Get the best Insurance Quote from Equitable

Call 1 844-542-4678 to speak to our advisors.

A Tax-Free Savings Account (TFSA) is a plan that allows you to grow your savings without ever paying tax within your account. This is a rare form of traditional savings accounts where you pay tax on the growth earned by your savings.

Call 1 844-542-4678 to speak to our advisors.

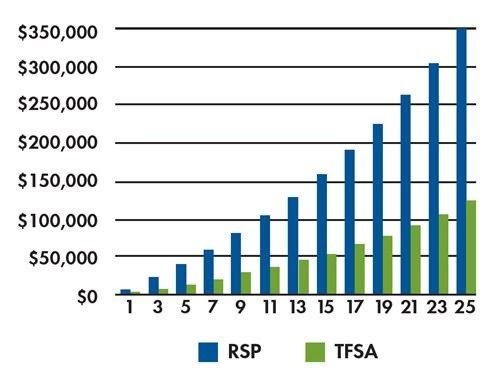

| Retirement Savings Plan (RSP) | Tax-Free Savings Account (TFSA) | |

|---|---|---|

| Primary Purpose | Retirement | Investing |

| Annual Contribution Limit | 18% of earned income* | $6,000 annually |

| Unused Contribution Room | Carried forward | Carried forward |

| Taxation on Investment Growth | Growth is tax-free. Tax is only paid when money is withdrawn. | Never required to pay tax on growth. |

| Deductions on Tax | Annual income tax will be reduced with deposits. A refund on tax can be equal to the deposit multiplied by the marginal tax rate. | There is no deduction on tax and contributions are made with after-tax dollars. |

| Withdrawals | Withdrawals do not increase annual contribution room. Withholding tax is charged on the amount withdrawn and the amount reported as taxable income. The income may affect eligibility for government sponsored retirement income programs. | Withdrawals are not taxed and considered “income”. Government sponsored retirement income programs are not affected by the income. They also increase the annual contribution room. |

| Maturity Date | The year when theperson turns 71 | At age 105 |

| Based on the annual contribution limit | ||

| Canada Revenue (CRA) sets the annual limit under specific guidelines. Your Notice of Assessment will inform you if you have contribution room that is unused from previous years. This information does not account for legal, tax or other professional advice. Information is believed to be accurate, butnot guaranteed. | ||

| ® Denotes a trademark of The Equitable Life of Canada Insurance Company. |

Call 1 844-542-4678 to speak to our advisors.

Sign-in to CanadianLIC

Verify OTP