Hello, and welcome to the universe of Universal Life Insurance! It’s good to know what happens behind the scenes of Universal Life Insurance policies if you are considering insurance coverage in Canada. Universal Life Insurance is akin to a Swiss army knife of finances, a multifunctional tool with protection and savings combined in one package. The monthly Universal Life Insurance price is a significant consideration that is frequently overlooked.

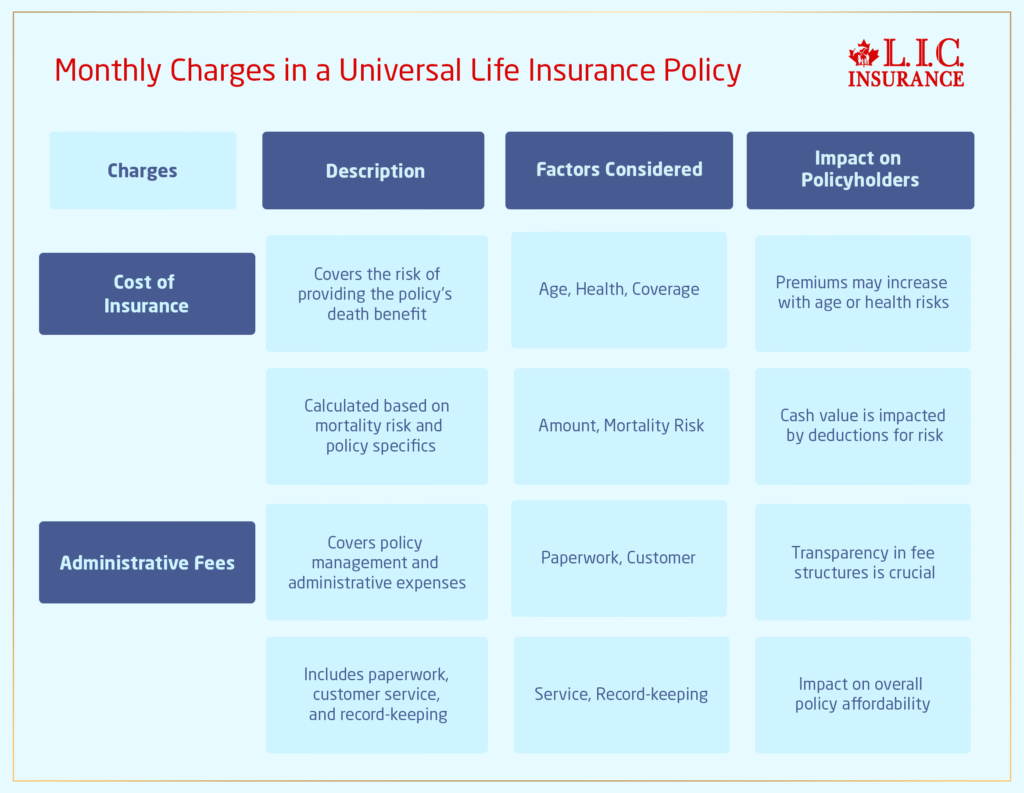

When diving deep into the functionality of Universal Life Insurance, two primary charges will catch your eye: administrative fees and the cost of insurance. These charges play an essential role since they affect your Universal Life Insurance policy’s performance and your wallet.

Various firms providing Universal Life Insurance cover these fees differently, thus the need to request quotations from multiple insurance firms. You can compare various Universal Life Insurance policies and select one that suits you best and your budget.

We’ll assist you in comprehending Universal Life Insurance better by defining these routine deductions. Having these fees known provides you with the confidence to handle Universal Life Insurance schemes.

If you are residing in Canada and possess a Universal Life Insurance policy, you should be aware of routine fees that could be deducted. Usually, these fees consist of two primary components: the cost of insurance and administrative charges.

Most Canadians wonder the same thing before they commit: how much is Universal Life Insurance a month, and what are they paying for anyway? The answer isn’t one-size-fits-all—it varies depending on your age, health, and how your policy is set up. Knowing what impacts your monthly fees can prevent surprises down the road. That’s why it’s more crucial than ever to break down these charges.

Monthly Charges in a Universal Life Insurance Policy

Cost of Insurance

What is the Cost of Insurance?

The cost of insurance is what the insurance provider deducts to cover the risk of providing Universal Life Insurance coverage. It’s like the fee for the protection your Universal Life Insurance offers.

How does it work?

- This charge is calculated based on factors like your age, health, and the coverage amount.

- As you keep growing older or if your health changes, this charge might increase.

Understanding Quotes from Different Providers

- Different Universal Life Insurance providers may offer varying costs for insurance.

- It’s smart to explore quotes from multiple providers to find a suitable option.

Administrative Fees

What are Administrative Fees?

These fees take care of the maintenance and management of your Universal Life Insurance policy. Think of them as the cost for the company to keep things running smoothly.

What’s Included?

- Administrative fees take care of tasks like paperwork, customer service, and keeping records up-to-date.

- Providers may differ in how they structure these fees.

Comparing Providers

- Just like with insurance costs, different providers might have varying administrative fees.

- Checking out quotes from different providers helps in understanding these differences.

Beyond the Basics: How Policy Design Impacts Your Monthly Cost

While most discussions around Universal Life Insurance stop at the cost of insurance and administrative fees, there’s another layer that directly affects how much is Universal Life Insurance per month—your policy design choices. These include how much you allocate toward the investment portion of the policy, your selected death benefit option (Level vs. Increasing), and how frequently you contribute over and above your minimum premium.

For example, policyholders who choose to contribute higher amounts into the investment portion early on may offset the rising cost of insurance later in life. This proactive funding can ease future financial pressure and prevent unexpected policy lapses due to underfunding. Additionally, opting for an increasing death benefit structure may slightly raise monthly costs but can provide better long-term value for families concerned about inflation or growing liabilities.

Another often-overlooked factor is the insurer’s internal cost structure—some insurers allow you to customize the investment component or frequency of administrative charges. These micro-adjustments can significantly influence how much is Universal Life Insurance per month and ultimately shape the sustainability of your policy.

By understanding these behind-the-scenes levers, you’re not just managing charges—you’re strategically building a policy that aligns with your long-term financial goals. This is where working with a knowledgeable advisor becomes essential—they can help you explore how to design your policy efficiently, based on your age, budget, and future needs.

Detailed Breakdown of the Cost of Insurance & Administrative Fees

Cost of Insurance

The insurance premium is what the insurance company charges to bear the risk of insuring you. It’s similar to hiring a security guard to keep an eye on your belongings. They determine this fee based on your age, health, and the amount of coverage you’ve selected.

This fee is important since it has a direct effect on your Universal Life Insurance policy’s cash value. Over the years, this fee increases as you age or in the event of changes in your health status. This is why comparing Universal Life Insurance quotes from various providers is important. All providers might have varying methods of determining this fee; hence, comparing quotes ensures that you get the most suitable one for you.

Importance of Comparing Quotes

Not all Universal Life Insurance companies compute the cost of insurance in the same manner. There may be some more competitive rates available under your conditions. This is where it is so critical to shop around for quotes with various companies. It’s similar to finding the best bargain when you’re purchasing something on the internet—browsing through various sites enables you to get the best price.

When you’re comparing quotes, it’s not only about the numbers. You’re also looking at what each provider can do for you for that amount. Some may include something extra or a different payment system that is more suitable for your needs.

Knowing how much insurance in your Universal Life Insurance costs is a little like knowing how much gasoline your vehicle requires to drive on a journey. You’d like to ensure you’re purchasing the appropriate amount for the best value, and getting quotes from different providers to compare helps to do exactly that.

Administrative Fees

The other that gets removed from your Universal Life Insurance each month is the administrative fee. These fees account for the work that must be conducted at the back of your Universal Life Insurance policy to keep your insurance content. They will handle the paperwork, record keeping, and other tasks that are required to operate your Universal Life Insurance policy.

That aside, every company selling Universal Life Insurance charges these fees differently. Some charge a bit more, some charge a bit less. It’s similar to viewing various stores selling the same running shoes. They might be different prices, but they all perform the same task.

If you wish to locate the top Universal Life Insurance, check how they deal with their administrative charges. Some may be more transparent in explaining why they price their insurance the way they do. That transparency may assist you in understanding what you are paying for.

Also, when you’re receiving quotes for Universal Life Insurance, don’t forget to compare the way each company administers its administrative costs. There is something tiny that could end up making a big difference down the line. It’s just about getting the most for your money and yourself.

It is essential to know these monthly premiums because they have a direct impact on the cash value of your Universal Life Insurance and the benefit you receive overall. You can select the Universal Life Insurance policy that suits your desires and budget by viewing quotes from several different insurance providers.

Individuals in Canada selling Universal Life Insurance will discover that every insurance company will charge these fees in a unique manner. It’s best to compare Universal Life Insurance quotes from more than one company so you can observe how they separate these charges. There are some providers that will give you lower COI but higher insurance fees, and vice versa. The most efficient method of maximizing your Universal Life Insurance protection is to establish the proper balance between these charges.

Keep in mind that Universal Life Insurance is adjustable, so you can modify your coverage and premiums until they are where you need them to be. When shopping around at various providers, don’t just consider the amount you pay per month. Consider what else they provide and what else you get out of their services. Some will provide more investment options or more helpful customer service, which will make your Universal Life Insurance valuable beyond the monthly payment.

Importance of Being Informed

Knowing how Universal Life Insurance companies compute monthly fees is important to policyholders. With a good understanding of these fees, you can make better decisions regarding your Universal Life Insurance and have it suited to your needs.

When you are comparing Universal Life Insurance Policies, you need to get quotes from multiple providers. This ensures that you compare not only the premiums but also the composition of monthly charges, such as the charge for insurance and administrative charges. Each provider would have a different set of charges affecting how your policy performs. It affects the overall value your policy provides in the long term.

You equip yourself with knowledge by requesting quotes from more than one Universal Life Insurance company. You are able to view the differences in fees and make an educated choice on what is suitable for your budget and coverage needs.

Keep in mind that being aware of monthly charges allows you to determine the actual worth of a policy. It makes it possible for you to understand not just the premium but also the cost breakdown, allowing you to choose the best fit for your financial protection.

Therefore, invest the time to find quotes from various Universal Life Insurance companies. It’s a move that can have a great bearing on the worth and efficiency of your policy in the future.

Concluding Thoughts

In conclusion, knowing the ins and outs of Universal Life Insurance policies is imperative in maximizing their benefits prior to purchasing Universal Life Insurance. By learning the two main charges—the charge for insurance and administrative fees—you have a better understanding of how your policy works.

While looking into your alternatives, make sure to contact different Universal Life Insurance companies. These different companies will have different quotes and plans for these fees. This diversity can actually benefit you by enabling you to obtain the most suitable Universal Life Insurance policy that will suit your needs and expenditure.

By remaining well informed and comparing quotes from several providers, you’re in a position to make an informed choice. It’s not merely taking out a policy; it’s taking out the optimum Universal Life Insurance policy—a policy that will protect your future while being conscious of your monthly rates.

Therefore, take the initiative to compare various Universal Life Insurance quotes from other providers. Your financial future is worth the attention to detail that comes with the knowledge of these fees and finding the most appropriate Universal Life Insurance plan for yourself.

Get The Best Insurance Quote From Canadian L.I.C

Call 1 844-542-4678 to speak to our advisors.

Faq's

The cost of insurance refers to the amount deducted monthly to cover the risk component of the policy. It includes the expenses associated with providing the death benefit.

Providers calculate this charge based on factors like age, health, coverage amount, and the insurer’s mortality risk.

Administrative fees cover the operational costs of managing the policy, such as paperwork, customer service, and record-keeping.

Yes, different providers can structure the cost of insurance and administrative fees differently, leading to variations in the quotes they offer.

The deductions for these charges impact the policy’s cash value. Understanding them is crucial as they directly influence the growth of the cash value over time.

Getting quotes from different providers allows you to compare not only premiums but also the structure of charges. This helps in finding a policy that aligns with your needs and budget.

Some providers might offer flexibility or customization options for charges based on the policy terms or your negotiation abilities. It’s worth discussing these aspects when exploring policies.

The charges can remain consistent throughout the policy term or may change based on various factors. It’s advisable to clarify this with your insurance provider before finalizing a policy.

Missing payments due to deductions for charges can impact the policy’s performance. It’s crucial to understand the policy terms regarding missed payments and their consequences.

While charges are inherent to the policy structure, some strategies might help minimize their impact. Discussing options with your insurance provider or financial advisor can provide insights into potential approaches.

Comparing quotes from different providers can give you an idea of what’s typical. Additionally, discussing the breakdown of charges with your insurance agent can help gauge reasonableness.

In some cases, policyholders can switch providers through a process called policy replacement. However, it’s essential to consider potential consequences and evaluate if the change benefits your financial goals.

Generally, these charges are separate from the death benefit. However, high charges over time can impact the policy’s cash value, potentially affecting the amount available for the death benefit.

Maintaining good health and reviewing the policy periodically with your provider can help ensure you’re getting the best rates. Some policies may also offer opportunities to adjust coverage or payment structures.

Request a detailed breakdown of charges from prospective insurance providers or the insurance brokers. Reviewing policy documents and asking questions about charges during consultations can provide clarity.

Yes, policies often have a free look period, allowing cancellation within a specified timeframe after purchase. However, cancelling a policy might have financial implications, so it’s advisable to understand the terms beforehand.

The cost of insurance usually increases as you age since mortality risk rises. It’s important to anticipate potential increases and plan for them when considering long-term financial strategies.

Some policies may have provisions for waivers or reductions under specific conditions, such as disability or premium payment moratoriums. It’s crucial to review policy terms for such features.

The deductions for charges typically don’t have direct tax implications. However, the policy’s cash value and death benefit might have tax considerations, so consulting an insurance broker or a tax advisor is advisable.

Regularly reviewing your universal life policy, staying informed about any changes, and discussing options with your insurance provider or financial advisor can help maximize the benefits of your Universal Life Insurance.

The above information is only meant to be informative. It comes from Canadian LIC’s own opinions, which can change at any time. This material is not meant to be financial or legal advice, and it should not be interpreted as such. If someone decides to act on the information on this page, Canadian LIC is not responsible for what happens. Every attempt is made to provide accurate and up-to-date information on Canadian LIC. Some of the terms, conditions, limitations, exclusions, termination, and other parts of the policies mentioned above may not be included, which may be important to the policy choice. For full details, please refer to the actual policy documents. If there is any disagreement, the language in the actual policy documents will be used. All rights reserved.

Please let us know if there is anything that should be updated, removed, or corrected from this article. Send an email to Contact@canadianlic.com or Info@canadianlic.com