- How Do I Use My RRSP For Retirement?

- Let’s First Understand RRSPs

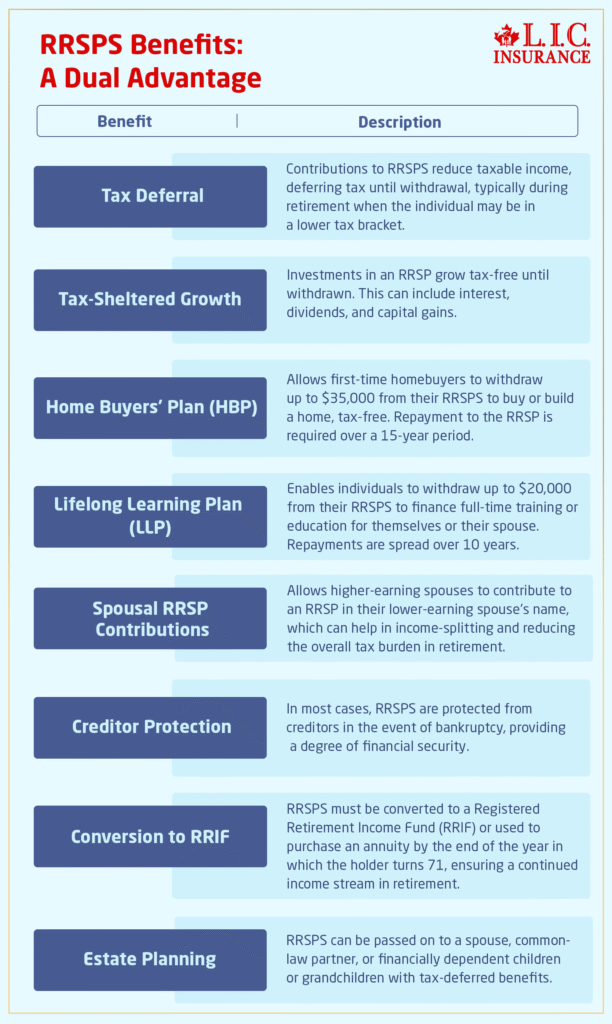

- RRSPs Benefits: A Dual Advantage

- Choosing The Right Investments

- Saving For Retirement: A Consistent Approach

- Understanding Contribution Limits

- Making RRSP Withdrawals: What You Should Know

- Strategic RRSP Timing: A Missed Opportunity Most Canadians Overlook

- Planning For The Unexpected

- Conclusion: Taking Action For A Secure Retirement

Retirement may feel like an event far, far away — but planning for it has to begin in earnest on schedule. In Canada, Registered Retirement Savings Plan (RRSP) is the most effective way to get ready for retirement. This article gives you a short overview of what RRSps are and what they can do for you and your retirement. This retirement blog will make understanding how to use your RRSP for retirement easy.

But contributing to your RRSP is only half the battle—what to do with RRSP when you’re retired is equally as significant. Most Canadians save money in a systematic manner yet they don’t have a plan for withdrawals, taxation and timing of income. The way you distribute the money from your accounts can affect your quality of life, the taxes you pay and your long-term financial health. Whether you’re close to retirement or just starting to think about it, it’s key to know how to manage your RRSP to meet your goals. In these next few pages you’ll discover the most efficient ways to use your RRSP-during your working years as well as in retirement.

Let’s first understand RRSPs

An RRSP is a special type of retirement savings plan registered with the Canadian government. It is a way to save money for retirement and part of the appeal is that you can get some tax breaks.

An RRSP is designed primarily to postpone the payment of tax. The cash you give your RRSP is tax deductible, which decreases the amount of income tax you pay now. However, you will pay taxes on this money when you withdraw it in retirement, presumably at a lower tax rate.

RRSPs Benefits: A Dual Advantage

- The RRSP: Two key benefits The RRSP is attractive to save for retirement in Canada for one main reason: The registered retirement savings plan (RRSP) has a two-fold advantage. To begin reducing your current taxable income is one of the key advantages of an RRSP. Every dollar you invest in your RRSP lowers your taxable income for that year and may put you in a lower tax bracket, which equals instant tax savings. And that’s especially advantageous for high-income earners.

- Tax-Deferred Growth: Your RRSP assets — such as stocks, bonds, and mutual funds — grow without tax erosion while they’re held within the plan. That means you pay no tax on the interest, dividends or capital gains your investments earn in the RRSP. The power of tax-deferred growth has a compounding effect, which over time, can really increase the value of your investment, and be a powerful weapon in your retirement saving arsenal.

- Variety of Investments: RSPPs have a large variety of investment alternatives. Depending on your risk tolerance and investment goals, you can select from a range of assets, including stocks, bonds, mutual funds and exchange-traded funds (ETFS). The flexibility allows you to customize your portfolio to match your particular retirement saving requirements.

- Lower Tax Bracket in Retirement: In retirement when you take out this money from the RRSP, you will most likely be at a lower tax bracket than when you were working. What this means in plain language is that, because all you’re withdrawing is your own contributions from the account, you will probably pay less tax on these withdrawals than you did on your income during your peak earning years.

- Spousal RRSP Contributions for Income Splitting: Making contributions to a Spousal RRSP can help to split income, something that is a tremendous benefit if there is a large divergence between a couple’s incomes. This tactic can lower the family’s overall tax bill during retirement.

- Home Buyers’ Plan (HBP) and Lifelong Learning Plan (LLP) Accessibility: RRSPS provide the ability to borrow HBP funds to buy your first home without immediate income tax, receive similar treatment to finance education (Repayment of these amounts to your RRSP must occur within a specified period after your home purchase or the cessation of the enrolled educational program).

- Estate Planning: RRSPS can be used for estate planning purposes. Upon death, the value of your RRSP can be rolled over to a surviving spouse, financially dependent child or grandchild with no immediate taxes owing.

- Aids in Developing a Saving Habit: Normal contributions to an RRSP foster the habit of saving, which is important for accumulating enough money to fund your retirement. As well, the nature of RRSPs, with contribution maximums and deadlines, can push people to commit to long term savings goals.

When you know these we can help you to make greater informed choices about your retirement planning. With the benefits of immediate tax savings and tax deferral, RRSPs have become a key investment vehicle for retirement savings in Canada.

Choosing the Right Investments

You can have a mix of investments in your RRSP- stocks, bonds, mutual funds and GICS (Guaranteed Investment Certificates) are all fair game. The trick is to invest in a way that matches your retirement goals and appetite for risk. A common one is that younger investors should have more stocks for growth, while those approaching retirement might shift toward more stable, income-producing investments, like bonds.

Saving for Retirement: A Consistent Approach

The single most important factor to ensuring your financial future, particularly in retirement, is to build a steady habit of saving.

If you consistently contribute to your Registered Retirement Savings Plan (RRSP), the magic of compound interest can turn small contributions into large amounts of money over years. How the benefits of regular RRSP contributions for retirement can work for you This section examines how saving for retirement through an RRSP, from the time a taxpayer first starts working, can benefit you and is provided as a listicle for easy reading.

- Benefit From Compound Interest By Starting Early: The earlier that you start contributing to your RRSP, the more time that your money has to benefit from compounding. Compound interest is the force that causes interest earned on the savings also to earn interest, it is the interest that interest earns, and that, over time, adds up to much more than a simple interest return on savings. For example, if you begin contributing in your 20s or 30s, you will have a much larger retirement fund than if you begin contributing in your 40s or 50s contributing the same amount.

- Take regular contributions goals: Regularly contributing to your RRSP can have a big impact on the size of your retirement nest-egg. Decide on a feasible figure that you can contribute on a monthly or annual basis. This could be a fixed amount, or a percentage of your income. And then of course, over time, regular contributions, because they compound, even if they are small, they compound and become significant over time.

- Know the Benefits of RRSP: One of the main advantages of an RRSP is that it offers instant tax relief. You can get a tax deduction on your contributions to your RRSP, which as a result will lower your tax rate and decrease the tax you have to pay now. Furthermore, the money you use to buy an RRSP gets shielded from taxes — you don’t have to pay taxes on investment growth until you withdraw the funds at a later date.

- Automate Your Savings: If you set it up, automatic contributions to your RRSP can make saving for your retirement a piece of cake. With automatic transfers from your bank account to your RRSPs, you guarantee contributions without relying on remembering to make contributions. It’s a ‘set and forget’ method of saving that works consistently.

- Gradually Increase Your Contributions: If you see your income growing, you may wish to increase your RRSP contributions. Incremental changes add up, and even the smallest can make a big difference in the long run. This becomes even more important as you near retirement since higher contributions can ultimately balloon your retirement savings.

- Reinvest in tax refunds: Reinvesting your tax refunds from RRSP contributions can supercharge your retirement portfolio for the future. That serves as a positive feedback loop in which your savings and tax benefits both help one another build your retirement account.

- Keep your RRSP investments diversified: In your RRSP, it’s important to diversify your investments to achieve a mix of risk and growth. Diversification with a mix of stocks, bonds, and mutual funds can spread risks while seeking moderate growth. Diversification is key, to help shield your savings from market gyrations.

- Keep tabs on your investments: Monitor your RRSP investments from time to time and make adjustments if necessary. When you get closer to retirement, you may prefer to invest more conservatively to protect your savings.

- Know Your Contribution Limits: Know what the annual contribution limits are and if there is any contribution room left from years past. Contributing too much might lead to penalties, so it’s important to stay on top of this.

- Speak with a FA: If you are unsure how to maximize your RRSP contributions consider speaking with a financial advisor. They can work with you to develop a plan that aligns with your financial goals and retirement expectations.

By adopting a steady, step-by-step way to save for retirement through an RRSP, you’ll discover the advantages of compound interest, tax breaks and a brighter financial future for yourself. And don’t forget: It’s not only what you save, it’s also how consistently and intelligently you save.

Understanding Contribution Limits

There also is a limit on how much you can contribute to your RRSP per year. For 2024, this ceiling is 18 percent of your earned income for the preceding year but no more than $31,560. If you don’t use all of your contribution room in a year, it can be carried forward to future years. Keeping in mind your personal contribution limit is essential to avoid over-contributing, as you may face penalties for going over it.

Get The Best Insurance Quote From Canadian L.I.C

Call 1 844-542-4678 to speak to our advisors.

Making RRSP Withdrawals: What You Should Know

De-registering a registered retirement savings plan (RRSP) is an important step for using the funds it contains for your retirement plan. Mastering the basics of RRSP withdrawals is critical if you want to maximize the impact your savings will have on your life in retirement. The following points are vital to understand as you consider how best to make RRSP withdrawals.

- RRSP Conversion To Do: You generally have until the end of the year you turn 71 to convert your RRSP to a RRIF or an annuity. This is a necessary conversion because it transitions what is happening to your savings from accumulation to distribution.

- Know the tax implications: Money you take from your RRSP is treated as income in the year that you take it out. Which means not only the return OF your investment, but the return ON your investment will simply added to your income and taxed. Strategizing your withdrawals to reduce tax comes with the territory when getting the most out of your RRSPs.

- Think About When to Tap RRSPs: If you retire young, be careful not to withdraw all of your RRSPs at once, opting instead to withdraw funds from your RRSP when you require the income or land in a lower tax bracket. This approach can aid in your retirement saving by enabling your investments to compound tax-deferred for more time.

- Be strategic with the Home Buyers’ Plan (HBP): The HBP is a program whereby you can pull out up to $35,000 from your RRSP to put toward your first home purchase. This drawdown is non-taxable if you repay it over 15 years. For aspiring home buyers it’s a big break.

- Utilize the Lifelong Learning Plan (LLP): Under the LLP, you can withdraw money from your RRSP to pay tuition for yourself or your spouse. You may withdraw a maximum of $10,000 a year, for a total of $20,000. Those withdrawals are tax free, so long as they are paid back over 10 years.

- Interface Minimum RRIF Withdrawals: After you convert your RRSP to a RRIF, the government stipulates minimum withdraws based on how old you have turned. Those minimums are rising with age.

- Consider Withholding Taxes: Keep in mind that the financial institution, when you make the withdrawal from a RRSP, will take a chunk of it (up to a certain amount) for tax purposes, depending on where you live and how much you withdraw. It’s important to know about these withholding taxes so it doesn’t come as a shock during tax time.

- Where to avoid tapping into, if at all possible: Withdrawing money from your RRSP in advance can have a big tax implication. It also diminishes your retirement savings, which can affect your financial stability in your retirement.

- Review your retirement income sources: When you plan your RRSP withdrawals, think about any other sources of income, such as pensions, government benefits, and income from other investments. The interplay of these sources can help maximize your retirement income and tax picture.

- Consult A Specialist: RRSP Withdrawals are complicated. A financial advisor can offer you custom advice for your personalized financial situation that will allow you to take full advantage of your RRSP.

Knowing these vital information about RRSP withdrawals will allow you to make the most informed decisions so you can maximize the benefits from your retirement savings. Remember, the point of an RRSP is not just to save for retirement, but also to help ensure you have income and options in your golden years.

Strategic RRSP Timing: A Missed Opportunity Most Canadians Overlook

One of the most overlooked aspects of retirement planning is how and when to withdraw from your RRSP—not just from a tax perspective but from a life design angle. Most articles focus on converting your RRSP to a RRIF at age 71, but very few talk about how your goals for retirement lifestyle, healthcare needs, and legacy planning should determine withdrawal timing.

So, what to do with RRSP when you retire?

Think beyond the default RRIF route. For example, if you retire early and your other income sources are minimal, it might make sense to begin modest RRSP withdrawals before age 71 to take advantage of lower tax brackets. Doing so could reduce future Old Age Security (OAS) clawbacks and ensure a more tax-efficient drawdown strategy later.

Also consider “income layering.” This strategy staggers withdrawals from your RRSP, TFSA, pension, and non-registered accounts to balance your yearly taxable income. It’s not about draining your RRSP first or last—it’s about coordinating with your unique timeline and needs.

By carefully mapping out what to do with RRSP when you retire, you’re not just minimizing taxes—you’re maximizing lifestyle flexibility and long-term financial security. Most Canadians don’t do this—and it can cost them thousands.

Planning for the Unexpected

Preparing for the unexpected is a critical element in saving for retirement. Even if RRSPS provide many advantages for retirement, also remaining relevant in the case of unplanned life events should be considered.

- Set Up an Emergency Fund: One of the initial steps for preparing for those unexpected events is setting up an emergency fund. They should be readily available and apart from your RRSP. You should have a long-term savings to handle 3-6 months’ worth of living expenses in your possession. This way, you won’t have to pull from your RRSP in an emergency and potentially incur taxes and lose contribution room.

- Know the Effects of RRSP Early Withdrawals: If you take out money from your RRSP before your retirement, there are financial consequences. Not only is it taxed, but it also reduces your investments in retirement in the future. Being aware of this can help you avoid decisions that aren’t well-informed when you use your RRSP funds.

- Think About Disability and Critical Illness Insurance: I am a big believer in Insurance as a part of your financial plan. Having a Disability or Critical Illness policy in place can help you if you need to take a health-related leave of absence from work, which means you won’t be raiding your retirement savings for such events.

- Review and Update Your Financial Plan Periodically: Major life changes such as marriage, birth of a child or a job change can impact your financial circumstances. It’s always a good idea to review your financial plan — including how you are contributing to your RRSPs and where the money is invested — to make sure it continues to reflect your situation.

- Diversify Your Investment Portfolio: Besides an individual RRSP, diversifying your portfolio investment can help mitigate risk. Owning a variety of assets, such as stocks, bonds and real estate, can add further security — and further income streams.

- Draft a Will and Estate Plan: When you have a will and an estate plan, you can control where your assets go when you die. The planning for your RRSP and other investments is all part of that, which for some people will be essential when it comes to supporting dependents.

- Keep Up To Date With RRSP Withdrawal Options: Knowing when you’re allowed to withdraw money from your RRSPs without facing onerous penalties (the Home Buyers’ Plan, Lifelong Learning Plan), in the event of financial hardship.

- Keep an Open Mind: Having a flexible mindset and remaining open to modifying your retirement plans is essential. This option can assist in getting through momentary cash flow issues without greatly derailing your long-term retirement plans.

- “Professional Advice: Receiving professional advice for your finances is helpful, especially when dealing with financial strains you didn’t anticipate,” Hamrick says. They can provide ideas about how to handle your finances without decimating your retirement savings.

- Don’t Neglect Your Savings: Despite the fact that life throws curveballs, keep investing in your RRSP and other savings accounts. Regular saving is the key to saving a lot for retirement.

More: Who should not use RRSP?

Conclusion: Taking Action for a Secure Retirement

Make the most of your RRSP Taking full advantage of your RRSP is the best single guarantee of a secure retirement. The advantages of RRSPs for retirement savings are evident: the tax benefits, the growth of your investments and a range of options for your future. It’s time to act now. Begin by assessing your position and see how it can be used to make the most of your RRSP contributions. Keep in mind the sooner you begin, the more you can benefit from compound interest and tax savings.

Discuss your options with a professional and tailor a plan that meets your financial needs to ensure you are on a path to a safe and secure future. Retirement may be a long way off, but with some careful RRSP planning, you can plan for your retirement with the knowledge, certainty and peace of mind.

Get The Best Insurance Quote From Canadian L.I.C

Call 1 844-542-4678 to speak to our advisors.

FAQ's

Your RRSP money is intended to provide you with an income in retirement. You can take it out in cash, but most people roll their RRSP into a Registered Retirement Income Fund (RRIF) or buy an annuity. They also offer a bit more of a reliable, structured form of income. You also have the ability to use RRSP proceeds for other things – you can invest in lifelong learning and pull money without penalty, and, you can use it to fund a down payment on a house.

Here are a few more details: You can access the money in your RRSP anytime you want, but it will be taxed if you withdraw it. Withdrawals are treated as income for the year they are taken and taxed at that time. RRSP monies are best withdrawn in retirement when your income is probably lower, which could mean that you may be in a lower tax bracket. Note also that this is the last year and the final year the year you turn 71 that you can contribute to an RRSP before converting it into an RRIF or an annuity.

Withdrawals of funds from an RRSP do not reduce your contribution room. So if you take out money, you don’t get that contribution room back. If you withdraw any amount, you cannot contribute that amount without using your remaining or future contribution room. This is unlike the TFSA (Tax-free Savings Account) where what you withdraw is added back to your contribution room in the year following your withdrawal.

Any Canadian resident with earned income and a social insurance number who files a tax return can open an RRSP. The ability to contribute to an RRSP continues until December 31st of the year, which is when you turn 71 years old.

Your RRSP contribution limit is 18% of your earned income from the previous year, up to a maximum limit set by the government for the current year. This limit is also affected by your pension adjustments and any unused contribution room from previous years.

The benefits include tax-deductible contributions, tax-deferred growth, potential tax savings in your highest earning years, and the flexibility to withdraw funds for specific programs like the Home Buyers’ Plan or Lifelong Learning Plan.

Yes, but withdrawals are subject to taxation. There are exceptions like the Home Buyers’ Plan and Lifelong Learning Plan, which allow for tax-free withdrawals under specific conditions and require repayment within a designated period.

Upon retirement, you typically convert your RRSP into a Registered Retirement Income Fund (RRIF) or use it to purchase an annuity. These options provide you with regular income during retirement. Withdrawals from these funds are taxed as income at your current tax rate.

Investment choices should be based on your risk tolerance, investment goals, and the time horizon until retirement. Common investment options include stocks, bonds, mutual funds, and GICs. Diversifying your investments is recommended to balance risk and growth.

Over-contributing beyond your limit by more than $2,000 can result in a penalty tax. It’s important to keep track of your contributions to avoid penalties.

RRSPs cannot be jointly held, but you can contribute to a spousal RRSP, which helps in income splitting and can be beneficial for tax purposes in retirement.

Contributions to your RRSP reduce your taxable income in the year they are made, potentially lowering your immediate tax liability. However, withdrawals from an RRSP during retirement are added to your income and taxed at your marginal tax rate.

There are basically two programs in which you can make tax-free withdrawals from an RRSP:

- Home Buyers’ Plan (HBP): First-time home buyers can withdraw up to $35,000, tax-free to buy or build a home. The amount received is tax-free, but you have 15 years to repay the RRSP.

- There are basically two programs in which you can make tax-free withdrawals from an RRSP:

- Lifelong Learning Plan (LLP): You can take out up to $20,000 for educational expenses. These withdrawals are tax-free but must be repaid over a 10-year period.

The above information is only meant to be informative. It comes from Canadian LIC’s own opinions, which can change at any time. This material is not meant to be financial or legal advice, and it should not be interpreted as such. If someone decides to act on the information on this page, Canadian LIC is not responsible for what happens. Every attempt is made to provide accurate and up-to-date information on Canadian LIC. Some of the terms, conditions, limitations, exclusions, termination, and other parts of the policies mentioned above may not be included, which may be important to the policy choice. For full details, please refer to the actual policy documents. If there is any disagreement, the language in the actual policy documents will be used. All rights reserved.

Please let us know if there is anything that should be updated, removed, or corrected from this article. Send an email to Contact@canadianlic.com or Info@canadianlic.com