It’s about time, your parents are finally visiting you in Canada after all those months of planning. You give them a tour, tidy up the guest room, and you’ve even created a list of the best places they need to go. Whether Visitor Insurance is a must-buy or not is a complex puzzle. Understanding and exploring these needs is critical to the knowledge of whether Visitor Insurance is Compulsory in Canada.? In this blog post, we will try to dissect Visitor Insurance. It will be advantageous to the hosting family, parents in particular and those who are new to Canada wanting to experience its breathtaking size. Let’s take a look at the world of ‘Visitor Insurance for Parents’, in a more real fashion of the struggles that many experience, for you to make some sense out of it and relate.

Though families always look forward to these happy reunions, there is always the question lurking in the background: Is visitor insurance mandatory or only recommended? This can be easy to overlook; people often assume that material damage coverage isn’t necessary if the trips at this time of year are short. But even an insignificant emergency can amount to a significant financial setback. That’s why it’s important to carefully consider your options before your loved ones join you in your home.

Is Visitor Insurance Mandatory in Canada?

There is one serious travle issue when you are plannning a trip to Canada and that is Health. The health system in Canada is at par with the rest of the world, but for a tourist or a temporary visitor the health is not free. That’s why Visitor Insurance is so necessary. But then, is it mandatory?

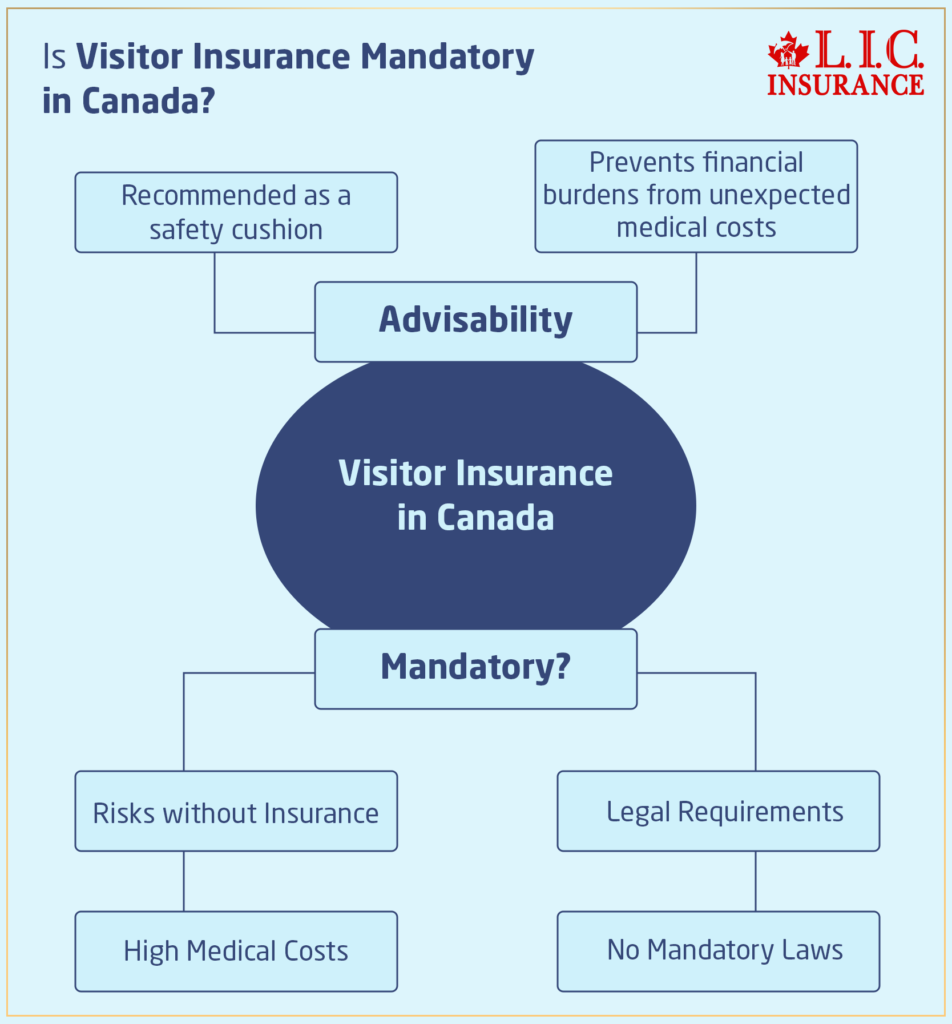

Legal Mandates: There are no such laws in Canada which mandate or make Visitor Insurance compulsory for those travelling to Canada on a Visitor Visa. But you can make it risky business to do without. Your mother is visiting Niagara Falls and requires unanticipated medical care. The medical expenses can be beyond your reach and may end up turning your dream trip into a disaster without Visitor Insurance.

Advisability: While it may not be obligatory, you should consider having a visitors insurance. Think of it as a kind of “safety net”, and it’ll give you peace of mind, and you’ll be able to enjoy your visit to your loved one more without wondering what if all the time. A Canadian ‘medium’ sized hospital will easily charge you thousands for the most mundane and unassuming of medial stuff, all almost 100% covered by an awesome insurance policy.

Unspoken Realities: The Financial Screening Practices of Canadian Hospitals for Uninsured Visitors

That being said, the question, “Is visitor insurance compulsory?” oftentimes results in a legal “no,” there remains a less public, real-world level to it all — how it plays out in Canadian hospitals that are treating uninsured international patients. Hospitals in some provinces, including Ontario and British Columbia, may demand upfront deposits of anywhere from $5,000 to $20,000 before they even begin treatment for elective procedures in cases where valid insurance is not given to them. Public promotion of this practice does not exist and visiting families are often shocked to be faced with financial demands at a time of medical crisis.

There are reports of “financial viability assessments” being made by admin teams before undertaking elective or non-urgent care. These screenings are designed to determine whether the visitor can afford to pay cash or if insurance applies. In the case of a questionable or negative response, there could be a delay or a reduction in treatment, thus impacting the quality and timeliness of care for your loved ones.

In light of this, the question “Is visitor insurance required?” less around law and more about readiness and timely access to care. Insurance is not just a financial product — it can directly influence medical decisions and outcomes.

This crucial truth, not often featured in competitor content, is further proof why you simply shouldn’t visit Canada without insurance — no ifs, ands, or buts!

The Importance of Being Prepared

Last summer, John had his parents come from India. The three weeks for which they came were so small that he thought they wouldn’t be in need of insurance. The first week itself, his father had a minor heart attack. The hospital bills summed up to close to $30,000; what a huge amount would have been saved with Visitor Insurance. This is a real example of how important preparation is.

How to Choose the Right Visitor Insurance

The right choice of Visitor Insurance can be as important as purchasing one. With the myriad options available, arriving at the right ‘Visitor Insurance Quote‘ can feel like finding a needle in a haystack. This is how it can be made simple:

Determine the Amount of Coverage to Be Insured: The history and current health conditions of the traveller are to be evaluated; this should clearly indicate the fact that for aged travellers, especially parents, health insurance coverage should be much higher compared to young people travelling.

Compare Quotes: Do not just go by the first quote you land on for Visitor Insurance. Use platforms with a good reputation to compare different policies. Be sure to look for coverage that may include hospitalization, emergency services, and probably even repatriation if required.

Shopping for the Best Option

Sarah wanted nothing but the best for her mother, who would visit her as a patient with diabetes. She looked through with so much detail and scrutiny, going through so many quotes before deciding on the deal. She goes for an all-inclusive plan that takes care of pre-existing conditions when taking the policy. This way, she is assured that her mother will enjoy a stay in the country without any hassle. She could, therefore, be free of unnecessary financial pressure.

Visitor Insurance for Parents

Getting visitor medical insurance for parents should be more than just a precaution. It should be a token of love and care. As our parents grow old, uncertainty about health issues grows. A strong Visitor Insurance policy ensures that you are free to build up memories without any concerns about medical costs.

A Small Mistake, A Big Cost

Last year, Alex’s mother travelled from Chile to visit him. He decided he would take a basic health plan for the most part, thinking it was spending some money, but by and large, enough for the travel. However, when she slipped on ice and needed surgery for a fractured hip, the basic plan covered only a fraction of the costs. Alex ended up having to pay thousands of dollars out of pocket, something that caused him financial strain and could have been easily avoided with a better-fitting insurance policy.

The Bottom Line

Visitors insurance isn’t obligatory in Canada, but those stories illustrate the potential peril — financial and emotional — of going without safeguard. Well, it would be wise to consider Visitor Insurance as, with good Visitor Insurance, ‘you can’t buy it for money’. It shields you from the problems an unplanned medical emergency can cause, and makes sure they don’t become too large for you to handle. The best is yet to come. Call today for a consultation, and discover how Canadian LIC guarantees you the opportunity to seek a Visitor Insurance coverage that suits you. Please don’t wait until the last minute. Tend to your family and ensure the visit is pleasant. After all, better safe than sorry, right? There is nothing more painful than seeing someone you love suffer, just because you couldn’t take timely measures, incur in an expenses, for something that could have been easily taken care of in advance.Explore>Your Options And Get A Visitor Insurance Quote Today, As You Spend Quality Time With Your Loved Ones With One Worry Off Your Head.

Explore your options and get a Visitor Insurance Quote today, so with one less worry on your head, you can spend quality time with your dear ones.

Get The Best Insurance Quote From Canadian L.I.C

Call 1 844-542-4678 to speak to our advisors.

Frequently Asked Questions About Visitor Insurance in Canada

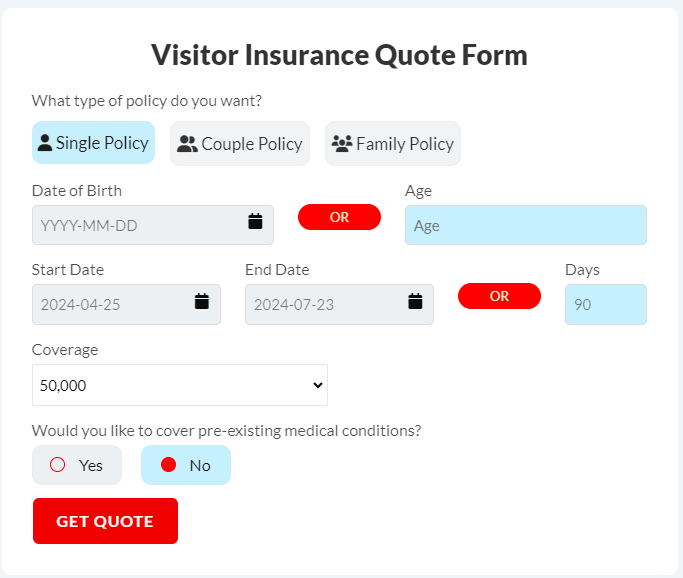

Obtaining a Visitor Insurance quote is easy – you can start off at the websites of insurers or do a comparison online of insurance plans from different insurance carriers. All you’ll need to do is tell them the ages of the visitor, how long they’ll be visiting, and anything special that you’ll want covered (e.g, pre-existing conditions), and you’ll be shown a variety of various plans. You may think of it as shopping online for a good deal: You want the most protection for the lowest cost that fits within your budget.

Visitor Insurance can cost incredibly different prices. They could be much lower if the covered party is younger, the stay is shorter, or the coverage is required to be lower. For example, the rates for insurance for young visitors with no preexisting conditions could be lower than the rates that might be necessary for insurance by elderly parents for full coverage. Think of it as deciding between safety nets of different robustness. The stronger the net, the pricier it is, with that peace of mind.

Yes, you can. Visitor Insurance can even be bought once your parents land in Canada, only it’s ideal if you get one for them already before they head for the trip. The early purchase option allows the coverage to become effective earlier than for most people and generally covers unexpected medical expenses due to a covered sudden and unexpected illness that occurs after the Coverage Effective Date, while being outside of the United States. It is an example I can relate to: your mother visits, and on the second day, is sick. You can purchase Visitor Insurance a day before you arrive. If the waiting period begins after a day, many policies will pay for the medical visits.

In general, damage control of this visitors insurance includes emergency care and sometimes hospitalization up to a certain limit coverage, prescribed drugs, and even emergency dental care. Also, there is repatriation coverage under certain circumstances that if medically required; the insured has to be brought back to his home country. So for instance, if the parent is paying a visit and some unknown appendicitis condition pops out, his visitor insurance plan can definitely cover most of the hospitalization and surgical related charges and help relieving the family from fundraising?

And selecting the right plan can be a headache, but reviewing some Visitor Insurance Quotes and being led by things like the parent’s health and the length of the visit comes to the rescue. In the parents case of pre-existing conditions, you need to opt for plans that provide that coverage. Let’s be real here—Sarah goes to lengths to keep her mother’s diabetes at bay. You would know best whether the plans were valuable – perhaps you would also like the plans with more coverage though at a higher price?

Visitor Insurance is not much of a necessity to get issued with the Canada visitor visa but Unluckily its is very much a demanded. Visitors without the coverage may incur high out-of-pocket medical service charges, that may prove financially catastrophic. So, think of John’s dad. The mistake he made is surely galling, but the time he spent without that insurance just did him a $30,000 medical bill. “It’s always better to have and not need than it is to need and not have.

The whole process goes quickly most of the time. As soon as you choose a plan and give all the necessary information, you can start getting aid the next day. This ensures that your parents are insured right from the beginning of the trip, hence a win-win situation for all parties.

Contact your Canada travel insurance company immediately if your parents become ill during the visit. Most companies have hotlines open 24 hours a day, seven days a week. Take the insurance information with your parents so that he or she will be able to present it at the health facilities if needed. This will streamline the treatment from their own initiative, just the way it would have helped in Alex’s case when his mother needed urgent care after falling.

When searching for visitor Canada insurance for parents if they have any pre-existing medical condition(s), you have to read all the policy wording very attentively. So many insurance plans they say they cover if you’ve had a pre-existing condition, there are ways, stipulations, about what that means, maybe it’s just you have to wait for a certain term for a condition. For example, your father has high blood pressure and is traveling in Canada when he suddenly requires major medical attention. For such a case, obtain a policy which includes the conditions so as to save yourself in the phenomenon where you find yourself paying great amounts of medical bills from your own pocket just because it isn’t covered under your normal policy.

In general, if you need them to remain longer than you have requested for or anticipated, they may be able to extend out the visitor’s medical insurance coverage if the parent wants to increase the duration of his period. But the request of extension should be made before the end of the original policy. Consider Helen’s parents, who dropped by for a couple of weeks and stayed an extra week, due to some unanticipated legal issues that required dealing with. Helen did manage to renew her insurance though, as she rang her insurance company three days before the end of the cover and gave them the information.

Yes, Visitor Canada Insurance Cover usually provides coverage for the provinces and territories in Canada. In other words, your parents’ travelling from the cultural sites of Quebec to the natural landscapes of British Columbia would be possible under one policy. Imagine your folks paddling a peaceful boat on a definitely insured Banff National Park, followed by a walk on the lively streets of Montreal—all under one policy.

While comparing different Visitor Insurance Quotes, consider aspects such as the coverage limit, the deductible to be paid by the client, the inclusion of pre-existing condition coverage, and the credibility of the insurance provider. That’s like when you’re shopping for a new car. You wouldn’t just look at the price; you’d look at features, reviews, and safety ratings. For example, when comparing plans, Amit considered taking the plan with lower deductibles and higher limits of coverage, considering that he knew his mother would go for hikes, and that was the activity that led to an increase in the risk of medical emergencies.

Most visitor health insurance plans will have a list of exclusions, which may include routine check-ups, elective treatments, and, in some instances, injuries from some adventurous activities like skydiving. Make sure you read and understand what is not covered to avoid surprises. This is much like what happened to Claudia’s father when he realized too late that his Visitor Insurance did not include any dental emergencies, thereby incurring quite a big out-of-pocket expense for a tooth extraction.

Visitor Insurance is usually cancellable in case your parents have to cancel their trip. Depending on the policy, you might get a prorated partial or full refund at the time of cancellation. It’s almost like returning a product that you bought because you found it at a lower price elsewhere—just remember to do it within the return policy period. Lisa heaved a sigh of relief when, two days before her parents’ travel, she cancelled the insurance just in time, as their visa was declined at the very last moment.

Usually, seeking a quote for Visitor Insurance comes with certain questions about some of the basic pieces of information regarding one’s parents—ages, the period they intend to stay in Canada, and any specific health conditions. This is much the same way you book a flight, requiring you to proceed with the passengers’ details. For example, when James was inquiring about insurance for his mom, the site only wanted the age of his mom and the travel dates; he didn’t need to give full details about his mom, and even got a quote for the trip.

Some of the insurance providers allow discounts on purchasing Visitor Insurance for more than one visitor, even provide discounts while buying the policy for an extended period. It’s kind of availing a discount on family cell phone plans. When it came to the purchase of Visitor Insurance for my parents and in-laws, I got to know that purchasing all together was allowing me to take a discount of 10%, which was a great relief.

If your parents are already under any kind of treatment for a certain condition at home, make sure the Visitor Insurance covers continued treatments. If it does not, then perhaps you can make arrangements in such a way that there is continuity of care in Canada for them, at least concerning health. This is important for the avoidance of any possible interruptions in healthcare. For example, when Tom’s mother had to keep on taking her chemotherapy during the six months of staying there, it was clearly necessary to know which policy to take so that there wouldn’t be any discontinuation of her treatment in Canada.

In general, most parents’ visitors’ insurance plans can be renewed if your parents’ stay in Canada is extended. But usually, it has to be done before the expiry of the original policy. Think about it like renewing the lease of your home before the lease expires so that you don’t have to lose your rental home. Sofia had to renew her insurance in advance so there wouldn’t be a gap in the coverage when her parents had to stay longer because of the pandemic.

In most cases, in order to make a claim, you will forward the medical bills and any supporting documentation to the insurance company. Most insurers will also have to notify before obtaining, say, certain types of medical treatment. That is much like filing a claim for car damage after an accident. When Raj’s father had to go through an emergency surgery, he got to claim it since he had submitted all the documents from the hospital through the insurer’s online portal, thus making it very convenient for him to get reimbursement.

Gain knowledge with these FAQS on Visitor Insurance to be in a better position while making your decisions, which guarantees safe and enjoyable visits by your loved ones. With the right information at your disposal and the perfect Visitor Insurance plan in place, you are not preparing for the worst but rather ensuring the best visit possible for your parents.

Sources and Further Reading

When it comes to understanding Visitor Insurance and ensuring you have all the information you need to make informed decisions, it’s beneficial to consult a variety of reliable sources. Below is a list of sources and further reading that can provide additional insights into the requirements, options, and benefits of Visitor Insurance for visitors to Canada. These resources will help you navigate the sometimes complex world of insurance with greater ease and confidence.

Government of Canada – Travel Insurance Page

The official Canadian government website offers guidance on the types of insurance recommended for visitors to Canada, including details on health insurance coverage.

Website: Travel and tourism

Canadian Life and Health Insurance Association (CLHIA) – Guide to Travel Health Insurance

This guide provides comprehensive information about what travel health insurance covers and what to look for when purchasing.

Website: CLHIA – Consumer Information

Insurance Bureau of Canada

Provides resources for understanding different types of insurance available in Canada, including Visitor Insurance.

Website: Insurance Bureau of Canada

Canadian Immigration Blog

Offers practical advice and firsthand experiences regarding travel to Canada, including tips on Visitor Insurance.

Blog: Canadian Immigration Blog

HealthCare.gov – Coverage for Travelers

Useful for understanding health insurance needs while traveling, including insights that might apply to visitors to Canada.

Website: HealthCare.gov

World Health Organization (WHO) – International Travel and Health

Provides global insights into health insurance needs for international travelers, which can be applied to visiting Canada.

Website: WHO – Travel and Health

By exploring these resources, you can deepen your understanding of Visitor Insurance, tailor coverage to meet specific needs, and ensure that your or your visitors’ stay in Canada is secure and protected. These sources provide the knowledge needed to purchase the right insurance and handle any situations that may arise during the trip.

Key Takeaways

- Visitor Insurance in Canada is not mandatory but highly recommended to avoid high healthcare costs.

- Ensure Visitor Insurance covers pre-existing conditions and medical emergencies for comprehensive protection.

- Compare Visitor Insurance Quotes online to find the best coverage options and rates.

- Consider policies that include emergency medical evacuation and repatriation for complete safety.

- Purchase Visitor Insurance before your parents arrive in Canada to ensure coverage starts right away.

- Extend Visitor Insurance policies if the visit duration changes to maintain continuous coverage.

- Familiarize yourself with the claims process to efficiently handle any medical issues that arise.

Your Feedback Is Very Important To Us

The above information is only meant to be informative. It comes from Canadian LIC’s own opinions, which can change at any time. This material is not meant to be financial or legal advice, and it should not be interpreted as such. If someone decides to act on the information on this page, Canadian LIC is not responsible for what happens. Every attempt is made to provide accurate and up-to-date information on Canadian LIC. Some of the terms, conditions, limitations, exclusions, termination, and other parts of the policies mentioned above may not be included, which may be important to the policy choice. For full details, please refer to the actual policy documents. If there is any disagreement, the language in the actual policy documents will be used. All rights reserved.

Please let us know if there is anything that should be updated, removed, or corrected from this article. Send an email to Contact@canadianlic.com or Info@canadianlic.com