole Life Insurance

No, Whole Life Insurance does not expire as long as you keep paying your premiums. It provides lifetime coverage, which means your policy stays active until your death, and your beneficiaries will receive the guaranteed death benefit whenever that happens.

Whole Life Insurance is a type of permanent life insurance that offers coverage for your entire lifetime. It combines a death benefit with a cash value component that grows over time. The policy guarantees fixed premiums, lifelong protection, and access to cash savings if needed.

Most insurance companies in Canada have an age limit for applying, typically between 75 and 85 years old. Once you’re approved, there’s no age limit for coverage—your policy remains in force for life as long as you keep up with the premium payments.

No, Whole Life Insurance premiums do not increase with age. Once your policy is issued, your premium stays the same for life. This makes it a predictable and stable option compared to other types of life insurance, where premiums can rise over time.

One of the most defining Canadian Whole Life Insurance Benefits is the lifelong protection it gives. It will not expire as Term Insurance will at the end of a specified term. Another big benefit is the accumulation of cash value, which is a tool of finance for life. For example, Clara’s story is from Edmonton. When that time arrived, she borrowed against the cash value of her policy to finance her daughter’s university education—all the while remaining on track financially for herself. This story emphasizes that cash value is not just a safety net but also a flexible financial resource if you want to know the differences between Term Life Insurance and Whole Life Insurance in detail.

This means that, as the individual pays the premium, the cash value in a Whole Life Insurance Policy keeps on growing. A portion of every premium made goes towards building this cash value, which the insurance company then invests. The sum then grows, usually at a guaranteed minimum rate, and matures to become an asset from which you can draw if you desire.

Consider, for example, the case of Raj, a software developer from Ottawa who found himself in need of some urgent cash when he was suddenly forced to replace his house’s roof. By drawing upon the cash value of his Whole Life Insurance Policy, he was effectively saved from taking a high-interest loan. It is this application of the cash value that can make this a workable solution in times of need.

Yes, most insurers are quite open to Whole Life Insurance policies. You can adjust your coverage and even add riders to enhance your policy. After her first child was born, Naomi in Winnipeg increased her coverage to make sure her growing family’s future was even more secure. Really, this is the magic of a Whole Life Policy. You can adapt it to your ever-changing life.

The premiums for this kind of Life Insurance are normally fixed and don’t go up with the advancing years of life. They are good for long-term budgeting. Consider Harold, a retired banker in Halifax, who is happy to know how much he has to save for premiums each year and doesn’t have to worry about the increases in the future. The predictability assures one of stable budgeting even during the retirement stage.

If you surrender your entire Life Insurance, you receive the cash surrender value, which is your cash value minus any charges and any outstanding loans. But again, look at Maria’s experience: after consulting with her advisor, she found it more worthwhile to borrow against the policy than to surrender, as this retained her coverage, and she was able to still meet her immediate financial needs.

Whole Life Insurance policies offer permanent coverage and have a cash value component. This sets them apart from Term Life Insurance Policies, which provide Life Insurance coverage for a fixed term and do not have a cash value. Now, Whole Life Insurance will be compared with long-term security and financial flexibility. Thomas, for instance, who lives in Toronto, realized that although the up-front expenses were more compared to a term policy, it was more comprehensive for what he wanted because of lifelong coverage and financial benefits such as a tax-preferred cash value.

Of course! When it comes to estate planning, Whole Life Insurance is very helpful because it has a fixed death benefit that can be used to take care of your heirs and lower your estate tax. Take Alice from Quebec City, who used hers to ensure that her estate was able to handle taxes without putting the burden on her children, hence being able to preserve more of what she built.

There are several tax advantages in a Whole Life Policy underwritten in Canada. First, the growth of the cash value in your policy is tax-deferred, so you will not have to pay taxes on the gains each year. Second, the death benefit to your beneficiaries is typically tax-free.

For instance, Susan from Vancouver leveraged the tax advantages of her Whole Life Policy to stretch her retirement savings as far as possible and also to bequeath a huge amount of wealth to her family. A tax-free death benefit from the policy ensured that the inheritance of her children was going to be so much larger, with no heavy tax repercussions.

There are a few Canadian Whole Life Insurance Policies with the participation feature, by which they may receive dividends from the performance of the insurance company. The dividends can take additional coverage, reduce the premium, or occasionally can be withdrawn in cash.

A teacher in Saskatoon, Liam chose a participating Whole Life Insurance Policy and used the dividends to slowly increase his policy’s death benefit. This did not only increase his policy coverage over time but also boosted his cash value, therefore giving him more financial options as his needs grew.

Yes, Whole Life Insurance can be a useful way to plan charitable giving. Putting a charity down as a beneficiary of the insurance policy means that you can leave a gift behind that you might not otherwise have been able to save for.

For example, when Emily lived in Toronto, she used her Whole Life Insurance Policy to support her favourite charity, and that made such a difference to her, knowing that her legacy would live on with the support of the cause dear to her heart.

Borrowing against your Whole Life Insurance cash value is usually pretty easy. You request a loan from your insurer, and your policy’s cash value secures the amount you borrow. Interest rates on these loans are generally lower than on conventional loans, and there is no mandatory repayment schedule.

Sam, an entrepreneur in Montreal, needed swift capital to finance an immediate buyout of a business partner. He accessed the required funds by borrowing against the cash value in his Whole Life Insurance Policy, which allowed him to handle the situation without pressure for external finance on his business needs.

When naming the beneficiaries, consider the person you want to benefit and their financial needs and circumstances. You can name more than one beneficiary and set the share of the benefit that each of them will receive. Calgary’s Nora made her three children beneficiaries, but the shares were distributed disproportionately, with the largest share going to the youngest son, who has special needs. This demonstrates wise planning for the safeguarding of future care needs for her son.

Whole Life Insurance supplements other retirement plans by permitting a tax-free cash flow through loans or withdrawals, which can be applied to retirement without impacting government benefits. For example, there is Derek, who is retired in Ottawa. He uses the cash value of his Whole Life Policy to withdraw money for retirement income. This way, he is able to maintain his living without touching other retirement plans.

Estate tax issues can be managed with Whole Life Insurance as a strategy for providing the necessary funds to pay off any estate liabilities at death. This way, the value of the estate is preserved for the beneficiaries. When someone dies, the money from their Whole Life Insurance Policy goes straight to their beneficiaries. Often, the money can be set up so that the costs of probate are not needed. Example: George is a real estate investor in Halifax. George has a large estate and would like to make sure there are no major tax ramifications for his beneficiaries. He can use his Whole Life Policy to make sure his estate taxes will be covered without having to liquidate his real estate quickly. This planning allows his family to make more thoughtful decisions regarding the estate.

Yes, it is possible to own more than one Whole Life Insurance Policy. Your financial plan might include things like family protection, funding a business agreement, or collateral for a loan. For example, Sophia is a business owner in Quebec City who has two Whole Life Insurance policies. One policy is taken to protect the family; the second is part of a buy-sell agreement with her business partner. Such an arrangement is good for both her business and personal financial needs.

If you should die, the cash value that is left over in your Whole Life Policy typically becomes part of the death benefit that is paid out to the beneficiaries you name. In the process, the total amount your beneficiaries receive is increased. Example: When one of Toronto’s most beloved teachers, Anita, passed away, her Whole Life Insurance Policy included the addition of her cash value accumulation, besides the normal death benefit. This went further to benefit her family at that very moment when they most needed some extra money. The excess money was paid for the last expenses of Anita and bequeathed to her children with a financial legacy.

Choose the right amount of coverage with respect to your current responsibilities, future needs, and desired financial objectives to achieve for your dependents. Consider the debts you want to pay off and what your family might require in terms of income replacement, the cost of raising and educating children, and any future financial obligations. Example: Consider Tom, who is a resident of Edmonton. Tom sat down with a financial advisor for his review in order to decide the proper level of coverage. Together, they added up his mortgage, projected college costs for his two kids, and calculated the replacement income needed for his spouse to make sure that the Whole Life Policy he went with would fit right in terms of long-term financial security.

There is no “right” age to purchase a Whole Life Insurance Policy; it all depends on a person’s particular financial conditions and goals. Generally, purchasing at a young age means lower premiums and a buildup of cash value over a much higher amount of time. Consider, for instance, Lisa, a young professional who lives in Vancouver. Early in her thirties, she acquired a Whole Life Insurance Policy. Her rate of premium was set lower since she started early, and she began to create cash value from a tender age—two of the factors that create tremendous financial flexibility later in life.

As long as you continue paying the premiums, your Whole Life Insurance Policy will remain in force. Some even offer the option of paying premiums with accumulated cash value, saving the policy from lapsing if the insured encounters hard financial times. Meet Victor from Montreal. He had money issues for a brief period. He was able to maintain his insurance through the tough times by continuing to pay the premiums using the cash value in his policy. This provided him with some important breathing room (make sure you’re always covered).

Do the situations sound familiar when it comes to your life circumstances, or do they bring new considerations to your Whole Life Insurance Financial Planning? If these concepts are of interest to you, and you would like to see how they could align with your financial plan, take a few moments more to research what this powerful tool can do in your life. So, Contact Us Today to maximise your earning potential from a Whole Life Insurance Policy in the best way possible.

Sources and Further Reading

Here are some suggested sources and further reading materials to deepen your understanding of Whole Life Insurance policies in Canada:

Insurance Bureau of Canada – Provides comprehensive resources on various insurance types including Whole Life Insurance and its benefits in Canada.

Website: www.ibc.ca

Financial Consumer Agency of Canada (FCAC) – Offers information on Life Insurance options and financial planning.

Website: www.canada.ca/en/financial-consumer-agency/

Canadian Life and Health Insurance Association (CLHIA) – Offers detailed guides and comparative studies on Life Insurance products, including whole life policies.

Website: www.clhia.ca

Investopedia – Provides educational articles on the basics of Whole Life Insurance and how it compares to other insurance products.

Article: “What Is Whole Life Insurance?”

Link: Investopedia – Whole Life Insurance

NerdWallet – Discusses the pros and cons of Whole Life Insurance and offers advice on choosing the right policy for your needs.

Article: “Whole Life Insurance: How It Works”

Link: NerdWallet – Whole Life Insurance

Forbes Advisor – Features articles on financial planning and insurance, including expert advice on Whole Life Insurance policies.

Article: “Best Whole Life Insurance Policies”

Link: Forbes Advisor – Whole Life Insurance

These resources will provide you with a wealth of information to understand the intricacies of Whole Life Insurance, its benefits, and its lifelong applicability in the Canadian context. They can also serve as a reference for your readers who wish to explore this topic further.

Key Takeaways

- Whole Life Insurance in Canada covers the insured for their entire life, provided premiums are paid.

- The policy provides a financial safety net for beneficiaries after the insured's death.

- It includes a cash value component that grows over time, accessible through loans or withdrawals.

- Premiums are generally fixed, aiding in long-term financial planning and budgeting.

- Growth of cash value is tax-deferred, and death benefits are typically tax-free.

- The policy can be used in broader financial strategies like estate planning and retirement funding.

- It can efficiently support estate planning by covering estate taxes and preserving wealth.

- Policyholders can access funds for emergencies, investments, or retirement.

Your Feedback Is Very Important To Us

The above information is only meant to be informative. It comes from Canadian LIC’s own opinions, which can change at any time. This material is not meant to be financial or legal advice, and it should not be interpreted as such. If someone decides to act on the information on this page, Canadian LIC is not responsible for what happens. Every attempt is made to provide accurate and up-to-date information on Canadian LIC. Some of the terms, conditions, limitations, exclusions, termination, and other parts of the policies mentioned above may not be included, which may be important to the policy choice. For full details, please refer to the actual policy documents. If there is any disagreement, the language in the actual policy documents will be used. All rights reserved.

Please let us know if there is anything that should be updated, removed, or corrected from this article. Send an email to Contact@canadianlic.com or Info@canadianlic.com