- Why is Critical Illness Insurance Coverage Important? And Do We Need It?

- What is Critical Illness Insurance?

- The Importance of Critical Illness Insurance

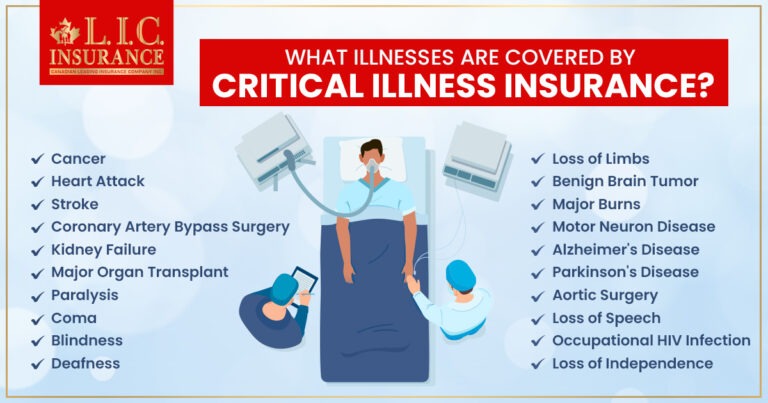

- What illnesses are covered by Critical Illness Insurance?

- Which are the best Critical Illness Insurance companies in Canada?

- Do You Need Critical Illness Insurance?

- How can I get my Critical Illness Insurance quotes?

- Final Thoughts

In today’s fast-paced and unpredictable world, health is a paramount concern for individuals and families alike. While many people invest in health insurance to cover the costs of medical treatments and hospitalization, there is another crucial aspect of health coverage that often goes overlooked – Critical Illness Insurance. So, let us find out the importance of Critical Illness Insurance coverage, the key reasons why it is vital, and whether or not you need it to secure your financial future.

What is Critical Illness Insurance?

Critical illness insurance, also known as critical illness cover or CI insurance, is a type of insurance policy designed to provide a lump sum payment to the policyholder in the event they are diagnosed with a critical illness covered by the policy. These illnesses typically include life-threatening conditions such as cancer, heart attacks, strokes, organ transplants, and other major diseases. Unlike regular health insurance, which covers medical expenses and hospital bills, Critical Illness Insurance provides a lump-sum payout that can be used as the policyholder sees fit.

Read More – What is Critical Illness Insurance?

The Importance of Critical Illness Insurance

Financial Security During Critical Illness

The most compelling reason for having Critical Illness Insurance is to provide financial security when you need it most – during a critical illness. The related expenditures might be extremely high when a serious medical problem is discovered. Medical treatments, surgeries, medications, and rehabilitation can quickly drain your savings and put you and your family under severe financial strain. Critical Illness Insurance ensures that you have a financial cushion to fall back on during these challenging times. The lump-sum payout can be used to cover medical bills, mortgage payments, daily living expenses, and even experimental treatments that may not be covered by regular health insurance.

Protection for Your Loved Ones

Critical Illness Insurance not only safeguards your financial well-being but also provides peace of mind to your loved ones. Knowing that you have a financial safety net in place can alleviate the stress and anxiety that often accompany a severe illness. Your family can focus on providing emotional support and assisting in your recovery rather than worrying about the financial repercussions of your condition. In the unfortunate event of your passing, the lump-sum payment can also serve as a financial legacy, helping your beneficiaries maintain their quality of life.

Coverage Gaps in Traditional Health Insurance

While traditional health insurance policies cover many medical expenses, they may not provide sufficient coverage for critical illnesses. Some treatments and medications for critical illnesses can be exceptionally expensive and may not be fully covered by health insurance. Critical Illness Insurance bridges this gap by offering a lump-sum payout that can be used for any purpose. It ensures that you are not left with significant out-of-pocket expenses during a time when your focus should be on recovery, not financial worries.

Flexibility in Use

One of the significant advantages of Critical Illness Insurance is its flexibility in use. Unlike some other insurance policies, there are no restrictions on how you can use the lump-sum payout. You can use it to cover medical expenses, pay off debts, make necessary home modifications, fund your children’s education, or even take a well-deserved vacation after recovery. This flexibility allows you to tailor the funds to your specific needs and priorities.

Coverage Beyond Traditional Health Insurance

Critical Illness Insurance complements your regular health insurance coverage. While health insurance is primarily focused on covering medical expenses, Critical Illness Insurance offers broader protection. It ensures that you have financial support when you need it most, regardless of the medical costs involved. This dual coverage strategy provides comprehensive protection for your health and financial well-being.

Coverage for Non-Medical Expenses:

In addition to medical expenses, Critical Illness Insurance can also cover non-medical expenses that may arise during your illness. These expenses can include travel costs for seeking specialized treatments, childcare expenses, home modifications to accommodate your condition, and even hiring a caregiver or nurse to assist with your daily needs. Having a lump-sum payout from your Critical Illness Insurance can ease the burden of managing these additional costs.

What illnesses are covered by Critical Illness Insurance?

Critical Illness Insurance in Canada typically covers a range of serious and life-threatening illnesses and medical conditions. The specific illnesses covered can vary between insurance providers and policy options, but here is a list of common conditions that are often included in Critical Illness Insurance policies in Canada:

Cancer: This typically includes invasive and life-threatening cancers, such as breast cancer, lung cancer, prostate cancer, and leukemia.

Heart Attack: Coverage typically applies to a heart attack that results in specific medical criteria being met.

Stroke: Both ischemic and hemorrhagic strokes are usually covered.

Coronary Artery Bypass Surgery: Coverage may include the need for surgery to bypass or graft specific coronary arteries.

Kidney Failure: End-stage renal failure requiring regular dialysis or a kidney transplant is typically covered.

Major Organ Transplant: This covers the transplantation of major organs such as the heart, lung, liver, or pancreas.

Paralysis: Coverage may apply if you become paralyzed due to a severe accident or specific medical conditions, such as multiple sclerosis.

Coma: Some policies may provide coverage in the event of a prolonged coma.

Blindness: Permanent and irreversible loss of vision in both eyes is generally covered.

Deafness: Coverage may apply for permanent and irreversible loss of hearing in both ears.

Loss of Limbs: This typically includes the loss of one or more limbs, either through amputation or due to a severe accident.

Benign Brain Tumor: Some policies cover the diagnosis of a non-cancerous brain tumour that results in specific medical criteria being met.

Major Burns: Coverage may apply to severe burns that meet specific criteria.

Motor Neuron Disease: Some policies include coverage for conditions like ALS (Amyotrophic Lateral Sclerosis).

Alzheimer’s Disease: Coverage for severe cognitive impairment due to conditions like Alzheimer’s disease may be included.

Parkinson’s Disease: Some policies provide coverage for severe cases of Parkinson’s disease.

Aortic Surgery: This includes surgical procedures on the aorta, such as aortic aneurysm surgery.

Loss of Speech: Permanent and irreversible loss of speech may be covered.

Occupational HIV Infection: In some policies, if a policyholder contracts HIV while performing their job duties, it may be covered.

Loss of Independence: This may cover the inability to perform specific activities of daily living without assistance.

It’s important to note that policy details can vary significantly, and some insurance providers may offer additional coverage options or specific conditions not listed here. When considering Critical Illness Insurance in Canada, it’s crucial to carefully review the policy terms, conditions, exclusions, and any optional riders or enhancements. Additionally, consulting with an insurance professional or advisor can help you understand the specifics of the policy you are considering and how it aligns with your needs and preferences.

Which are the best Critical Illness Insurance companies in Canada?

In order for you to choose a reputable source of Critical Illness Insurance, we analyzed the top companies that sell these kinds of policies. In Canada, organizations like the Canada Protection Plan (which accepts credit card payments), Sun Life, Canada Life, BMO Insurance, and others provide the best Critical Illness Insurance coverage.

Do You Need Critical Illness Insurance?

While Critical Illness Insurance offers numerous benefits and can be a valuable addition to your financial portfolio, the decision to purchase it should be based on your individual circumstances, financial goals, and risk tolerance. Here are some factors to consider when determining if you need Critical Illness Insurance:

Your Health and Family History

Your personal health history and family medical history play a significant role in the decision to purchase Critical Illness Insurance. If you have a family history of certain critical illnesses or if you are at higher risk due to lifestyle factors, such as smoking or a sedentary lifestyle, having this insurance may be more important for you.

Existing Financial Resources

Consider your existing financial resources, including savings, investments, and other insurance policies. If you have substantial savings that can cover the costs of a critical illness without significantly impacting your financial stability, you may have less need for Critical Illness Insurance. However, having the additional financial protection can still provide peace of mind.

Lifestyle and Debt

Evaluate your lifestyle and financial commitments. If you have significant debts, such as a mortgage or student loans, Critical Illness Insurance can help ensure that your debts are paid off if you become critically ill. It can also cover ongoing living expenses, allowing you to maintain your standard of living during your recovery.

Risk Tolerance

Consider your risk tolerance and willingness to take on financial risk. Critical illness Insurance provides a safety net, and for some individuals, knowing they have this protection in place outweighs the cost of the premiums. It can be particularly important if you are the primary breadwinner in your family and want to ensure your loved ones’ financial security.

Affordability

The cost of Critical Illness Insurance premiums varies based on factors such as age, health status, coverage amount, and the specific policy. Before purchasing a policy, assess whether the premiums are affordable within your budget. It’s essential to strike a balance between coverage and affordability.

Get The Best Insurance Quote From Canadian L.I.C

Call 1 844-542-4678 to speak to our advisors.

How can I get my Critical Illness Insurance quotes?

Have more questions? Make an appointment to speak with a Canadian LIc licensed insurance agent. They’re happy to answer any questions you have and give you numerous quotes from the top insurance providers in Canada. Save time and money by speaking with one of our brokers, creating a life insurance strategy, and comparing quotes online.

Read More – Critical Illness Insurance in detail here

Final Thoughts

In conclusion, Critical Illness Insurance is a crucial component of a comprehensive financial plan. It provides financial security during times of severe illness, protects your loved ones, and bridges gaps in traditional health insurance coverage. While not everyone may need Critical Illness Insurance, it is a valuable consideration for those with specific health risks, financial obligations, and a desire for added peace of mind. Before making a decision, it’s advisable to consult with a financial advisor who can assess your individual circumstances and help you determine whether Critical Illness Insurance is the right choice for you. Ultimately, having this coverage can provide the reassurance that, should the unexpected occur, your health and financial well-being are protected.

Get The Best Insurance Quote From Canadian L.I.C

Call 1 844-542-4678 to speak to our advisors.

Faq's

Now let’s find out some frequently asked questions (FAQs) related to Critical Illness Insurance Coverage in Canada:

Critical Illness Insurance in Canada is a type of insurance policy that provides a lump-sum payment to the policyholder if they are diagnosed with a covered critical illness. This payment is made upon diagnosis and can be used for any purpose, such as covering medical expenses, paying off debts, or maintaining your standard of living during recovery.

The specific illnesses covered can vary between insurance providers, but common covered conditions include cancer, heart attack, stroke, organ transplant, kidney failure, and major surgeries. It’s essential to review the policy terms to understand the exact conditions covered.

No, Critical Illness Insurance is not mandatory in Canada. It is an optional coverage that individuals can purchase to protect themselves and their families from the financial impact of a critical illness.

Critical Illness Insurance is suitable for individuals who want to ensure financial security in the event of a critical illness. It is particularly important for those with dependents, significant financial obligations, or a desire to protect their savings and investments.

Yes, you can purchase Critical Illness Insurance even if you have health insurance in Canada. Health insurance covers medical expenses, while Critical Illness Insurance provides a lump-sum payment that can be used for various purposes beyond medical bills.

To file a claim, you typically need to provide a medical diagnosis from a licensed physician confirming that you have a covered critical illness. You will then submit this documentation to your insurance provider, who will review the claim and, if approved, make a lump-sum payment to you.

In Canada, Critical Illness Insurance payouts are generally tax-free. This means that the lump-sum payment you receive is not subject to income tax.

Yes, many insurance providers offer Critical Illness Insurance policies for children. These policies can provide financial protection if a child is diagnosed with a covered critical illness. The terms and conditions may vary, so it’s essential to review the policy details.

To choose the right policy, consider your health needs, budget, and coverage preferences. Compare policies from different providers, and review the specific illnesses covered, policy exclusions, premiums, and any additional features or riders that may be available.

The cost of Critical Illness Insurance in Canada can vary depending on factors such as your age, health, coverage amount, and the specific policy. It’s advisable to obtain quotes from multiple insurance providers and work with a financial advisor to find coverage that suits your budget.

Please note that insurance policies and regulations can change over time, so it’s essential to consult Canadian LIC, as it is a licensed insurance professional or advisor in Canada, to get the most up-to-date and tailored information regarding Critical Illness Insurance coverage.

The above information is only meant to be informative. It comes from Canadian LIC’s own opinions, which can change at any time. This material is not meant to be financial or legal advice, and it should not be interpreted as such. If someone decides to act on the information on this page, Canadian LIC is not responsible for what happens. Every attempt is made to provide accurate and up-to-date information on Canadian LIC. Some of the terms, conditions, limitations, exclusions, termination, and other parts of the policies mentioned above may not be included, which may be important to the policy choice. For full details, please refer to the actual policy documents. If there is any disagreement, the language in the actual policy documents will be used. All rights reserved.

Please let us know if there is anything that should be updated, removed, or corrected from this article. Send an email to [email protected] or [email protected]