It’s good to be able to work as a Canadian, and Disability Insurance insures them financially if they become ill or injured and are unable to work. Disability Insurance may be difficult to understand, though. This blog will guide you through figuring out how much Disability Insurance you need based on factors such as your salary, your costs, and your options for coverage. Whether you are new to the concept or simply wish to know more about it, this blog will assist in explaining it to you so that you can make informed choices with regard to your finances.

Having the ability to work is significant to Canadians, and Disability Insurance keeps them secure financially in case they fall ill or are injured and cannot work. But it is difficult to understand how to utilize Disability Insurance. This blog will teach you how to determine how much Disability Insurance you should have by considering such factors as your income, your expenses, and your coverage options. Whether you are new to the concept or simply wish to learn more about it, this blog will assist you in better comprehending it so that you can make intelligent decisions regarding your financial health.

When it comes to the age old question: how much Disability Insurance should I have or how much Disability Insurance do I need, it is not always so clear. You will find tools like a Disability Insurance calculator, a Disability Insurance cost calculator, or even a long term Disability Insurance premium calculator, but everybody is different. This can be a useful tool, but it doesn’t always account for the big picture: What is the true Disability Insurance cost per month, how your benefits will replace income, or even what an individual Disability Insurance rate should look like.

This guide will take things to the next level. We’ll show you how to analyze your needs, if you’re searching for a Disability Insurance quote calculator; comparing cost of Disability Insurance Canada; or thinking, “How much is Disability Insurance for someone in my occupation?” Whether you are looking for great west Disability Insurance, working around mortgage protection using a mortgage Disability Insurance calculator, or rounding out your total coverage with a Disability Insurance calculator Canada we are here to simplify it for you. By the end, you’ll have the knowledge you need not only to access Disability Insurance — along with the peace of mind in knowing you can stay covered as your needs evolve in the future.

Let’s first get to know Disability Insurance

Disability Insurance, also known as income replacement insurance, provides financial support if you are unable to work due to a disability. In Canada, Disability Insurance companies offer various policies customized to meet the diverse needs of individuals. Before going into the calculation process, it’s essential to understand the key components of disability coverage:

Coverage Options:

Disability Insurance Policies in Canada offer different coverage options, including short-term Disability Insurance and long-term Disability Insurance. Short-term policies typically provide coverage for a limited duration, such as a few months, while long-term policies offer protection for an extended period, often until retirement age.

Benefit Amount:

The benefit amount of Disability Insurance is typically a percentage of your pre-disability income. In Canada, it is recommended that your Disability Insurance benefit cover approximately 60% of your income, aligning with your after-tax earnings. Calculating this amount accurately requires consideration of your current income, monthly expenses, and future financial obligations.

Waiting Period:

Disability Insurance policies often include a waiting period, also known as an elimination period, during which you must wait before getting the benefits after becoming disabled. The waiting period duration varies depending on the policy, with longer waiting periods typically resulting in lower premiums.

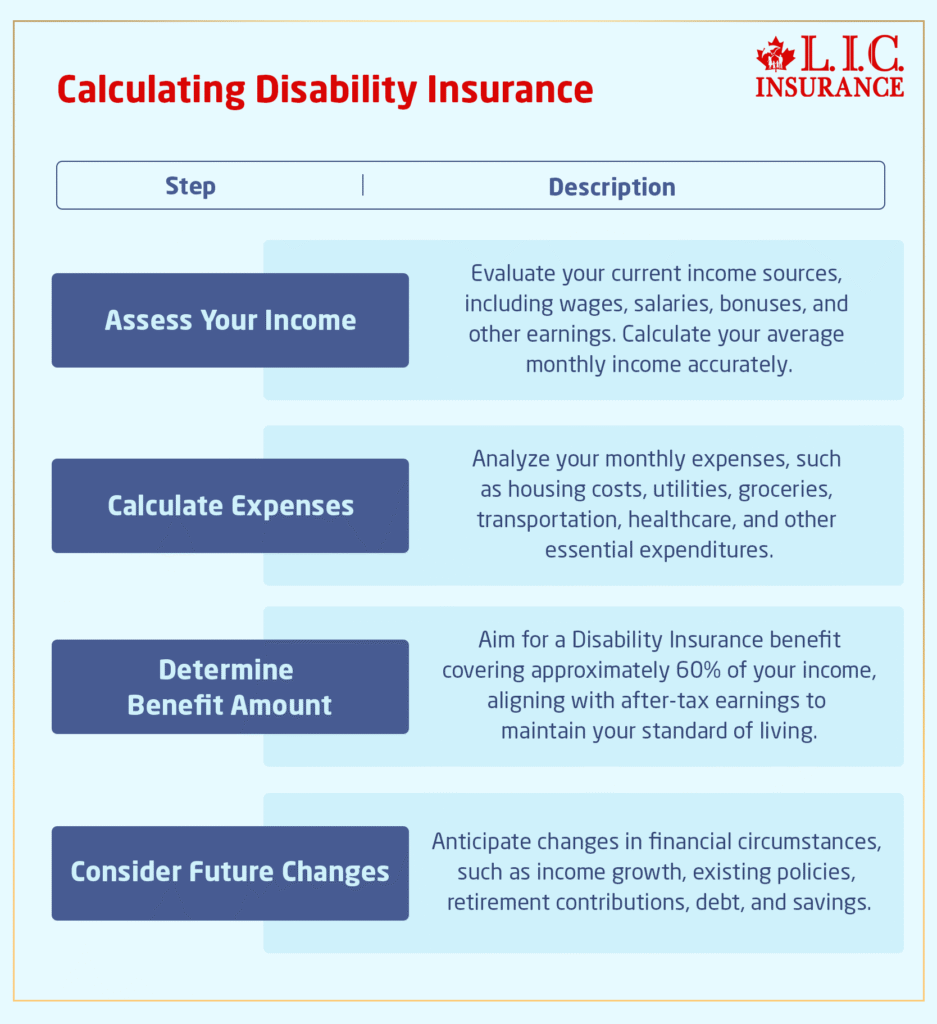

Calculating Disability Insurance

Now that we’ve established the fundamentals, let’s get into the process of calculating Disability Insurance. The steps below will help you determine the appropriate coverage amount and cost, ensuring you’re prepared for any unforeseen circumstances.

Assess Your Income:

The initial calculation for Disability Insurance involves determining your income. Count all forms of earnings, such as wages, salaries, bonuses, and any other sources of income you might have. It is crucial that you take into account fluctuations or irregularities in earnings to reach a proper average monthly income. Having an idea of your current income level will be a good place to start when calculating your coverage requirement.

Calculate Your Monthly Expenses:

After you’ve evaluated your income, the next thing to do is to estimate your monthly expenses. This means evaluating all areas of your budget, such as housing, utilities, grocery bills, transportation, medical bills, and other basic expenses. Be careful to note all applicable expenses, as failure to include any of them might lead to underestimating your coverage needs. The idea is to be able to sustain your lifestyle in case you become disabled, so it’s essential to know your monthly expenses in full.

Determine Your Desired Benefit Amount:

With your income and expenses clearly in mind, you can now calculate your desired benefit amount. As a rule of thumb, plan for Disability Insurance coverage that will replace about 60% of your income. Use your after-tax earnings when calculating this amount, so that it will give you adequate coverage to take care of yourself financially if you become disabled. Matching your benefit amount to your income can help you protect your financial security during difficult times.

Consider Additional Factors:

Aside from your present income and expenses, you should also consider other elements that can affect your coverage requirements. Projected changes in your financial situation, including expected growth in income, current Disability Insurance policies, retirement plan contributions, current debt balance, and savings, must be considered. These elements can directly affect the level of coverage you need, thus, a good assessment is necessary. By taking these other factors into account, you can have confidence that your Disability Insurance coverage will properly cover your financial health.

Disability Insurance Companies in Canada

| Company Name | Description |

|---|---|

| Manulife | Large insurer offering reliable disability plans. |

| Sun Life Financial | Trusted provider with comprehensive options and support. |

| Great-West Life | Established presence, competitive premiums, and customization. |

| Canada Life | Renowned for stability, responsive claims, and benefits. |

| Desjardins Insurance | Innovative, flexible policies with transparent service. |

When it comes to safeguarding your financial future with Disability Insurance in Canada, selecting the right insurance provider is paramount. With numerous options available, it’s crucial to research reputable companies that offer comprehensive coverage and exceptional customer service. To help you make an informed decision, here’s a list of some prominent Disability Insurance companies in Canada:

Manulife:

Manulife is one of the biggest insurance companies in Canada. They have many different types of Disability Insurance plans to meet the needs of people and families. With a strong reputation for dependability and financial stability, Manulife gives clients who become disabled unexpectedly mental peace.

Sun Life Financial:

Sun Life Financial is another trusted name in the insurance industry, known for its comprehensive Disability Insurance offerings and commitment to customer satisfaction. With a focus on flexibility and tailored solutions, Sun Life Financial ensures that policyholders receive the support they need during challenging times.

Great-West Life:

Great-West Life is renowned for its long-standing presence in the Canadian insurance market and its dedication to delivering quality products and services. As a leading provider of Disability Insurance, Great-West Life offers competitive premiums and customizable coverage options to suit individual preferences and budgets.

Canada Life:

Canada Life boasts a solid reputation for stability and reliability, making it a top choice for Disability Insurance coverage. With a focus on customer-centric solutions and responsive claims processing, Canada Life provides policyholders with the confidence and security they need to navigate life’s uncertainties.

Desjardins Insurance:

Desjardins Insurance is recognized for its innovative approach to Disability Insurance, offering flexible policies and comprehensive benefits to meet the evolving needs of Canadians. With a commitment to transparency and integrity, Desjardins Insurance ensures that policyholders receive fair and equitable treatment throughout their coverage period.

Before making a decision, it’s essential to compare policies, benefits, premiums, and customer reviews from these Disability Insurance companies in Canada. Consider factors such as coverage limits, waiting periods, optional riders, and premium affordability to determine the best fit for your needs and budget.

In addition, take advantage of online resources and tools provided by these insurance companies to obtain personalized quotes and explore different coverage options. By taking a proactive approach to research and comparison, you can select a Disability Insurance provider that offers the right balance of protection, affordability, and customer service.

Hence, choosing the right Disability Insurance company is a very important step towards securing your financial future in Canada. With reputable providers, you can trust that your Disability Insurance needs will be met with professionalism, reliability, and integrity. Take the time to research and compare options to find the best Disability Insurance coverage that fits your unique needs and circumstances.

Disability Insurance Cost

Exploring the complexities of Disability Insurance costs in Canada unveils various factors that influence premiums, from age and occupation to health status and coverage options. Understanding these nuances is essential for deciding to secure financial protection against disability.

Age:

As with many insurance products, age plays a very important role in figuring out the cost of Disability Insurance in Canada. Generally, younger individuals can secure coverage at lower premiums compared to their older counterparts. This is because younger individuals typically have a lower likelihood of experiencing a disabling injury or illness, resulting in reduced risk for insurance providers.

Occupation:

Your occupation can greatly impact the cost of Disability Insurance. Those in lower-risk occupations, such as office workers or professionals in non-hazardous fields, often enjoy lower premiums due to their reduced likelihood of workplace injuries or illnesses. Conversely, individuals in high-risk occupations, such as construction workers or firefighters, may face higher premiums to account for the increased likelihood of disability-related claims.

Health Status:

Your current health and medical history also influence the cost of disability coverage. Insurance providers may assess factors such as pre-existing medical conditions, lifestyle habits, and overall health when determining premiums. Generally, individuals in good health can secure coverage at more affordable rates, while those with underlying health issues may face higher premiums or coverage limitations.

Coverage Amount:

The amount of coverage you choose significantly impacts the cost of disability coverage. Opting for higher benefit amounts will naturally result in higher premiums, as insurance providers assume greater financial risk at the time of a disability claim. It’s essential to carefully assess your income needs and financial obligations when selecting the appropriate coverage amount to ensure adequate protection without overextending your budget.

Benefit Period:

The benefit period, or the maximum length of time your policy will pay out benefits, also influences the cost of Disability Insurance. Policies with longer benefit periods, such as those that provide coverage until retirement age, typically command higher premiums due to the longer duration of potential claims. Conversely, policies with shorter benefit periods may offer lower premiums but provide less comprehensive coverage.

Waiting Period:

The waiting period, also known as the elimination period, is the amount of time you must wait after becoming disabled before receiving benefits. Shorter waiting periods typically result in higher premiums, as they provide quicker access to benefits in the event of disability. Conversely, opting for a longer waiting period can help reduce premiums but requires a longer wait before benefits commence.

Why Online Disability Insurance Calculators Alone Aren’t Enough

Most Canadians looking into Disability Insurance begin by searching for tools like a Disability Insurance calculator, Disability Insurance quote calculator, or even a long-term Disability Insurance cost calculator. While these tools offer a quick estimate of how much Disability Insurance you should get, they often miss crucial nuances, especially if you’re self-employed, changing jobs, or facing fluctuating income.

Online Disability Insurance software or Disability Insurance rates calculators typically ask for basic inputs: age, income, and occupation. But they rarely factor in deeper financial elements like debt-to-income ratios, inflation over the benefit period, or ongoing contributions to TFSAs or RRSPs. They also fail to account for personalized costs such as Disability Insurance cost per month for specific professions, like the average cost of physician Disability Insurance, or how mortgage Disability Insurance calculators evaluate benefit alignment with home loan payments.

When evaluating how much is Disability Insurance, how is Disability Insurance calculated, or how much Disability Insurance do I need, a more comprehensive approach is key. Consider your post-tax income, lifestyle needs, and family obligations. Simply knowing that Disability Insurance replaces income isn’t enough—you need to ensure the amount is sustainable over time.

Even top providers like Great West Disability Insurance recommend combining tools like a Disability Insurance calculator Canada with expert consultation. This helps you match your budget with actual Disability Insurance cost, especially when considering individual Disability Insurance rates or Disability Insurance monthly costs based on occupation risk.

Ultimately, the cost of Disability Insurance or Disability Insurance price should not be the only deciding factor. Understanding your unique financial picture—not just monthly premiums—will help you determine how much Disability Insurance you should I have and how to get Disability Insurance that truly supports your future.

Figuring Out Your Options

In order to obtain an accurate estimate of your Disability Insurance cost, it’s essential to consider these factors and explore your options carefully. Start by researching reputable Disability Insurance companies in Canada and requesting quotes from multiple insurers. By comparing their offerings, including coverage options, premiums, and policy features, you can decide well based on your needs and budget.

The End

In conclusion, calculating Disability Insurance is important in safeguarding your financial stability in the event of unforeseen circumstances. You can figure out the appropriate coverage amount and cost that suits your circumstances by assessing your income, expenses, and future financial needs. Remember to research reputable Disability Insurance companies in Canada and compare policies to find the best fit for your needs. Taking proactive steps to secure adequate Disability Insurance coverage can provide you with peace of mind and financial security for you and your loved ones. Don’t wait until it’s too late – protect your future today.

Get The Best Insurance Quote From Canadian L.I.C

Call 1 844-542-4678 to speak to our advisors.

FAQ’s on Disability Insurance Plans

What is the difference between Social Security Disability Insurance and other kinds of insurance or benefits, such as workers’ compensation, veterans’ benefits, or private disability insurance? Disability Insurance protects you and your family from your lost income because you are unable to work due to your disability, helping secure your financial well-being. This differs from other types of insurance, where your policy would pay out should something happen (e.g., life insurance) or might help with medical expenses (e.g., health insurance); however, the impact on your job availability or ability to work doesn’t factor in.

When determining your Disability Insurance needs, take into account your current income, monthly costs, estimated future income, any current insurance coverage, retirement plan contributions, any outstanding debt, general savings, and any other benefits.

Short-term Disability Insurance often pays claims for a few months, while long-term disability carries on for an extended period, which in many instances is until retirement age. Select a policy depending on your financial liabilities and your preferences.

In Canada, income benefits from Disability Insurance are typically taxable if the original premiums were paid by the employer. But if you pay the premiums out of pocket, benefits are generally tax-free. Consult a tax professional for personal advice.

While some insurance companies may be providing coverage for those who receive pre-existing medical conditions, it is imperative that you disclose any existing health issues when you apply for a policy. Is the Health Insurance Marketplace. Depending on your health, you could pay more for coverage or have some of your medical conditions excluded from coverage.

Yes, some Disability Insurance products do come with some flexibility where you can adjust the amount of coverage or add extra policies to keep pace with changing needs. Discuss with your insurance company about reducing your coverage.

Alert your insurance carrier as soon as you become disabled and need to file a claim. Follow their requirements for submitting documentation like medical records or proof of disability, and they should guide you through the claims process to ensure a hassle-free experience.

Yes, you generally can cancel your Disability Insurance policy at any time, subject to the terms and conditions of your policy. Contact your insurance professional for advice on cancelling and possible penalties or refunds.

Disability Insurance in Canada: In Canada, Disability Insurance payments can be taxed, because premiums and benefits are usually taxed as revenues. But if you paid the premiums yourself, the benefits are generally tax-free. For tailored advice, we recommend you speak to a tax professional.

Video Surveillance—Disability Insurance Surveillance of disabled claimants is conducted under the guise of determining the validity of the claim. That’s anything from surveilling an individual’s social media to even possibly tracking down interviews with known associates, or employing private investigators. But mostly that’s all in the confines of the law with the proper authority.”

The amount of disability coverage you need depends on factors such as your income, monthly expenses, projected future income, insurance benefits you already receive, debts and more. As a rule of thumb, target coverage that would replace 60 per cent or so of your pre-disability income in order to sustain your standard of living.

You may want to get Disability Insurance earlier in your career when your financial situation is more secure and you have fewer financial obligations. But Disability Insurance policies are extremely helpful at any age, especially if you have dependents or financial obligations.

“What is the best Disability Insurance company?” The best Disability Insurance company is different for everyone, depending on what you need and want, and what your “situation” is. Understanding your options is crucial, including comparing policies, benefits, premiums and customer reviews to determine the best one for you.

Disability Insurance rates are usually paid for by the insured alone or as part of an employer-based plan. Disability Insurance plans can sometimes have contributions from both the employer and the employee. The policyholder must pay premiums to keep the coverage in effect.

In general, there is no taxable income to the recipient due to the payment. The benefits are also typically treated as taxable income if your employer paid the premiums. But if you’re the one who paid the premiums, the benefit is usually tax-free. I would recommend reading the wording of your policy, and if in any doubt, speak to a tax adviser.

Read up, talk to insurance experts, or sign up for a seminar or workshop to understand Disability Insurance plans in Canada a little more. Contact reliable insurance businesses or organizations and ask them for advice that will help you comprehend your alternatives.

The above information is only meant to be informative. It comes from Canadian LIC’s own opinions, which can change at any time. This material is not meant to be financial or legal advice, and it should not be interpreted as such. If someone decides to act on the information on this page, Canadian LIC is not responsible for what happens. Every attempt is made to provide accurate and up-to-date information on Canadian LIC. Some of the terms, conditions, limitations, exclusions, termination, and other parts of the policies mentioned above may not be included, which may be important to the policy choice. For full details, please refer to the actual policy documents. If there is any disagreement, the language in the actual policy documents will be used. All rights reserved.

Please let us know if there is anything that should be updated, removed, or corrected from this article. Send an email to Contact@canadianlic.com or Info@canadianlic.com