- How Long Do You Pay Premiums For Universal Life Insurance?

- Let’s Understand Universal Life Insurance

- Duration Of Premium Payments

- Lifetime Coverage

- Flexibility In Premium Payments

- Understanding Regional Costs and Real-Time Estimations

- Exploring Universal Life Insurance Quotes Online

- Choosing The Right Insurance Brokerage

- To Wrap It All Up

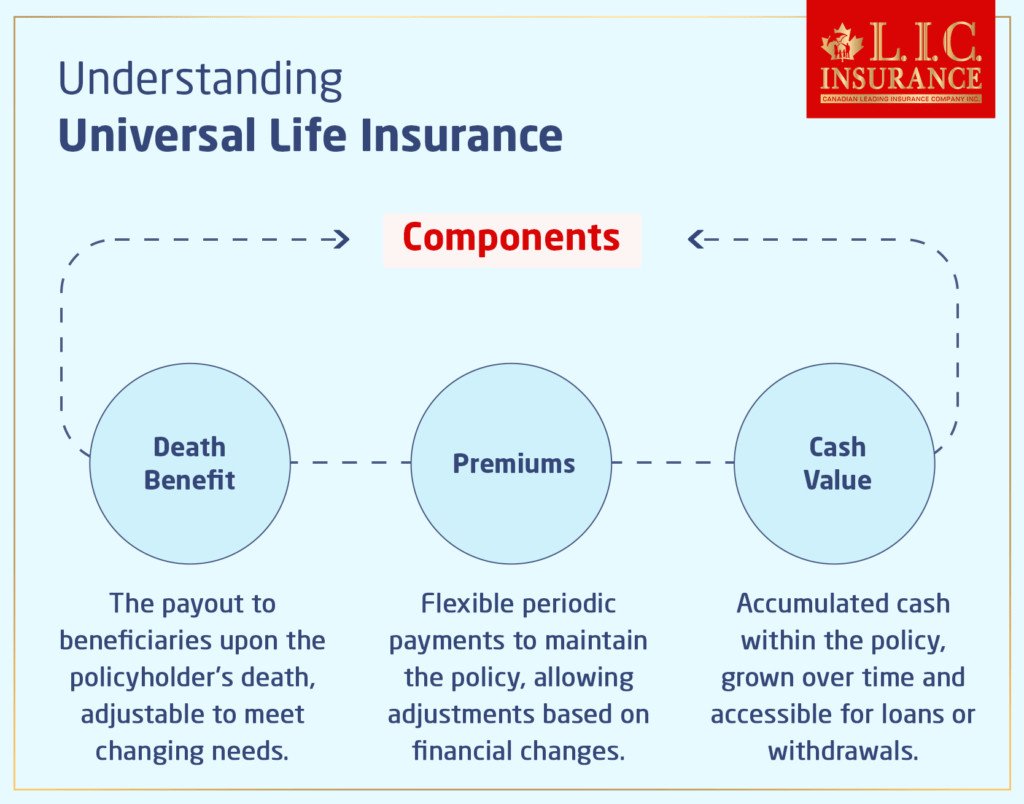

Universal Life Insurance is a special kind of protection that combines death benefits with investments. In this way, people can accumulate cash value over time, which can be used for many things, like adding to their retirement income or paying for unforeseen expenditures. A key feature of Universal Life Insurance is the flexibility it provides, allowing policyholders to adjust both the death benefit and premium payments.

Let’s Understand Universal Life Insurance

Universal Life Insurance is a special kind of protection that combines death benefits with investments. In this way, people can accumulate cash value over time, which can be used for many things, like adding to their retirement income or paying for unforeseen expenditures. A key feature of Universal Life Insurance is the flexibility it provides, allowing policyholders to adjust both the death benefit and premium payments.

Duration of Premium Payments

Understanding the duration of premium payments is extremely essential when considering Universal Life Insurance in Canada. Unlike Term Life Insurance, where premiums are paid for a specified term, Universal Life Insurance covers the policyholder’s entire lifetime. This unique feature makes it a dynamic and enduring financial tool, allowing individuals to tailor their premium payments to suit their evolving needs and circumstances.

Lifetime Coverage

The overarching difference between Universal Life Insurance and its term counterpart is the length of time your coverage exists. Term Life Insurance covers you for a specific length of time, usually from 10 to 30 years. Permanent Life Insurance, on the other hand, will last as long as the user needs it to. This durability feature is particularly attractive for individuals with a long-term goal and who want to put something in place that isn’t going to be easily changed to protect their loved one’s financial future.

Although with Universal Life Insurance, you still have the peace of mind of knowing that your death benefit will still be in place, protecting your beneficiaries, even as you grow old. And of course, the lifelong (to 121 at least) nature of this coverage is attractive to those who believe life insurance is a permanent need, not just a temporary one.

Flexibility in Premium Payments

One of the things that makes Universal Life Insurance unique is the control it gives to policyholders regarding premium payments. This flexibility is especially beneficial in light of the changing financial circumstances in people’s lives.

The policyholder has the flexibility to adjust premiums – how much and how often to save – according to their individual financial requirements and objectives. Others may prefer keeping the premiums the same throughout life, and have a fixed and predictable outgo. It’s a compliment to give a sense of continuity and will prevent the coverage from being interrupted.

By contrast, people with inconsistent income streams or who expect to face additional financial commitments further down the line can choose a more adaptable payment schedule. They could, for example, front-load their premium payments during their working years, when earnings are generally higher, and cut back during retirement, when they might have fewer financial responsibilities.

That adjustability also means you can take a break from paying premiums or add extra premiums in a given year, depending on your situation. It’s a financial product that grows with you, with a level of control not typically available in other insurance offerings.

Understanding Regional Costs and Real-Time Estimations

When it comes to preparing for long-term financial security through insurance, location may do more to determine cost than is commonly realized. For example, individuals who are seeking out Universal Life Insurance in Calgary tend to run into different price points than those in smaller towns and rural areas. This is driven by geographic underwriting habits, variances in the availability of healthcare, and lifestyle-related policies that factor into underwriting.

So, what is the cost of Universal Life Insurance in these areas? The answer is: It varies based on your age, health history, investment goals, and whether you choose to purchase Universal Life Insurance, which provides a cash value accumulation. Although entry-level policies for young people might begin at around $50 a month, high-value policies with strong cash value components can easily top $300 a month.

To understand that range, more and more Canadians are now using tools such as a Universal Life Insurance Policy calculator. These tools provide customized estimates that consider the amount of coverage, the length of premium payment, and options for growth potential in cash value. These are particularly helpful for seeing how Premium Increases on Universal Life Insurance may impact your policy over time, from age-related risk increases or higher cost of insurance charges.

When you’re thinking long term and want to focus on protecting your wealth for your lifetime and your heirs’, these are the instruments that could help demystify pricing and make sure you’re only getting into what’s right for your actual financial road map.

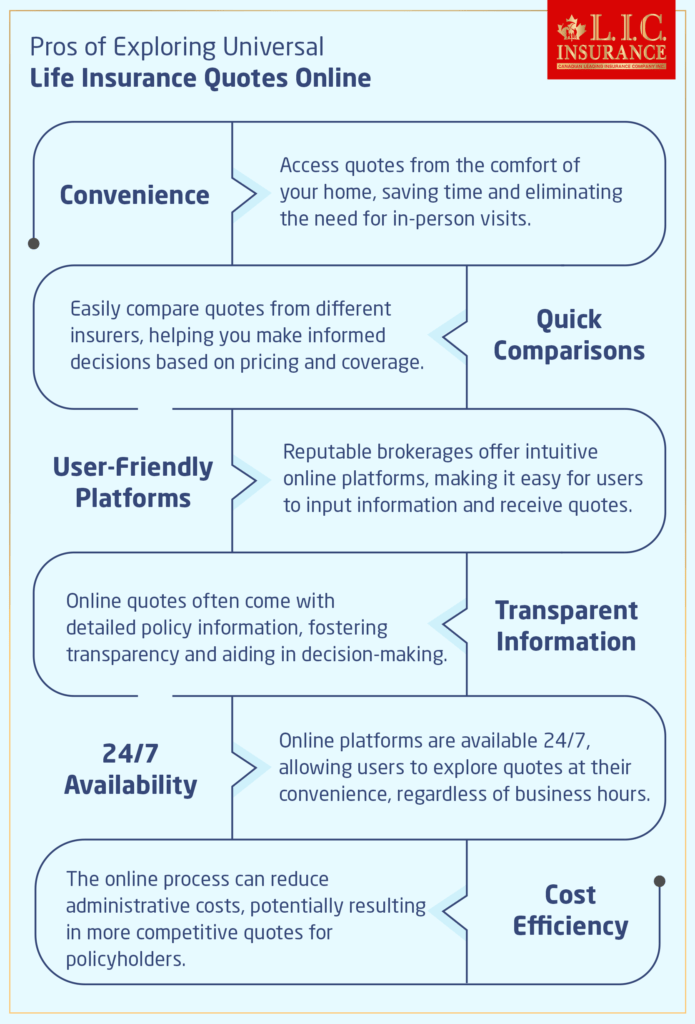

Exploring Universal Life Insurance Quotes Online

In this modern age, the internet has changed how we get services and information, including insurance. People can now get insurance quotes online with just a few clicks, which makes the process faster and easier than ever. When it comes to securing the best Universal Life Insurance quotes online in Canada, choosing the right insurance brokerage is the most important.

Partnering with a Reputable Insurance Brokerage:

The internet is flooded with insurance options, but not all are created equal. It’s very important to partner with a reputable insurance brokerage that understands the little details of the Canadian market. A reliable brokerage will have a deep understanding of the world of insurance and will be equipped to guide you through the process of obtaining Universal Life Insurance quotes online.

User-Friendly Online Platforms:

The right insurance brokerage will have a convenient online system in place where individuals can input their specific information and be given the type of quotes that makes sense for them. These platforms are built to make the quoting process easier by providing the ability for a person to research coverage from their computer at home.

If you are searching for Universal Life Insurance quotes online, then find a brokerage that values simplicity and clarity. The top online platforms will hold your hand through each part of the quoting process so that the information is clear for you.

Competitive Quotes and Informed Decision-Making:

Getting online Universal Life Insurance quotes is only half the battle. You will want to work with a broker that offers competitive quotes and that takes the time to walk you through any complexities in each policy. Trustworthy brokers will be staffed with knowledgeable professionals who can answer all your questions and guide you to the best decision about your coverage.

When doing a comparison of Universal Life Insurance rates, use the following three factors to help you compare policies and decide which one is best for you. While price is an important consideration, it’s hardly the only thing to keep in mind when choosing a policy. Find coverage that strikes the right balance between coverage and affordability, while taking into account long-term financial goals and commitments.

Transparency and Trust:

And when it comes to online Universal Life Insurance quotes, that is not a quality you want in a company. An insurance brokerage should be able to present each policy in a transparent & understandable way, complete with potential limitations or exclusions. They should also be transparent about any fees or costs linked to the policy so that you know the T’s and C’s before making a commitment.

So, getting Universal Life Insurance quotes online is the most convenient, easiest way to see what you have to choose from when it comes to coverage. First thing is to team up with a trusted insurance brokerage and land the best coverage available, with a clear, no-hassle agenda. And keep in mind, your financial well-being is too valuable to just hope for the best. Then take the time to carefully consider your options—and the peace of mind you deserve.

Choosing the Right Insurance Brokerage

Choosing the right insurance broker is a critically important decision for your financial future. In Canada, there are so many different options on the market that if you just review some of these factors and go from there, you can usually find yourself a brokerage that is a pretty good fit.

Reputation Matters:

You should start your search by checking the reputation of your insurance brokerages. A good brokerage is always determined by service, quality and satisfaction. Several online platforms, social media and review websites are great places where you can learn about the reputation of different brokerages. Check for signs of reliability. If the company has happy clients and can demonstrate a legacy of superior service, there is reason to trust them.

Customer Reviews:

Read the reviews of traders; doing so can give you insight into other people’s expectations and thoughts on the chosen broker. Look for reviews that touch on the Universal Life Insurance policies they handle and how easy it was to receive online quotes. If they have had successful interactions and received timely responses to questions in the past, then the experience with the broker will be more seamless.

Transparent Communication:

An important consideration when comparing potential brokerages is their transparency in communicating information. A reputable broker makes all aspects of their service transparent and understandable, offline and online. Find a broker who is willing to sit down and discuss complicated terms and conditions that come with your Universal Life Insurance policy. By keeping things in the open, you can be more confident and make smarter decisions about your financial future.

Experienced Professionals:

To fully comprehend the obstacles of Universal Life Insurance, you need the direction of a seasoned professional. A reliable broker will possess a crew of informed experts to help you with this issue. Whether it’s about coverage questions, premium payments or the online quoting process, having access to experts who are well-versed in the industry can be a huge benefit.

To Wrap It All Up

A Universal Life Insurance policy is a great insurance solution that combines life insurance protection with the advantages of tax-free savings. Knowing the length of the premium payment is the cornerstone to achieving the potential of this adaptable insurance policy. When it comes to finding the best Universal Life Insurance quotes online in Canada and having the peace of mind knowing that you will be taken care of, that’s where we come in.

You need to keep in mind that your financial future is a forever investment, and down this road, the right Universal Life Insurance policy and insurance brokerage will help you travel this road with the confidence that you’ll be financially secure and protected.

Get The Best Insurance Quote From Canadian L.I.C

Call 1 844-542-4678 to speak to our advisors.

FAQs

Universal Life Insurance provides a death benefit when you die and allows you to save money while you’re alive. Term Life Insurance Vs Universal Life Insurance. There is a contrast between term life coverage and all-inclusive disaster protection. Term Life Insurance protects you for a certain period, and that’s it, whereas Universal Life Insurance is known to be there indefinitely. The policyholder can also adjust the death payout as well as the premiums they pay as the years pass.

Universal Life Insurance is a good investment. Whether or not Universal Life Insurance is a good investment for you will depend on your financial goals and risk appetite. Universal Life Insurance policies have a component that accrues cash value over time, referred to as either a savings or investment element. This cash can be used for many things, including supplementing your retirement income and paying for unexpected costs. It’s important to do a comprehensive review of your financial goals and talk with an investment advisor to see if buying a Universal Life Insurance policy is consistent with your total investment plan.

Yes, Universal Life policies can and do lapse if they are not properly funded. Since it’s whole life, your premium depends on keeping a premium payment current in order to keep the policy in force. That the policy could “lapse” is correct in that it is another way of saying that if premiums are not paid, the policy terminates and coverage is lost. Policyholders should be aware of premiums due and make sure that the premium payment is received in time for the continuity of the policy.

For the most part, Universal Life Insurance rates can go up as you get older. Age, health, and coverage amount are some of the factors that affect the cost of insurance. There is an increasing risk of death, and hence, the insurance cost increases as policyholders live longer. To account for these escalating costs, your premiums can adjust over time. Be sure to see the policy terms and premium structure when considering Universal Life Insurance to see how the premium could increase as you get older.

Yes, a key characteristic of the Universal Life insurance policy is the buildup of cash value. A portion of the premium you pay for it gets allocated to a cash value account. Thanks to the investment portion of the insurance, this account increases over time. This cash value is different from the death benefit, and the insured is able to use it. Being able to take a loan against or withdraw from the cash value offers some flexibility and an investment element to Universal Life Insurance, which is in addition to protection.

Universal Life Insurance premiums can differ depending on your own preferences. With a Term Life Insurance policy, the payment of premiums is for a certain period of time, while with a Universal Life Insurance policy, policyholders may continue to pay premiums as long as desired to preserve insurance protection. Some may prefer to pay a fairly level premium all the way through to life, while others may prefer to front-load the premium while they are working.

Yes, there are several credible insurance brokerages in Canada that offer online platforms that are simple and easy to use in order to provide your details and obtain accurate Universal Life Insurance quotes. You want to work with a brokerage that knows the Canadian market and gives competitive quotes. Seek a platform that not only gives you quotes but breaks down the details for each policy to ensure you make a smart choice.

When you get online, instantly compare quotes for Universal Life Insurance, and don’t get caught up in just the price. Examine coverage limits, premium amounts, and policy features. With your long-term financial goals and responsibilities in mind, select a policy that provides optimal coverage at an affordable price. Make sure to also check how transparent the broker is as you want to see what the terms of the policy are, the limitations on the policy, and any other charges.

Yes, Universal Life Insurance quotes online can be safe with a reputable and established insurance brokerage. Ensure the website is using a secure encryption protocol to secure your personal data. You should always check if the broker is reliable before giving any personal or sensitive information.

Yes, flexibility is a big part of Universal Life Insurance. Once you have quotes online, you can use your insurance brokerage to tweak your coverage as your situation changes! This might involve changing the death benefit or the premiums in a way that better suits your financials.

When you receive your Universal Life Insurance quotes online, you will likely be asked for personal information, including age, sex, health, and the amount of coverage you want. The more specific and detailed your information is, the more accurate the quotes will be. Have ready at your fingertips answers to questions about how you live and work, and if you are managing any health ailments now.

The above information is only meant to be informative. It comes from Canadian LIC’s own opinions, which can change at any time. This material is not meant to be financial or legal advice, and it should not be interpreted as such. If someone decides to act on the information on this page, Canadian LIC is not responsible for what happens. Every attempt is made to provide accurate and up-to-date information on Canadian LIC. Some of the terms, conditions, limitations, exclusions, termination, and other parts of the policies mentioned above may not be included, which may be important to the policy choice. For full details, please refer to the actual policy documents. If there is any disagreement, the language in the actual policy documents will be used. All rights reserved.

Please let us know if there is anything that should be updated, removed, or corrected from this article. Send an email to Contact@canadianlic.com or Info@canadianlic.com