- Can You Convert Universal Life To Whole Life?

- Understanding Universal Life Insurance Policie

- Exploring Whole Life Insurance

- Universal Life Insurance Vs. Whole Life: An Overview

- Can You Convert Universal Life Insurance To Whole Life In Canada?

- Key Considerations Before Converting

- Benefits Of Converting Universal Life Insurance To Whole Life Insurance Policy

- Why Some Canadians Consider Switching from Universal to Whole Life

- Potential Drawbacks And Considerations

- The Cost Of Converting

- Exploring The Cost Considerations

- How Hidden Cost Structures Impact Conversion Decisions in Canada

- When Does It Make Sense to Convert?

- Consulting with Universal Life Insurance Providers

- Need Help Getting Life Insurance Coverage?

- The Bottom Line: Making The Perfect Decision

Members have the flexibility to customize their Universal Life policy, which makes it an attractive option for many Canadians looking for protection and investment opportunities. But life throws us curves, and so you’re probably wondering can I convert my Universal Life Insurance to Whole Life Insurance.” This post will address the specifics, including various pros and cons, of replacing Universal Life Insurance and considering a whole life conversion.

Understanding Universal Life Insurance Policies

But, before we get into converting let’s get what Universal Life Insurance means?

Universal Life Insurance: One form of Permanent Life Insurance is a policy which bundles a death benefit with a savings portion. The traditional plan provides policyholders the ability to change both the premium payments they make and the death benefit they receive as their financial situation and objectives change. Universal Life Policies have cash value accumulations, which allows the policyholder to save over time.

Exploring Whole Life Insurance

Whole Life Insurance, on the other hand, provides lifelong coverage with fixed premiums and guaranteed cash value accumulation. Unlike Universal Life Insurance, where premiums and death benefits can fluctuate, Whole Life Insurance offers stability and certainty, making it a popular choice for those seeking long-term financial security.

Universal Life Insurance vs. Whole Life: An Overview

In comparing universal life policies to Whole Life Insurance, it really is important to recognize that they have different features, and one may be more appropriate than the other based on their specific financial needs and objectives.

Universal Life Insurance Policies:

Universal Life Insurance Policy provides flexibility and customizable features, enabling policyholders to adjust Universal Life Insurance premiums, payments, and death benefits according to their changing financial situations. Most of these policies also have a savings component that builds cash value over time. The policyholder can access this value through policy loans or withdrawals, offering increased liquidity for different financial needs.

Whole Life Insurance Policies:

Whole Life Insurance offers permanent coverage and stable Whole Life Insurance hauliers, and guaranteed cash value growth. Drastically different from universal life policy … Financial Planning Moreover, Whole Life Insurance policies provide a guaranteed death benefit, meaning that a predetermined payment is made to the beneficiaries upon the death of the person whose life was insured.

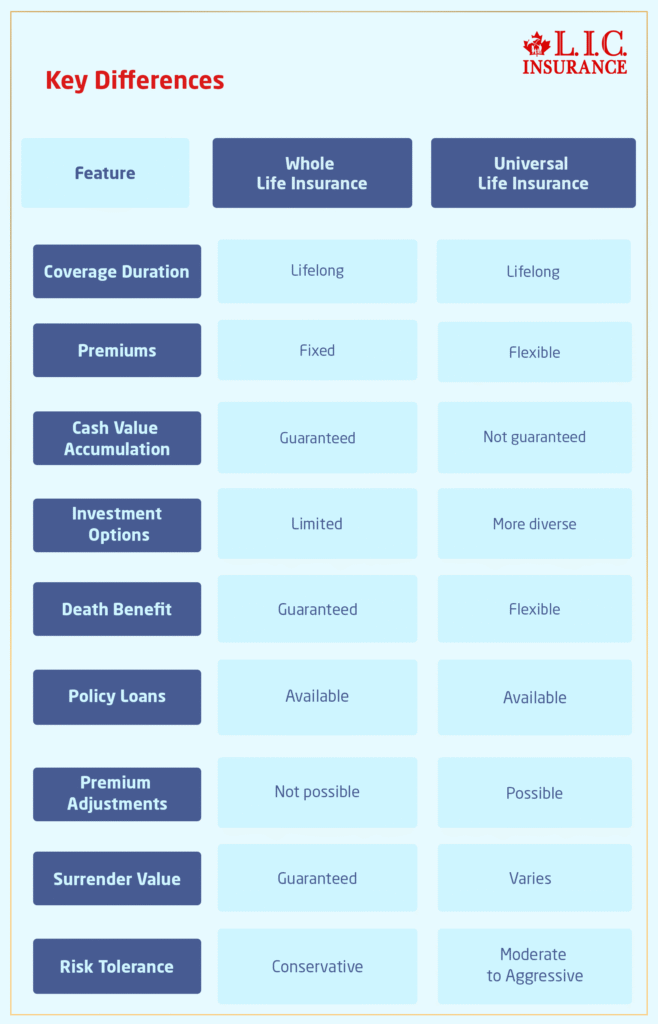

Key Differences

Universal Life Insurance vs Whole Life Insurance. The most noticeable variation between the two is flexibility and stability. Universal Life Insurance Flexible premium payments and flexible death benefit options for those with changing financial needs. In contrast to this, Whole Life Insurance provides stability and security with fixed premiums and guaranteed cash value accumulation giving you worry free financial security all your life.

Can You Convert Universal Life Insurance to Whole Life in Canada?

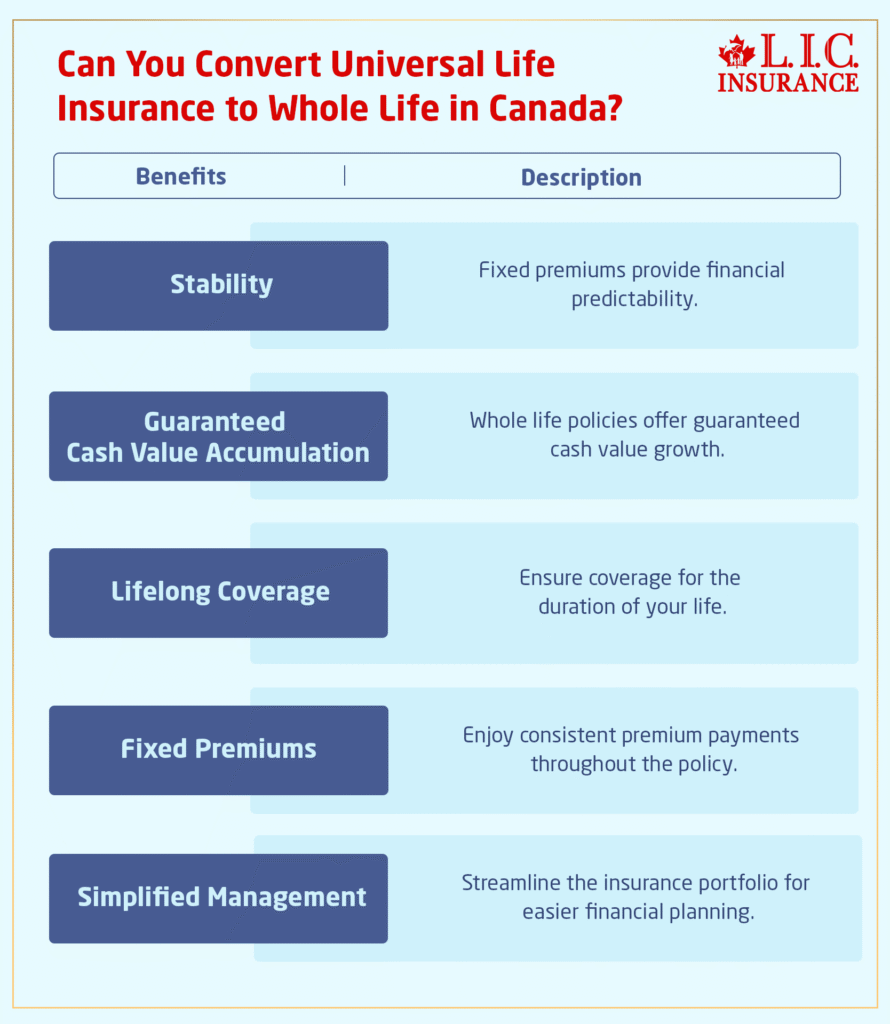

Can I convert my Universal Life Insurance policy to Whole Life Insurance in Canada? Yes, it can be converted, but this is subject to change and depends on your provider and policy terms. There are some advantages to converting your Universal Life Insurance into Whole Life, such as:

- Stability and Predictability: Whole Life Insurance comes with level premiums and guaranteed cash value accumulation, which means stability and predictability in your financial planning.

- Lifetime Coverage: Whole life insurance will never expire and last as long as you live; An ideal solution used during estate planning to protect your financial legacy and provide for heirs.

- Cash Value Accumulation: Whole Life Insurance provides cash value growth, which can be used for various financial needs in the future, including supplementing retirement income or paying for your child's education.

Key Considerations Before Converting

The points below will come in handy for you when considering converting a Universal Life Insurance to a Whole Life Insurance:

- Read the Fine Print: You want to be aware of any conversion options (in and out of the policy), limitations, or penalties that may be associated with your Universal Life Insurance.

- Cost Analysis: Compare the cost to converting to regular Whole Life Insurance with any change in premiums and fees.

- Evaluate Your Needs: Consider how much cash you need now and how much you’ll need into the future to help you determine if Whole Life Insurance is a good option for you.

- Insurance Company: Talk to your insurance agent about conversions and be clear on how it works and what that means for you.

Benefits of Converting Universal Life Insurance to a Whole Life Insurance Policy

Here are the reasons you’re going to love converting your Universal Life Insurance policy to Whole Life Insurance in Canada:

- Lifetime Protection: Whole Life offers coverage for a lifetime, guaranteed cash value accumulation, and level premiums that together provide the security and peace of mind to you and your family.

- Guaranteed Premiums: Permanent Life Insurance comes with fixed premiums that remain the same for the life of the policy for your added peace of mind and predictable financial planning.

- Cash Value Accumulation: Whole Life Insurance policies accumulate cash value during the life-time of the policyholder and make for a valuable asset that could be used to meet financial requirements in the future, if the need arises.

- Ease of Administration: By consolidating to Whole Life Insurance, you can simplify the management of your overall insurance plan and your financial resources and responsibilities.

Why Some Canadians Consider Switching from Universal to Whole Life

Just as Canadians’ financial needs evolve throughout their lives, so does the type of life insurance that makes sense at any given time. One of those shifts has come in the form of more clients wanting to exchange their currently flexible but complicated Universal Life Insurance for the guaranteed protection of Whole Life Insurance. Generally it’s not a decision made in the dead of night — it tends to happen as years of expertise, the evolution of life stages, or a reconsideration of long-term financial security.

And with that, below are the main reasons people are re-evaluating their universal life vs whole life strategy and making the change:

1. Shift from Wealth-Building to Stability

For most Canadians, when they first purchase a Universal Life Insurance policy, it is the investment options and flexibility that attracts them to the concept. Such features would be appealing to younger policyholders or business owners seeking to accumulate wealth with coverage in place.

But when it comes to retirement or estate planning, the appetite for flexibility often takes a back seat to the need for predictability. In that case Whole Life Insurance — which has level premiums, guaranteed cash value, and a level death benefit — is more attractive. For many, the move isn’t just about returns, but about setting up a financial legacy with as few variables as possible.

2. Concerns Over Market Volatility and Interest Rate Risk

Universal Life policies are partially underpinned by market-linked or interest-sensitive elements. These can perform well in favourable circumstances, but the negative is that some can perform poorly when markets move to within the band or interest rates fall, and this is what Canadians are used to seeing during economic downturns and crazy financial times.

This is where Whole Life truly gains the upper hand in the universal life vs Whole Life argument. Your death benefit and cash value are shielded from the vagaries of the market because Whole Life Insurance does not rely upon it. Consequently, it is gaining popularity as a choice in the Canadian market for cautious individuals or those who have had poor past experiences with proportional returns, who value the protection offered by Whole Life guarantees.

3. Underperformance Compared to Initial Projections

Quite possibly one of the most prevalent areas of regret among Universal Life policyholders is seeing real outcomes fall short of those initially presented at the point of sale. Perhaps the investment didn’t grow as large, the policy required higher premiums to continue in effect, or charges dissipated the gains.

Down the years, the gap between the sale and in reality has made a lot of people rethink the whole life vs universal life debate. Whole Life, spent prudently, offers stable returns, but premiums will generally be higher, which can be more advantageous if you are seeking an inheritance to create or assist in transferring expenses.

4. Complexity vs. Simplicity in Policy Management

Universal Life Insurance requires regular monitoring and financial decision-making. Policyholders may need to:

- Review investment performance

- Adjust death benefits

- Monitor the cost of insurance increases

- Pay attention to market trends

For busy families, aging individuals, or anyone not keen on micromanaging their insurance portfolio, this can become overwhelming. By contrast, Whole Life Insurance is hands-off: fixed premiums, a clear schedule of cash value growth, and no market exposure.

When people compare universal life vs whole life, the simplicity of Whole Life becomes a major selling point—especially for those approaching retirement or managing multiple financial responsibilities.

5. Emotional Drivers: Estate Planning, Peace of Mind, and Family Security

Estate Planning and Peace of Mind for Family Security

Not every financial decision is number-oriented — many of them are very emotionally based. When individuals get older, the need for a proper, tax-saving, and reliable legacy grows greater. In that case, Whole Life Insurance will give more people peace of mind.

With Whole Life, there is no concern about whether a down market will affect the death benefit or need to deal with policy complexities. With the universal life vs whole life controversy, the latter provides emotional comfort, especially for those planning to support children, grandchildren, or charities to continue after they leave.

We have people who have crossed over to make this change simply because they do not like the uncertainty. They like the idea of knowing their loved ones are going to have a guaranteed, tax-free income no matter what happens. Something that Universal Life does not necessarily offer.

Potential Drawbacks and Considerations

While there are numerous advantages of converting your Universal Life Insurance policy to Whole Life Insurance, be sure to look at the following drawbacks:

- Financial Impact: Changing to Whole Life Insurance has financial implications, such as the possibility of increased premiums or charges that may impact your overall financial plan.

- Strategic Drawbacks: Whole Life Insurance is predictable and stable, but it might not provide the flexibility of Universal Life Insurance when it comes to premium payments and death benefit adjustments.

- Policy Surrender Charges: In case your Whole Life Insurance Policy has penalties or surrender charges, converting may decrease the value of the investments overall.

- Underwriting Requirements: Furthermore, since you are switching to a permanent Whole Life Insurance policy, you could be required to go through new underwriting evaluations that might influence your insurability or access to coverage.

Get The Best Insurance Quote From Canadian L.I.C

Call 1 844-542-4678 to speak to our advisors.

The Cost of Converting

If you are interested in knowing how much actually costs you when you need to convert your Universal Life Insurance policy to Whole Life Insurance in Canada, here is a tip. While converting a policy, there are some financial concerns that can impact your overall financial strategy. So here is what you should know about the cost factors of converting your Universal Life Insurance policy:

- Premium Adjustments: If you are transferring to Whole Life Insurance, your premiums could be adjusted. Whole Life Insurance typically has level premiums, but they are usually higher than Universal Life Insurance premiums, which are more flexible in nature. You must consider whether these premium adjustments will suit your budget and long-term.

- Policy Charges and Fees: There might be an additional fee when you switch your Universal Life Insurance coverage to a whole Life Insurance policy. This might involve administrative charges by your insurance company, underwriting charges, or a policy conversion charge. Review your policy conditions and inquire with your insurance agent or provider regarding fees.

- Surrender Charges: Moving from Universal Life Insurance to Whole Life Insurance can also have surrender charges or penalties, depending on your own Universal Life Insurance policy language. These charges are used to recover the insurer's expenses for terminating the policy prematurely. Knowing the structure of the surrender charge set out in your own policy and how it can impact the dollar worth of your investment is critical.

- Underwriting Requirements: You might be required to go through new underwriting tests to qualify for Whole Life Insurance, which would establish whether you are insurable and eligible. Underwriting might include such tests as medical exams, health checkups, and other tests for determining your risk profile. Prepare yourself for any underwriting requirements and know how they can affect your coverage and premiums.

- Consultation Fees: Getting advice from insurance advisors or financial consultants throughout the conversion process may carry consultation fees or charges. These fees, being usually minimal, should nonetheless be included in your cost analysis.

Exploring the Cost Considerations

Being aware of the cost implications of switching your Universal Life Insurance policy to Whole Life Insurance entails cautious consideration and planning. Below are some guidelines that can assist you in proceeding with the process successfully:

- Review Policy Terms: Carefully read the terms and conditions of your Universal Life Insurance policy, including any conversion provisions, charges, or surrender terms described in the policy documents.

- Compare Quotes: Get quotes from several Universal Life Insurance companies that provide Whole Life Insurance policies. Compare premiums, coverage levels, and policy benefits to make sure you're getting the best return on your investment.

- Consult with Experts: Seek guidance from insurance advisors or financial professionals who specialize in life insurance. They can provide valuable insights and advice tailored to your specific needs and circumstances.

- Take Into Account Long-Term Advantages: Although there could be initial expenses when switching to Whole Life Insurance, take into account long-term advantages like stability, security, and the build-up of cash value. Consider how these advantages will support your overall financial targets and aims.

How Hidden Cost Structures Impact Conversion Decisions in Canada

One under-considered element in the universal life insurance versus whole life debate is the effect of internal policy cost structures, infrequently revealed in simplified examples. Numerous Canadians searching to determine if they can transfer universal life to whole life do not consider how these internal fees, like mortality and expense (M&E) fees or cost-of-insurance rate hikes, stealthily consume cash value, particularly on older Universal Life policies.

In contrast to Whole Life Insurance, where fees tend to be level and incorporated into the fixed premium, Universal Life policies can increase internal fees over time, especially as the policyholder gets older. If not controlled, this can lead to the policy becoming underfunded, needing higher out-of-pocket payments to keep coverage in force.

This subtle level of financial pressure is causing more Canadian policyholders to reconsider the whole life vs universal life debate, no longer simply about investment control or death benefit, but also on cost predictability. When to convert, gaining insight into what portion of today’s cash value is consumed by these internal fees becomes paramount.

Financial experts advise seeking a complete cost breakdown disclosure prior to starting a conversion. This frequently neglected process keeps clients converting from Universal Life to Whole Life in the know and with confidence, particularly when attempting to construct a lifelong, secure financial foundation.

When Does It Make Sense to Convert?

Whether or not you should replace your qualifying universal life insurance with whole life insurance is a complex decision which requires you to consider your financial situation, goals, and really what is important to you. There is no one-size-fits-all answer, but, basically, some circumstances that might indicate converting would be wise are the following:

- Stability and Predictability: The conversion to Whole Life Insurance may be relevant if you seek predictability and stability in your life insurance coverage and financial planning. Whole Life Insurance offers premium and guaranteed cash value accumulation to provide you and your family with protection and financial stability.

- Long-Term Financial Security: Whole Life may a better fit for you if you want to accumulate wealth and achieve long term security. Whole Life Insurance also offers a distinct asset that accumulates cash value over time, and can continue to serve as a valuable resource to support evolving financial objectives over your lifetime.

- Evolving needs and priorities: If your financial situation or priorities have changed since you purchased your Universal Life Insurance policy, converting to a Whole Life Insurance policy can help ensure your coverage keeps pace with your life and your goals. Whole Life Insurance may be a remedy for you and your family to resolve all of the various issues you will likely have to deal with whether it be retirement, education, succession or estate planning.

- Simple Management: If you know that you only want to concentrate on Whole Life Insurance, than it is also available. The Whole Life Insurance is an ideal plan for individuals who prefer simplicity and predictability as it has an easy management system, making it convenient for anyone with fixed premium and lifetime coverage.

Consulting with Universal Life Insurance Providers

When determining whether or not to convert your Universal Life policy to Whole Life, it is critical to work with the best Universal Life insurance companies and investigate your options to make sure that the decision fits with the long-term financial plan and goals. Universal Life Insurance companies can also provide valuable information, advice, and support to help you with the conversion so that you make the most advantageous decisions for your circumstances and goals.

Need Help Getting Life Insurance Coverage?

Wondering if you should convert your Universal Life Insurance to Whole Life in Canada? At the same time, there are resources to help you get what you need and want in terms of coverage.

- Example Providers of Universal Life: There are numerous well-established insurance companies and providers that sell Universal Life Insurance policies, and these can be customized in order to suit different financial goals and options. Reviewing Universal Life Insurance quotes from several reputable companies and comparing them will get you started down the path of finding an insurance policy that appeals to your budget, coverage needs, and objectives for the future.

- Use of Insurance Advisors: Using an insurance advisor or agents can be invaluable in the process of converting your Universal Life Insurance into Whole Life Insurance. Their expert professional advice provides you with a competitive choice of products and will help you make well-informed decisions to meet your financial objectives.

- Financial Professionals: You could also hire a financial advisor/planner to do a deep dive into the financial side of things (including evaluating and advising on insurance). Working with a financial professional enables you to take stock of the whole financial picture, identify where there are opportunities or threats, and then develop an organized plan to help you address those needs in order to achieve the results you want.

The Bottom Line: Making The Perfect Decision

In summary, you can turn a Universal Life Insurance policy into Whole Life Insurance in Canada, and it has plenty of rewards: stability, security, and cash value growth. But you should first look at your policy’s specifics, how much coverage you need, and what your financial goals are before you do. Work with someone you trust. Your insurance advisor or financial professional can help you through the conversion process and ensure it is suitable for your financial goals and priorities. Choose wisely and best for you and your family’s financial protection and peace of mind!

Get The Best Insurance Quote From Canadian L.I.C

Call 1 844-542-4678 to speak to our advisors.

FAQ's

Conversion eligibility depends on your policy terms. Check with your provider.

No, the coverage amount and death benefit should remain unchanged.

Yes, expect potential higher premiums or fees.

Consult with an advisor to align with your goals.

Stability, guaranteed cash value, and fixed premiums distinguish whole life.

Yes, but it may require new health assessments.

The timeline varies; initiate early and coordinate closely with your provider.

It may transfer, subject to conversion terms.

Yes, but consider implications like surrender charges.

Reach out to your provider, advisor, or financial professional for tailored guidance.

The above information is only meant to be informative. It comes from Canadian LIC’s own opinions, which can change at any time. This material is not meant to be financial or legal advice, and it should not be interpreted as such. If someone decides to act on the information on this page, Canadian LIC is not responsible for what happens. Every attempt is made to provide accurate and up-to-date information on Canadian LIC. Some of the terms, conditions, limitations, exclusions, termination, and other parts of the policies mentioned above may not be included, which may be important to the policy choice. For full details, please refer to the actual policy documents. If there is any disagreement, the language in the actual policy documents will be used. All rights reserved.

Please let us know if there is anything that should be updated, removed, or corrected from this article. Send an email to Contact@canadianlic.com or Info@canadianlic.com