Have you ever gotten a loan for something big, like a house or a car, or even used a credit card for shopping? If so, there’s a good chance someone has offered you something called loan protection insurance. It’s like the insurance you get to protect your health or your life, but this one is all about making sure your loan payments are taken care of if something unexpected happens. In this blog, we will get to know about Loan Insurance, mainly focusing on how long this type of insurance lasts to protect you. Loan Protection Insurance Plans and personal Loan Insurance are like protections for the money that you have. They’ll help you out if things go badly, like if you get sick and can’t work or if you lose your job. Just think about this: You have a loan for a car and love running around in it. But what if you got hurt and couldn’t work right away? Loan Insurance comes in useful in this case. It’s like having a friend who is willing to pay your car bills until you can get back on your feet.

A common question that comes up is — Can you cancel loan protection insurance once you’ve started it? We’ll cover that too, because knowing your cancellation rights is just as important as understanding what you’re signing up for. Many Canadians are unaware of the flexibility these policies offer. Whether you’re adding it to your plan or reconsidering it later, this blog will help you make fully informed decisions.

Introduction to Loan Insurance

Loan Insurance in Canada serves as a financial shield, protecting borrowers during times of need. Whether it’s due to illness, injury, or unemployment, having a personal Loan Insurance cover or a Loan Protection Insurance Plan means your repayments are taken care of, even when you’re unable to meet them due to these unforeseen events.

Find Out: Do you need insurance on your loan?

Types of Loan Insurance in Canada

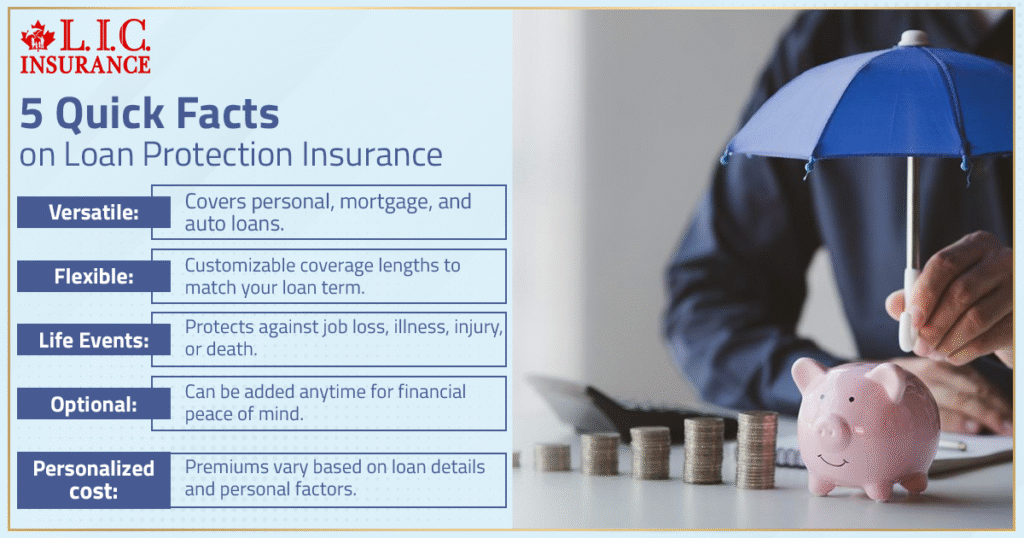

There really are only two types of Loan Insurance available to Canadians:

- Personal Loan Insurance Cover: This is an insurance contract, which covers the repayments of the loan, in case the borrower is unable to repay (due to death, disability, critical illness), so that it does not become a burden either on the individual or his family.

- Loan Protection Insurance Plan: Like personal Loan Insurance cover, a Loan Protection Insurance Plan provides more comprehensive cover, including cover against unemployment (which could be quite reassuring in the current job market).

Duration of Loan Insurance in Canada

Loan Insurance policies can have markedly different terms, depending on the type of loan, the term of insurance, the insurer, and product design. Typically, that coverage is for the life of the loan, or until the loan is paid in full. But there are a few factors that will dictate for how long this is the case:

- Type of Loan: With closed-ended loans such as automobiles or a mortgage often have Loan Insurance that is in force for the life of the loan, which can be up to 30 years in some cases. An open-ended loan, such as a credit line, might offer more flexible or renewable terms of insurance.

- The terms of the Policy: Insurance companies have different types of plans with different terms. Some insure you for a specific number of years, whereas other policies cover you for life, as long as you keep paying the premiums.

Key Considerations for Loan Insurance Duration

You can figure out when your Loan Insurance is before the due date from a variety of things: How to calculate how long your Loan Insurance is.

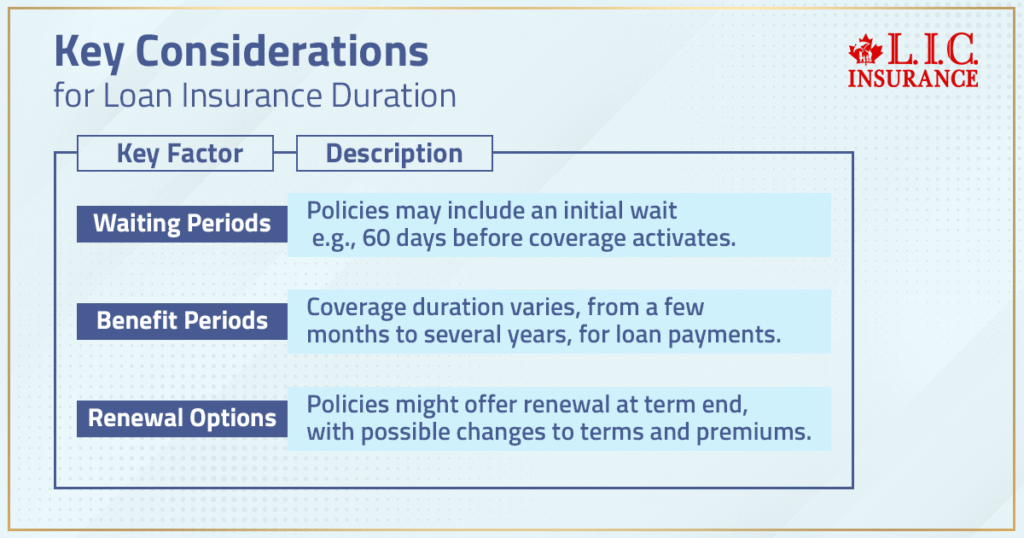

- Waiting Periods: Some policies have waiting periods before coverage commences. For instance, disability or unemployment benefits may not be available for the first 60 days.

- Benefit Periods: This is how long the insurance company will pay loans for you. This period varies based on the policy, but benefit periods can extend from a few months to many years.

- Renewable: Another feature of certain Loan Insurance covers is the provision to renew it at the end of the term, thus allowing you to lengthen the policy period. But the wordings and premiums can alter at the time of renewal.

The Importance of Loan Insurance Duration

The length of time your Loan Insurance covers you, also known as its duration, is super important. Let’s break down why that is and how to ensure you’re covered just right.

Why Duration Matters

Suppose you have borrowed money to purchase your dream car. It’s all good with a Personal Loan Insurance Cover which steps in to pay your loan if you can’t, due to illness, injury, or if you are laid off work. Next, consider the duration of that insurance. If it only covers you for a year or two, but your loan is for five years, what if you fall into trouble in year three or four? You got it — you are on your own when it comes to paying for those.

Having said that, you’ve been paying for superfluous additional insurance if your Loan Protection Insurance Plan spans 10 years, but your car is paid off at the end of five.

Aligning Duration with Your Needs

So make sure to decide the length of your Loan Insurance based on the length of your loan and your budget. If you’re borrowing money, you will be repaying for five years, you should compare Loan Insurance and Loan Protection Insurance Plans that cover you for five years.

And think about your own life. Do you have major changes on the horizon, such as starting a family or changing careers? These changes mean alterations for your finances, too, so based on when you think you might need to use that protection for yourself, weight your decision for how long you might need coverage.

Making Smart Choices

Selecting the right length cover for your Loan Insurance… shouldn’t be difficult. Here are some tips to simplify:

- Know Your Loan: Know how much you have to pay for how many years and what each monthly payment will be.

- Evaluate Your Risk: Are you in a job that is fairly secure, or do you think there is a reasonable chance that you could be out of work? Are there any health concerns that could rear their head? These considerations can help you determine how long you want coverage.

- Compare: You shouldn’t accept the initial Loan Insurance offer you receive. Shop around until you find a plan that’s just right — not only in terms of what the plan covers, but also in terms of how long it delivers coverage.

Loan Insurance Beyond the Basics: The Overlooked Flexibility Clause

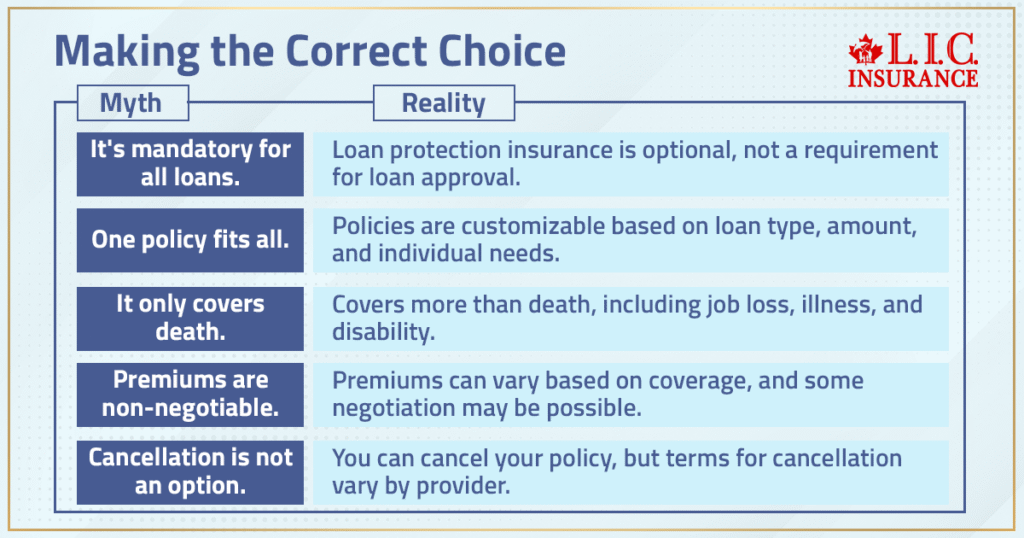

One of the most overlooked—but critically important—features of Loan Insurance in Canada is flexibility in policy termination and customization mid-term. Most borrowers sign up for Loan Protection Insurance at the time of taking a loan, assuming it’s a set-it-and-forget-it product. However, many policies today offer modification or early cancellation options that lenders or insurers don’t widely advertise.

So, can you cancel loan protection insurance? Yes—and knowing when and how can save you money or even help you switch to a more suitable plan. For instance, if your financial situation improves significantly or if you repay your loan early, continuing to pay premiums may not be necessary. Some insurers allow partial premium refunds upon cancellation, especially for lump-sum payments made upfront.

What’s more, a growing number of Canadian insurers are allowing policyholders to update coverage terms—such as benefit period extensions or reduced coverage levels—midway through the policy term, especially in response to major life events like job changes or medical diagnoses. This is not just a consumer convenience—it’s a financial strategy that allows you to optimize your premium-to-benefit ratio over time.

This flexibility makes Loan Insurance not just a protective layer, but a dynamic financial tool that should evolve with your life. Before committing long-term, ask your provider about policy customization, refund clauses, and upgrade paths—these hidden features can make all the difference.

Get The Best Insurance Quote From Canadian L.I.C

Call 1 844-542-4678 to speak to our advisors.

Making the Correct Choice

When selecting a Loan Insurance plan here’s some tips to help you make the right decision:

- Take Stock of Your Needs: Evaluate your financial stability, health, and job security. Such variables will help establish the appropriate coverage lengthh for you.

- Read the Fine Print: Read through the policy fine print, particularly the length of cover, waiting time, benefit period, and renewal options.

- Compare Offers: You don’t have to jump on the first policy you see. And you compare several plans from different insurance carriers to choose one that is most suitable for your coverage needs, travel duration, and price range.

The Final Verdict

Loan Insurance provides coverage that can help keep your financial goals on schedule when times get tough. Loan Insurance Term Length. It is very important to know the term of Loan protection so you have coverage when you need it. The duration of Loan Insurance in Canada is subject to change. And yet, armed with the right information and a focus on the details of your policy, you can find the right coverage for you.

Securing your future is a wise thing to do. If you are thinking of Loan Insurance, the time is now to evaluate your needs, review your options, and select a policy that provides you with peace of mind. Don’t forget: The aim is not just to have insurance, but to have insurance that’s in sync with the path of your life and financial goals. The right insurance protection also gives you the peace of mind that comes from knowing you are covered if the unexpected happens. Protect your loan today and make yourself ready for whatever lies ahead!

Find Out: More on Loan Protection Insurance

FAQs

Loan Insurance is a type of financial product that covers your loan payments in case you’re unable to make them due to unavoidable circumstances, such as illness, injury, unemployment, or death.

The duration of Loan Insurance in Canada typically lasts for the term of the loan or until the loan is fully repaid. However, specific terms can vary based on the type of loan, the insurance provider, and the policy details.

Yes, there are mainly two types: personal Loan Insurance cover, which protects your loan repayments in cases like death, disability, or critical illness, and Loan Protection Insurance Plan, which may also cover unemployment.

Loan protection insurance acts like a safety net for your loan payments. If you are unable to make payments for specific reasons like losing your job, getting sick, or getting injured, this insurance steps in. It makes the payments on your behalf for a set period, ensuring you stay caught up. Each plan has its own rules about what situations it covers, so it’s like having a backup plan tailored to your needs.

Think of Loan Insurance as a protective cover for your financial health. It keeps you covered during life’s unexpected storms. If something unexpected happens to you, like an illness or job loss, having a personal Loan Insurance cover or a Loan Protection Insurance Plan means you won’t have to worry about loan payments on top of everything else. It’s about peace of mind, knowing your financial commitments are taken care of, and it helps protect your credit score by avoiding missed payments.

If you pay off your loan early, what happens to your Loan Insurance premiums depends on your policy type. Some insurance plans might give you a partial refund for the premiums you’ve paid but haven’t used, especially if you paid a lump sum upfront. However, others might not offer refunds. It’s important to check the specific terms of your personal Loan Insurance cover or Loan Protection Insurance Plan to understand how early loan payoff affects your premiums.

Yes, in many cases, you can add Loan Insurance after you’ve already taken out a loan. However, the sooner you add it, the sooner you’re protected. Adding insurance later might also involve a new assessment of your situation, and the cost could be different based on factors like your age and health at the time you decide to add it.

The cost of loan protection, including personal Loan Insurance cover and Loan Protection Insurance Plans, can vary widely. It depends on several factors, like the amount of your loan, the term of your loan, your age, and your health status. Some policies charge a fixed fee, while others calculate your premium based on the outstanding balance of your loan, meaning the cost could change as you pay down your loan. To get the best idea of cost, it’s wise to shop around and compare offers from different insurance providers.

Yes, the duration can vary depending on several factors, including the type of loan (e.g., open-ended vs. closed-ended), the policy’s terms, and whether the policy offers renewal options.

Many Loan Insurance policies include a waiting period, typically around 60 days, before the coverage starts, especially for benefits related to disability or unemployment.

A benefit period is the length of time the insurance company will make loan payments on your behalf. As per the policy, this can range from a few months to several years.

Some policies offer renewal options at the end of their term, allowing you to extend your coverage. However, terms and premiums may change upon renewal.

Assess your financial stability, health, job security, and loan length. Understand the policy’s terms and compare offers from different providers to find the coverage that best matches your needs.

If your Loan Insurance includes coverage for death, the insurance should cover the remaining loan payments, relieving your family from this financial burden.

Yes, alternatives include long-term disability, Critical Illness, and Life Insurance, each offering different benefits and coverage durations that might better suit your needs.

If your loan extends beyond the duration of your insurance coverage, you will no longer be protected by the policy. It’s imperative to align the coverage duration with your loan term.

It’s possible to cancel most policies, but the details, like whether you will get a refund for any premiums you’ve already paid, depend on the policy terms and the insurance company.

For variable-rate loans, the amount of Loan Insurance Coverage and the premium might adjust as the interest rate changes. This ensures that the insurance coverage comes in line with the outstanding balance of your loan.

Loan Insurance typically covers the monthly loan payments up to a specific limit, which is determined by your policy’s terms. It may not cover the entire loan amount, but it ensures that payments are made during the coverage period.

No, Loan Insurance is not mandatory for all loans in Canada. However, some lenders may require you to have specific types of insurance, like Mortgage Insurance, as a loan condition.

Eligibility for Loan Insurance with a pre-existing medical condition varies by insurer. Some policies may exclude coverage for conditions present before obtaining the policy, while others may offer coverage with certain limitations.

Premiums for Loan Insurance are typically calculated based on the loan amount, type of loan, coverage options selected, and the borrower’s age and health status. These factors influence the risk level perceived by the insurer.

Having multiple Loan Insurance policies for the same loan is generally unnecessary or cost-effective. Instead, focus on finding a comprehensive policy that meets all your needs.

If you’re facing financial difficulties, contact your insurance provider to discuss your options. Some policies may offer flexibility in terms of premium payments or coverage adjustments.

To file a claim, contact your insurance provider as soon as possible after the qualifying event occurs. You will likely need to provide documentation, such as medical records or proof of unemployment, to support your claim.

If you refinance your loan, you may need to obtain a new Loan Insurance policy, as the original policy was tied to the terms of the original loan. Discuss your options with your lender and insurance provider.

Benefits received from a Loan Insurance policy are typically not taxable as income in Canada. However, it’s always a good idea to consult with a tax professional for specific advice.

Loan Insurance policies are generally not transferable between loans or lenders because they are specifically underwritten based on the original loan’s terms and the borrower’s information.

Loan Insurance covers loan payments in case of the borrower’s death, disability, critical illness, or unemployment. Mortgage Insurance, on the other hand, protects the lender against the borrower’s default on a mortgage.

For more information about Loan Insurance options, consider speaking with financial advisors, insurance brokers, or directly with insurance companies that offer loan protection products. Additionally, researching online and comparing different policies can provide valuable insights.

The above information is only meant to be informative. It comes from Canadian LIC’s own opinions, which can change at any time. This material is not meant to be financial or legal advice, and it should not be interpreted as such. If someone decides to act on the information on this page, Canadian LIC is not responsible for what happens. Every attempt is made to provide accurate and up-to-date information on Canadian LIC. Some of the terms, conditions, limitations, exclusions, termination, and other parts of the policies mentioned above may not be included, which may be important to the policy choice. For full details, please refer to the actual policy documents. If there is any disagreement, the language in the actual policy documents will be used. All rights reserved.

Please let us know if there is anything that should be updated, removed, or corrected from this article. Send an email to Contact@canadianlic.com or Info@canadianlic.com