- What happens if I take a loan from my Whole Life Insurance Policy?

- Understanding Whole Life Insurance and Cash Value

- The Reality of Taking a Loan from Your Whole Life Insurance Policy

- The Benefits of Borrowing Against Your Whole Life Insurance Policy

- Managing a Policy Loan: Tips from Canadian LIC

- Conclusion: Is a Policy Loan Right for You?

The cost of living in Toronto is no joke, and you never know when an unplanned expense will arise — a new business venture, a health issue, or urgent home maintenance. If you’ve held onto a Whole Life Insurance Policy for years, you may have accumulated enough cash value to do just that in cases such as these. You know that you can borrow from Whole Life Insurance, but you’re unsure what would actually happen if you were to borrow

This is something a lot of Canadians are dealing with. At Canadian LIC, we work with many clients who find themselves in a situation where they need to access funds urgently and are thinking of tapping into their policy cash value. They want to know the risks and benefits of using their policy effectively, especially the Whole Life Insurance Canada tax benefits that can be played with. In this blog, we’ll detail everything you should know before you decide, so you can feel secure about using your insurance when it’s time to use it.

Understanding Whole Life Insurance and Cash Value

Before we dive into the basic details on how Whole Life Policy Loans actually work, let’s quickly recap what Whole Life Insurance is, and how the Cash Value piece operates. Defined: Whole Life Insurance is a permanent life insurance policy that remains in effect for your entire life, provided premiums are paid. Its more unique feature is the cash value it builds over time, which you can access with a policy loan.

What is the Whole Life Insurance Cash Value?

Think of a cash value basically as a savings component in your Whole Life Insurance. Now, as you go on paying premiums, some of that money is placed in a savings account, which is growing tax-deferred over time. That is what is considered the cash value. The more premiums you pay, the higher your cash value will be.

Now, here is where it gets exciting: Unlike your standard savings account, the cash value within a Whole Life Insurance Plan isn’t just sitting around doing nothing. It grows at a minimum guaranteed interest rate set by your insurance provider. Over time, this can become quite an asset from which you can borrow.

The Reality of Taking a Loan from Your Whole Life Insurance Policy

Let’s go back to our example. You find yourself in a situation where you need some money. You’ve heard about your policy’s cash value, so you think, “Why not?” But how? At Canadian LIC, we’ve seen a range of outcomes, and they’re not always that simple.

How Does the Loan Process Work?

Basically, when you decide to take a loan against your Whole Life Insurance Cash Value, that’s money you’re borrowing from yourself. You are not borrowing from some bank or outside lender but from your insurance company, and they are using the cash value in your policy as collateral. Best of all, there’s no long approval process, and you don’t have to state your reason for needing the money. It’s cash value, and it is very handy; you can access it conveniently.

As simple as the process is, it is important to remember that it is a loan. You get charged interest based on the amount of money you borrow, and should you fail to pay back the loan, you’ll start to accrue compounding interest on the interest you previously owed. Things can start to get a little tricky with this.

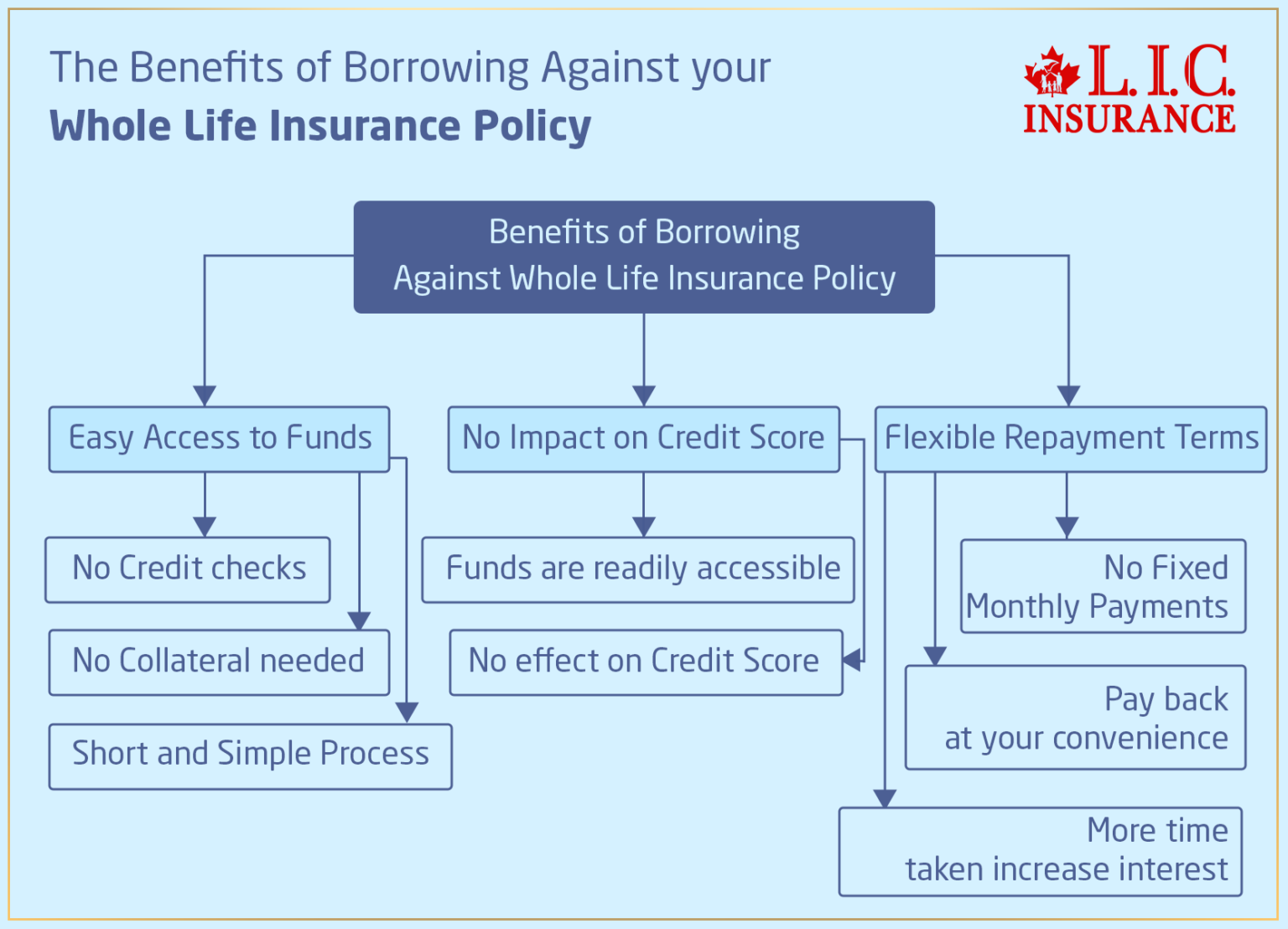

The Benefits of Borrowing Against Your Whole Life Insurance Policy

So why do so many people choose to take loans against their life insurance policies? At Canadian LIC, we have seen that clients may use Whole Life Policy Loans against a host of financial needs; there are also several advantages.

Easy Access to Funds

One of the most attractive features when borrowing against your Whole Life Insurance is how easily accessible the funds are. Unlike applying for a loan, which can be lengthy and full of headaches, the process of borrowing from your policy is short and simple. There is no need to go through credit checks or collateral since the cash value of your policy serves as the collateral.

No Impact on Credit Score

Certainly, one of the most attractive features of borrowing against your Whole Life Insurance Plan is how easily and readily accessible the money is. In comparison with applying for a traditional loan, which can be extraordinarily long-winded and frustrating, borrowing from your policy is relatively fast and easy. You do not need to go through credit checks or provide any type of collateral since the cash value of the policy acts as such.

Flexible Repayment Terms

The other advantage is that it allows for flexibility in the payment. You do not need to make a fixed monthly payment for this loan. You can return it whenever you want to. So definitely, the more time you take to pay off the loan, the more interest you will pay; however, again, that depends upon your decision.

The Risks and Considerations of Taking a Policy Loan

While the benefits are apparent, it’s important to think about the potential risks and drawbacks of borrowing against your Whole Life Insurance Cash Value. as well Canadian LIC believes in being fully transparent with our clients, so let’s dive into what you need to know.

Impact on Death Benefit

One of the biggest questions is how a policy loan could affect your death benefit—the cash your beneficiaries will see when you’re gone. This means that when you take out a loan, what you borrowed will be subtracted from your death benefit. That means your loved ones could get less money than you intended for them.

Let’s consider a real-life example. Jonathan, a client from Vancouver, took a loan against his policy to fund his daughter’s education. The purpose might have been noble, but he didn’t really consider the toll it would take on his long-term death benefit. Now, many years after that, when Jonathan passed away, the family received a much lower death benefit because of the outstanding loan and interest. This has placed them in a tough financial corner; this could have been avoided if there had been proper planning.

Loan Interest Accumulation

As with any loan, interest on your policy loan compounds over time. Unless you pay it, the interest is added to the loan balance, increasing the total amount owed. If the loan balance becomes too large, it could eventually exceed the cash value of your policy, thereby causing a policy lapse. That means you could lose your coverage and cash value.

We had another client, Sakshi from Montreal, who used her Whole Life Insurance Plan to help her open a small business. She was quite confident that she could repay this loan in only a few months, but didn’t realize how much interest would be added. Over time, the loan balance increased to an enormous amount until her policy was on the brink of collapsing. Fortunately, Sakshi contacted us in time, and we were able to find a solution for her. But her story tells a highly cautionary tale about the importance of fully understanding what a policy loan implies.

Tax Implications

Borrowing from your Whole Life Insurance is generally tax-free. However, you could face significant tax consequences if your policy lapses or you surrender it with an outstanding loan. The amount of the loan that exceeds the premiums you’ve paid could be considered taxable income.

Take the example of Robert from Calgary. He borrowed quite a sum of money against his Whole Life Insurance. Circumstances that he could not foresee prevented him from paying back the loan, and his policy lapsed. Robert was hit with a huge tax bill he hadn’t planned on, further straining his resources.

When Taking a Policy Loan Helped vs. When It Hurt

Borrowing from Whole Life Insurance can be a lifeline—but only when used wisely. At Canadian LIC, we’ve worked with clients from all walks of life who used policy loans either as a tool for progress or, unfortunately, as a pitfall they didn’t fully understand. These real-life examples show how things can go both right and wrong, and what could’ve been done differently.

When It Helped: Building a Business Without Breaking the Bank

Raj, a 42-year-old client from Brampton, had been paying into his participating Whole Life Insurance policy for over a decade. He had accumulated over $90,000 in cash value and had just identified a golden opportunity—a franchise business with low startup overhead. Instead of taking a personal loan or tapping into his RRSP (which would trigger taxes and reduce retirement savings), he chose to leverage the cash value from his policy.

How it worked:

By borrowing from Whole Life Insurance, Raj accessed $65,000 without any credit check, without liquidating investments, and most importantly, without impacting his credit score.

Why it worked:

- His policy had grown in substantial value, thanks to regular premium contributions and dividends.

- He had a clear repayment plan from expected business profits.

- He understood the Whole Life Insurance Canada tax benefits—this loan wasn’t taxable as long as his policy remained in force.

The result:

Raj’s business flourished; he repaid his policy loan in under 3 years, and his policy remained intact, continuing to grow both in death benefit and cash value.

When It Hurt: A Policy Lapse and a Tax Surprise

Now let’s talk about Elaine, a 55-year-old entrepreneur from Vancouver. She had a similar Whole Life Insurance Policy and a solid track record of consistent contributions. When a medical emergency hit her family, she urgently needed funds. Borrowing from Whole Life Insurance seemed like the easiest option—and it was. She withdrew $40,000 from her policy’s cash value within a week.

What went wrong:

- Elaine did not set a repayment plan.

- She stopped reviewing her loan interest accumulation.

- As the loan and interest piled up, it crossed the remaining cash value threshold.

- Her policy lapsed after 6 years, triggering a large taxable gain, because her outstanding loan amount exceeded the premiums she had paid over time.

The aftermath: Elaine faced an unexpected tax bill—thousands of dollars in taxable income from what she assumed was a tax-free benefit. In addition, her life insurance coverage vanished at a time when she needed financial protection the most.

What Could Have Been Done Differently?

For Raj:

- He treated his policy like an investment tool, not just an insurance plan.

- He discussed the long-term implications of borrowing from Whole Life Insurance with a licensed advisor.

- He used one of the core Whole Life Insurance Canada tax benefits—loan access without triggering taxes—to his advantage.

For Elaine:

- A scheduled annual policy review could have helped her catch the rising interest early.

- She should’ve explored options to pay just the interest annually, preserving her policy’s cash value.

- She could have asked about dividend strategies to offset interest or consulted on partial repayments.

These two examples highlight the importance of understanding not just how to borrow, but how to manage your policy loan responsibly. The same feature—borrowing from Whole Life Insurance—helped one client and hurt another. What made the difference? Planning, monitoring, and guidance.

At Canadian LIC, we help clients make informed choices, ensuring they benefit from their Whole Life Insurance Policies—whether for building wealth or covering emergencies—without putting their future at risk.

Managing a Policy Loan: Tips from Canadian LIC

At Canadian LIC, we work with our clients to ensure they have a full understanding of the proper management of policy loans. Here are some of the little tips and hints we share with those contemplating — or already holding — a loan against their Whole Life Insurance Cash Value.

Have a Repayment Plan

Even though you’re not required to follow a strict repayment schedule, it’s wise to have a plan in place. This helps you avoid accumulating too much interest and ensures that your death benefit remains intact. At Canadian LIC, we often advise our clients to set up automatic payments or allocate a portion of their income to repay the loan gradually.

Regularly Review Your Policy

It’s crucial to keep an eye on your policy’s cash value and the loan balance. If you notice that the loan balance is growing faster than expected, it might be time to reevaluate your repayment strategy. We encourage our clients to schedule regular reviews with us so we can help them stay on track.

Consider the Long-Term Impact

Before taking out a loan, consider how it will affect your long-term financial goals. Is the loan necessary? Can you afford to repay it? How will it impact your beneficiaries? At Canadian LIC, we ask these questions to help our clients make informed decisions that align with their financial objectives.

Conclusion: Is a Policy Loan Right for You?

Leveraging cash value–Borrow against your Whole Life Insurance Plan- When done correctly, this can be a great way to access cash quickly and have flexible terms. But you must make sure you understand the risks and how withdrawals will affect your death benefit and interest accumulation, as well as the tax implications of the withdrawal. As mentioned, Canadian LIC has walked through the pros and cons of Whole Life Policy loans for decades, and we’re here to hold your hand through the process.

To find out policy loan or for Whole Life Insurance Quotes Online, contact us at Canadian LIC now! We will help guide you through the complexities of Canadian Whole Life Insurance and provide a solution that fits you. Stop waiting for tomorrow—take charge of your future now.

Are you ready to explore your options? Contact Canadian LIC now at 1 416 543 9000 to learn more about how Whole Life Insurance can work for you.

Get The Best Insurance Quote From Canadian L.I.C

Call 1 844-542-4678 to speak to our advisors.

FAQs: Taking a Loan from Your Whole Life Insurance Policy

A Whole Life Insurance loan is the term used for money you borrow from the cash value that accumulates within your Whole Life Insurance Policy. The insurance company borrows you the same amount and uses your policy’s cash value as collateral. No credit check is required, and there are no restrictions on

Borrowing from Whole Life Insurance, you are essentially borrowing money from the cash value that you have built up in your policy. You can borrow from your insurer, usually with funds in your account within days. Interest accrues on the loan, and any unpaid amounts are deducted from your policy’s death benefit. It’s a fast way to access funds without having to sell assets or go through loan approvals.

Since Whole Life policies will have built up cash value, usually after a few years you are able to borrow against it. How soon will depend on your payments and the insurer’s policy. Specific policies may allow loans after 2 to 3 years, while others may take longer.

Loans against a Whole Life Policy are typically not taxable as long as the policy does not lapse. However, if the loan plus interest is more than the cash value and the policy lapses or is surrendered, the excess over your total premium payments may be taxed. Before borrowing, always consult a financial advisor

You can think about the cash value part of your Whole Life Insurance Coverage like this: It’s kind of like a savings account that grows over time as you pay your premiums. You can even think about it as an asset you can tap for money later on when you need it for everything from emergencies to good investment opportunities and everything in between. At Canadian LIC, we often meet clients who have built up substantial cash value and need help in utilizing it. For instance, a client in Ottawa wanted to refinance her home for some renovations and was surprised that liquidity from her policy’s cash value was available to her without a long approval process.

You can easily take a loan against the cash value of Whole Life Insurance. You can simply call your insurer, and they will give you instructions on how to do it. No credit check or collateral is needed, as your policy cash value will serve as the collateral. According to one of our clients in Toronto, who needed money to help with his small business, this step was very fast and not stressful at all. He didn’t have to be concerned about impacting his credit score or undergoing a tedious application process. If this is something you’re considering, you can get Whole Life Insurance Quotes Online and compare how different Canadian Whole Life Insurance Plans provide cash value benefits.

Yes, it will. When you get a loan from your Whole Life Insurance Coverage, the amount you are borrowing, plus interest, comes off the death benefit. That means your beneficiaries could get less money when you die. We had a client in Calgary who borrowed from his policy to pay for his daughter’s education. He didn’t realize how much the loan would reduce his death benefit, and unfortunately, his family received less than they expected. This is something you should carefully consider and discuss with your financial advisor at Canadian LIC.

Failure to repay it on time continues to attract interest, increasing your outstanding loan balance. After some time, the result can be the loan amount growing to more than the cash value, thereby rendering your policy lapsed. We once had a client from Montreal take out a loan, and he could not estimate how much interest would be accumulated. She came very close to losing her insurance coverage because the balance was too high. To help forestall this in the future, we would encourage her to set up a repayment plan, or at least periodically check on the status of the loan balance.

In most cases, loans against the cash value of your Whole Life Insurance are tax-free. However, be cautious when your policy lapses or you have surrendered your policy with the outstanding loan against it because the amount of the loan that is more than the premiums you paid will then be taxable. One of our clients from Vancouver faced this situation when his policy lapsed. He was hit with a significant tax bill, which added to his financial stress. It’s important to understand these potential tax consequences and plan accordingly.

Canadian Whole Life Insurance Plans offer a great many options, including the ability to accumulate cash value from which you can borrow. At Canadian LIC, we help people make these choices every day, ensuring clients understand how each plan can work for them. If you’re looking for options, compare Whole Life Insurance Quotes Online to determine which is the best plan for you. Whether you are building cash value for the future or money you need today, having the right plan can help ensure peace of mind and financial flexibility.

At Canadian LIC, we specialize in helping our clients know their Whole Life Insurance options inside and out, including how to manage the cash value of loans. We know firsthand how proper guidance can make all the difference. For example, a lady from Halifax was still perplexed about borrowing from her policy. By discussing her options with us, she is confident in the decisions she has to make and exactly how they would affect her financial future. Are you looking for Whole Life Insurance Quotes Online or seeking advice on Canadian Whole Life Insurance Plans? Let us help you make better decisions.

What you can borrow is usually based on the cash value you have accumulated in the Whole Life Insurance Plan. Most, if not all, insurers will allow you to borrow up to 90% of the cash value. At Canadian LIC, we’ve had clients like Maria of Toronto, who, through a Whole Life Policy, had built up a significant cash value over 15 years. She was impressed by how much she could get access to and not have to sell anything else or apply for a regular loan when needing the funds for investment in a new business.

Yes, the interest on the policy loan does accrue. In case one is unable to repay this loan, interest is tacked onto the outstanding loan balance, and it will continue to grow. We always remind our clients, like Dave from Vancouver, to consider this very carefully. Dave had borrowed from his Whole Life Insurance Cash Value to help his son with university fees. He initially thought of delaying the repayment, but he came to realize, after discussing it with us, that growing interest would, at some point, impact his policy’s benefits. Well, he then set in place a manageable plan for repayment so he could continue the policy and, therefore, help his family.

Yes, you can have multiple loans against your policy as long as there is enough cash value to support them. However, each outstanding loan reduces the remaining cash value and the available death benefit. For instance, we have a client in Montreal who has taken out several loans in the recent past to fund various business ventures. While each loan was useful at the time, he did not realize that it would cut down so much from the total death benefit his family would receive. After reviewing with us, he decided to focus on paying back the loans to restore value to his policy. If you’re thinking of multiple loans, keep in mind the overall impact on your policy.

Now, if you can’t repay that, then at death, the outstanding amount plus interest will be deducted from the death benefit. Sometimes, if the loan balance gets too big, it may cause your policy to lapse. This happened to one of our clients in Calgary, who borrowed against her policy during a time of financial constraint. Unfortunately, she was not able to pay off the loan, and her policy lapsed, leaving her really uncovered at a critical moment. At Canadian LIC, we help our clients avoid such situations by providing them with consultation and support on how to manage policy loans in general.

Absolutely! Comparing Whole Life Insurance Quotes Online before you decide can help you understand the many Canadian Whole Life Insurance Plans available. In this way, you can choose a plan that really offers the best cash value growth and loan options to help you achieve your financial goals. This is something that we often advise our clients, including Susan from Ottawa, to do before finally taking out a loan. Susan did not realize that some plans had superior loan provisions or better cash value growth. She could compare plans online to find one that suited her current needs and would lay a firm foundation for the future.

When you borrow against that cash value in a Whole Life Insurance Plan, the cash value of the policy does continue to grow; however, the interest on the loan might slow that down. For example, one client I have in Edmonton borrowed from his policy to buy another property. While he still experienced some growth in cash value during that time, the loan interest somewhat offset this growth. We helped him understand that by paying back that loan, his cash value would recover and continue growing at full potential. If you’re considering taking out a loan, you’ll want to discuss with your insurance advisor how that might impact your policy’s cash value over time.

Yes, you can use your Whole Life Insurance Policy’s cash value for any purpose: funding a child’s education, starting a business, or handling unexpected medical expenses. Our Halifax client was able to tap into her policy’s cash value to pay for the family member’s urgent medical treatment. She felt relieved she wouldn’t have to wait through some long-winded loan approval process, and she had easy access to the funds. At Canadian LIC, we have many clients who, from time to time, appreciate the flexibility that Whole Life Insurance Cash Value offers.

Taking a loan against your Whole Life Insurance Plan is an important decision that has to be made carefully. Canadian LIC has experience handling this process several times, ensuring that the clients understand the benefits as well as the risks associated with it. If you’re thinking about borrowing against your policy or shopping for Canadian Whole Life Insurance Plans, don’t hesitate to contact us today. We are here to help you every step of the way, ensuring your insurance works for you and your family at all times.

Sources and Further Reading

- Canadian Life and Health Insurance Association (CLHIA)

Visit the CLHIA website for detailed information on Whole Life Insurance Policies, cash value accumulation, and industry standards in Canada.

- Government of Canada – Financial Consumer Agency of Canada (FCAC)

The FCAC website provides resources on insurance options, including the pros and cons of Whole Life Insurance and how policy loans work.

- Investopedia – Whole Life Insurance:

A Deeper Dive into Whole Life Insurance

- Investopedia offers a detailed explanation of Whole Life Insurance, including how cash value works and the pros and cons of this type of policy.

- Insurance Bureau of Canada (IBC)

The Insurance Bureau of Canada offers valuable information about life insurance in Canada, helping consumers understand their options and the impact of policy loans.

These sources will help you dive deeper into the topics covered in the blog and better understand Whole Life Insurance, cash value, and policy loans in Canada.

Key Takeaways

- You can borrow against your Whole Life Insurance Cash Value quickly without credit checks.

- Loans reduce the death benefit your beneficiaries will receive

- Interest on the loan accumulates, potentially increasing the loan balance.

- Borrowing from your policy doesn’t impact your credit score.

- Unpaid loans may have tax consequences if the policy lapses.

- Canadian LIC offers guidance on understanding policy loans.

- A repayment plan helps avoid reducing your policy’s benefits.

- Comparing Whole Life Insurance Quotes Online helps find the best plans

Your Feedback Is Very Important To Us

We appreciate your feedback! Please take a moment to share your experiences and challenges related to taking a loan from your Whole Life Insurance Policy. Your insights will help us better understand your needs and improve our services.

Thank you for your time and valuable insights! Your responses will help us better tailor our services to meet the needs of those navigating the complexities of insurance in Canada.

The above information is only meant to be informative. It comes from Canadian LIC’s own opinions, which can change at any time. This material is not meant to be financial or legal advice, and it should not be interpreted as such. If someone decides to act on the information on this page, Canadian LIC is not responsible for what happens. Every attempt is made to provide accurate and up-to-date information on Canadian LIC. Some of the terms, conditions, limitations, exclusions, termination, and other parts of the policies mentioned above may not be included, which may be important to the policy choice. For full details, please refer to the actual policy documents. If there is any disagreement, the language in the actual policy documents will be used. All rights reserved.

Please let us know if there is anything that should be updated, removed, or corrected from this article. Send an email to Contact@canadianlic.com or Info@canadianlic.com