What is Commercial Automobile Insurance?

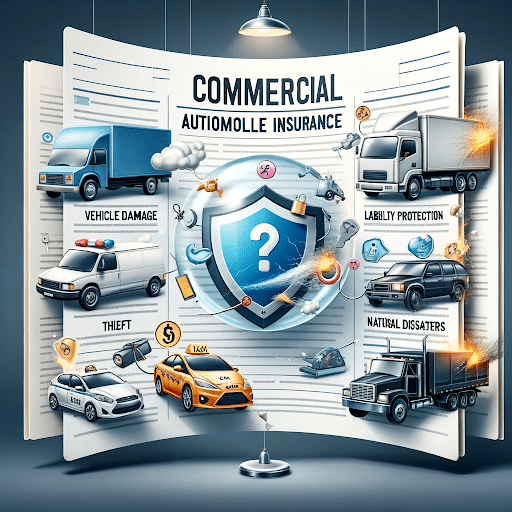

Commercial Automobile Insurance in Canada is a specialized form of insurance designed to provide comprehensive coverage and protection for businesses that rely on vehicles as a crucial part of their operations. It is specifically tailored to address the unique risks and challenges faced by commercial vehicles, including trucks, vans, cars, and other vehicles used for business purposes.

This insurance offers financial protection to businesses in the event of accidents, damage, theft, or other unforeseen incidents involving their commercial vehicles. It encompasses various coverage options, including: