- Connect with our licensed Canadian insurance advisors

- Shedule a Call

Super Visa Insurance alberta

Affordable super visa insurance in Alberta

In Canada’s Alberta province, urban opportunities coexist peacefully with breathtaking natural scenery. Thanks to the spectacular scenery, including the majestic Rocky Mountains, calm lakes, and expansive prairies that allow outdoor enthusiasts to engage in various recreational activities. Cities in the province that are thriving, like Calgary and Edmonton, offer a wide range of cultural events, educational facilities, and a robust job market. All the residents enjoy a good level of life, adequate healthcare, and a solid social welfare system.

Hence, Alberta is a desirable place for all those looking for a balanced and rewarding lifestyle, as it has a welcoming community spirit, strong economic outlook, along beautiful surroundings.

Purchasing Super Visa Insurance for your visiting parents and grandparents in Alberta guarantees complete coverage for the medical costs incurred during their stay. Secure this crucial insurance policy with one of the many trustworthy insurance companies. It will protect you and your loved ones, allowing you to enjoy the province’s beauty and attractions in peace.

What is Super Visa Insurance?

All those parents and grandparents of Canadian citizens or permanent residents who want to go to Canada for an extended period can apply for the Super Visa. The other standard tourist visas typically have a maximum validity of six months, but Super Visa is a multi-entry visa that permits multiple entries for a period of up to ten years and allows applicants to stay in Canada for up to five years at a time.

All those applying for a Super Visa must have a letter of invitation from a Canadian child or grandchild, documentation of financial assistance, and proof of medical insurance from a Canadian insurance provider.

All individuals applying for a Super Visa must have Super Visa Insurance. Super Visa Insurance is a type of health insurance that pays for unexpected medical costs for parents or grandparents while they are in Canada. It is important for the insurance to meet the Canadian government’s minimum coverage requirements and should have a minimum term of at least a year.

The requirement for Super Visa Insurance arose to ensure that visitors to Canada have access to proper medical coverage while they are living in the country, thus not straining the country’s healthcare system. Super Visa Insurance allows both the Canadian government and the family who is funding the visit to have peace of mind because of it.

It is best to keep yourself updated with the most recent requirements and coverage information with the official Canadian government website or a credible immigration expert because laws and regulations are subject to change over time.

Go to ‘Everything You Need to Know About the Canadian Super Visa Insurance’ to learn more deeply about Super Visa Insurance.

How to Apply for a Super Visa in Alberta?

You have to follow the below-mentioned steps to apply for a Super Visa in Alberta:

- Research Insurance Providers: As the first step, start searching for the best insurance companies in Alberta that offer Super Visa Insurance coverage. You can either go and search online or go with your friends, family, or immigration advisors’ recommendations.

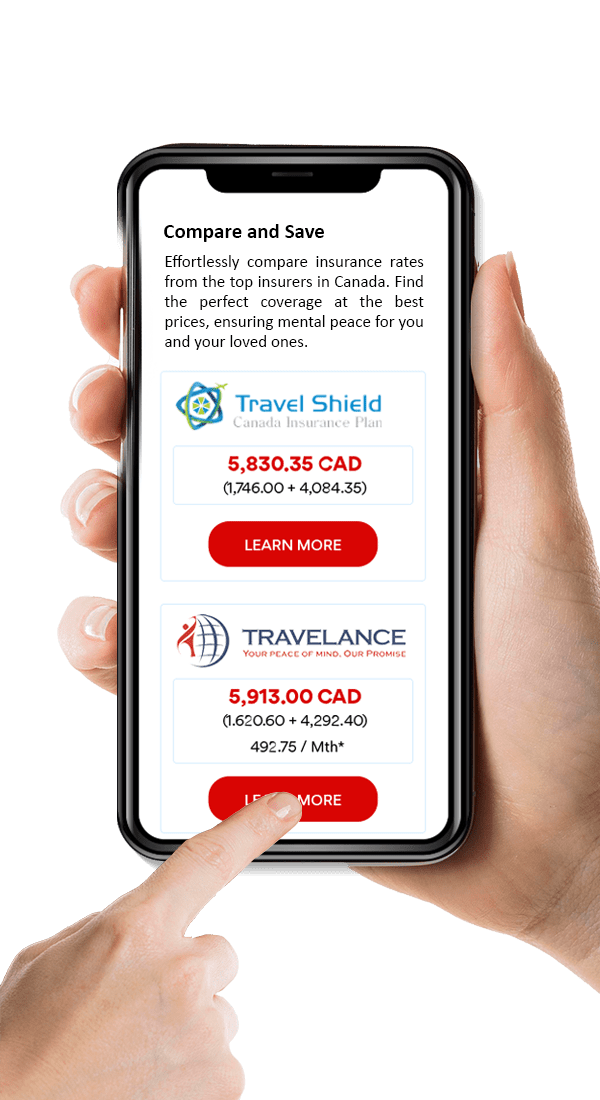

- Compare Policies: Once you are ready with a list of the best insurance providers in Alberta. Now you can compare their policies. The important factors you should consider are the coverage amount, duration, premium costs, and additional benefits or features, if any.

- Choose a Policy: Now is the time to pick an insurance policy that is perfect for your needs and budget. Make sure the policy you decide to go with meets all the required criteria for Super Visa Insurance, including the duration of the coverage and the minimum coverage amount.

- Submit Application: To submit your Super Visa Insurance application to the insurance company of your choice, you will have to provide details like your personal information, the reason for visiting, and the information about your parents’ or grandparents’ health.

- Receive Policy Documents: After the processing and approval of your application, you will finally receive the Super Visa Insurance policy documents. Please review them carefully to ensure they match your requirements.

- Payment of Premium: You will have to pay the insurance premium as it is specified in the policy documents. Please keep proof of payment safe with yourself, as you may need it for your Super Visa application.

- Visa Application: After completing the process for Super Visa Insurance and obtaining the Super Visa Insurance policy, go ahead with the application for the Super Visa itself. You will have to follow the regular process for applying for the Super Visa, which includes submitting the required documents, finishing up the application forms, and paying the visa fees.

- Submit Proof of Insurance: You will have to provide proof of Super Visa Insurance as part of the Super Visa application process. Submit the insurance policy documents and other required documents for the Super Visa application.

- Wait for Decision: Once you have submitted the Super Visa application, you will now have to wait for the Canadian authorities to process and review your application. You will have to remain patient as the processing times may vary.

- Travel to Canada: Finally, once the Super Visa gets approved, your parents or grandparents can now travel to Alberta or any other part of Canada with the Super Visa Insurance coverage in effect.

Get The Best Insurance Quote From Canadian L.I.C

What are the basic requirements for Super Visa Insurance in Alberta?

The basic requirements for Super Visa Insurance in Alberta include the following:

- Verage Duration: The duration of the Super Visa Insurance policy must be valid for a minimum of one year from the date of entry into Canada. Some insurance providers may even provide policies with longer durations in certain exceptional cases.

- Minimum Coverage Amount: The Super Visa Insurance policy must provide a minimum coverage amount of CAD $100,000 for medical care, hospitalization, and repatriation. This amount is subject to change, so verifying the current requirement with the Canadian government is essential.

- Coverage for Healthcare and Emergency Services: The Super Visa Insurance policy should also cover emergency medical care, hospitalization, and other healthcare services during the entire duration of stay in Canada.

- Validity for Multiple Entries: It is also important for the Super Visa Insurance policy to allow multiple entries to Canada. All the Super Visa holders can leave and re-enter the country during the entire validity period of the Super Visa.

- Issued by a Canadian Insurance Company: It is also essential that a Canadian insurance company must provide the insurance policy. Also, it is necessary to go with a reputable and authorized insurance provider.

- Proof of Payment: It is also essential for the applicant to provide proof of payment for insurance coverage.

- Compliance with Canadian Regulations: The Super Visa Insurance policy must comply with all the relevant requirements that have been put forward by the Canadian government for Super Visa Insurance.

- Available for Review: Whenever a visa holder comes to Canada, the Super Visa Insurance policy must be active and accessible for inspection by an immigration official.

Super Visa CHECKLIST

Are you applying for a Super Visa for your parents or Grandparents?

What documents do you need to apply for this?

We are here to help you! Let’s have a look at the Documents checklist while applying for a Super Visa.

- A Letter of Invitation from your Child or Grandchild who is residing in Canada as a Permanent Resident or Canadian Citizen

- A document that can prove that your child or grandchild meets the Low Income Cut off Minimum (LICO)

- Evidence of the parent or grandparent relationship to the Canadian citizen or permanent resident you wish to visit

- Proof of private medical insurance coverage for a minimum of one year with a Canadian Insurance Company (hint: get it from Canadian LIC)

We can assist you in obtaining the finest Medical Insurance coverage for your Parents/Grandparents in Canada.

What does Super Visa Insurance cover in Alberta?

Super Visa Medical Insurance can take care of most of the treatment expenses. There are other benefits as well. Here’s a list, have a look:

- Hospital accommodation

- Nursing care

- Ambulance Services

- Surgeries

- Emergency dental repair

- Prescription medications

- Diagnostics and X-rays

- Medical services and hospitalization

- Follow up treatment

- Rental or purchase of medical appliances

- Besides companion Accommodation and Much more

Visit here to learn more about Super Visa Insurance and what it covers.

Super Visa Insurance – LICO Table For 2025

Do you intend to apply for a Super Visa for your parents or grandparents?

Do you know you require a document that proves that you meet the Low Income Cut off Minimum (LICO)

Let’s have a look at LICO Table for 2025

The LICO table below illustrates income thresholds based on 2025 statistics for various household sizes and locations across Canada:

| SIZE OF FAMILY UNIT | One person |

|---|---|

| One person | $29,380 |

| Two persons | $36,576 |

| Three persons | $44,966 |

| Four persons | $54,594 |

| Five persons | $61,920 |

| Six persons | $69,834 |

| Seven persons | $77,750 |

| If more than seven persons, for each additional person, add | $7,916 |

What does Super Visa Insurance not cover in Alberta?

The majority of Super Visa Insurance policies exclude:

- routine medical visits

- planned dental or eye procedures (such as aesthetic procedures)

Keep in mind that this is a form of medical protection for travellers to Canada. It is intended to be helpful if an unforeseen event occurs and you require medical attention.

Do I need Super Visa Insurance in Alberta?

Yes, Super Visa Insurance is absolutely necessary for travellers who enter Canada. It is to ensure that the visitors don’t put any financial burden on the country’s public healthcare system or the relative sponsoring them. This insurance is required to prove that you have sufficient coverage if a medical emergency arises during the extended stay.

How much Super Visa Insurance do I need in Alberta?

A minimum of $100,000 CAD is needed for Super Visa Insurance; however, many prefer to exceed it. Getting Super Visa Insurance for up to $1 million is possible. Going for a higher medical coverage level is normal because of the high expense of medical care in the absence of access to public healthcare and the advanced age of the average Super Visa Insurance applicant.

Can I get a refund if my Super Visa is not approved?

Yes, you can receive a refund for your Super Visa Insurance. But only under certain conditions. For instance, if your Super Visa application is Not Approved while your insurance application is accepted. Your Super Visa Insurance policy is fully refundable in this scenario.

Is Super Visa Insurance available in a Monthly Payment Plan?

Do I need Super Visa Insurance to invite my parents or grandparents to meet me and my family in Canada? How can I afford it? These questions might be on your mind. Isn’t it? Well here is some good news for you. The reuniting of families in Canada is very easy because of insurance companies that allow flexible payment choices, including monthly payments.

According to Immigration, Refugees, and Citizenship Canada (IRCC), initially, for the first two months’ monthly Super Visa plan fee must be paid upfront. This makes Super Visa Insurance budget-friendly by making it possible for you to stretch the payment over a longer time frame. You can also ask your insurance company to set up regular payments for you if you are already in Canada and applying to extend your Visa.

It’s extremely crucial to evaluate different policies when choosing a Super Visa Insurance plan for Your parents according to their health conditions. Go with the one that best suits your needs. We at Canadian LIC recognize very well that this can be a difficult task. It is because of this reason that our knowledgeable insurance agents are available to assist you 24*7 to ensure you get the best coverage for your needs and within your budget. We will walk you through the entire process and address any questions you may have.

The time with your loved ones is above everything, and the cost of Super Visa Insurance shouldn’t affect it. The flexible monthly payment option helps you to spread out the cost over time and helps you be at peace knowing that you are protected enough in the case of any medical crises.

Get in touch with us immediately to learn more about our Super Visa Insurance Monthly plans and how we can assist you in getting the protection you require at a reasonable cost.

How Does Medical Insurance Work for Super Visa?

You are eligible for medical coverage for a whole year in Canada. The best part is that no expiry date exclusion will apply. You can travel back to your home country without incurring any cancellation fees during your trip. There are options for deductible per claim deductible and rates for persons up to 89.

What does Super Visa Medical Insurance cover?

When you purchase Super Visa Insurance, hospitalization, dental work, urgent care, prescription drugs, and remaining repatriation are all covered along with ER and outpatient appointments. Additionally covered are ambulance services, post-operative care, surgeries, and nursing care. Since Super Visa Medical Insurance also takes care of other diagnostic procedures such as X-rays and any necessary follow-up care, you won’t need to worry about these as well. With this kind of insurance, you can also get companion lodging, rental or sales of medical appliances, and other medical services.

What diseases are covered under Super Visa Insurance?

You would be happy to know that with Super Visa Medical Insurance, you can still be covered if you suffer from an illness like Alzheimer’s, a stroke, schizophrenia, or Parkinson’s. Any conditions that result from a pre-existing condition must be disclosed, including diabetes, problems with essential organs, previous surgeries, and blood pressure problems. To avoid having a claim denied, ensure you know what your insurance covers and does not cover. It would be best to consult through the many plans to locate one that meets your needs or speak with the advisors at Canadian L.I.C.

How long will Super Visa Insurance be valid?

You need to know that the Super Visa Insurance is distinct from standard visitor visas, which only permit you to stay in Canada for a maximum period of six months. You can stay for a maximum of five years with Super Visa Insurance, but the coverage is only good for a year. During each visit, the visitor can only stay for five years at a time, but a regular Super Visa can be provided for up to ten years.

Which are the best Super Visa Insurance companies in Canada?

Some of Canada’s top insurance providers offer parent/grandparent Super Visa Insurance, including:

The various suppliers offer several bundles. Get in touch with one of Canadian LIC representatives right now to find out which is ideal for you and your family!

Will Super Visa Insurance start from my Super Visa start date?

Keep in mind that when you apply for Super Visa Insurance, the coverage should not begin until the Super Visa has been obtained and the trip dates are set. Your insurance coverage is meant to start on the day of your departure from your parents’ home country.

When you cancel your insurance or go back to your home country, the coverage will end. If your policy expires, it will do so on that day. You can prolong your Super Visa by applying for an extension of up to one more year before the existing status expires.

Is Medical Insurance Mandatory for a Super Visa?

You won’t require a medical examination to obtain a Super Visa, but you must respond honestly to several medical questions.

For a Super Visa, you must have medical insurance, often known as Super Visa Insurance. It is mandatory for each applicant to provide proof of emergency medical health insurance from a Canadian insurance provider. The coverage must be at least $100,000.00 CND, as the Canadian government requires.

Does Super Visa Insurance cover dental?

The Super Visa Medical Insurance also provides for Accidental and Emergency Dental Coverage. The accidental coverage will take care of your emergency treatment for any or all of your teeth, including the capped and the crowned teeth.

If you have dental emergency coverage, you can get quick relief from dental emergencies that result in acute dental pain but not facial injuries. All previously treated conditions will not be covered. Similar to the Accidental coverage, you must receive medical attention within 90 days of the emergency to travel back to your home country.

Do You Know?

Super Visa Insurance can Cover your Parents during their Journey too!

Are you planning to invite your parents and grandparents on a Super Visa?

Now you can cover them for Medical Emergencies while they are on their flight.

Yes, this is true. They can also be protected while travelling! Give us a call to obtain the most outstanding insurance protection for your grandparents or parents. Medical emergencies can put a strain on your finances and force you to pay a lot. Check whether your parents or grandparents are covered for these medical expenses or not.

Super Visa Insurance can be Paid in Monthly Installments too!

This Plan is for all those who bring their parents on a Super Visa and find it impossible to pay for the insurance all at once.

The great news is that Super Visa Insurance is also available for monthly installment payments. You may choose the greatest insurance coverage that matches your needs and budget with the assistance of our knowledgeable advisors.

Now you can break that one large insurance payment into monthly payments. So now you don’t have to worry about its cost. Call us right away for additional information on this!

A partial Refund can be applied for the Unused Period of Super Visa Insurance!

Do your grandparents or parents stay with you on a Super Visa Insurance policy?

You can receive a portion of your insurance premiums for the unused months if they intend to depart from Canada before the completion of the year.

Yes! You may be eligible for a refund if they do not stay in Canada for the entire year.

Call Canadian LIC Customer Service or make an appointment now to learn more about it. You can get all the answers to your questions from our knowledgeable advisors!

You can get a Full Refund of your Money Paid for Super Visa Insurance if the Visa is not Approved!

Are you considering applying for a Super Visa for your grandparents or parents?

Are you concerned about losing the premiums you paid if the Visa application is denied?

It would be best if you stopped worrying about this, as in the event that the Canadian Immigration Department does not grant the Visa, the insurance companies will offer a full refund on it.

You will not lose any money doing it this way! To learn more about Super Visa Insurance, give us a call. Our knowledgeable advisors will answer all of your questions. Make an appointment right away!

Super Visa Insurance with a pre-existing condition

Another good news is all the pre-existing medical issues that OHIP or your private health insurance policies do not cover are covered by Super Visa Insurance. Some plans take care of pre-existing medical conditions, while others also provide for stable pre-existing conditions.

Learn more on how to apply for Super Visa Insurance here- ‘What is a Canadian Super Visa and How to apply for one?’

FAQ

Super Visa Insurance is a type of travel medical insurance that is designed specifically for parents and grandparents of Canadian citizens or permanent residents who wish to visit and stay with their loved ones in Canada for extended periods of time under the Super Visa program. The Super Visa Insurance covers any unexpected emergency healthcare and medical expenditures while they are in the country.

Super Visa Insurance is needed for all parents and grandparents of Canadian citizens or permanent residents seeking a Super Visa to enter Canada for an extended period of time (up to five years without the need for frequent renewals).

This insurance protects tourists from any unexpected medical expenses. Super Visa Insurance ensures that visiting family members have access to high-quality medical treatment without any financial constraints. This insurance policy is an essential necessity that respects the concept of a family reunion while emphasizing loved ones’ health and well-being.

Super Visa Insurance covers any unexpected emergency medical bills, hospitalization, repatriation, and other important medical treatments that may arise during the visitor’s stay in Canada.

The Canadian Super Visa Insurance must cover at least $100,000, offer coverage for at least one year, and cover hospitalization and repatriation fees.

It doesn’t Yes, you certainly can. You can get a Super Visa Insurance policy in Canada since the Canadian insurance providers who offer this specialized coverage allow you to get one. The most important thing to remember is to choose an insurance company that follows the strict requirements established by the Canadian government.have to be only a portion. You can with the entire amount as well.

Yes, Super Visa Insurance is different from regular travel insurance as it provides complete medical coverage for a safe and secure stay in Canada and is developed specifically to meet the requirements of the Super Visa program.

To apply for Super Visa Insurance, follow the steps highlighted below:

- Researching and choosing a reputable insurance provider

- Getting a quote

- Applying the required documentation

- Paying the premium and receiving an insurance certificate

Yes, you can renew your Super Visa Insurance insurance before it expires. However, you have to maintain continuous coverage during your whole stay in Canada.

Yes, Super Visa Insurance is required in order to get a Super Visa to visit Canada. Your Super Visa application can be denied if you do not have enough insurance coverage.

Super Visa Insurance can be bought online since many Canadian insurance companies provide online purchasing choices to their customers. You have to apply, pay the payment, and obtain your insurance certificate digitally.

Cancellation of Super Visa Insurance in Canada is possible. However, the cancellation and refund processes are determined by the insurance company. Cancellation can incur a cost, and refunds may be partial or subject to the restrictions of the policy. As a result, it is important to examine the conditions and contact your insurance provider for the most up-to-date information.

Yes, insurance companies will provide particular discounts if you purchase multiple Super Visa Insurance plans at the same time. Each company has its own distinct offering. You must understand more about the multi-policy discount in order to save money!

No, a medical check and lab testing are not required to get Super Visa Insurance. When applying for coverage, you simply need to answer a few simple questions about your health genuinely. There is no need to do anything else!

Yes, if you are a Canadian citizen or permanent resident, you can get Super Visa Insurance for your parents or grandparents.

People who use a Super Visa to support their family’s stay in Canada are responsible for covering their family’s expenses for the duration of their stay. It covers any medical expenses that your insurance may be unable to cover. Because they are already responsible for their visitors’ expenditures, many sponsors seek to buy their families Super Visa Insurance. This can be used to establish if they have enough coverage and, if necessary, to purchase additional coverage.

Go read ‘Mistakes to Avoid While Buying Super Visa Insurance’ for additional clarity on the topic.

Sign-in to CanadianLIC

Verify OTP