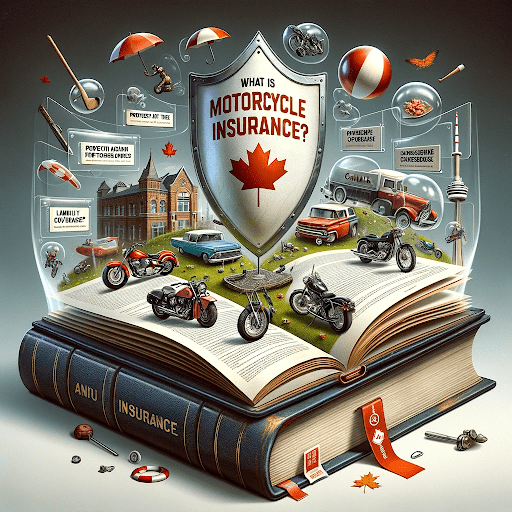

What is Motorcycle Insurance?

Motorcycle Insurance in Canada serves as a crucial financial safeguard against accidents, theft, or damages. It encompasses liability coverage for injuries or damage caused to others, while also extending to cover your personal medical expenses and property damage. The specific cost and extent of coverage fluctuate based on factors such as the province, motorcycle type and value, your driving record, and the chosen insurance provider. It is imperative to possess Motorcycle Insurance not only for legal compliance when riding on Canadian roads but also for ensuring financial protection against unforeseen risks.