You may be feeling an exciting nervousness about traveling to Canada, particularly if you are concerned about your health. What if you get suddenly ill, or the victim of an accident? This fear is compounded if you have a health problems already — what are sometimes referred to as “pre-existing conditions” – according to experts.

Purchasing Visitors insurance can be difficult in many respect but however for pre-existing conditions can be very confusing. Here’s a look at how Visitor Insurance in Canada functions and what it covers–this blog post will simplify things for you. We want to provide information that will make you feel safe and worry-free on your trip.

Many people are unaware that Visitor Insurance with pre existing conditions exists—and not all plans cover pre existing conditions in the same way. And with the demand for Visitor to Canada Health Insurance on the rise, it is more important than ever to know what is coverable and what isn’t covered. Whether you have short-term visit or long-term Visitor Insurance pre existing conditions plans in mind, having the right policy makes a big difference. Some Visitors to Canada travel insurance for pre existing condition may have stability period exclusions or clauses that can impact your claims. Understanding what to ask for when you get a quote can help you avoid any unpleasant surprises later. This comprehensive guide will take you through “all” the facts you need about Health Insurance for visitors to Canada with pre existing conditions, so you can travel with confidence.

Let's Get To Know Visitor Insurance First

Before we dive in, let us explain what Visitor Insurance is all about. Visitor Health Insurance-ENTITY Also called visitor Health Insurance, this insurance type is intended to cover an accident or illness that might suddenly occur while you are in a foreign country for travel or work including Canada.

Now you may be asking yourself why you would even require such a thing as Visitor Insurance? Canada is famous for its great healthcare, why would I need extra insurance? It has to do with the cost of doing so. Canada has high quality health care and it is not free for non-residents. You would have to pay huge medical bills if you are sick or injured, because you would not be entitled to Canadian resident’s health care.

At this point, having Visitor Insurance is very crucial. With a Visitor Insurance plan in place you protect yourself as much as you can from potential unexpected medical conditions. It takes the stress out of worrying about how to afford the care you need.

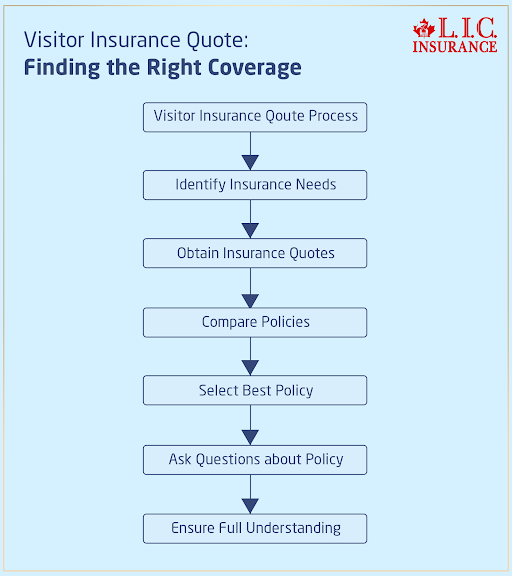

Visitor Insurance Quote: Finding the Right Coverage

Not all Visitor Insurance is the same though, and there are literally dozens of companies and plans out there offering different coverages at very different price points. So, who is best for you?

Another way could be to obtain a Visitor Insurance Quote. You would have to input the number of days stay and any pre existing condition you might have, to obtain a quote.

One of the first and essential steps when buying insurance for visitors is Getting a Visitor Insurance Quote. It also makes it possible to compare multiple policies and is a sure way to get the best coverage at the lowest price. It even takes the time to ask you any questions you might be having about the policy just so you know what you are getting yourself into.

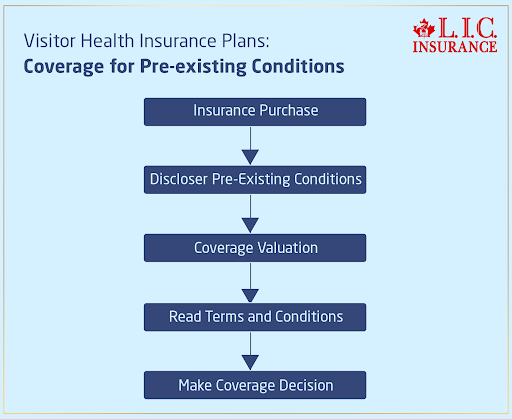

Visitor Health Insurance Plans: Coverage for Pre-existing Conditions

Now, let’s move to the next big question, the most important question: Can you buy Visitor Insurance, which also covers pre-existing conditions? The short answer is “yes,” with a few caveats.

Actually, the majority of Visitor Health Insurance Plans also provide pre-existing coverage. But the coverage and limitations are far from standard. One policy will have a wide range of pre-existing conditions it will cover while another one will have one type of exclusions and limitations.

Some, for instance, may demand full disclosure of any previous medical conditions at the time of purchase. If these are not stated the conditions are not insured, whatever they are due to. Other policies may cover pre-existing conditions but have waiting periods before the coverage kicks in.

Please always read the visitor’s Health Insurance plan’s terms and conditions very carefully before making purchase to understand the fine print of what is covered and what is not including the pre-existing conditions. And if one has any pre-existing conditions it would be better if one were honest about that when they get a quote for visitor’s insurance. Under this system the premium and conditions of the cover can be aligned.

Why Medical Stability Periods Matter When Choosing Visitor Insurance with Pre-Existing Conditions

One of the more peculiar and heavily glossed over aspects to choosing Visitor Insurance with pre existing conditions, is the medical stability period — a condition that could very well determine the coverage of your condition during your visit to Canada. It is a common requirement from many policies for Health Insurance for visitors to Canada with pre existing conditions that your health condition to be “stable” for the amount (usually 90 to 180 days) before coverage starts. But just how stable is that?

In most cases, that stability would mean the condition would not have necessitated a change in medication, dosage, treatment or symptoms. But what defines PHER in policy terms, and where and if minor fluctuations (say, because your slingshot was throwing bolts bastard hard for the month of January, and nothing else in your training had changed, your insulin regiment or your HTN meds were adjusted as a result) are considered being non-stable?

Canadian LIC has worked with hundreds of clients who believe that pre-existing conditions are covered automatically, only to receive the news that changing a medication dose even slightly, nullifies their claims. This is the place where Visitors to Canada coverage pre existing conditions should be analysed not with amount of rates but with the stability block’s wordings.

When purchasing Visitor Health Insurance for Canada, or any type of Visitor Insurance pre existing conditions, be certain to ask your broker or agent if your condition fits the definition under the policy’s stability clause. This single course of action could be the difference between total coverage and a surprise out-of-pocket medical bill.

The good news? Some newer Visitor to Canada Medical Insurance now have minimum stability (like 8 or 7 days) while other Visitor Insurance with pre existing conditions provide full coverage for health conditions without stability if purchased through a broker who is familiar with these newer plans. It’s this type of insider know-how that allows visitors to travel more confidently and safely throughout Canada.

Visitor Insurance Struggles: A Real Story

Let us tell an incident from our personal experience as an example for your reference, how it is important to know about Visitor Insurance coverage on a pre-existing condition!

A few years back one of our client’s aunts was visiting Canada and we had all been set up to have this person to come and see our client. She was ill with some form of sickness and had a previous heart condition. With her regular Travel Insurance she believed every conceivable medical cost incurred during her time away was going to be reimbursed.

But if you get sick on your trip, you seek treatment and learn, at the time of treatment, that your insurance policy won’t cover that specific ailment and that it qualifies as “pre-existing,” it can be flat-out stunning. That left her with substantial medical bills that weighed heavily on her finances.

This client learned a valuable lesson in the necessity for good insurance research and understanding, particularly when it comes to preexisting conditions. I hope others can learn something from it too.

To Wrap It All Up

In sum, yes you can get insured as a visitor to Canada with pre-existing conditions, but you need to know what it is you are buying – read the fine print! Get a Quote for Visitors to Canada When you are ready to visit Canada, make sure you read the details of any visitor’s Health Insurance policy to ensure you have coverage during your stay in Canada.

But the last thing you want is to end up in an emergency without insurance to help you out. And don’t wait till you are crying to invest some time on researching investing on a good and complete visitors insurance.

And if which is the best insurance brokerage that gives the way through the maze of Visitor Insurance, look none other than the best, Canadian LIC, sitterû. With their expertise and personal service, you can have peace of mind when it comes to your search for the right policy, even if you have pre-existing conditions. Don’t leave these matters to chance. Contact experts of Canadian LIC now for the best advice.

Get The Best Insurance Quote From Canadian L.I.C

Call 1 844-542-4678 to speak to our advisors.

FAQs About Visitor Insurance and Pre-Existing Medical Conditions

Yes, pre-existing is covered but it would be helpful to know what the coverage restrictions were and what options were open. And a pre-existing condition is built into many of the Health Insurance consumer visitor plans.

Certain pre-existing conditions are completely covered, but some plans may be limiting or excluding them. One ought to ensure that that one should be revealing all pre-existing condition that one has very upfront when one is obtaining quote for Visitor Insurance so that person gets his pricing right as well as detail coverage.

Sarah was visiting family in Canada and her pre-existing condition of asthma was an issue. She googled out for “Visitor Insurance Plans” and stumbled upon on a feature called “Pre-existing condition with zero waiting period” in one such policy. Sarah got covered for the travel as she was able to declare her asthma when getting a Visitor Insurance Quote.

It is the best to get an online quote and compare the few insurance companies on the insurance coverage and plans. 1. Find the most trusted insurance companies that provide the Visitor Health insurance plan which suits your needs. Therefore, you can request Travel Insurance visitor quotes from multiple companies.

At a minimum, they should lay out the dates your travel will start and end, if applicable. From there, get a handful of quotes in order to compare the coverage options to one another to make sure you’re getting the best policy value for your dollars.

David was a businessman and he was ready to fly for a business trip to Canada. He was looking for Visitor Health Insurance Policies to cover his pre-existing heart ailment. He was pretty quick to get quotes from several providers and his up coverage options in a insurance comparison tool online.

David was able to obtain a best value Visitor Health Insurance Plan at the best possible price, just by shopping around and looking what fit his pocket.

For example, if there is, but you need Visitor Insurance. For that, you must at least inform this (to) when taking quote of Visitor Insurance. Be sure to accurately tell the truth about your medical history in order to get the right pricing and appropriate insurance.

Carefully examine all of the policies to find the best coverage after comparing quotes from multiple companies. If you are uncertain about anything, give the insurance provider a call to ask about it.

With Emily preparing for a trip with her family to Canada, she was afraid for her son’s severe peanut allergy. When she was obtaining quotes for Visitor Insurance, she finally mentioned his allergy. Eventually, she found a plan that covered pre-existing conditions, and for which no exclusion was made. It was only because Emily did take the time to discuss her concerns with the company’s insurer that her family was able to take the holiday.

It would be very difficult to travel to Canada without Visitor Insurance since it provides protection against various uncertainties like bad health conditions. WHILE CANADA has a pretty good health care service, it’s not free. You are a guest in their country who doesn’t have the same entitlement to services that a Canadian citizen has. Visitor Insurance lifts the financial weight of unforeseen urgent medical expenses for the patient and makes it to ensure that help is never hindered in arriving.

Mark and his wife had been looking forward to a romantic trip to Canada. All at once the wife was taken ill; and it turned out to be appendicitis. There, if there were no Visitor Insurance they would have been end up at the receiver ends of huge medical bill. But they thanked their stars as the Visitor Insurance was purchased before leaving for the trip. And that was truly it as she was operated upon on emergency the moment she got there and she was hospitalized for weeks. But, with the help of Visitor Insurance plan, which paid for the surgical procedure and subsequent hospital stay; they focused on recovering rather than to ponder upon the dollar numbers.

To the extent included, coverage for pre-existing conditions, depends on the Visitor Insurance plan. Some plans cover all of treatment and medication (i.e., that will be managed in house) while in other cases an insurer might not be able to cover or to manage it (i.e., they don’t actually deal with the actual treatment, but with related management). Look over the visitor insurance plan wording so you understand what is said with pre-existing conditions.

Rachel flew into Canada from overseas to attend a conference, and, as soon as she crossed the border to arrive in Canada, her arthritis struck. She purchased Visitor Insurance but was unsure whether this condition was covered or not. But then when she looked at the policy, she actually learned that the policy really did cover her arthritis, and so she received treatment, without worrying about the bill.

Can you buy Visitor Insurance after landing in Canada? You can also insure yourself for coverage before you go and then your travel and stay will be taken care of in Canada! If no insurance is purchased for the date you enter Canada and you wish to extend your insurance after you have arrived in Canada, some insurance companies can do this after you have arrived.

Certainly if you decide that you don’t feel you need the Visitor Insurance policy any longer, you can cancel it at any time. The process and rates will be according to the insurance company. Some insurance companies won’t charge you for the portion you didn’t use if you cancel the policy. Some may charge you a cancellation fee, or it may be included in the policy as the cancellation terms. Be sure to review the cancellation of visitors insurance plan before you purchase it.

Maria had organized the whole family to go to Canada, and an hour before it all got moved around simply.a family appointment. So, the Visitor Insurance plan that Maria’s family had purchased for that particular trip was bound to be considered as cancelled. She phoned her insurer, who told her she could cancel and get some of the money back — the practice that, in fact, turned out to be quite useful in relieving some financial pressure over a crisis.

In the majority of Visitor Insurance Plans, there is a provision to cover for the emergency medical evacuation back to home country, when it is determined to be medically required due to medical liability. As such, such coverage will provide that there is treatment which is not available or inadequate in Canada and which ensures treatment in the home country.

But it is very important to read and understand the terms and conditions of Visitor Insurance policy to find out exactly what the limit is for coverage and what the prerequisites are in emergency medical evacuation.

James came for a visit to Canada. He had a severe allergy and demanded emergency treatment, they said, in his case. But the Visitor Insurance policy he had bought did include emergency medical evacuations. James was airlifted to his home country and treated under that policy. His health insurance, which enabled him to receive the care he required, so arguably saved his life.

Sources & Further Reading

Government of Canada – Visitors to Canada: Health Insurance:

This official website provides information on health insurance for visitors to Canada, including what is covered and how to obtain coverage.

Insurance Bureau of Canada – Visitor to Canada Insurance:

The Insurance Bureau of Canada offers insights into Visitor Insurance in Canada, including the types of coverage available and factors to consider when purchasing a policy.

Travel Insurance Review – Visitor to Canada Travel Insurance:

This website provides reviews and comparisons of Visitor Insurance Plans available in Canada, helping travelers make informed decisions about their coverage options.

Canadian Life Insurance Company (Canadian LIC) – Visitor Insurance: https://www.canadianlic.com/services/visitor-insurance/

Canadian LIC offers Visitor Insurance Plans tailored to the needs of travelers to Canada, including coverage for pre-existing conditions. Their website provides information on available plans and how to obtain a quote.

World Nomads – Understanding Pre-existing Conditions and Travel Insurance:

World Nomads provides insights into pre-existing conditions and travel insurance, explaining how coverage works and what travelers need to consider when purchasing a policy.

These sources offer valuable information and insights into Visitor Insurance in Canada, including coverage options, policy terms, and considerations for travelers with pre-existing conditions. By consulting these resources, travelers can make informed decisions about their insurance needs and ensure they have the coverage they require for a safe and worry-free trip to Canada.

Key Takeaways

- Visitor Insurance provides coverage for medical emergencies during visits to Canada.

- You can get Visitor Insurance with pre-existing conditions, but coverage varies.

- Visitor Insurance is for short-term visits, while travel medical insurance is more comprehensive.

- Compare quotes to find the best coverage for your needs.

- Disclose pre-existing conditions when obtaining a quote to ensure accurate pricing.

- Consider factors like condition severity and trip duration when choosing insurance.

- Understand cancellation and refund policies before purchasing insurance.

- Many plans offer coverage for emergency medical evacuation if needed.

The above information is only meant to be informative. It comes from Canadian LIC’s own opinions, which can change at any time. This material is not meant to be financial or legal advice, and it should not be interpreted as such. If someone decides to act on the information on this page, Canadian LIC is not responsible for what happens. Every attempt is made to provide accurate and up-to-date information on Canadian LIC. Some of the terms, conditions, limitations, exclusions, termination, and other parts of the policies mentioned above may not be included, which may be important to the policy choice. For full details, please refer to the actual policy documents. If there is any disagreement, the language in the actual policy documents will be used. All rights reserved.

Please let us know if there is anything that should be updated, removed, or corrected from this article. Send an email to Contact@canadianlic.com or Info@canadianlic.com