- Travel Medical Insurance Plans: Choose the Perfect One for Your Trip

- Understanding the Need for Travel Medical Insurance

- Why You Need Travel Medical Insurance With Canadian LIC

- The Complexity of Travel Medical Insurance Plans

- Travel Medical Insurance Coverage Explained: What Canadians Need To Know In 2026

- Canadian LIC’s Comparative Approach

- Personalized Recommendations

- The Convenience of Online Access

- Real-Life Testimonials

- Making Your Travel Worry-Free

- Customization for Your Unique Needs

- The Freedom of Choice: Multiple Insurance Providers

- The Benefits of Choosing Canadian LIC Put Together

- Conclusion: Empowering Your Travel Experience

SUMMARY

This blog explains how travel insurance costs in Canada vary in 2026 and why comparing coverage matters more than just price. It breaks down average travel insurance costs, medical coverage needs, trip risks, and factors like age, destination, and activities. It guides Canadians on comparing travel insurance providers, finding low-cost and best-value plans, and choosing reliable medical travel insurance that protects against emergencies, trip disruptions, and unexpected expenses.

Introduction

Preparing for a trip can be an exciting but also intimidating process, and one essential item that many people tend to forget on their travel checklist is Travel Medical Insurance. As a Canadian lifestyle investment company, Canada’s leading insurance brokerage, we know the importance of being healthy and secure wherever you travel. This post details how Canadian LIC compares Travel Medical Insurance plans –it will empower you to understand and to make a conscious choice– and to travel with peace of mind.

No matter whether you are travelling to a new country or visiting your relatives abroad, a good Travel Health Insurance Canada Plan helps you in providing coverage against the sudden medical expenses that may arise.

With the cost of health care increasing around the world, the purchase of Travel Medical Insurance is no longer an option—it’s a necessity. In 2026, rising global healthcare inflation and higher emergency treatment costs have made adequate travel medical coverage essential, especially for travel outside Canada and to the United States. Whether you need emergency care or hospitalization, the right coverage allows you to focus on your trip without sudden financial pressure.

Understanding the Need for Travel Medical Insurance

Why You Need Travel Medical Insurance With Canadian LIC

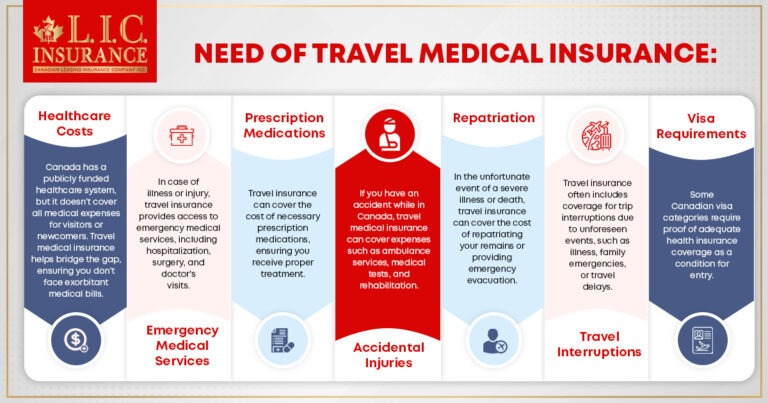

For Canadian travellers, the security of having provincial healthcare coverage can be comforting. But in 2026, provincial plans reimburse little to no out-of-country medical costs, meaning emergency treatment abroad can result in significant out-of-pocket expenses.

Emergency medical evacuation, repatriation, and early return home are generally not covered by provincial healthcare plans, which makes Travel Medical Insurance critical. Travel Medical Insurance fills these gaps by covering medical emergencies, hospitalization, and evacuation while travelling.

Canadian LIC – Your Trusted Insurance Advisor

Canadian LIC has earned a reputation as a trusted insurance advisor, offering expert guidance and a wide range of insurance solutions. With a commitment to customer satisfaction, Canadian LIC stands out in helping you navigate the complex world of insurance, including Travel Medical Insurance.

The Complexity of Travel Medical Insurance Plans

Choosing a suitable Travel Medical Insurance plan can be challenging due to the variety of coverage limits, exclusions, stability clauses, deductibles, and premiums. In 2026, many insurers will also apply stricter stability periods for pre-existing conditions, making it important to review policy wording carefully.

Travel Medical Insurance Coverage Explained: What Canadians Need To Know In 2026

Travel medical insurance is designed to protect travellers from unexpected healthcare expenses while outside their home province or country. In simple terms, Medical Travel Insurance ensures you are not financially exposed if you require treatment due to illness or injury during a trip.

Many Canadians confuse Travel Insurance and Medical Insurance, but the distinction matters. Travel Insurance medical benefits focus specifically on emergency healthcare costs, while non-medical Travel Insurance may cover trip cancellation or baggage issues. A complete policy often combines both, which is why travellers frequently look for Travel Insurance to cover medical expenses when comparing plans.

For those travelling abroad, Medical Travel Insurance international coverage is essential. Healthcare systems outside Canada often require upfront payment, making Emergency Medical Travel Insurance a critical safeguard against high hospital and evacuation costs.

Canadian travellers should also understand that Canada Medical Travel Insurance and Medical Travel Insurance Canada plans are structured differently depending on destination, age, and health history. Seniors, in particular, benefit from policies specifically designed as Medical Travel Insurance for seniors, which account for age-related risks and higher medical expenses.

Travellers with health concerns should pay close attention to pre-existing medical conditions for Travel Insurance. In 2026, most insurers apply medical stability clauses, meaning coverage depends on whether a condition has remained stable for a defined period before travel.

When selecting coverage, look for policies clearly labelled as Travel Medical Insurance, Travel Insurance medical, or medical for Travel Insurance, ensuring emergency treatment, hospitalization, and evacuation benefits are included. Choosing the right medical coverage allows travellers to focus on their journey instead of worrying about unexpected healthcare costs.

Addressing the Hidden Gap: What Most Travellers Overlook About Local Health Regulations Abroad

Most Travel Medical Insurance shoppers pay attention to coverage limits, premiums, and exclusions when comparing plans; however, it is equally important to pay attention to how your local health care regulations work with your coverage plan. At Canadian LIC, we have found that most travellers are not aware that even the top-rated Travel Health Insurance Canada plans may experience hold-ups in processing or claims rejection if the insurer is not accustomed to the unique reporting practices of local medical facilities worldwide.

But, for example, in some parts of Southeast Asia or South America, some hospitals require upfront payment, regardless of insurance. If you do not follow local reporting processes or provide required documentation in the right format, these claims may only be reimbursed later on, sometimes weeks after your return. Canadian LIC actively informs its customers on these subtleties to assist when comparing policies; it’s advice is over and above just trying to sell a policy. We also have a real-time database of known country-specific medical compliance requirements, allowing you to avoid delays and increase claim acceptance.

This kind of real-life information is invaluable to consumers when making their choices, which in reality also helps raise-travellers not only select a Travel Medical Insurance plan from a good-looking piece of paper, but one that works well in practice, no matter where your travels may take you.

Canadian LIC’s Comparative Approach

Canadian LIC simplifies the process of selecting the right Travel Medical Insurance plan by offering a comparative approach. Their experts thoroughly review multiple insurance plans from reputable providers, considering factors such as:

- Coverage Limits: Canadian LIC evaluates the maximum coverage offered by different plans, ensuring it meets your needs.

- Premiums: They analyze premium costs to find an option that fits your budget.

- Coverage Details: Canadian LIC examines the specifics of coverage, including emergency medical treatment, hospitalization, prescription drugs, and more.

- Exclusions: They highlight policy exclusions and limitations to prevent unexpected surprises during your trip.

- Additional Benefits: Canadian LIC identifies plans with additional benefits, such as coverage for trip cancellations, delays, or lost baggage.

This comparative process reflects 2026 underwriting practices and insurer-specific medical coverage rules.

Personalized Recommendations

Canadian LIC considers travel destination, duration, activities, age, and medical stability requirements that apply under 2026 insurer guidelines, including eligibility rules for pre-existing conditions. They consider your travel destination, duration, activities, and any pre-existing medical conditions to tailor their suggestions to your unique requirements. Whether you’re embarking on a relaxing beach vacation, a daring adventure, or visiting family abroad, Canadian LIC ensures you have the right level of coverage.

The Convenience of Online Access

Canadian LIC’s user-friendly online platform allows you to compare Travel Medical Insurance plans at your convenience. You can access quotes, policy details, and expert recommendations from the comfort of your home, saving you time and effort.

Real-Life Testimonials

Real-life testimonials from satisfied travellers highlight Canadian LIC’s commitment to excellence. These stories demonstrate how Canadian LIC helped travellers during challenging situations abroad, showcasing their dedication to providing reliable insurance solutions.

Making Your Travel Worry-Free

Canadian LIC’s thorough comparative approach ensures you choose the most suitable Medical Travel Insurance plan for your trip. By addressing potential concerns and risks in advance, you can embark on your journey with peace of mind, knowing that you are adequately protected.

Customization for Your Unique Needs

Every traveller is different and has different requirements, wants and circumstances. At Life Insurance Canada, we understand that individuals and work to present insurance quotes that allow the policy to be tailored for what you need it for.

This is how Canadian LIC supports customization:

- Personalized Coverage: Canadian LIC will consider your personal travel needs. This comprises destination, travel duration, plans, age, and any known conditions. They leverage this data to suggest plans that can then be customized to your individual situation.

- Coverage Amendments: Canadian LIC can assist you in modifying the level of coverage limits you wish to hold in different areas based on your needs, including medical costs, return home coverage, and lost/disrupted trip coverage. This will also help you make sure your plan correlates with your expectations.

- Optional benefits: Some policies have optional benefits or riders that you can add for increased protection. Canadian LIC allows you to investigate these alternatives and choose the best that suits your travel itinerary.

- Deductibles and Co-Pays: In 2026, higher deductibles are commonly used to reduce premiums, particularly for senior travellers.

- Budget-friendly alternatives: In case you can’t afford the life insurance coverage, Canadian LIC will suggest cost-effective alternatives that fulfil your basic insurance requirements without breaking your bank.

- Pre-existing conditions: Coverage for pre-existing conditions is subject to medical stability clauses, which vary by insurer in 2026.

- Family/Group Coverage: Canadian LIC considers families or groups’ particular requirements of Travel Insurance coverage, and offers plans that cover all individuals with good protection.

The inclusion of Customize means Travel Medical Insurance is personalized for you! This amount of personalization means that you have peace of mind while you travel because your coverage is the exact match for you.

The Freedom of Choice: Multiple Insurance Providers

Canadian LIC works with multiple insurance carriers. In 2026, coverage availability, medical limits, and stability definitions vary significantly by provider, making comparison essential.

Here’s why it’s beneficial to have several insurance companies on your side:

- Many to choose from: There are different policies with different benefit plans offered by insurers. The beauty of finding many providers is that you can shop around.

- Competition: Competition between insurance companies can result in more competitive pricing and value for travellers. Canadian LIC is allowed to encourage plans with more favourable conditions through the use of this competition.

- Reputation of the Provider: The service of one may not be of the same level as that of other insurance companies. Canadian LIC may also suggest plans from reputed insurers, who have a history of quality service.

- Niche Coverage: There are some insurance companies that specialize in a particular type of coverage to appeal to a niche market. Canadian LIC can also help you to apply for quotes from providers who have cover specifically tailored to suit your travel plans.

- Coverage Availability: The availability of coverage may vary by provider. Canadian LIC ensures that you get plans that protect you where you need it most, particularly if that will be through remote or unexplored territories.

The ability to choose between different insurance companies also means that you are not limited to only one insurance company’s customers. This flexibility helps to provide the most competitive fares for whichever plan best suits your travel needs.

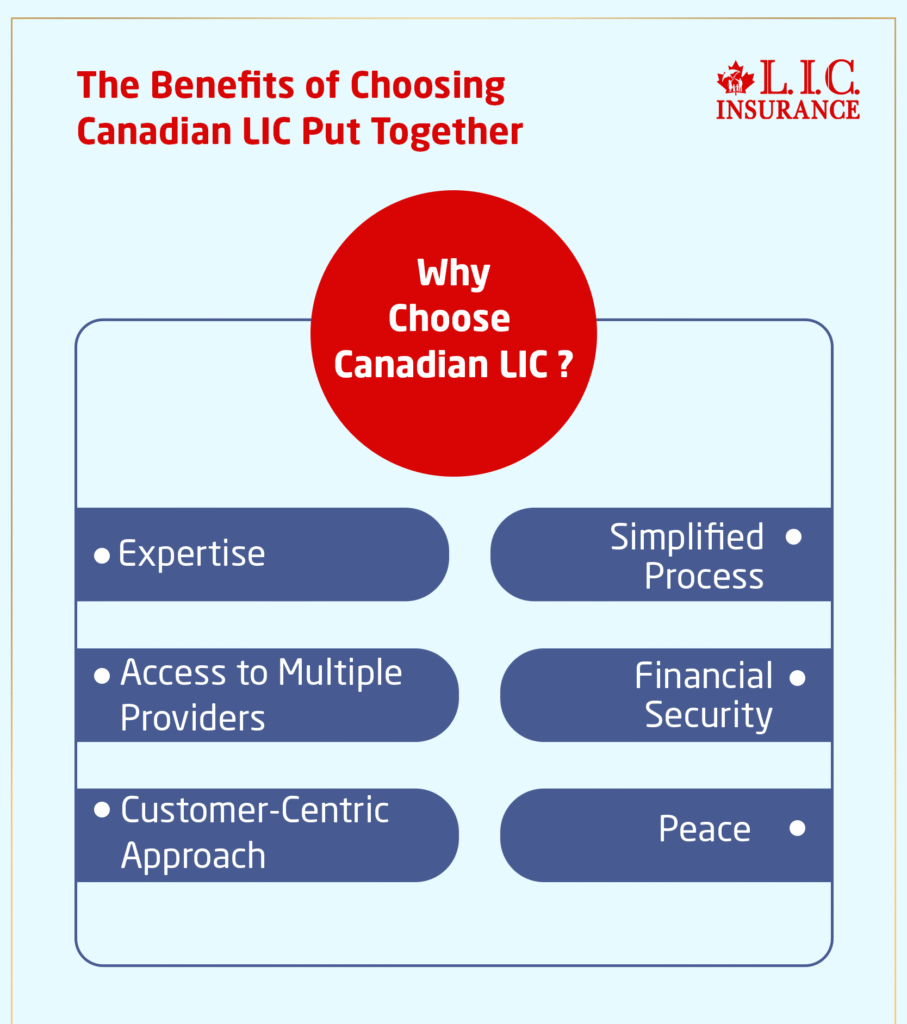

The Benefits of Choosing Canadian LIC Put Together

Gets travel medical insurance via Canadian LIC has a number of important benefits, that makes it an easy and beneficial process:

- Experience: The staff at the Canadian LIC is made up of experienced insurance professionals ready to provide you with the ins and outs of Travel Medical Insurance. They know how all the insurances work, they can help you get good advice.

- Multiple Providers: Canadian LIC can connect you with a wide range of insurance companies. This means that the organization can provide you with different types of insurance, that way you can choose what is right for you.

- Customer Focus: Canadian LIC is truly customer-oriented. Then they spend time listening to what, how and where you are planning to travel, making it available to you insurance that is tailored to you because they have taken time to get to know you.

- Easy Process: Insurance can be overwhelming to understand. Leave everything to Canadian LIC we explain things clearly, help out with the paperwork, and make sure you get through the process with ease.

- Financial Support: Canadian LIC's travel insurance offers financial support while during your travels. It covers medical bills, emergency evacuations, trip interruptions and more so unexpected expenses don’t ruin your travel plans.

- Peace: Probably the greatest advantage is the peace of mind of knowing that you are covered. As you fly with Assured Futures, you can travel reassured, safe in the knowledge that you are covered in the event of the unexpected by Canadian LIC.

Canadian LIC assists travellers in navigating 2026 policy structures, medical underwriting requirements, and claim procedures, helping ensure coverage functions effectively when needed.

Conclusion: Empowering Your Travel Experience

The right Travel Medical Insurance Plan selection is one of the most crucial ingredients toward a worry-free and relaxing travel experience. In 2026, increased medical costs, stricter underwriting rules, and limited provincial coverage make Travel Medical Insurance a necessity, not a luxury. With our dedication to our customers and our expertise and experience in insurance, Canadian LIC is a name you can trust for all your Canadian travel insurance needs. Their method of comparing Travel Medical Insurance plans is all about making it easy for you to make decisions that work with your individual needs, wants, and budget.

With support from Canadian LIC, you can be confident you’re getting protection from a licensed Canadian Travel Insurer. The choice in plan options, the transparency in pricing and the level of attention available to you allow you to create a Travel Medical Insurance plan that meets your needs. Before your next adventure, keep in mind the value of Travel Medical Insurance and be sure to contact Canadian LIC, your trusted provider, to locate your best travel coverage.

Get The Best Insurance Quote From Canadian L.I.C

Call 1 844-542-4678 to speak to our advisors.

The above information is only meant to be informative. It comes from Canadian LIC’s own opinions, which can change at any time. This material is not meant to be financial or legal advice, and it should not be interpreted as such. If someone decides to act on the information on this page, Canadian LIC is not responsible for what happens. Every attempt is made to provide accurate and up-to-date information on Canadian LIC. Some of the terms, conditions, limitations, exclusions, termination, and other parts of the policies mentioned above may not be included, which may be important to the policy choice. For full details, please refer to the actual policy documents. If there is any disagreement, the language in the actual policy documents will be used. All rights reserved.

Please let us know if there is anything that should be updated, removed, or corrected from this article. Send an email to Contact@canadianlic.com or Info@canadianlic.com