- Is Visitor Insurance The Same As Travel Insurance?

- Visitor Insurance Vs. Travel Insurance: What’s The Difference?

- Coverage Details And Why They Matter

- Differences Between Visitor Insurance And Travel Insurance

- Similarities Between Visitor Insurance And Travel Insurance

- Special Considerations for UK Travellers: What You May Not Realize

- Visitor Health Insurance Plans: Importance And Considerations

- Choosing The Right Plan

- Making an Informed Decision

- The Final Verdict

At last the day that you have been anticipated has come, the day of your dream trip to Canada. From the bustling streets of Toronto to the Rockies’ summits, you’re good to go- you’ve ticked them all of with visitor visas and a few carefully-scheduled flights. So as you cross and double-check the list of things to travel with, this thought begins to haunt you: “But do I have the right insurance for the trip?” That has a lot of travelers a little confused: Does Visitor Insurance mean Travel Insurance? This has led to confusion and at times even cases of stress, such as being underinsured in the face of a medical emergency or losing money on an unexpected cancelation of a trip.

This question is even more crucial if you are planning your visit from the UK. A lot of travellers who are shopping around for visitor insurance for Canada from UK believe that it operates much like standard travel insurance however, this is not always the case. Confusing the two can result in an extra cost and some tense moments. Knowing what protection you actually need to have in place will ensure that your Canadian trip is secured in the best possible way, from beginning to end.

This blog will eliminate this confusion and enable you to make an educated decision regarding proper insurance that you should have to your trip to travels within Canada. We will also hear some real examples of travelers who faced problems at the time of unwanted incidents, and the distinctions as well as similarities between Visitor Insurance and Travel Insurance, and more importantly why one must be absolutely clear about them. Well, once you have finished reading my blog you will have all the information you need to get a Visitor Insurance Quote, you will know how important is the Visitor Health Insurance Plan and you will have done all you can to make sure your visit is safe and enjoyable!

Visitor Insurance vs. Travel Insurance: What's the Difference?

Understanding the Basics

But before we can do that, we need to define those terms. Visitor Insurance or Visitor Health Insurance covers your cost due to ill health during the time you are traveling to Canada. This is supposed to cover your actual medical costs, that you will need if you fall ill or are in an accident (according to the policy), which you obviously won’t be expecting whilst you’re on the road. Travel Insurance is the general name for the umbrella of coverage for medical events while traveling, but also can include coverage for cancelled trips, lost baggage, and many other forms of coverage.

This UK tourist learned it the hard way: he thought his Travel Insurance was going to make sure that he will be covered medically, but then an emergency situation arose during his visit to Montreal. A few years ago, however, after a skiing accident, he found out that he had to confront massive medical bills because his policy didn’t cover medical expenses, only the loss of items on the trip and the delay. So the moral is to buy a Visitor Insurance Quote of your price range but with full medical coverage.

Coverage Details and Why They Matter

Medical Expenses in Visitor Insurance

When you look for a Visitor Insurance Quote, you will look at the plans designed to indemnify you against high healthcare costs in Canada. Normally, those plans provide hospitalisation and emergency medical care; sometimes, they include dental emergencies, too. Understanding the scope of these plans is crucial for any traveller, especially if you have pre-existing conditions.

Travel Insurance: Beyond Medical Care

Travel Insurance may include medical coverage, though very often, it is aimed more at the logistics of travelling. This may include such things as coverage for flights or lost baggage, and trip interruption. These features are great for dealing with the bumps in your travelling journey, but they’re no replacement for medical coverage.

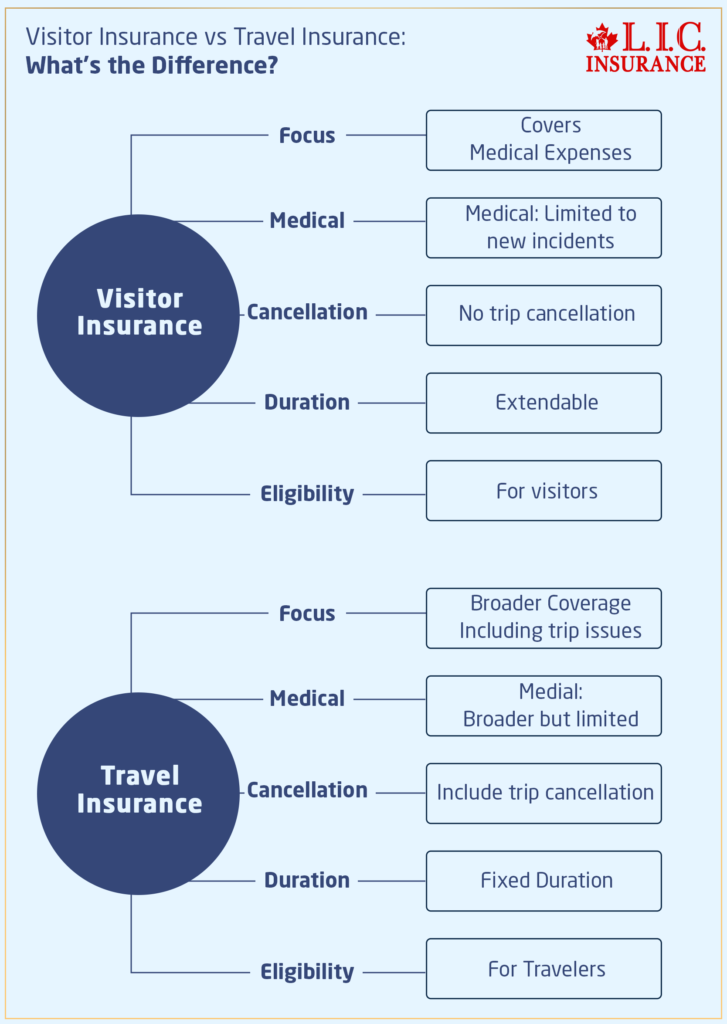

Differences between Visitor Insurance and Travel Insurance

| Feature | Visitor Insurance | Travel Insurance |

|---|---|---|

| Primary Focus | Covers medical expenses during your stay. | Broader Optional coverage, including trip cancellation, baggage loss, and travel delays. |

| Coverage for Medical Expenses | Primarily provides coverage for new illnesses and accidents | May include limited medical coverage; the focus is not solely on medical expenses. |

| Trip Cancellation | Generally, it does not include trip cancellation benefits. | Often includes trip cancellation, interruption, and delays. |

| Duration of Coverage | Can be purchased for the duration of the stay, from a few days to a year, extendable in some cases. | Typically covers the exact duration of the trip, usually not extendable |

| Eligibility | Available to visitors, including tourists, students, and temporary workers. | More suited for residents and citizens planning to travel abroad. |

| Pre-existing Conditions | Some plans cover acute onset of pre-existing conditions. | Coverage for pre-existing conditions is less common and usually limited. |

| PPO Network | PPO NetOften includes access to a PPO network, offering lower rates at specific hospitals and clinics. | Does not usually include a PPO network; claims are often reimbursement-based. |

| Availability | Can be purchased before or after arrival in Canada. | Must be purchased before departure. |

| Refund Policy | Refund policies may vary, with some flexibility before or after the policy start date. | Generally offers a “free look” period but is non-refundable once the trip begins. |

| Suitable For | Designed for medical emergencies during visits to Canada. | Designed to cover a range of travel-related issues, from logistics to minor medical needs. |

Similarities between Visitor Insurance and Travel Insurance

| Aspect | Visitor Insurance | Travel Insurance |

|---|---|---|

| Purpose | Designed to provide financial protection during travel. | Designed to provide financial protection during travel. |

| Coverage for Medical Emergencies | Often includes emergency medical expenses. | Often includes emergency medical expenses. |

| Available to Foreign Visitors | Yes, designed for individuals visiting from abroad. | Yes, also available for foreign visitors and often for residents too. |

| Can Cover Short Trips | Yes, suitable for short visits and can be adjusted based on trip length. | Yes, typically covers the trip duration, suitable for short trips as well. |

| Regulatory Compliance | Helps comply with visa and country entry requirements regarding health insurance | Helps comply with travel requirements and visa regulations in some cases. |

| Pre-purchase Requirement | Best purchased before traveling to ensure coverage from arrival. | Best purchased before departure to ensure coverage starts with the trip. |

| Coverage Extension | Some plans allow for extension if the visit is prolonged. | Some plans may allow for extension under certain circumstances. |

| Protection Level | Provides a safety net against unforeseen health issues during the stay. | Provides a safety net against various unforeseen travel and health issues. |

| Plan Flexibility | Offers various options tailored to the length of stay and health needs. | Offers a range of plans tailored to travel needs and trip duration. |

| Claim Process | Typically involves submitting evidence of expenses for reimbursement. | Also involves claims submission for covered expenses and losses. |

Special Considerations for UK Travellers: What You May Not Realize

When getting visitor insurance for Canada from UK, there is something you may neglect: the way UK travel insurance products are designed and what they cover might not reflect the healthcare situation in Canada. “The U.K. has got the NHS, so you can get off the plane and there’s someone there to help you, but with Canada, you don’t get free health care as a visitor, not even for standard medical and emergency services.”

We’ve worked with many UK clients who thought that their current travel insurance already automatically had enough emergency medical coverage for Canada as part of its coverage. In reality, those policies often have maximums that are much lower than what an emergency room visit in Canada might actually cost. ” A day at the hospital in Canada can be over $5000, and even just a non-critical appointment can cost $400-800 without insurance.

Another is something that’s all about UK travellers – the different terminology and structure of insurance. What’s sold as “comprehensive” travel coverage in the U.K. might favor trip delays and cancellations over high-limit medical protection. This is why you need more than the insurance companies you know from home, and instead, consider Canada-specific plans that give you emergency medical coverage, pre-existing condition coverage, and the ability to create a quote and plan based on your vacation plans.

So, if you are planning your Indian adventure, do not forget to compare visitor health insurance for Canada in uk from reliable canadian insurance brokers, who know your exclusive cross-border risks better than anyone. It’s a small gesture that could save you thousands, not to mention stress, when you travel.

Visitor Health Insurance Plans: Importance and Considerations

Why It’s Essential

Now, let’s consider another traveller, Maria from Brazil, who really had no interest in health insurance for visitors. She was involved in planning only her trip’s adventure parts. A sudden illness left her stranded in a Canadian hospital, facing not only health challenges but also a financial dilemma. Her story is a perfect reminder of why Visitor Health Insurance is indispensable.

Get The Best Insurance Quote From Canadian L.I.C

Call 1 844-542-4678 to speak to our advisors.

Choosing the Right Plan

Visitors looking for the right Visitors Medical Insurance Plan do not just look at it as ticking off any box, but rather as securing their peace of mind while exploring Canada. We shall look at some of these key factors which you should consider in making your choice so that you get what best suits your traveling needs, after all the right plan acts as your financial shield against unexpected medical expenses.

Length of Stay: Tailoring Coverage to Your Travel Timeline

What is more, the visitor’s insurance should be for the exact same period of stay. The insurance that you purchase should be for the whole length of your stay, whether you are just popping over to take a few pics on your digital camera by Niagara Falls or you are staying for a good while on Vancouver Island enjoying the huge diversity in British Columbia. Take the example of Angela, whose guest stay of three months was bought to save on cost for only two months. Now, the sad part about the tale is that Angela became ill shortly after the policy lapsed, and she was retested with heavier medical bills with no assistance at all from her expired policy. Don’t make Angela’s mistake. Coverage is available up to 364 days, and if coverage is purchased for 364 days and there is a renewal, coverage may be renewed for up to 2 years.

Coverage Limits: Ensuring Adequate Protection

So, coordinating medical care in the Canadian healthcare system can be very costly, particularly if you are a visitor. This is why the availability of a plan with coverage limits is crucial. With those restrictions, you can view the amount the insurance company cut a check for on your medical care. Consider the case of Tom, the man who skied himself into a jam on the slopes of Whistler. He had some minor surgery, and he was in the hospital for a couple of days, and then poof. The bill lost its mind and was well over thirty grand in no time. Tom was fortunate in this respect, having purchased a plan with a high coverage limit. He didn’t have to think about all the medicals and bills hanging over his head, stacking higher and higher on over him. Always remember to compare Visitor Insurance Quotes before choosing your plan, and Financial protection is provided up to a certain limit. In health care, after all, you often want more coverage than you think you will need.

Pre-existing Conditions: Special Considerations for Your Health History

The cover for pre-existing medical conditions with acute onset is one of the things that you may not take lightly. That would be an important contingency, because ordinary health woes could take a turn for the worse when staying overseas. Consider Sarita, for example, a woman who had had well-controlled high blood pressure. One of her experiences of onset high blood pressure was when she was in Toronto, and that incident had her in a pretty severe state where she required immediate medical help. She received help without financial heartache – thanks to her insurance policy which did, in fact, cover sudden onset of preexisting. Then you would do well to read the fine print, and check that, indeed, your insurance covers emergency situations involving pre-existing conditions. That way, you won’t be caught off guard.

So now that you know all that, it’s about figuring out how to use that information. Begin by making a list of your particular requirements: the length of your trip, the probable level of medical expenses, and, eventually, any pre-existing conditions. Actively Compare no health insurance visitor plans. An finally, because of any doubt or personal advice you can fill free to personally consult insurance experts to help to be free of all suspicion. And don’t forget: the right visitors insurance plan not only helps fulfill a legal requirement but also provides you with a cushion, so you can fully enjoy the fruits of your Canadian adventure, without any doubts or fears.

Knowing and taking adequate measures on these key issues shall ensure that you are not caught in the dark and are fully equipped to make an Informed decision on Visitor Health Insurance policy that will not only benefit you but will go beyond catering to your needs. Prepare to travel with complete confidence in Canada and full protection.

Making an Informed Decision

Comparing Quotes

Comparing quotes for visitors’ insurance is fairly easy, as some websites are dedicated to that, and the same insurance policy can be found from different insurers. Look for transparent pricing and clear information on what is being covered and what is not.

Consulting with Experts

If you are still confused about the kind of insurance you will need, you might be best advised to talk to a duly licensed insurance broker. They give advice tailored to individual travel needs and health requirements.

The Final Verdict

There you have it, folks, I’ve discussed in numerous ways throughout this blog the contrast between visitors insurance and Travel Insurance, both of which provide very distinct and pertinent roles in your travels. When you select the best visitors insurance, you protect your health and also financial stability when you are in Canada. Don’t risk your life over lower prices or popular misconceptions.

Talk to a Canadian LIC team member to assist you in obtaining your visitor visa and visitor visa insurance. Get the right coverage and it’s one more peace bringer, along with Canada’s stunning landscapes and vibrant cultures. After all, the right insurance is not just a requirement; but a necessary part of your travel planning.

Protect your trip to Canada with the best insurance policy ever – Get a quote now! Insure Yourself, Your Family, and Your Finances Against Surprises. Get the best insurance for yourself before you validate the country with your presence. Join the ranks of the smart travellers who dare to be intrepid, and yet safe. Purchase Visitor to Canada Insurance now and start your adventure to Canada!

Get The Best Insurance Quote From Canadian L.I.C

Call 1 844-542-4678 to speak to our advisors.

FAQs About Visitor Health Insurance

Draw the coverage boundary in chalk. Go for a relatively high limit, remember the bubbly cost of health care in Canada; it may be expensive. Put yourself in Carlos’s shoes, who went with a low limit only because he felt like saving cash. But as a result of a biking accident in Vancouver, Carlos found himself facing hospital bills that far exceeded his coverage limit, and he had to pay thousands of dollars out of pocket. To avoid Carlos’ predicament, consider projected medical expenses for your activities and health issues. As a general rule, I think it’s best to choose a limit that makes you feel safe (and sound) (and salty) under the worst-case scenario.

Some policies are available for purchase after arrival, but it’s a better idea to have your insurance affairs in order prior to your trip. Observe, for example, Lisa, who traveled to Canada and then figured she’d be able to buy visitors insurance when she arrived. But, frankly, in the past 24 hours, it was really hard work looking for a good plan, and clearly, there were not many options. Book your insurance before you leave and make sure it’s taking effect from day one of your trip, therefore preventing you from an immediacy in any health issue or emergencies.

If you have a pre-existing condition, find a plan that covers acute onset of a pre-existing condition. Alex, a diabetic traveller could pick a plan that was an actual emergency one, based on his condition. It’s a good thing, then, that predicting a Lyme infection while strapped into a child seat is no longer the same as knowing you need to see a doctor after a lifelong dream jaunt with friends to Quebec turned into an urgent care visit with five days of antibiotics. Be honest about your health condition when you ask for a quote so that you are protected, and double check the pre existing health condition clause.

A small number of Visitor Insurance plan(s) do include some additional tap-on benefits such as dental coverage or repatriation, but these are rarely utilized and only serve as supplementary to actual medical emergencies. Janet had a dental-coverage policy, for example, so when she needed an emergency extraction while sitting in Ottawa, the policy covered it. These extras could really save your life, so try to think about which additional protections would be necessary during your travels.

Travel Insurance versus Visitor Insurance for Canada The insurances are different, travel insurance insurance gives a complete range of coverage such as lost of luggage, trip cancellations, delays in travel and so on where as visitor insurace gives coverage for their actual stay in the Canada One such example is Mark and Emily whose Travel Insurance saved them when Calgary flight was cancelled at last hour. Also, when Mark was hurt skiing and had to go to the hospital, the visitor’s insurance took care of all the bills that came during the hospital stay. Knowing the difference will allow you to pick the one that’s best for you.

Most visitors’ insurance offer the possibility of an extension, which is important in case your travel period is prolonged. Michael learned it hard: he had to extend his stay for some legal reason, but had no insurance for an extra month. To avoid such issues, check if your chosen plan allows extensions and under what conditions you can renew your policy.

That’s great you’ll never have to use your visitors insurance, but remember that if you do, then the trip wasn’t clean or healthy! Consider it something of a safety net. Neha for one flew from India to Toronto and by God’s grace never had to see a hospital where she would have made use of her insurance. “For me, it was a small price to pay for that peace of mind when I am travelling,” says Neha, who treated her unused insurance in the same vein. Remember, insurance is designed to protect against risks, not serve as a pre-payment for services you want to take advantage of.

Current visitors insurance plans in general also cover the health of a person with COVID-19 to the same amounts that they would provide coverage for any other health care plan. For instance, when Simon became infected during a business trip to Montreal, he also had to be hospitalized. At least he could ease some of the financial strain of his treatment; his visitors’ insurance thus paid his hospitalization bills. To ensure that you’re covered for Covid-19, check that pandemics are included in your new insurance plan.

It is individualized coverage, meaning each guest will have to have his or her own coverage plan. It had turned out to be really useful when the Lee family from South Korea visited Canada, and their youngest daughter required pediatric care out of the blue — all of them had purchased a plan tailored to their health, so it was not an issue. Shopping as individuals guarantees that individuals’ unique medical needs are what get covered.

Filing a claim may seem like a hassle, but with a clearly defined plan it’s relatively simple. Take the example of Roberto’s ski accident which required him to visit a Calgary emergency facility. And so he rang the helpline from his insurance company and followed the instructions of how to do how a claim, submit hospital bills, and a medical report, etc. Overall, you will need to report to your insurance company as soon as you can and maintain all receipts and doctor reports. As a rule of thumb, report the accident to your insurer as quickly as possible, and retain every receipt and all related medical paperwork, along with a completed claim form (which includes information about the incident and your injuries).

Coverage for adventure sports is not standard and varies widely among insurance plans. Jenna’s experience is the kind of cautionary tale; she assumed her visitor’s insurance would pay her medical bills after her rock climbing accident, but in fact, her plan specifically didn’t cover high-risk activities. Look specifically for plans that include adventure sports if you look forward to engaging in such sports, or otherwise purchase an additional cover for it.

So it needs to be an insurance company that will be investigated and verified in its legitimacy. Read reviews, verify their licensing in Canada, and turn to online chat rooms or local contacts for advice. Thomas, who is often abroad on work, has this piece of advice: Give the insurance company a call and clear your doubts. Also, you see the speed and the clarity with which they fall, which means good customer support.

Our aim is that by responding to these FAQs in simple, applicable recommendations and real-life stories, you grow with the correct information to decide how to pick and apply to your visitor medical insurance. You want only good to be your memories of so mental these travel insurance, and where you hit they may perhaps focus.

Sources and Further Reading

For those looking to deepen their understanding of visitor and Travel Insurance in Canada, the following sources and further reading suggestions provide comprehensive information and insights into selecting the best insurance plan for your needs:

Government of Canada – Travel Insurance

The official Canadian government website offers essential advice on Travel Insurance, including what to look for in a policy and how to understand the various types of coverage available.

Canadian Life and Health Insurance Association (CLHIA) – Guide to Travel Health Insurance

This guide by CLHIA is an invaluable resource for understanding the specifics of travel health insurance, including tips on what to consider before purchasing and how to make a claim.

CLHIA Guide to Travel Insurance

Insurance Bureau of Canada

The Insurance Bureau of Canada provides insights into the insurance market, including detailed explanations of personal insurance policies like visitor and Travel Insurance.

Canadian Immigration Blog

This blog covers a wide range of topics relevant to visitors to Canada, including detailed articles on why Visitor Insurance is necessary and how to choose the right policy.

Canadian Immigration Blog – Insurance Tips

Travel Insurance Review

An independent resource that offers reviews and comparisons of different Travel Insurance plans available to Canadians and visitors to Canada.

Travel Insurance Review – Canada

Canadian Consumer Handbook – Travel Insurance Tips

Provided by the Canadian government, this handbook offers practical advice on Travel Insurance, helping consumers make informed decisions.

These sources will equip you with the necessary tools to navigate the complexities of insurance for your travels in Canada, ensuring you are well-protected throughout your journey. Whether you are researching for a future trip or looking to understand the intricacies of insurance products, these resources provide a robust foundation for making informed insurance decisions.

Key Takeaways

- Visitor Insurance primarily covers medical expenses, while Travel Insurance includes broader aspects like trip cancellations and baggage loss.

- Choose a coverage limit that securely covers potential healthcare costs in Canada, considering the worst-case scenarios.

- For those with pre-existing conditions, ensure the plan includes coverage for acute onsets to avoid high out-of-pocket expenses.

- Purchase Visitor Insurance before traveling to Canada to avoid limitations and ensure coverage for early trip emergencies.

- Visitor Insurance can often be extended to match your stay length, unlike Travel Insurance which is fixed to your trip dates.

- Always thoroughly read your insurance policy's terms and conditions to understand coverage scopes, limitations, and exclusions.

- Consult with insurance experts for personalized advice to choose the best plan based on your travel plans and health needs.

- Compare different Visitor Insurance plans and engage with credible, licensed providers for reliable coverage.

Your Feedback Is Very Important To Us

To better understand the common struggles and confusions people face when choosing between Visitor Insurance and Travel Insurance, the following feedback questionnaire can be distributed:

This questionnaire aims to gather insights on the personal experiences and challenges that individuals face when deciding on the appropriate type of insurance for their travels. The feedback received can help insurers improve their communication, tailor their products, and better meet the needs of their customers.

The above information is only meant to be informative. It comes from Canadian LIC’s own opinions, which can change at any time. This material is not meant to be financial or legal advice, and it should not be interpreted as such. If someone decides to act on the information on this page, Canadian LIC is not responsible for what happens. Every attempt is made to provide accurate and up-to-date information on Canadian LIC. Some of the terms, conditions, limitations, exclusions, termination, and other parts of the policies mentioned above may not be included, which may be important to the policy choice. For full details, please refer to the actual policy documents. If there is any disagreement, the language in the actual policy documents will be used. All rights reserved.

Please let us know if there is anything that should be updated, removed, or corrected from this article. Send an email to Contact@canadianlic.com or Info@canadianlic.com