- Can You Transfer An RESP To An RRSP?

- Let’s Understand Registered Education Savings Plan

- RESP Guidelines

- Understanding The Why

- Rules For RESP To RRSP Transfers

- Rules For RESP Withdrawals

- Dealing With Limited RRSP Contribution Room

- Step-By-Step Guide For Transferring RESP Funds To An RRSP

- Wrapping It Up

A Registered Education Savings Plan (RESP) offers parents a smart way to make sure their children have money to use for their post-secondary education, such as undergraduate studies or a certified trade or technical school program. But what people may not realize is there are some strategies available to transfer money from an RESP to an RRSP. So let’s dive into whether you can transfer an RESP to an RRSP and the necessary steps and factors to consider. But before we delve into that, we should begin by understanding what is RESP and why it is important.

Let’s Understand Registered Education Savings Plan

An RESP is a government-approved savings plan designed to help families save up for their kids’ post-secondary education. After you open an RESP, parents, grandparents, or the remaining family members can contribute money to an account that can be used for tuition, books, and additional education-related expenses at a college, university, or trade school.

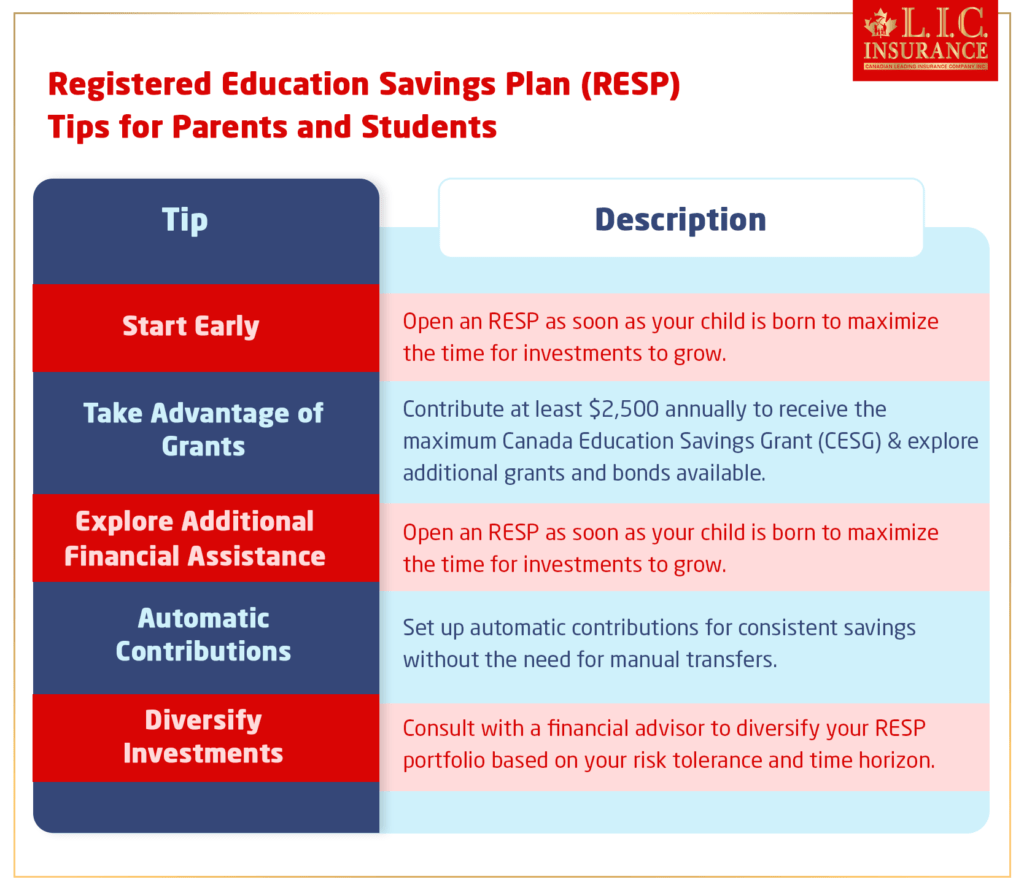

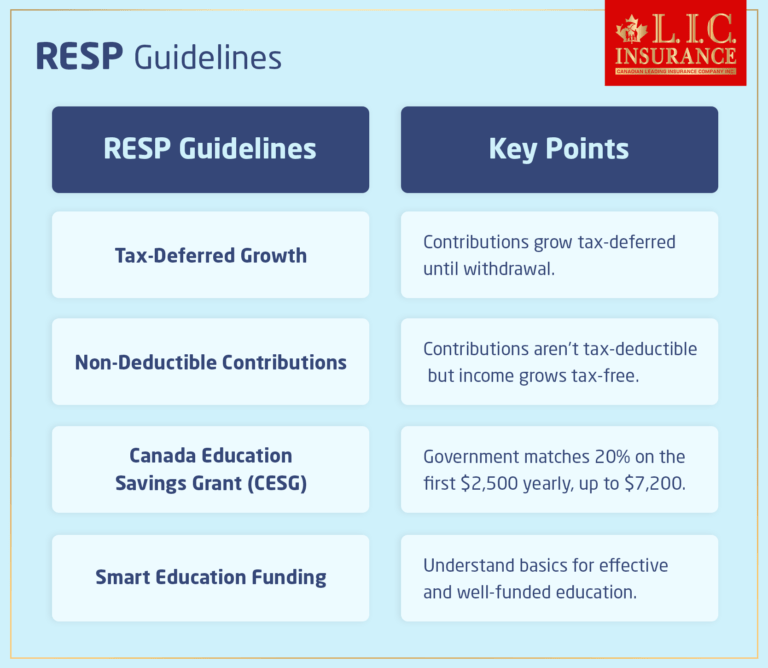

RESP Guidelines

If you’re a beginner at contributing to your child’s RESP, here’s what you need to know:

- The money grows tax-deferred until it is withdrawn.

- Contributions to an RESP are not tax-deductible, but investment income inside the RESP will grow tax-free until it is withdrawn to pay for education.

- The Canadian government sweetens the pot a bit with the Canada Education Savings Grant (CESG). It’s a 20 percent match on the first $2,500 you save each year, with the per-child lifetime maximum equal to $7,200.

Courtesy of RESP ProvidersThese are just the basics, but knowledge is power when it comes to getting the most from your RESP and ensuring your child’s educational aspirations are fully funded when the time comes to take the next steps.

Go here to get more clarity on -‘Why to choose an RESP?

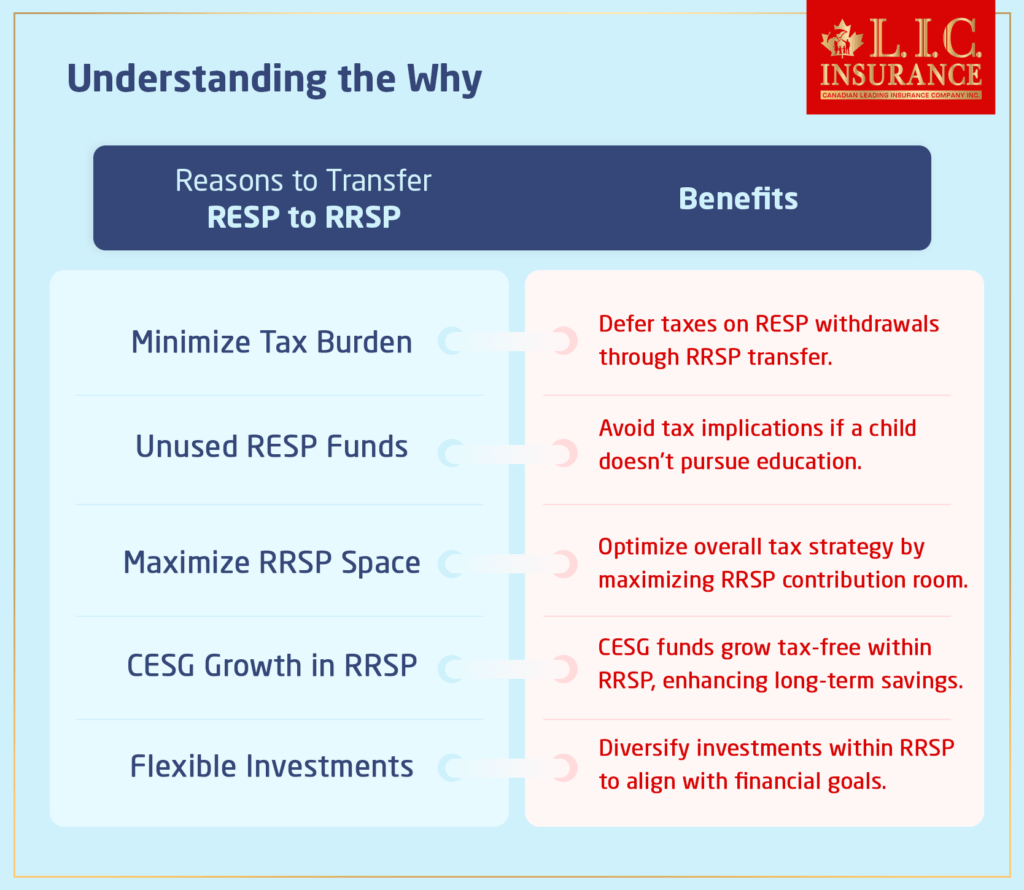

Understanding the Why

So there you have a general RESP overview which can take us to the next topic, how to transfer money from an RESP to an RRSP. So why would a person transfer funds that were supposed to be used for their child’s education instead into their retirement plan? The fact is that not all children decide to go to college. In some instances, even after your child has completed their post secondary education by 1 or 2 years, you will still have some proceeds left in their RESP. Moving this money to your RRSP can be a money-making strategy that will defer taxes on the withdrawal, and arguably one of the best RESP withdrawals for non-education purposes.

Rules for RESP to RRSP Transfers

Before moving money from your Registered Education Savings Plan (RESP) to your Registered Retirement Savings Plan (RRSP), you should make sure you know the exact rules and conditions that apply to this financial move. For ease of understanding, consider the following points:

Age and Education Status:

- Each child beneficiary must be at least 21 years old.

- They should not be currently enrolled in post-secondary education.

Tip for Parents: Plan ahead and consider your child’s education for the future when thinking about the RESP to RRSP transfer. Ensure they’ve reached the specified age and are not actively pursuing higher education.

RESP Duration:

The RESP account must have been open for a minimum of 10 years.

Tip for Parents: Start your child’s RESP early to meet the 10-year requirement. The longer the account is open, the more options and flexibility you have for managing the funds.

RRSP Contribution Space:

You need to have enough RRSP contribution space available.

Tip for Parents: Keep track of your RRSP contribution room. Ensure it aligns with the amount you intend to transfer from the RESP. Consult with insurance experts if needed to optimize your contribution space.

Timing and Exceptions:

- The transfer is also possible in the 35th year after entering the RESP plan.

- Alternatively, it’s allowed if all beneficiaries under the plan have passed away.

Tip for Parents: Be aware of these time-sensitive conditions. If the RESP has been diligently maintained, it can serve as a valuable financial resource well into the future.

RESP Flexibility:

An RESP can remain open for 35 years, providing flexibility even if your child is not actively pursuing education.

Tip for Parents: Understand the extended lifespan of the RESP. This flexibility makes it possible for you to adapt to changing circumstances and logically decide when and how to utilize the funds.

Hence, understanding these rules and registered education savings plan tips for parents and students is extremely vital before initiating an RESP to RRSP transfer. By having all the required knowledge and planning strategically, you can confidently deal with this financial process, ensuring the optimal benefits possible for both you and your child’s future.

Rules for RESP Withdrawals

It’s very important to understand the rules around withdrawals when it comes to managing your RESP. Those guidelines should serve as a course of action for navigating the financial landscape whether you’re contemplating a withdrawal for non-educational purposes or mulling transferring money from an RESP to an RRSP. Here are two plain points that will provide clarity for parents and students:

Tax-Free Distributions on Contributions:

When it comes to your contributions to your RESP, you are like super lucky: you can pull them out faster than you can say “oh my god I can buy skis with this,” and the best part is that no tax man cometh. That means your contributions come back to you with no tax penalty. This is a breath of fresh air for parents trying to get to the money they have worked hard to save.

Returning CESG or CLB Funds:

One thing to remember is that any grants (i.e. CESG or CLB) can be a slippery slope. If the EAPs are not pulled out, then really these EAPs would have to be paid back to the government. It’s a refund policy, only there’s a bit more paperwork involved.” This rule creates certainty that prevents everything from going to hell.

Normal Taxable Income For Non-Educational Withdrawals:

And now, brace yourself for the tax talk. It is not, however, without its disadvantages to use funds for purposes other than education: This income is taxed at your ordinary income tax rate plus an additional 20 percent. Although students typically benefit from a low tax rate during their student lifetime, the situation is different when the money is spent for other purposes.

How to get RESP to RRSP Transfers:

“That is where some intentional planning can really come in. To reduce the tax hit from drawing income, have withdrawals sent directly to your registered retirement savings plan (RRSP). What’s beautiful about this is the fact that the investment EARNINGS from the RESP, after it’s been transferred, will continue to grow tax-free inside that tax-deferred RRSP.

Get The Best Insurance Quote From Canadian L.I.C

Call 1 844-542-4678 to speak to our advisors.

Dealing with Limited RRSP Contribution Room

While the maximum transfer amount from RESP to RRSP is $50,000, ensuring you have enough RRSP contribution space is very important. Options for those with limited space include:

- Adding a spouse to the RESP.

- Waiting to build an additional room.

- Adjusting their salary for small business owners to create more contribution space.

Real-World Scenarios Where RESP to RRSP Transfers Make Strategic Sense

While the RESP to RRSP transfer process may seem technical, its practical impact becomes clearer when viewed through real-life financial planning lenses. For instance, families with more than one child may open a family RESP, pooling funds under a single plan. If one child decides not to pursue post-secondary education, the leftover grant-earning contributions and accumulated income in the RESP can still be used effectively. In such cases, a RESP transfer to RRSP offers a smart pivot, especially when the RESP subscriber (usually a parent) has ample RRSP contribution room.

Another often-overlooked use case involves self-employed individuals. Many small business owners delay RRSP contributions during the early stages of their business due to inconsistent income. Later, if their child doesn’t use all the RESP funds, they can transfer RESP to RRSP CRA-compliantly and simultaneously boost their retirement savings, while keeping the income growth sheltered from tax.

These nuanced financial strategies are not widely discussed, yet they show how RESP transfer rules can be applied to maximize tax efficiency and retirement preparedness. Always ensure compliance by cross-verifying RESP to RRSP eligibility criteria and contribution caps. For those who plan early and think long-term, a transfer RESP to RRSP is more than a tax move—it’s a strategic upgrade.

Step-by-Step Guide for Transferring RESP Funds to an RRSP

Suppose you find yourself in a situation where you are certain that your child won’t be pursuing further education, and you are considering the strategic move of transferring RESP savings to your RRSP. In that case, following a systematic approach is essential to ensure a smooth process. Here are the steps that are needed to make this move.

- Confirm that you meet the transfer conditions:

Really it is important that you make sure you are qualified to transfer an RESP to RRSP before you start the transfer. Make certain that each child RESP recipient is at least 21 years old and not enrolled in post-secondary education. You’ll also want to confirm that your RESP has been open for at least 10 years and that you have enough room for RRSP contributions.

This is very crucial as it is a prelude to a successful move. If you satisfy those requirements you’re halfway toward enjoying the tax-deferred benefits of funds being transferred from RESP to RRSP.

- Check your RRSP contribution room:

The next step is to figure how much RRSP contribution room you have for the transfer. The money you can put in your RRSP is called the contribution room. You can obtain this information by looking at your latest notice of assessment from the Canada Revenue Agency (CRA).

If space is limited, there are options like adding a spouse to the RESP or waiting until you’ve built up enough space. Knowing your contribution room is key to a smooth transfer.

- Gather the necessary documents, including your account number:

In order to begin the transfer, you need to collect certain documents. This can be a copy of your RESP account statements, pieces of your identification, and also your RRSP account number. You can speed up the process when you contact your own RESP promoter if you have these papers ready ahead of time.

They need your account number, which is very important for a good and secure transfer. This information should also be verified to avoid the delays and problems that can result from incorrect information.

- Contact your RESP promoter for the required forms and facilitate the transfer:

With your paperwork at the ready, contact your RESP promoter and ask for the forms to make the transfer. All banks have call center agents who can walk you through the process and even have the necessary papers delivered to you.

Complete the forms carefully, and make certain all information is fully completed and accurate. Send your forms to your RESP promoter, and they will arrange this income transfer and the return of any federal and provincial grants to the government.

- Considerations and Potential Fees:

Just a note that there might be some fees associated with such a transfer. Your RESP promoter may charge a transfer fee, plus a closing fee for the account. Also note that some financial institutions may require you to sell your investments in order to transfer them as cash.

Also, remember it depends on how long the transfer process takes as well. Transfers can take a few weeks to a few months but some may complete in a week or so. It’s important to be patient and maintain open communication with your RESP promoter at this point.

Wrapping It Up

In short, snaking underutilized RESP funds to your RRSPs can be a very savvy tax play, which will ultimately reduce your tax bill. Although there are some administrative and possibly monetary burdens to the process, the rewards of expatriation are certainly worth the headaches. Investigate and accomplish the transfer the right way just in case your child doesn’t go to college so you can make the most of the savings you have. If you’re thinking about embarking on such a transfer, there’s no harm in having a discussion with your RESP provider to get some individual advice tailored to your circumstances.

Get The Best Insurance Quote From Canadian L.I.C

Call 1 844-542-4678 to speak to our advisors.

Faq's

RESP stands for Registered Education Savings Plan. It’s a Canadian government-approved savings plan that helps families save for their children’s post-secondary education. Contributions grow tax-deferred until withdrawal.

RESP operates by providing a tax-advantaged way to save for education. Family members contribute, the government offers grants (CESG), and the money grows tax-free. Withdrawals fund qualified educational expenses.

RESP withdrawals are taxable. Contributions are not taxed, but income and government grants are taxed at the beneficiary’s regular rate plus an extra 20%. Transferring to an RRSP can minimize the tax burden.

If your child decides not to pursue higher education or there are remaining funds in their RESP after studies, transferring to your RRSP can defer taxes on the withdrawn amount, offering a strategic move for non-educational purposes.

In order to complete the transfer, each child beneficiary must be at least 21 years old, not currently enrolled in post-secondary education, and the RESP must have been open for a minimum of 10 years. Additionally, sufficient RRSP contribution space is required.

Yes, an RESP can remain open for up to 35 years, providing flexibility even if your child is not actively pursuing education. During this time, grants and earnings remain tax-sheltered within the RESP.

Yes, the maximum transfer amount is $50,000. However, you need to ensure you have enough RRSP contribution space available to complete the transfer.

Any Canada Education Savings Grant (CESG) or Canada Learning Bond (CLB) funds that are not taken out as an Education Assistance Payment (EAP) must be given back to the government. However, payments can be taken out tax-free.. Income withdrawn for non-educational purposes is taxable at your regular tax rate plus 20%.

A6: To minimize the tax burden, consider transferring funds from your RESP to your RRSP. The income growth from the RESP, once transferred, is not taxed within the tax-deferred RRSP account.

The maximum amount that you can transfer is $50,000, and having enough RRSP contribution space is crucial. Options include adding a spouse to the RESP, waiting to build an additional room, or adjusting your salary (for small business owners) to create more contribution space.

A8: If you’re certain your child won’t pursue further education, confirm meeting transfer conditions, check the RRSP contribution room, gather necessary documents, and contact your RESP promoter for the required forms. The transfer involves administrative steps, and it may take some time to complete.

Yes, some fees may apply, including a transfer fee and possibly an account closure fee. Additionally, depending on the financial institution, you may need to sell investments, and the transfer duration can vary.

The transfer from RESP to RRSP is considered an indirect transfer. While the transfer amount is reported as income, you also claim an equal amount as an RRSP contribution. This doesn’t lower your taxable income like a traditional RRSP contribution, but offsets the added income.

The above information is only meant to be informative. It comes from Canadian LIC’s own opinions, which can change at any time. This material is not meant to be financial or legal advice, and it should not be interpreted as such. If someone decides to act on the information on this page, Canadian LIC is not responsible for what happens. Every attempt is made to provide accurate and up-to-date information on Canadian LIC. Some of the terms, conditions, limitations, exclusions, termination, and other parts of the policies mentioned above may not be included, which may be important to the policy choice. For full details, please refer to the actual policy documents. If there is any disagreement, the language in the actual policy documents will be used. All rights reserved.

Please let us know if there is anything that should be updated, removed, or corrected from this article. Send an email to Contact@canadianlic.com or Info@canadianlic.com